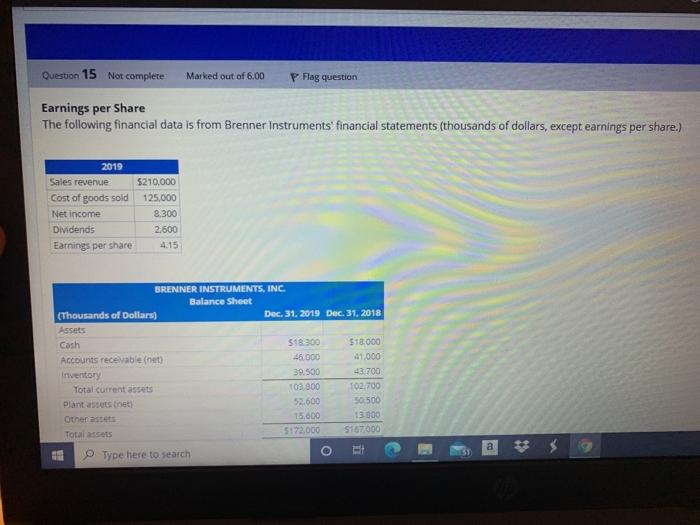

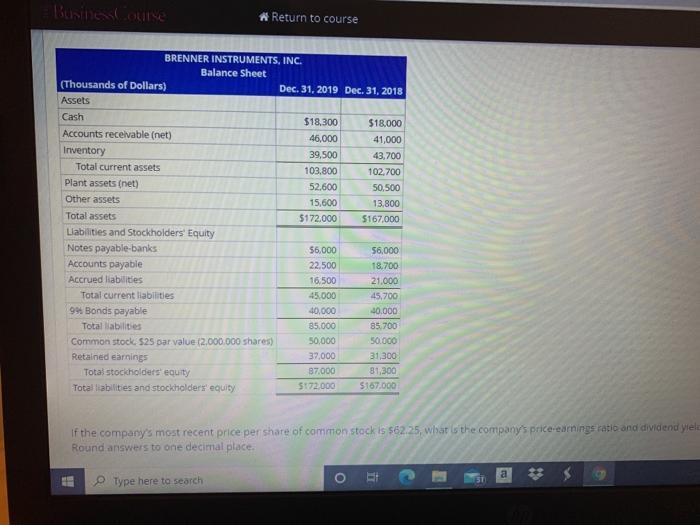

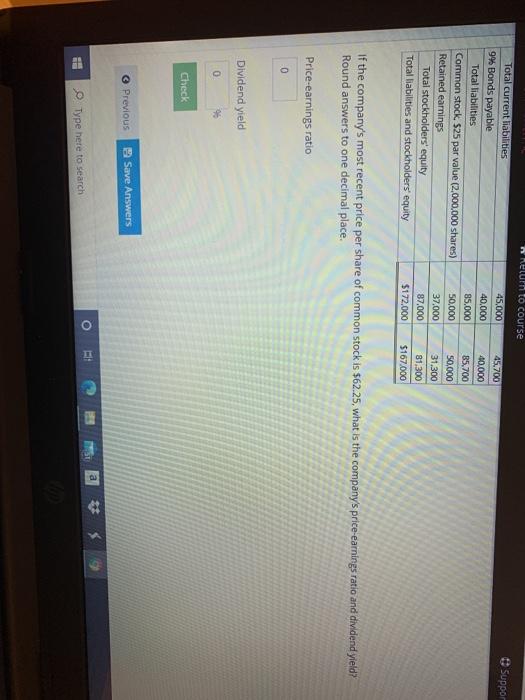

Question 15 Not complete Marked out of 6.00 P Flag question Earnings per Share The following financial data is from Brenner Instruments financial statements (thousands of dollars, except earnings per share.) 2019 Sales revenue $210.000 Cost of goods sold 125.000 Net income 8.300 Dividends 2.600 Earnings per share 4:15 BRENNER INSTRUMENTS, INC Balance Sheet (Thousands of Dollars) Dec. 31. 2019 Dec 31, 2018 Assets Cash 518.300 $18.000 Accounts recevable (net) 45.000 41.000 Inventory 39.500 43.700 Total current assets 102.800 102.700 plant assets et 52.000 50.500 Other astet 15,600 13.000 Total sets 5172,000 5167000 o Type here to search Business house * Return to course BRENNER INSTRUMENTS, INC. Balance Sheet (Thousands of Dollars) Dec 31, 2019 Dec 31, 2018 Assets Cash $18,300 $18.000 Accounts receivable (net) 46,000 41,000 Inventory 39,500 43,700 Total current assets 103.800 102.700 Plant assets (net) 52.600 50.500 Other assets 15,600 13.800 Total assets $172.000 $167.000 Llabilities and Stockholders' Equity Notes payable-banks 56.000 56,000 Accounts payable 22.500 18.700 Accrued liabilities 16,500 21.000 Total current liabilities 45,000 45,700 99 Bonds payable 40,000 40.000 Total liabilities 85.000 85.700 Common stock. 525 par value (2.000.000 shares) 50,000 50.000 Retained earnings 37,000 31,300 Total stockholders' equity 87.000 81,300 Total liabilities and stockholders' equity 5172.000 $167.000 If the company's most recent price per share of common stock is $62.25, what is the company's price earnings ratio and dividend yiele Round answers to one decimal place. o a Type here to search Nelumn to course Suppor Total current liabilities 9% Bonds payable Total liabilities Common stock. $25 par value (2.000.000 shares) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 45,000 40.000 85.000 50,000 37.000 87.000 $172.000 45.700 40.000 85.700 50,000 31,300 81,300 $167.000 If the company's most recent price per share of common stock is $62.25, what is the company's price-earnings ratio and dividend yield? Round answers to one decimal place. Price-earnings ratio 0 Dividend yield 0 Check