I have an assessment about engaging to research and comparative risk report about two companies in the same industry. Please see more detail in picture. Let me know if you could help me about this. I haven't started yet and I want to get your guide and to complete.

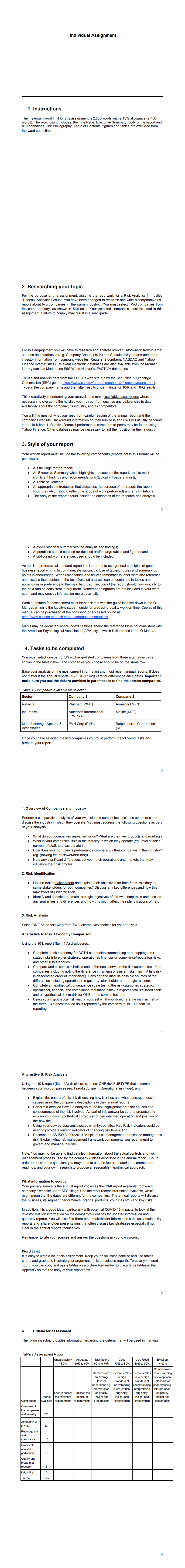

ndividual Assignment 1. Instructions idiots. The Bibliography. Table of contests. nouns and we are also 2. Researching your topic For the purpose of this assignment, assume that you work for a Risk Analytics form called he same industry. as shown in Section 4. Your selected companies must be used in this assignment. Facture to comply may result in a zero grade. evenfor information from company websites. Reuters, Bloomberg, NASDAQ and Yahoo Library such as Marketthe IBIS World. Hoover's, FACTIVA databases. Commission (SECI go to: mites, dose for to watch Him yoe in the company name and then fier results under Filings for 10-K and 10-Q results necessary to overcome the hurdles you may content such as any deficiencies in data dustry, and its competitors. 1- Relative financial performance compared to peers may be found using 3. Style of your report "andeam fangs and recommends the scope of the report, and its most A Table of Contents structure (which should reflect the scope of work performed) and any limitations . Appendices should be versus the analysis and findings; : A bebiography of referenced for detailed and of references used should be include titles and figures; and us iness report writing to communicate succinctly. Use of isbles, figures and summary d saints is encouraged. When using tables and figures cernerster in isbed them and reference age andices in preference the next and be consistent in argument. Remember diagrams are not included in your word Manual, which is the faculty's student guide for producing quality work on sme. Copies of this janusi can be purchased at the bookshop or accessed online at: the American Paychological Association (APA) style, which is illustrated in the Q Manual. 4. Tasks to be completed must se got one pair of us exchange loved combines michelle ake sure you use the tickers provided in parentheses to find the correct companies Insurance Camp Ation Mettle (MET) Manufacturing - Apparel & PVF Corp (PVH) RL) Lauren Coperation prepare your report two companies you must perform the following tasks and discuss the industry in which they operate. You must address the following questions as part What is your companions' size in go industry in when seems number of staff, total assets etc) (eg. growing faster/sloweridedining) Note any significant differences between their operations and Infuence their risk profiles same stakeholders for both companies? Discuss any kay differences and how this may affect risk identification. any skaaritles and afterences and how this might affect their kensications of risk Risk Analysis elect ONE of the folowing from TWO ahernatives choices for your analysis. ative A: Risk Taxonomy Comparison sing the 10-k report (flem 1 A] disclosures: stoned risks ings soonerly for BOTH comp had other subcategories. ual financial or compliance.heputs on risk I'm descending order a imports day care cradle of similar reks them 1.A lists rish Complete a hypothetical consequence scale (using the risk categories strategic. as a hypothetical risk matix for ONE of the companies; and. the tree (3) highest marked risks reported by the company in is tom um fx Alternative B: Risk Analysis between your two companies (es. Fraud subtype in Operational rek bygel and. . Explain the nature of this risk disc y's descriptions in thered and what cores quer Perform a detailed Bow The analysis of the risk highlighting both the causes and explain your own hypothetical controls and their intended operation and position on to provide a leading backsfor of that myboth nging riek leventmy risk indicator . Despite an folsomin terrereference management process to manage this met. Explain what risk management frame buthe gement process used by the company (unless described in the annual report). So, cadings, and your own research to propose a reasonable hypothetical approach. Information to source four primary source is the annual report known as the 10-K report available from each company's website under SEC filings. Use the most recent information available, which business. its segment performance (brands. products, courteouswildsous investor relation information on the company's websites for updated information and sports and shareholder presentarices that often discuss key strategies especially if not your own words. charts and graphs to in ustrain your seguments (x is a business see opendix so that the body of your report a picture Remember to p