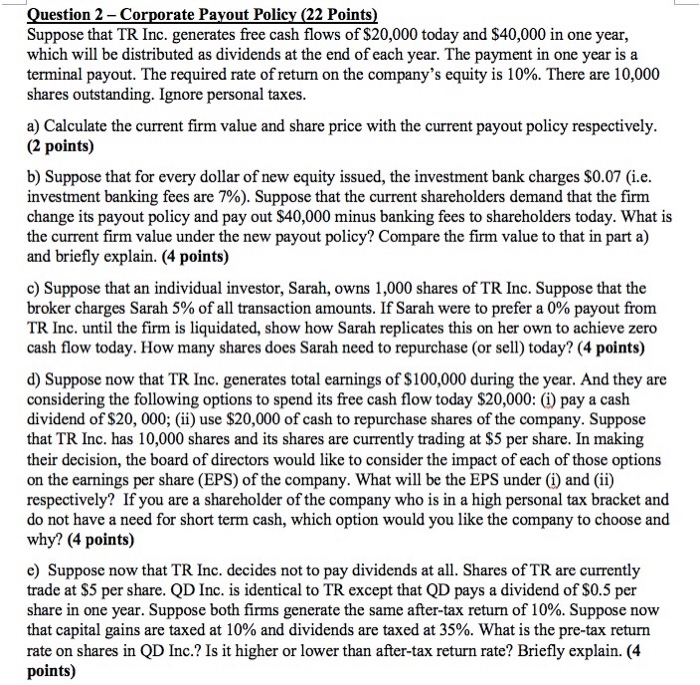

I have been provided a practice quiz for my Finance course, and I need some help figuring out this question. Answer and explanation would be much appreciated!

Question 2 - Corporate Payout Policy (22 Points) Suppose that TR Inc. generates free cash flows of $20,000 today and $40,000 in one year, which will be distributed as dividends at the end of each year. The payment in one year is a terminal payout. The required rate of return on the company's equity is 10%. There are 10,000 shares outstanding. Ignore personal taxes. a) Calculate the current firm value and share price with the current payout policy respectively. (2 points) b) Suppose that for every dollar of new equity issued, the investment bank charges $0.07 (i.e. investment banking fees are 7%). Suppose that the current shareholders demand that the firm change its payout policy and pay out $40,000 minus banking fees to shareholders today. What is the current firm value under the new payout policy? Compare the firm value to that in part a) and briefly explain. (4 points) c) Suppose that an individual investor, Sarah, owns 1.000 shares of TR Inc. Suppose that the broker charges Sarah 5% of all transaction amounts. If Sarah were to prefer a 0% payout from TR Inc. until the firm is liquidated, show how Sarah replicates this on her own to achieve zero cash flow today. How many shares does Sarah need to repurchase (or sell) today? (4 points) d) Suppose now that TR Inc. generates total earnings of $100,000 during the year. And they are considering the following options to spend its free cash flow today $20,000: (i) pay a cash dividend of $20,000; (ii) use $20,000 of cash to repurchase shares of the company. Suppose that TR Inc. has 10,000 shares and its shares are currently trading at $5 per share. In making their decision, the board of directors would like to consider the impact of each of those options on the earnings per share (EPS) of the company. What will be the EPS under (i) and (ii) respectively? If you are a shareholder of the company who is in a high personal tax bracket and do not have a need for short term cash, which option would you like the company to choose and why? (4 points) e) Suppose now that TR Inc. decides not to pay dividends at all. Shares of TR are currently trade at $5 per share. QD Inc. is identical to TR except that QD pays a dividend of $0.5 per share in one year. Suppose both firms generate the same after-tax return of 10%. Suppose now that capital gains are taxed at 10% and dividends are taxed at 35%. What is the pre-tax return rate on shares in QD Inc.? Is it higher or lower than after-tax return rate? Briefly explain. (4 points) Question 2 - Corporate Payout Policy (22 Points) Suppose that TR Inc. generates free cash flows of $20,000 today and $40,000 in one year, which will be distributed as dividends at the end of each year. The payment in one year is a terminal payout. The required rate of return on the company's equity is 10%. There are 10,000 shares outstanding. Ignore personal taxes. a) Calculate the current firm value and share price with the current payout policy respectively. (2 points) b) Suppose that for every dollar of new equity issued, the investment bank charges $0.07 (i.e. investment banking fees are 7%). Suppose that the current shareholders demand that the firm change its payout policy and pay out $40,000 minus banking fees to shareholders today. What is the current firm value under the new payout policy? Compare the firm value to that in part a) and briefly explain. (4 points) c) Suppose that an individual investor, Sarah, owns 1.000 shares of TR Inc. Suppose that the broker charges Sarah 5% of all transaction amounts. If Sarah were to prefer a 0% payout from TR Inc. until the firm is liquidated, show how Sarah replicates this on her own to achieve zero cash flow today. How many shares does Sarah need to repurchase (or sell) today? (4 points) d) Suppose now that TR Inc. generates total earnings of $100,000 during the year. And they are considering the following options to spend its free cash flow today $20,000: (i) pay a cash dividend of $20,000; (ii) use $20,000 of cash to repurchase shares of the company. Suppose that TR Inc. has 10,000 shares and its shares are currently trading at $5 per share. In making their decision, the board of directors would like to consider the impact of each of those options on the earnings per share (EPS) of the company. What will be the EPS under (i) and (ii) respectively? If you are a shareholder of the company who is in a high personal tax bracket and do not have a need for short term cash, which option would you like the company to choose and why? (4 points) e) Suppose now that TR Inc. decides not to pay dividends at all. Shares of TR are currently trade at $5 per share. QD Inc. is identical to TR except that QD pays a dividend of $0.5 per share in one year. Suppose both firms generate the same after-tax return of 10%. Suppose now that capital gains are taxed at 10% and dividends are taxed at 35%. What is the pre-tax return rate on shares in QD Inc.? Is it higher or lower than after-tax return rate? Briefly explain. (4 points)