Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I have done part a and need help with part b Cash paid to suppliers is required for expenses as well. You are provided with

I have done part a and need help with part b

Cash paid to suppliers is required for expenses as well.

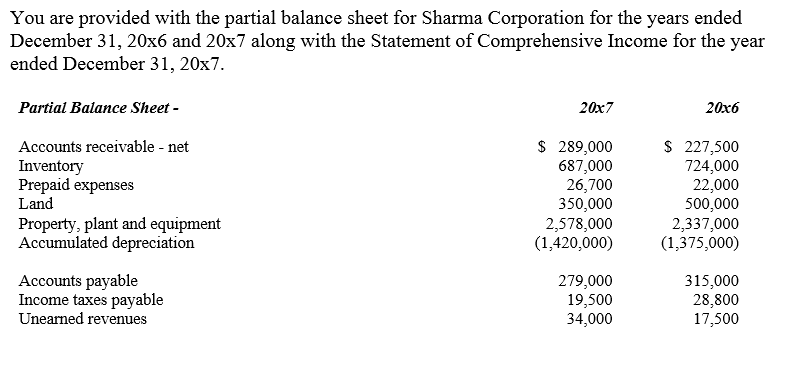

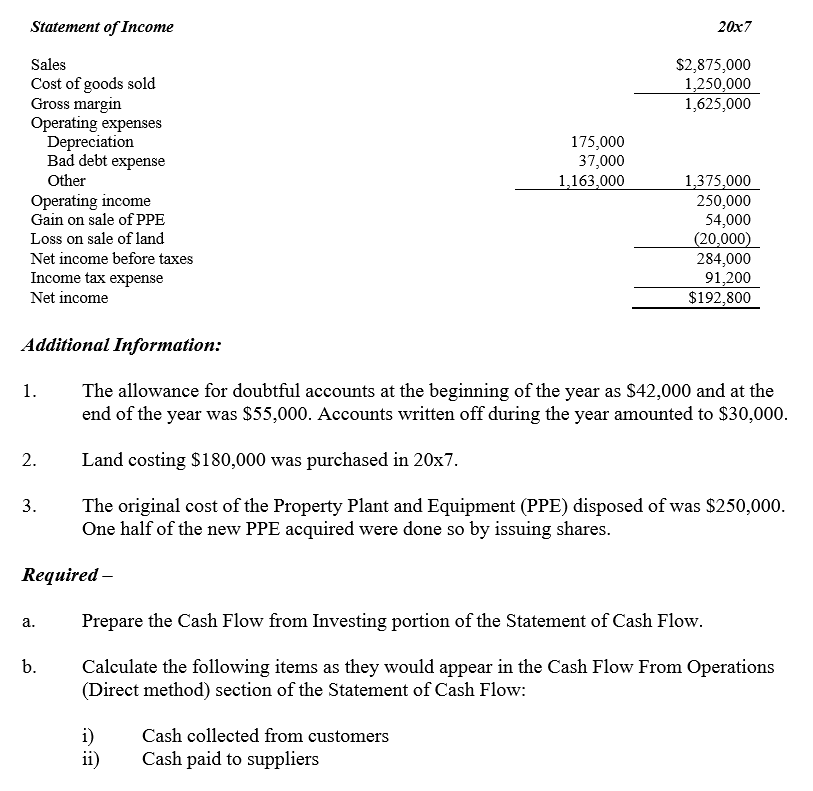

You are provided with the partial balance sheet for Sharma Corporation for the years ended December 31, 20x6 and 20x7 along with the Statement of Comprehensive Income for the year ended December 31, 20x7. Partial Balance Sheet - 20x7 20x6 Accounts receivable - net Inventory Prepaid expenses Land Property, plant and equipment Accumulated depreciation $ 289,000 687,000 26,700 350,000 2,578,000 (1,420,000) $ 227,500 724,000 22,000 500,000 2,337,000 (1,375,000) Accounts payable Income taxes payable Unearned revenues 279,000 19,500 34,000 315,000 28,800 17,500 Statement of Income 20x7 $2,875,000 1,250,000 1,625,000 Sales Cost of goods sold Gross margin Operating expenses Depreciation Bad debt expense Other Operating income Gain on sale of PPE Loss on sale of land Net income before taxes Income tax expense Net income 175,000 37,000 1,163,000 1,375,000 250,000 54,000 (20,000) 284.000 91,200 $192,800 Additional Information: 1. The allowance for doubtful accounts at the beginning of the year as $42,000 and at the end of the year was $55,000. Accounts written off during the year amounted to $30,000. Land costing $180,000 was purchased in 20x7. The original cost of the Property Plant and Equipment (PPE) disposed of was $250,000. One half of the new PPE acquired were done so by issuing shares. Required - a. Prepare the Cash Flow from Investing portion of the Statement of Cash Flow. Calculate the following items as they would appear in the Cash Flow From Operations (Direct method) section of the Statement of Cash Flow: i) ii) Cash collected from customers Cash paid to suppliersStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started