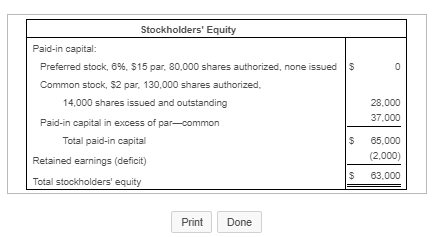

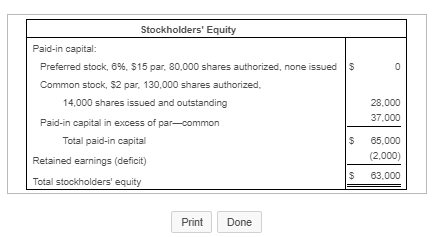

I have a question revolving around a balance sheet and stockholder's equity. Here is the full incorrect question followed by its values. If the image is too small just right click and open in the new tab. After the full incorrect question and it's values will be the new values for the new identical question I have to do.

Here is the new values for the new question:

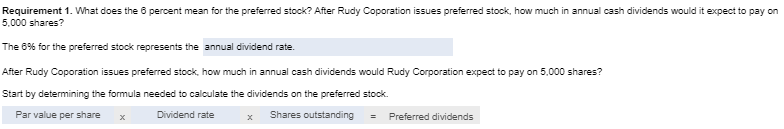

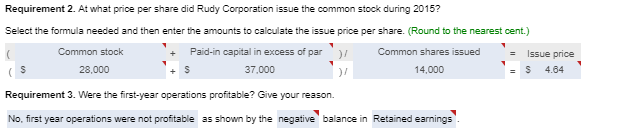

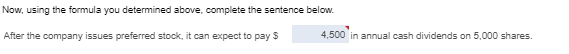

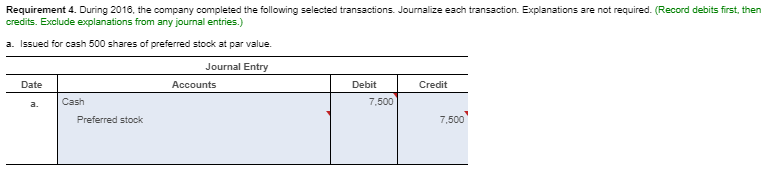

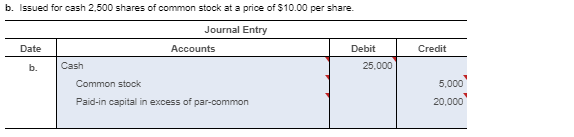

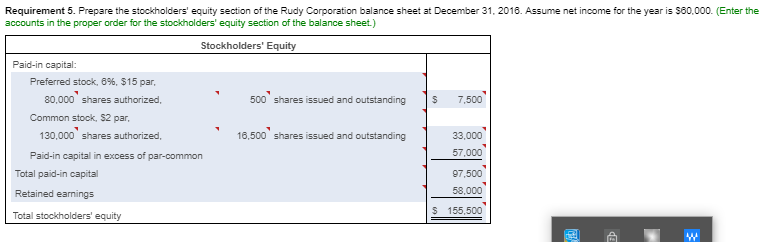

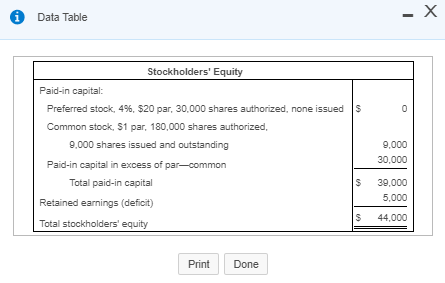

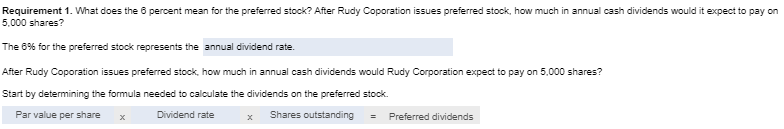

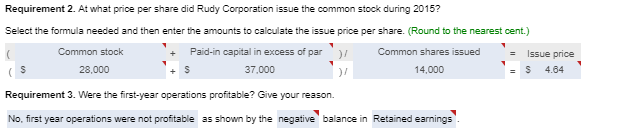

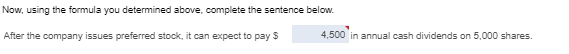

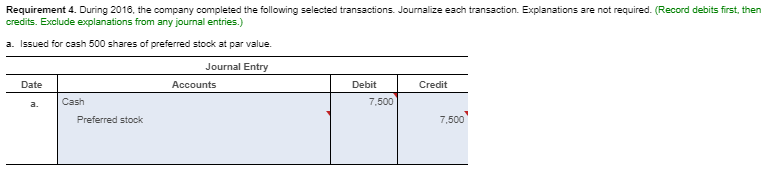

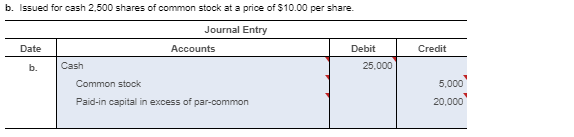

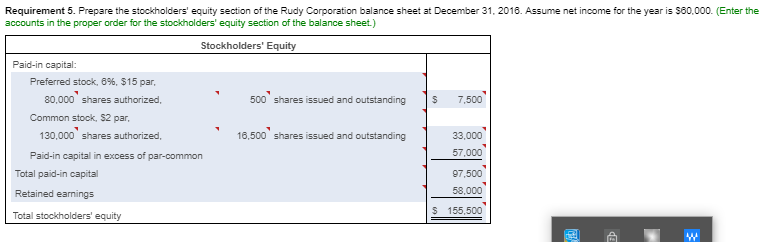

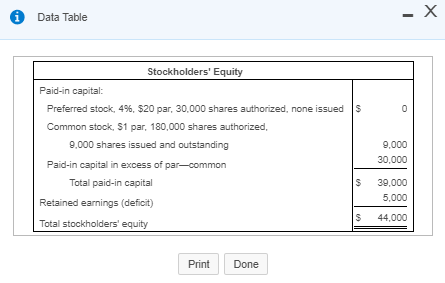

ISO $ Stockholders' Equity Paid-in capital: Preferred stock, 8%. $15 par. 80.000 shares authorized, none issued Common stock, S2 par, 130,000 shares authorized, 14,000 shares issued and outstanding Paid-in capital in excess of par-common Total paid-in capital Retained earnings (deficit) Total stockholders' equity 28,000 37,000 65,000 (2.000) 83.000 $ Print Done Requirement 1. What does the 6 percent mean for the preferred stock? After Rudy Coporation issues preferred stock, how much in annual cash dividends would it expect to pay on 5,000 shares? The 8% for the preferred stock represents the annual dividend rate. After Rudy Coporation issues preferred stock, how much in annual cash dividends would Rudy Corporation expect to pay on 5,000 shares? Start by determining the formula needed to calculate the dividends on the preferred stock Par value per share X Dividend rate x Shares outstanding = Preferred dividends Requirement 2. At what price per share did Rudy Corporation issue the common stock during 2015? Select the formula needed and then enter the amounts to calculate the issue price per share. (Round to the nearest cent.) Common stock + Paid-in capital in excess of par ) Common shares issued - Issue price 28,000 37.000 14,000 $ 4.64 Requirement 3. Were the first-year operations profitable? Give your reason. No, first year operations were not profitable as shown by the negative balance in Retained earnings Now, using the formula you determined above, complete the sentence below. After the company issues preferred stock, it can expect to pay $ 4,500 in annual cash dividends on 5,000 shares. Requirement 4. During 2016, the company completed the following selected transactions. Journalize each transaction. Explanations are not required. (Record debits first, then credits. Exclude explanations from any journal entries.) a. Issued for cash 500 shares of preferred stock at par value. Journal Entry Date Accounts Credit Debit 7.500 a. Cash Preferred stock 7.500 b. Issued for cash 2.500 shares of common stock at a price of $10.00 per share. Journal Entry Date Accounts Credit Debit 25,000 Cash 5.000 Common stock Paid-in capital in excess of par-common 20,000 Requirement 5. Prepare the stockholders' equity section of the Rudy Corporation balance sheet at December 31, 2016. Assume net income for the year is $80,000. (Enter the accounts in the proper order for the stockholders' equity section of the balance sheet.) Stockholders' Equity Paid-in capital: Preferred stock, 8%, $15 par, 80,000 shares authorized, ' 500 shares issued and outstanding Common stock, S2 par, 130,000 shares authorized 16,500 shares issued and outstanding Paid-in capital in excess of par-common Total paid-in capital Retained earnings 33,000 57.000 Total stockholders' equity 155,500 w Data Table Stockholders' Equity Paid-in capital: Preferred stock, 4%, $20 par, 30.000 shares authorized, none issued Common stock. $1 par, 180.000 shares authorized 9,000 shares issued and outstanding Paid-in capital in excess of par-common Total paid-in capital 9,000 30.000 Retained earnings (deficit) 39,000 5,000 44,000 Total stockholders' equity Print Done