Answered step by step

Verified Expert Solution

Question

1 Approved Answer

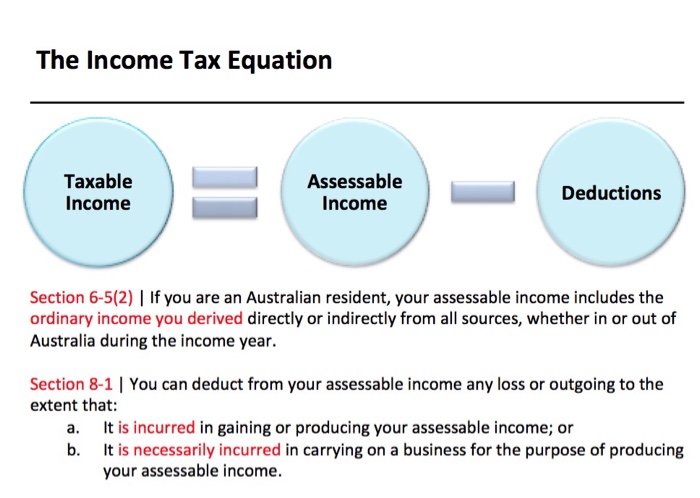

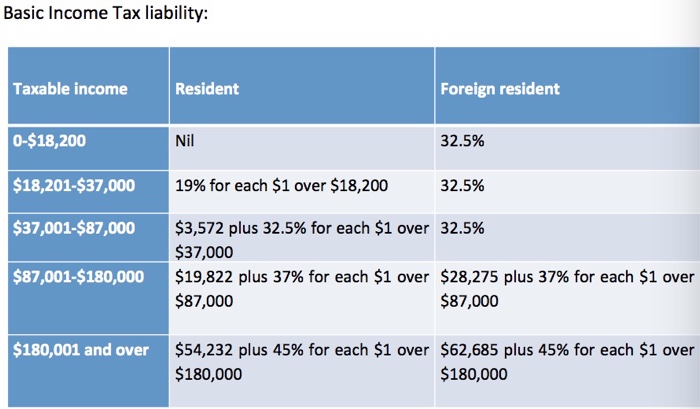

Josh have been presented with the 2017-2018 financial statements of M Pty Ltd. Required: To calculate his taxable income for the 2017-2018 income year, starting

Josh have been presented with the 2017-2018 financial statements of M Pty Ltd.

Required:

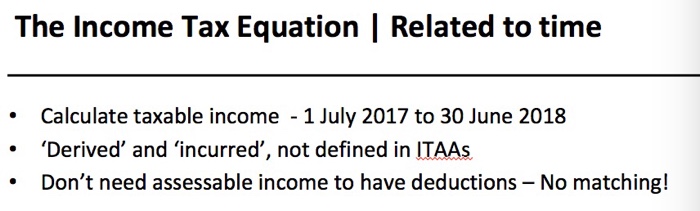

To calculate his taxable income for the 2017-2018 income year, starting with profit before tax of $12,000,000, providing explanations for your calculation. These are the relevant notes for the 2017-2018 income year:

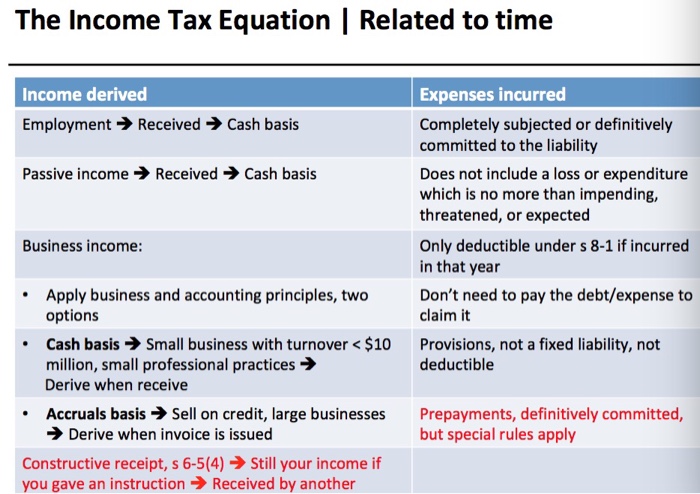

-Accounting depreciation totalled $500,000.

-The company qualifies for capital allowances (tax depreciation) on a basis which is different

to accounting depreciation. The accountant determined the capital allowances to total

$350,000.

-The provision for leave pay was increased by $25,000 to take into account new staff

appointments.

-The company is planning to expand its retail arm. To partly fund the expansion, set to take

place in the 2018-2019 income year, a provision for future expansion was created totalling

$1,000,000.

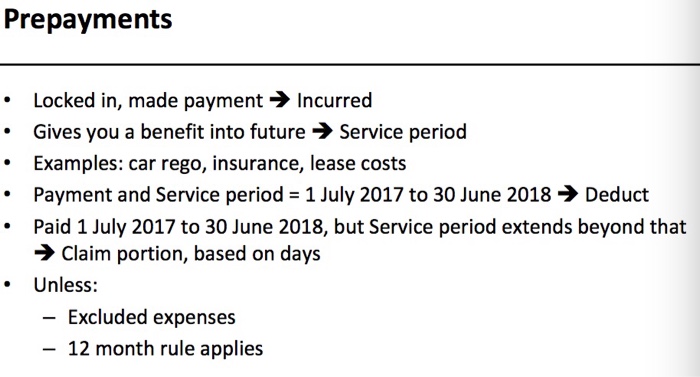

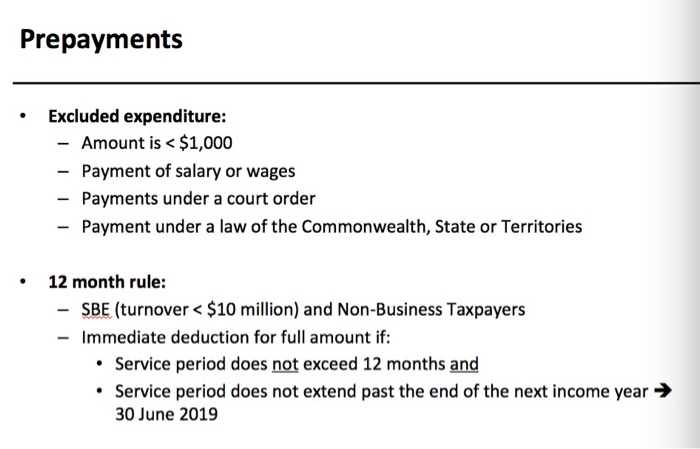

-On 1 June 2018, the company prepaid its public liability insurance for the period 1 July 2018

to 30 June 2019. The payment totalled $12,000. Using generally accepted accounting principles, no part of the amount was expensed in the 2017-2018 income year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started