Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i have attached Q1 answers. i need Q2 and Q3 answers in 50 mins i will give you thumb up Suppose we have the following

i have attached Q1 answers.

i need Q2 and Q3 answers in 50 mins i will give you thumb up

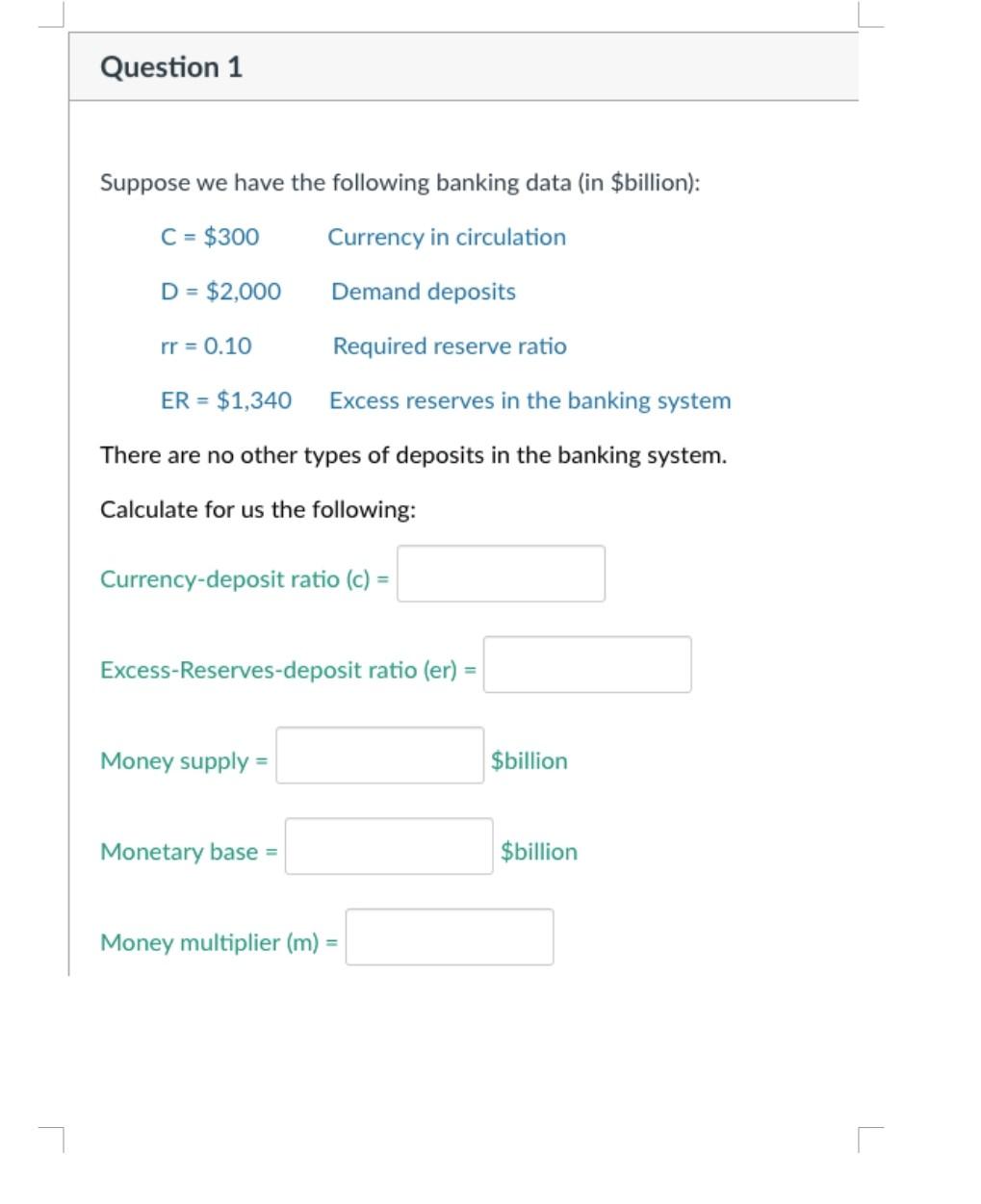

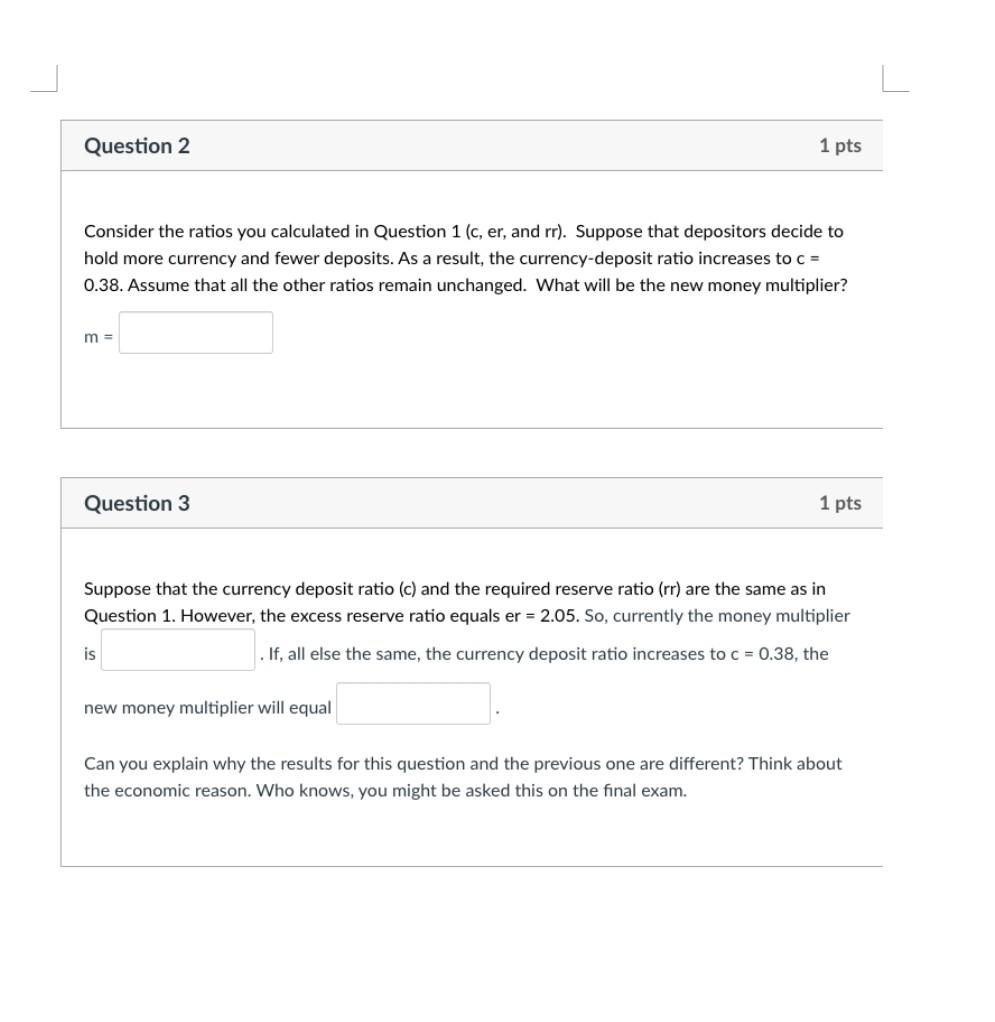

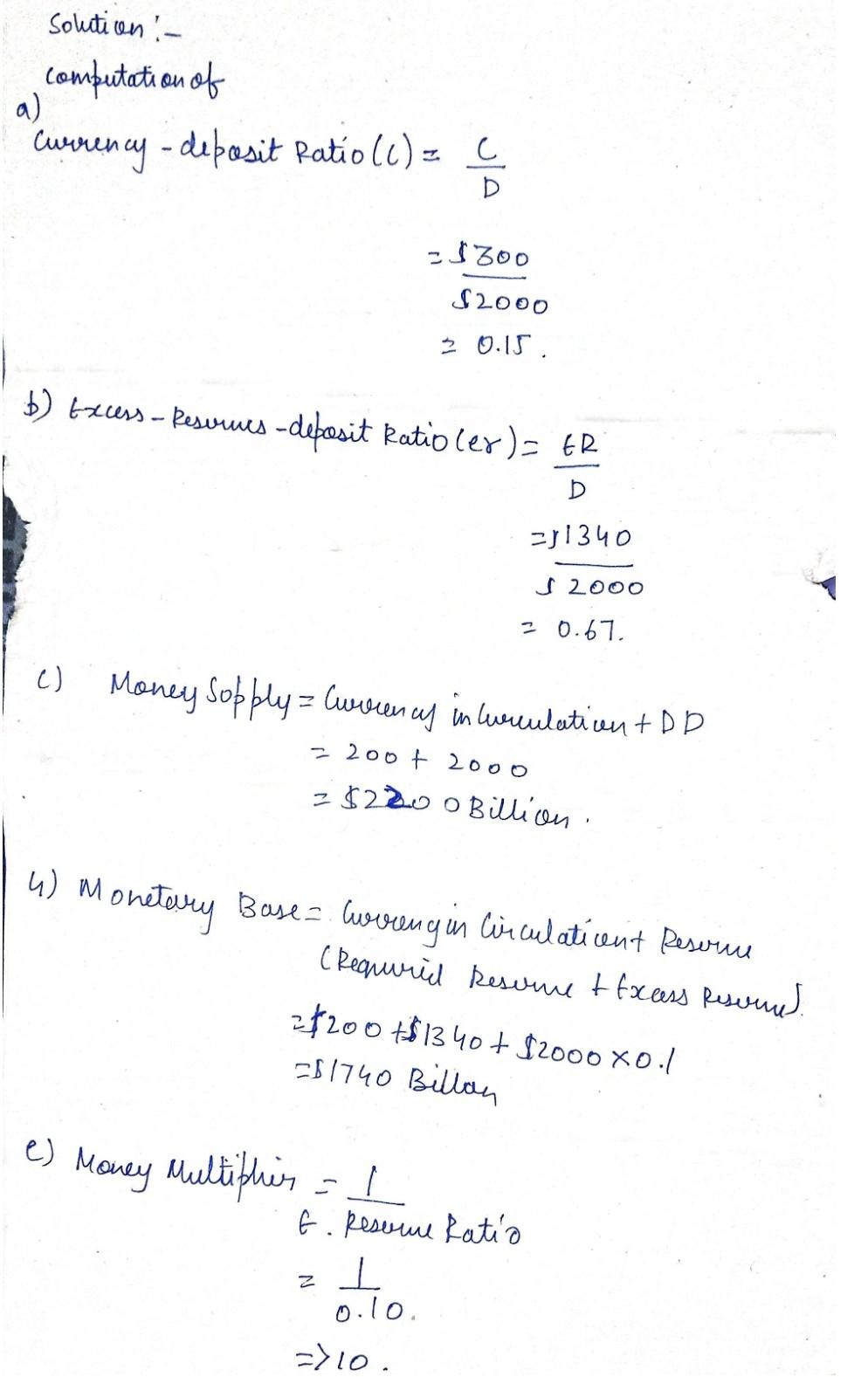

Suppose we have the following banking data (in \$billion): C=$300 Currency in circulation D=$2,000 Demand deposits rr=0.10 Required reserve ratio ER=$1,340 Excess reserves in the banking system There are no other types of deposits in the banking system. Calculate for us the following: Currency-deposit ratio (c)= Excess-Reserves-deposit ratio (er) = Money supply = \$bilion Monetary base = \$billion Money multiplier (m)= Consider the ratios you calculated in Question 1 (c, er, and rr). Suppose that depositors decide to hold more currency and fewer deposits. As a result, the currency-deposit ratio increases to c= 0.38. Assume that all the other ratios remain unchanged. What will be the new money multiplier? m= Question 3 1 pts Suppose that the currency deposit ratio (c) and the required reserve ratio (rr) are the same as in Question 1. However, the excess reserve ratio equals er =2.05. So, currently the money multiplier is . If, all else the same, the currency deposit ratio increases to c=0.38, the new money multiplier will equal Can you explain why the results for this question and the previous one are different? Think about the economic reason. Who knows, you might be asked this on the final exam. currency-depositRatio(C)=DC=$2000$300=0.15. b) Excess-Resumes - deposit Ratio (er) =DER =1200051340=0.67. C) Money Sopply = Gromay inkerulaticen +DD =200+2000=$200Billion. 4) Monetary Base = Groengin Circulaticent Reserne (Requirid Rescrue +fx cess Rescme.). =$200+$1340+$20000.1 =51740 BillanStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started