Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I have compleated the journal entries for a-e, but I am stuck from there on. Can someone help me please? The Bell Wholesale Company began

I have compleated the journal entries for a-e, but I am stuck from there on. Can someone help me please?

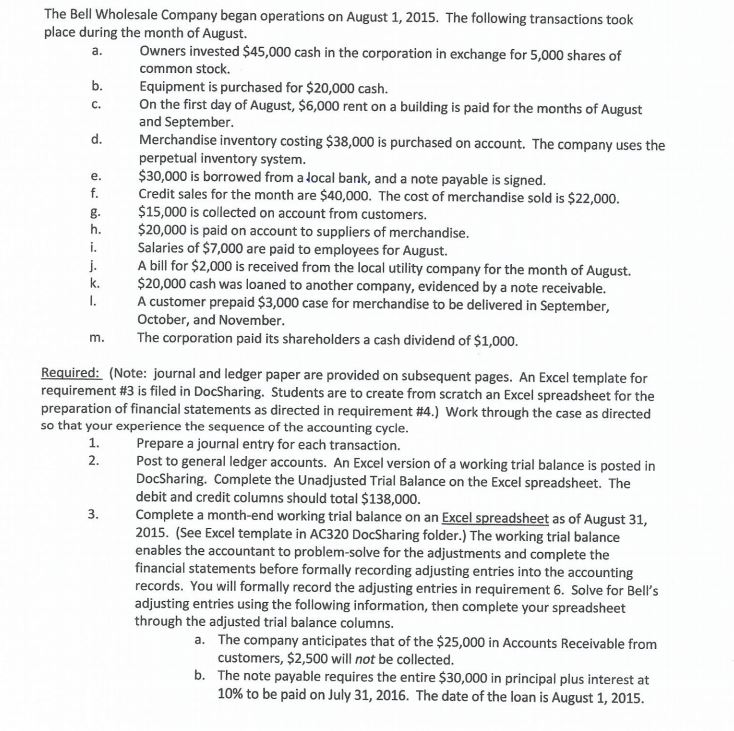

The Bell Wholesale Company began operations on August 1, 2015. The following transactions took place during the month of August. Owners invested $45,000 cash in the corporation in exchange for 5,000 shares of common stock. Equipment is purchased for $20,000 cash. On the first day of August, $6,000 rent on a building is paid for the months of August and September Merchandise inventory costing $38,000 is purchased on account. The company uses the perpetual inventory system $30,000 is borrowed from a local bank, and a note payable is signed. Credit sales for the month are $40,000. The cost of merchandise sold is $22,000 $15,000 is collected on account from customers. $20,000 is paid on account to suppliers of merchandise c. d. e. i. Salaries of $7,000 are paid to employees for August. j. Al for $2,000 is received from the local utility company for the month of August. k. $20,000 cash was loaned to another company, evidenced by a note receivable. A customer prepaid $3,000 case for merchandise to be delivered in September, October, and November The corporation paid its shareholders a cash dividend of $1,000 m. Required: (Note: journal and ledger paper are provided on subsequent pages. An Excel template for requirement #3 is filed in DocSharing. Students are to create from scratch an Excel spreadsheet for the preparation of financial statements as directed in requirement #4.) work through the case as directed so that your experience the sequence of the accounting cycle Prepare a journal entry for each transaction. Post to general ledger accounts. An Excel version of a working trial balance is posted in DocSharing. Complete the Unadjusted Trial Balance on the Excel spreadsheet. The debit and credit columns should total $138,000 Complete a month-end working trial balance on an Excel spreadsheet as of August 31, 2015. (See Excel template in AC320 DocSharing folder.) The working trial balance enables the accountant to problem-solve for the adjustments and complete the financial statements before formally recording adjusting entries into the accounting records. You will formally record the adjusting entries in requirement 6. Solve for Bell's adjusting entries using the following information, then complete your spreadsheet through the adjusted trial balance columns. 1. The company anticipates that of the $25,000 in Accounts Receivable from customers, $2,500 will not be collected The note payable requires the entire $30,000 in principal plus interest at 10% to be paid on July 31, 2016, The date of the loan is August 1, 2015 a. bStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started