Answered step by step

Verified Expert Solution

Question

1 Approved Answer

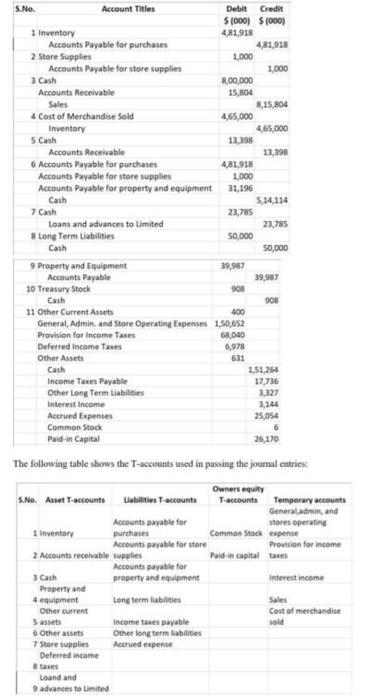

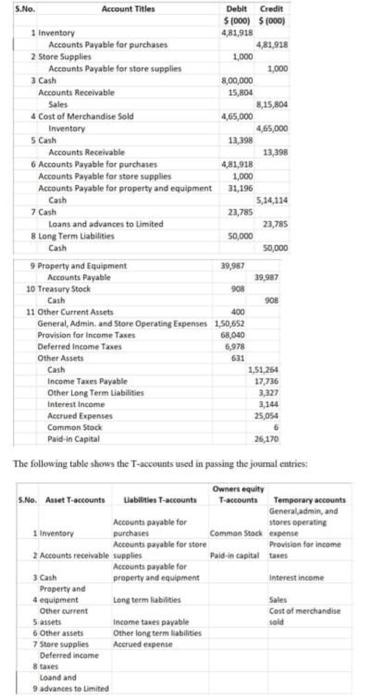

I have complete part a and b need from c to g . Please answer this question ASAP . The following table shows the T-acceunts

I have complete part a and b need from c to g . Please answer this question ASAP .

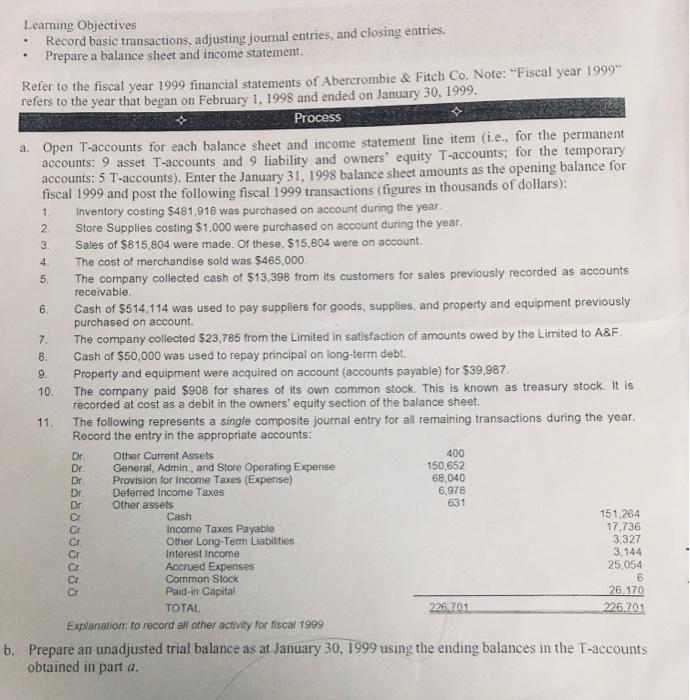

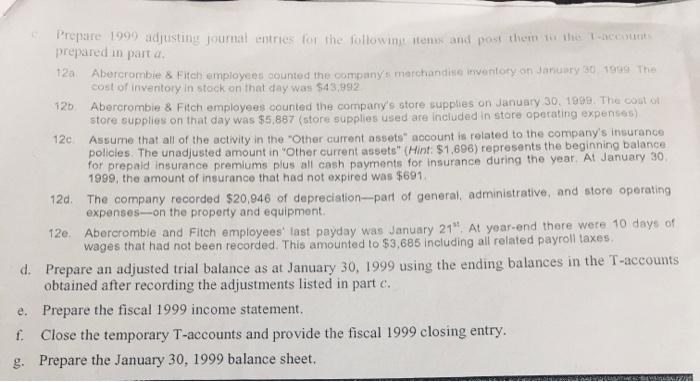

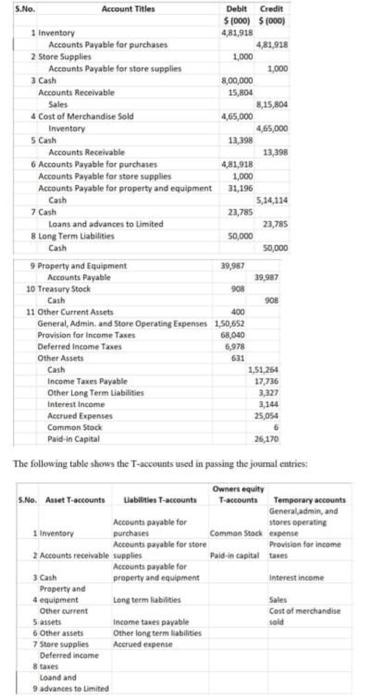

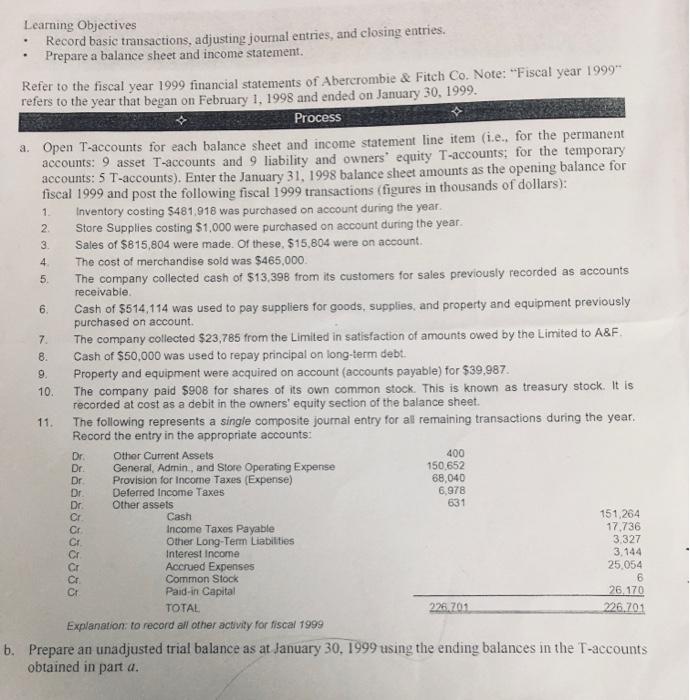

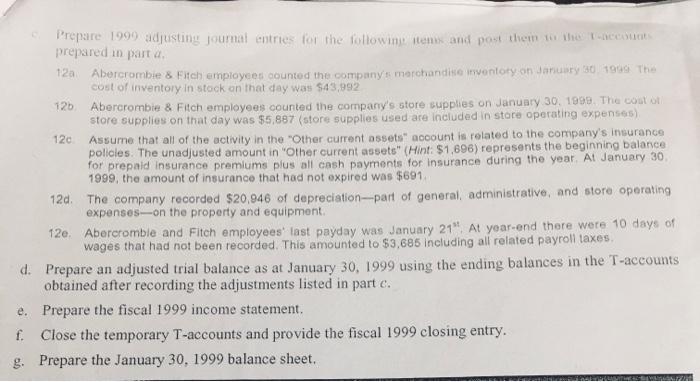

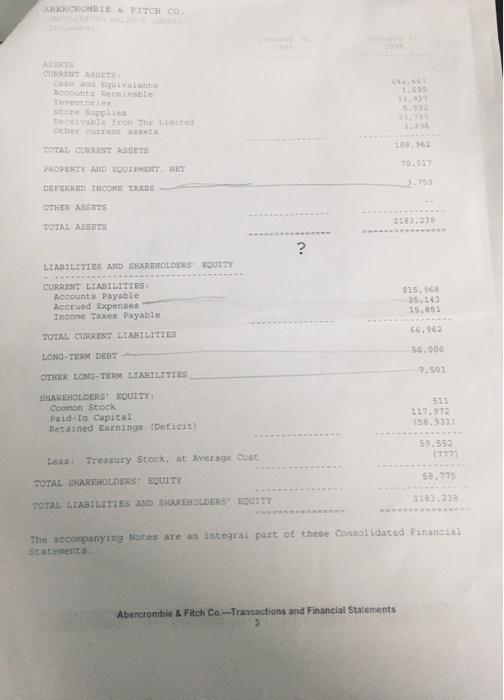

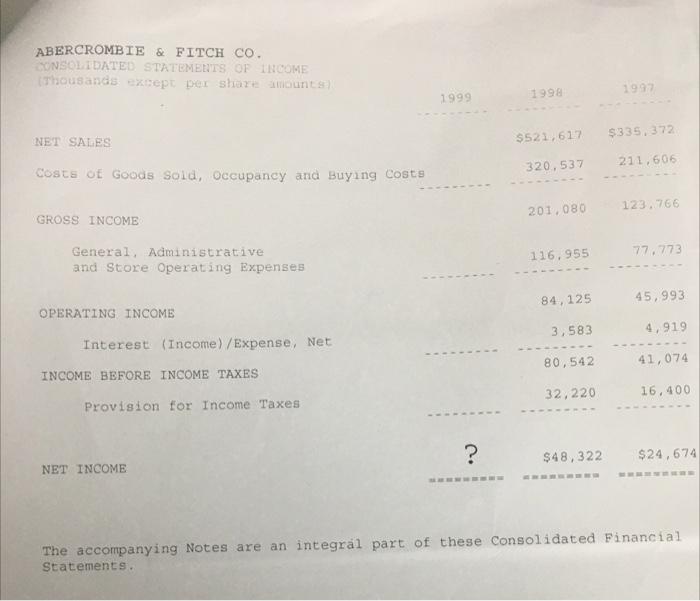

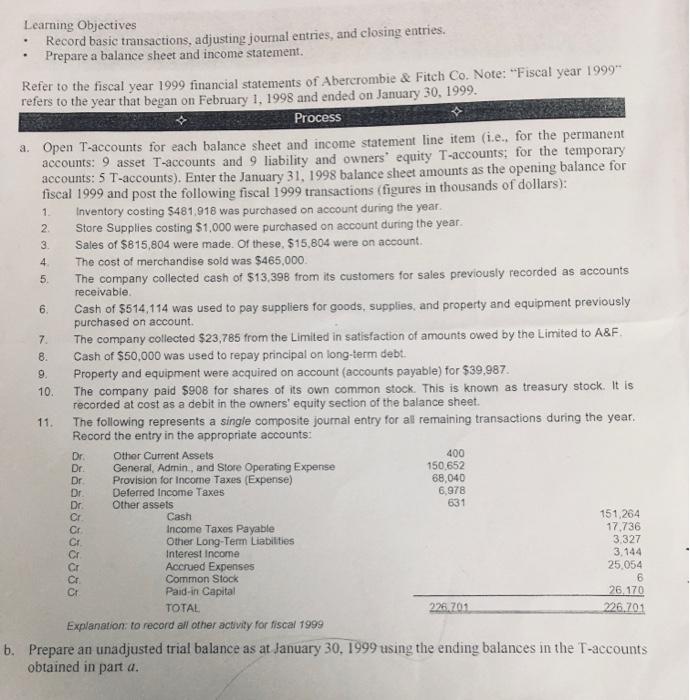

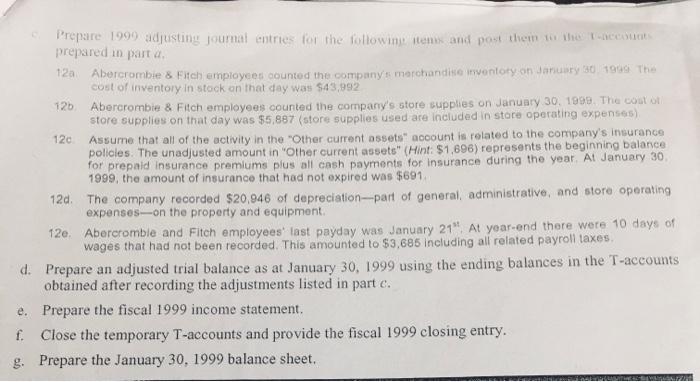

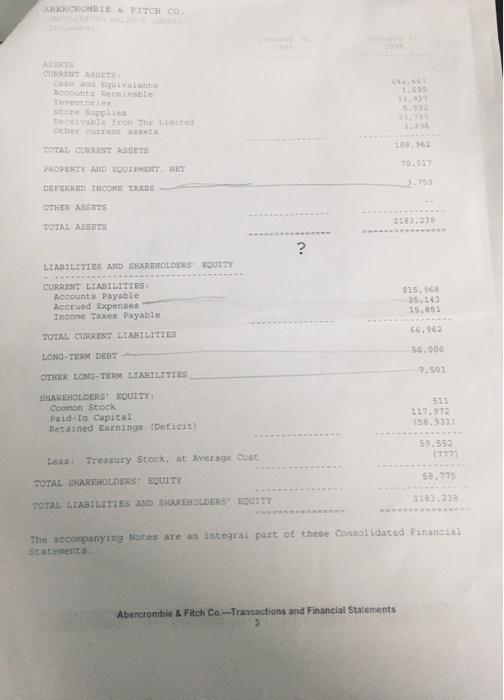

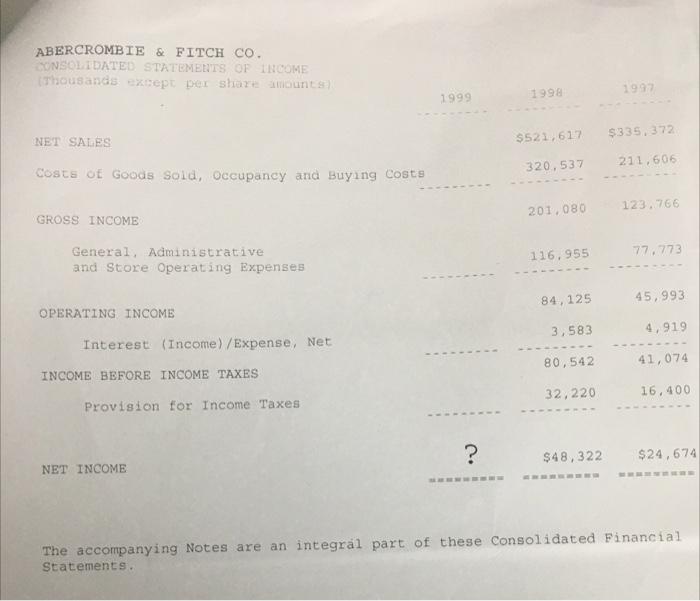

The following table shows the T-acceunts used in passing the journal eutries: Learning Objectives - Record basic transactions, adjusting journal entries, and closing entries. - Prepare a balance sheet and income statement. Refer to the fiscal year 1999 financial statements of Abercrombie \& Fitch Co. Note: "Fiscal year 1999" refers to the year that began on February 1,1998 and ended on January 30, 1999. a. Open T-accounts for each balance sheet and income statement line item (i.e., for the permanent accounts: 9 asset T-accounts and 9 liability and owners' equity T-accounts; for the temporary accounts: 5 T-accounts). Enter the January 31,1998 balance sheet amounts as the opening balance for fiscal 1999 and post the following fiscal 1999 transactions (figures in thousands of dollars): 1. Inventory costing $481,918 was purchased on account during the year. 2. Store Supplies costing $1,000 were purchased on account during the year. 3. Sales of $815,804 were made. Of these, $15,804 were on account. 4. The cost of merchandise sold was $465,000. 5. The company collected cash of $13,398 from its customers for sales previously recorded as accounts receivable. 6. Cash of $514,114 was used to pay suppliers for goods, supplies, and property and equipment previously purchased on account. 7. The company collected $23,785 from the Limited in satisfaction of amounts owed by the Limited to A\&F. 8. Cash of $50,000 was used to repay princlpal on long-term debt. 9. Property and equipment were acquired on account (accounts payable) for $39,987. 10. The company paid $908 for shares of its own common stock. This is known as treasury stock. It is recorded at cost as a debit in the owners' equity section of the balance sheet. 11. The following represents a single composite journal entry for all remaining transactions during the year. Record the entry in the appropriate accounts: Prepare an unadjusted trial balance as at January 30.1999 using the ending balances in the T-accounts obtained in part a. prepared in part a. 12a. Abercrombie \& Fitch employees counted the company's merchandise inventofy on Jariuary 30.1949 The cost of inventory in stock on that day was $43,992 120. Abercrombie \&. Fitch employees counted the company's store supplies on January 30.1999. The cout of store supplies on that day was $5,887 (store supplies used are included in store operating expenses) 120. Assume that all of the activity in the "Other current assets" acoount is related to the company's insurance policles. The unadjusted amount in "Other current assets" (Hint: \$1,696) represents the beginning balance for prepaid insurance premlums plus all cash payments for insurance during the year. At January 30 1999 , the amount of insurance that had not expired was $691. 12d. The company recorded $20,946 of depreciation-part of general, administrative, and store operating expenses-on the property and equipment. 12e. Abercromble and Fitch employees' last payday was January 21. At yoar-end there were 10 days of wages that had not been recorded. This amounted to $3,685 including all related payroll taxes. d. Prepare an adjusted trial balance as at January 30,1999 using the ending balances in the T-accounts obtained after recording the adjustments listed in part c. e. Prepare the fiscal 1999 income statement. Close the temporary T-accounts and provide the fiscal 1999 closing entry. Prepare the January 30,1999 balance sheet. The following table shows the T-acceunts used in passing the journal eutries: Learning Objectives - Record basic transactions, adjusting journal entries, and closing entries. - Prepare a balance sheet and income statement. Refer to the fiscal year 1999 financial statements of Abercrombie \& Fitch Co. Note: "Fiscal year 1999" refers to the year that began on February 1,1998 and ended on January 30, 1999. a. Open T-accounts for each balance sheet and income statement line item (i.e., for the permanent accounts: 9 asset T-accounts and 9 liability and owners' equity T-accounts; for the temporary accounts: 5 T-accounts). Enter the January 31,1998 balance sheet amounts as the opening balance for fiscal 1999 and post the following fiscal 1999 transactions (figures in thousands of dollars): 1. Inventory costing $481,918 was purchased on account during the year. 2. Store Supplies costing $1,000 were purchased on account during the year. 3. Sales of $815,804 were made. Of these, $15,804 were on account. 4. The cost of merchandise sold was $465,000. 5. The company collected cash of $13,398 from its customers for sales previously recorded as accounts receivable. 6. Cash of $514,114 was used to pay suppliers for goods, supplies, and property and equipment previously purchased on account. 7. The company collected $23,785 from the Limited in satisfaction of amounts owed by the Limited to A\&F. 8. Cash of $50,000 was used to repay princlpal on long-term debt. 9. Property and equipment were acquired on account (accounts payable) for $39,987. 10. The company paid $908 for shares of its own common stock. This is known as treasury stock. It is recorded at cost as a debit in the owners' equity section of the balance sheet. 11. The following represents a single composite journal entry for all remaining transactions during the year. Record the entry in the appropriate accounts: Prepare an unadjusted trial balance as at January 30.1999 using the ending balances in the T-accounts obtained in part a. prepared in part a. 12a. Abercrombie \& Fitch employees counted the company's merchandise inventofy on Jariuary 30.1949 The cost of inventory in stock on that day was $43,992 120. Abercrombie \&. Fitch employees counted the company's store supplies on January 30.1999. The cout of store supplies on that day was $5,887 (store supplies used are included in store operating expenses) 120. Assume that all of the activity in the "Other current assets" acoount is related to the company's insurance policles. The unadjusted amount in "Other current assets" (Hint: \$1,696) represents the beginning balance for prepaid insurance premlums plus all cash payments for insurance during the year. At January 30 1999 , the amount of insurance that had not expired was $691. 12d. The company recorded $20,946 of depreciation-part of general, administrative, and store operating expenses-on the property and equipment. 12e. Abercromble and Fitch employees' last payday was January 21. At yoar-end there were 10 days of wages that had not been recorded. This amounted to $3,685 including all related payroll taxes. d. Prepare an adjusted trial balance as at January 30,1999 using the ending balances in the T-accounts obtained after recording the adjustments listed in part c. e. Prepare the fiscal 1999 income statement. Close the temporary T-accounts and provide the fiscal 1999 closing entry. Prepare the January 30,1999 balance sheet. The accompanying Notes are as intequal part of these Conalidated Financial Stiatemerits. Abercrombio 8 Fitch Co-Transactions and Financial Statenents 5 The accompanying Notes are an integral part of these consolidated Financial Statements. The following table shows the T-acceunts used in passing the journal eutries: Learning Objectives - Record basic transactions, adjusting journal entries, and closing entries. - Prepare a balance sheet and income statement. Refer to the fiscal year 1999 financial statements of Abercrombie \& Fitch Co. Note: "Fiscal year 1999" refers to the year that began on February 1,1998 and ended on January 30, 1999. a. Open T-accounts for each balance sheet and income statement line item (i.e., for the permanent accounts: 9 asset T-accounts and 9 liability and owners' equity T-accounts; for the temporary accounts: 5 T-accounts). Enter the January 31,1998 balance sheet amounts as the opening balance for fiscal 1999 and post the following fiscal 1999 transactions (figures in thousands of dollars): 1. Inventory costing $481,918 was purchased on account during the year. 2. Store Supplies costing $1,000 were purchased on account during the year. 3. Sales of $815,804 were made. Of these, $15,804 were on account. 4. The cost of merchandise sold was $465,000. 5. The company collected cash of $13,398 from its customers for sales previously recorded as accounts receivable. 6. Cash of $514,114 was used to pay suppliers for goods, supplies, and property and equipment previously purchased on account. 7. The company collected $23,785 from the Limited in satisfaction of amounts owed by the Limited to A\&F. 8. Cash of $50,000 was used to repay princlpal on long-term debt. 9. Property and equipment were acquired on account (accounts payable) for $39,987. 10. The company paid $908 for shares of its own common stock. This is known as treasury stock. It is recorded at cost as a debit in the owners' equity section of the balance sheet. 11. The following represents a single composite journal entry for all remaining transactions during the year. Record the entry in the appropriate accounts: Prepare an unadjusted trial balance as at January 30.1999 using the ending balances in the T-accounts obtained in part a. prepared in part a. 12a. Abercrombie \& Fitch employees counted the company's merchandise inventofy on Jariuary 30.1949 The cost of inventory in stock on that day was $43,992 120. Abercrombie \&. Fitch employees counted the company's store supplies on January 30.1999. The cout of store supplies on that day was $5,887 (store supplies used are included in store operating expenses) 120. Assume that all of the activity in the "Other current assets" acoount is related to the company's insurance policles. The unadjusted amount in "Other current assets" (Hint: \$1,696) represents the beginning balance for prepaid insurance premlums plus all cash payments for insurance during the year. At January 30 1999 , the amount of insurance that had not expired was $691. 12d. The company recorded $20,946 of depreciation-part of general, administrative, and store operating expenses-on the property and equipment. 12e. Abercromble and Fitch employees' last payday was January 21. At yoar-end there were 10 days of wages that had not been recorded. This amounted to $3,685 including all related payroll taxes. d. Prepare an adjusted trial balance as at January 30,1999 using the ending balances in the T-accounts obtained after recording the adjustments listed in part c. e. Prepare the fiscal 1999 income statement. Close the temporary T-accounts and provide the fiscal 1999 closing entry. Prepare the January 30,1999 balance sheet. The following table shows the T-acceunts used in passing the journal eutries: Learning Objectives - Record basic transactions, adjusting journal entries, and closing entries. - Prepare a balance sheet and income statement. Refer to the fiscal year 1999 financial statements of Abercrombie \& Fitch Co. Note: "Fiscal year 1999" refers to the year that began on February 1,1998 and ended on January 30, 1999. a. Open T-accounts for each balance sheet and income statement line item (i.e., for the permanent accounts: 9 asset T-accounts and 9 liability and owners' equity T-accounts; for the temporary accounts: 5 T-accounts). Enter the January 31,1998 balance sheet amounts as the opening balance for fiscal 1999 and post the following fiscal 1999 transactions (figures in thousands of dollars): 1. Inventory costing $481,918 was purchased on account during the year. 2. Store Supplies costing $1,000 were purchased on account during the year. 3. Sales of $815,804 were made. Of these, $15,804 were on account. 4. The cost of merchandise sold was $465,000. 5. The company collected cash of $13,398 from its customers for sales previously recorded as accounts receivable. 6. Cash of $514,114 was used to pay suppliers for goods, supplies, and property and equipment previously purchased on account. 7. The company collected $23,785 from the Limited in satisfaction of amounts owed by the Limited to A\&F. 8. Cash of $50,000 was used to repay princlpal on long-term debt. 9. Property and equipment were acquired on account (accounts payable) for $39,987. 10. The company paid $908 for shares of its own common stock. This is known as treasury stock. It is recorded at cost as a debit in the owners' equity section of the balance sheet. 11. The following represents a single composite journal entry for all remaining transactions during the year. Record the entry in the appropriate accounts: Prepare an unadjusted trial balance as at January 30.1999 using the ending balances in the T-accounts obtained in part a. prepared in part a. 12a. Abercrombie \& Fitch employees counted the company's merchandise inventofy on Jariuary 30.1949 The cost of inventory in stock on that day was $43,992 120. Abercrombie \&. Fitch employees counted the company's store supplies on January 30.1999. The cout of store supplies on that day was $5,887 (store supplies used are included in store operating expenses) 120. Assume that all of the activity in the "Other current assets" acoount is related to the company's insurance policles. The unadjusted amount in "Other current assets" (Hint: \$1,696) represents the beginning balance for prepaid insurance premlums plus all cash payments for insurance during the year. At January 30 1999 , the amount of insurance that had not expired was $691. 12d. The company recorded $20,946 of depreciation-part of general, administrative, and store operating expenses-on the property and equipment. 12e. Abercromble and Fitch employees' last payday was January 21. At yoar-end there were 10 days of wages that had not been recorded. This amounted to $3,685 including all related payroll taxes. d. Prepare an adjusted trial balance as at January 30,1999 using the ending balances in the T-accounts obtained after recording the adjustments listed in part c. e. Prepare the fiscal 1999 income statement. Close the temporary T-accounts and provide the fiscal 1999 closing entry. Prepare the January 30,1999 balance sheet. The accompanying Notes are as intequal part of these Conalidated Financial Stiatemerits. Abercrombio 8 Fitch Co-Transactions and Financial Statenents 5 The accompanying Notes are an integral part of these consolidated Financial Statements

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started