Answered step by step

Verified Expert Solution

Question

1 Approved Answer

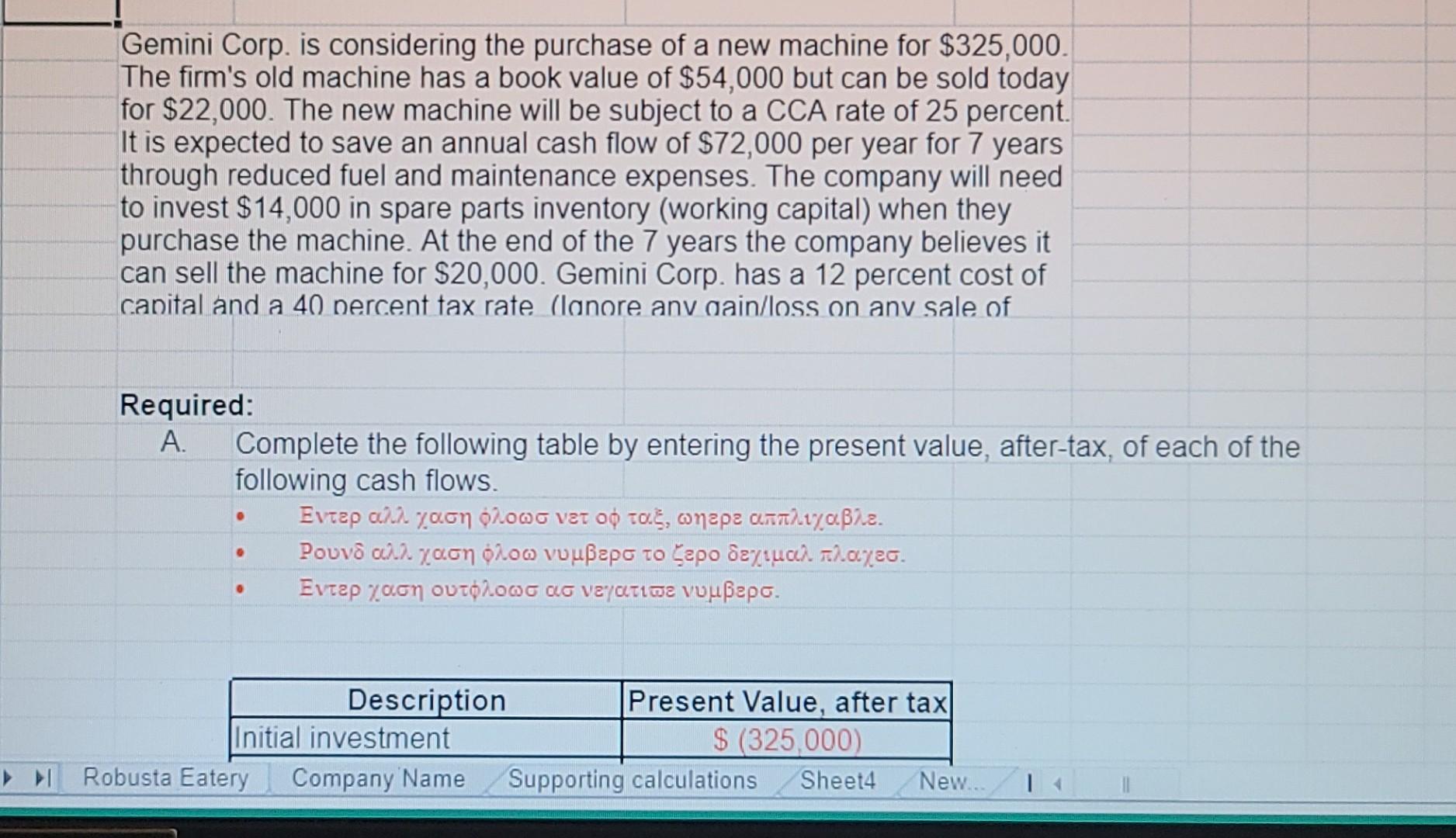

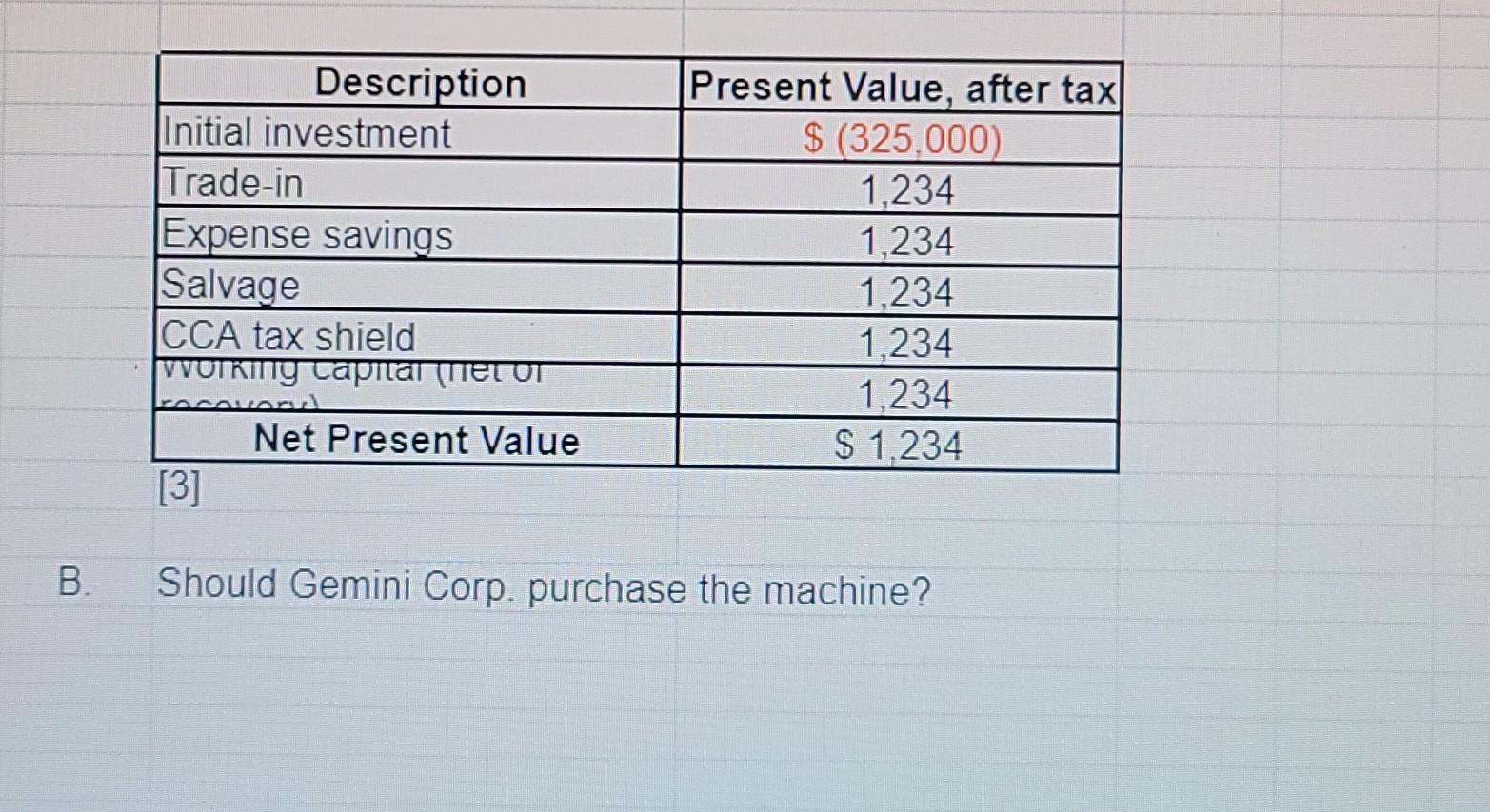

i have added 2 pictures. A. COMPLETE THE FOLLOWING TABLE BY ENTERING THE PRESENT VALUE, AFTER-TAX, OF EACH OF THE FOLLOWING CASH FLOWS. IGNORE THE

i have added 2 pictures.

A. COMPLETE THE FOLLOWING TABLE BY ENTERING THE PRESENT VALUE, AFTER-TAX, OF EACH OF THE FOLLOWING CASH FLOWS. IGNORE THE RED PARTS.

I NEED STEP BY STEP EXPLANATIIN PLUS ANSWER THANKS.

Gemini Corp. is considering the purchase of a new machine for $325,000. The firm's old machine has a book value of $54,000 but can be sold today for $22,000. The new machine will be subject to a CCA rate of 25 percent. It is expected to save an annual cash flow of $72,000 per year for 7 years through reduced fuel and maintenance expenses. The company will need to invest $14,000 in spare parts inventory (working capital) when they purchase the machine. At the end of the 7 years the company believes it can sell the machine for $20,000. Gemini Corp. has a 12 percent cost of capital and a 40 percent tax rate (lanore anv gain/loss on any sale of Required: A. Complete the following table by entering the present value, after-tax, of each of the following cash flows. , . . . 0 Description Present Value, after tax Initial investment $ (325.000) > Robusta Eatery Company Name Supporting calculations Sheet4 New... 1 Description Initial investment Trade-in Expense savings Salvage CCA tax shield VOTking Capital (met or Present Value, after tax $ (325.000 1.234 1,234 1,234 1.234 1.234 $ 1,234 racovard Net Present Value [3] . Should Gemini Corp. purchase the machineStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started