I have added the information needed in the second picture

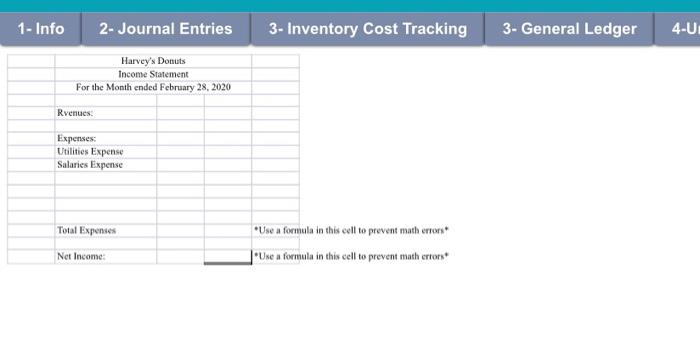

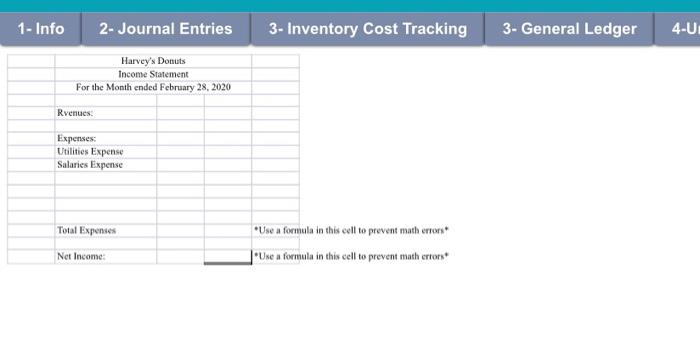

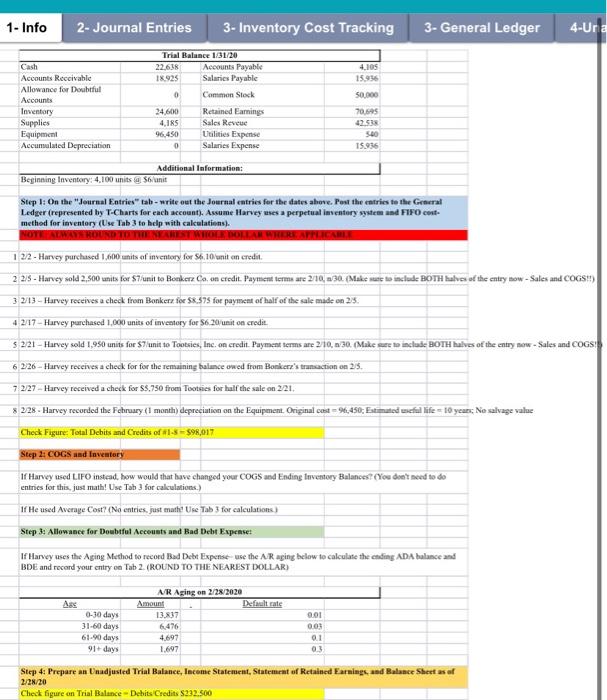

1- Info 2- Journal Entries 3- Inventory Cost Tracking 3- General Ledger 4-UI Harvey's Donuts Income Statement For the Month ended February 28, 2020 Rvenues. Expenses: Utilities Expense Salaries Expense Total Expenses *Use a formula in this cell to prevent math erros* *Use a formula in this cell to prevent math errors Net Income: 1 - Info 2- Journal Entries 3- Inventory Cost Tracking 3- General Ledger 4-Ura 4.105 15.936 50.000 Accounts Receivable Allowance for Doubtful Accounts Inventory Supplies Equipment Accumulated Depreciation Trial Balance 131/20 22.618 Accounts Payable 18.925 Salaries Payable 0 Common Stock 24600 Retained Earings 4.IRS Sales Revue 96.450 Utilities Expense 0 Salaries Expense 70595 4253 5.0 15.936 Additional Information: Beginning Inventory: 4.100 units @ $6/unit Step 1: On the Journal Entries" tab - write out the Journal entries for the dates above. Post the entries to the General Ledger (represented by T-Charts for each account). Assume Harvey uses a perpetual inventory system and FIFO cost method for inventory (Use Tab 3 to help with calculations). NOTEFALWAYRO REST WHOLE DOLLAR WHERE APLICARE 1 2/2 - Harvey purchased 1,600 units of inventory for Sh.10 unit on credit. 2 215 - Harvey sold 2,500 units for $7'unit to Benkerz Co, on credit. Payment terms are 2/10, 2/30. (Makt want to include BOTH babes of the entry now - Sales and COGS) 3 2/13 - Harvey receives a check from Bonkerz for 58.375 for payment of half of the sale made on 25 42/17 -Harvey purchased 1,000 units of inventory for $6.20 unit on credit $ 221 - Harvey sold 1,950 units for $71 unit to Tootsies, Inc. on credit. Payment terms are 2/10, n. 30. (Make sure to include BOTH halves of the entry now - Sales and COGS 6 2/26 - Harvey receives a check for for the remaining balance owed from Bankete's transaction on 25. 7 2/27 - Harvey received a check for 8.750 from Tootsies for half the sale on 221. * 228 - Harvey recorded the February (1 month) depreciation on the Equipment. Original cast = 96,450, Extmated useful life = 18 years; Ne salvage value Check Figure: Total Dehits and Credits of #1-8-898,017 Step 2: COGS and Inventory If Harvey used LIFO instead, how would that have changed your COGS and Ending Inventory Balancest (You don't need to do entries for this. just math! Use Tab 3 for calculations.) If He used Average Cost? (No entries. just math! Une Tab 3 for calculations) Step 3: Allowance for Doubtful Accounts and Bad Debt Expensez If Harvey uses the Aging Method to record Bed Debt Expense use the Raging below to calculate the coding ADA balance and BDE and record your entry on Tab 2. (ROUND TO THE NEAREST DOLLAR 0-30 days 31-60 days 61-90 days 91 days AR Aging on 2/28/2020 Amount Defaultats 13.37 6.476 4.697 1.697 201 0.03 0.1 03 Step 4: Prepare an Unadjusted Trial Balance, Income Statement. Statement of Retained Earnings, and Balance Sheet as of 2/28/20 Check figure on Trial Balance - Dehits Credits $232.500 1- Info 2- Journal Entries 3- Inventory Cost Tracking 3- General Ledger 4-UI Harvey's Donuts Income Statement For the Month ended February 28, 2020 Rvenues. Expenses: Utilities Expense Salaries Expense Total Expenses *Use a formula in this cell to prevent math erros* *Use a formula in this cell to prevent math errors Net Income: 1 - Info 2- Journal Entries 3- Inventory Cost Tracking 3- General Ledger 4-Ura 4.105 15.936 50.000 Accounts Receivable Allowance for Doubtful Accounts Inventory Supplies Equipment Accumulated Depreciation Trial Balance 131/20 22.618 Accounts Payable 18.925 Salaries Payable 0 Common Stock 24600 Retained Earings 4.IRS Sales Revue 96.450 Utilities Expense 0 Salaries Expense 70595 4253 5.0 15.936 Additional Information: Beginning Inventory: 4.100 units @ $6/unit Step 1: On the Journal Entries" tab - write out the Journal entries for the dates above. Post the entries to the General Ledger (represented by T-Charts for each account). Assume Harvey uses a perpetual inventory system and FIFO cost method for inventory (Use Tab 3 to help with calculations). NOTEFALWAYRO REST WHOLE DOLLAR WHERE APLICARE 1 2/2 - Harvey purchased 1,600 units of inventory for Sh.10 unit on credit. 2 215 - Harvey sold 2,500 units for $7'unit to Benkerz Co, on credit. Payment terms are 2/10, 2/30. (Makt want to include BOTH babes of the entry now - Sales and COGS) 3 2/13 - Harvey receives a check from Bonkerz for 58.375 for payment of half of the sale made on 25 42/17 -Harvey purchased 1,000 units of inventory for $6.20 unit on credit $ 221 - Harvey sold 1,950 units for $71 unit to Tootsies, Inc. on credit. Payment terms are 2/10, n. 30. (Make sure to include BOTH halves of the entry now - Sales and COGS 6 2/26 - Harvey receives a check for for the remaining balance owed from Bankete's transaction on 25. 7 2/27 - Harvey received a check for 8.750 from Tootsies for half the sale on 221. * 228 - Harvey recorded the February (1 month) depreciation on the Equipment. Original cast = 96,450, Extmated useful life = 18 years; Ne salvage value Check Figure: Total Dehits and Credits of #1-8-898,017 Step 2: COGS and Inventory If Harvey used LIFO instead, how would that have changed your COGS and Ending Inventory Balancest (You don't need to do entries for this. just math! Use Tab 3 for calculations.) If He used Average Cost? (No entries. just math! Une Tab 3 for calculations) Step 3: Allowance for Doubtful Accounts and Bad Debt Expensez If Harvey uses the Aging Method to record Bed Debt Expense use the Raging below to calculate the coding ADA balance and BDE and record your entry on Tab 2. (ROUND TO THE NEAREST DOLLAR 0-30 days 31-60 days 61-90 days 91 days AR Aging on 2/28/2020 Amount Defaultats 13.37 6.476 4.697 1.697 201 0.03 0.1 03 Step 4: Prepare an Unadjusted Trial Balance, Income Statement. Statement of Retained Earnings, and Balance Sheet as of 2/28/20 Check figure on Trial Balance - Dehits Credits $232.500