I have done qn3 (a), (b) & (c). I need help with qn 3(d)&(e).

Could you show me your workings to part (d) & (e)

Thank You!!!

I have attached the guidelines for part (d) & (e) at the back.

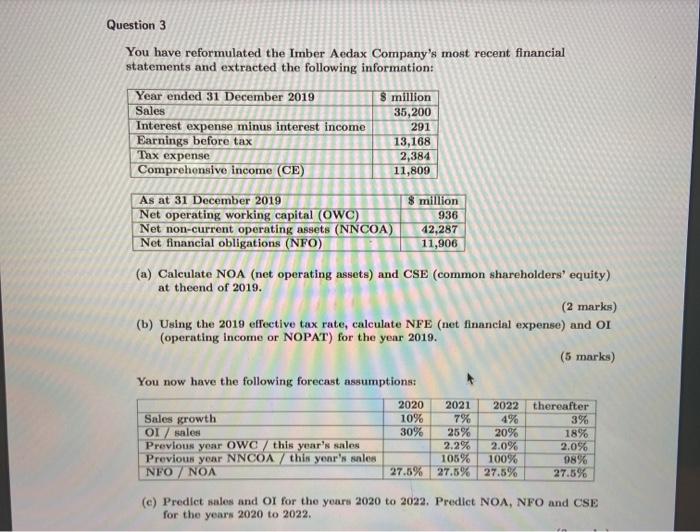

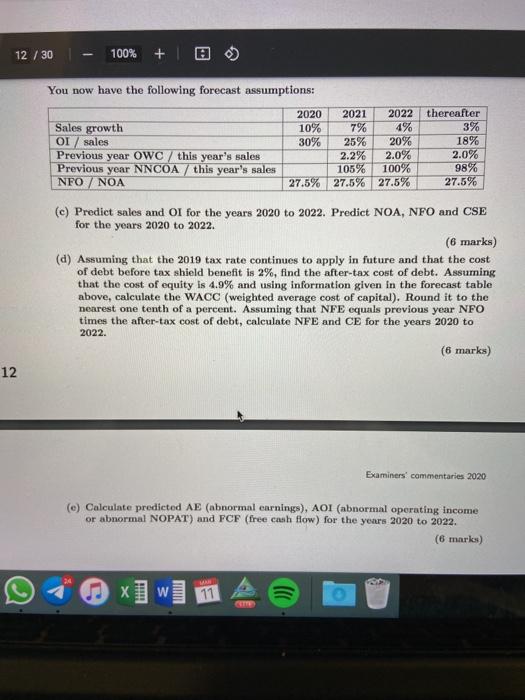

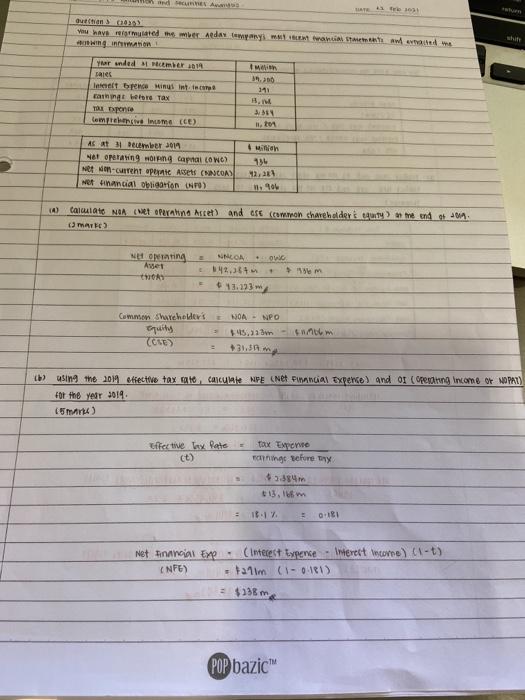

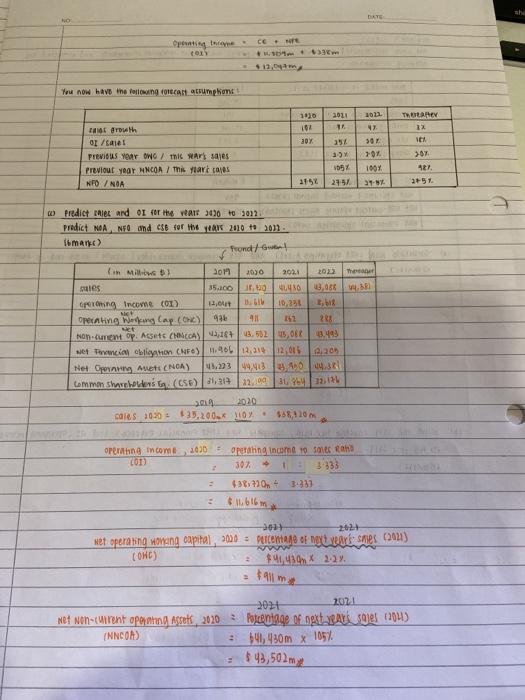

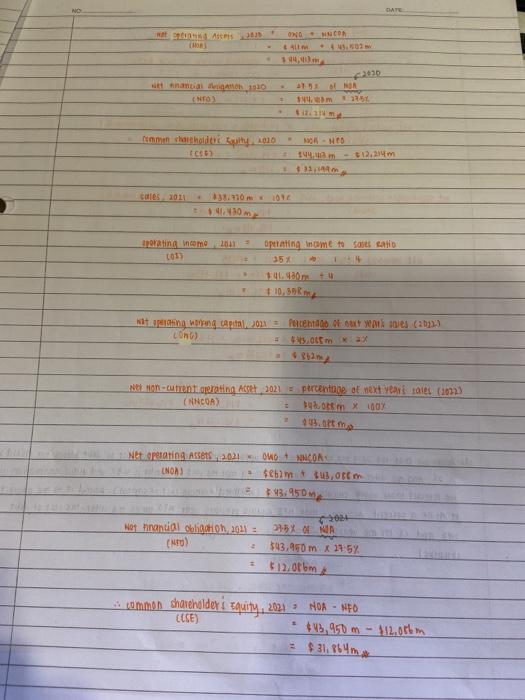

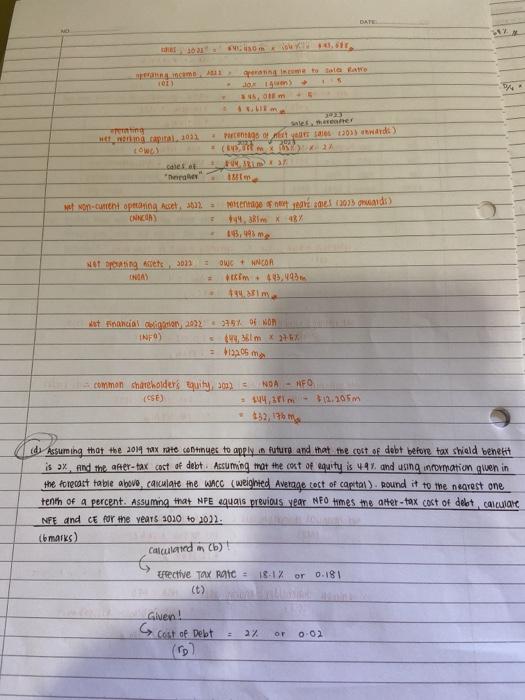

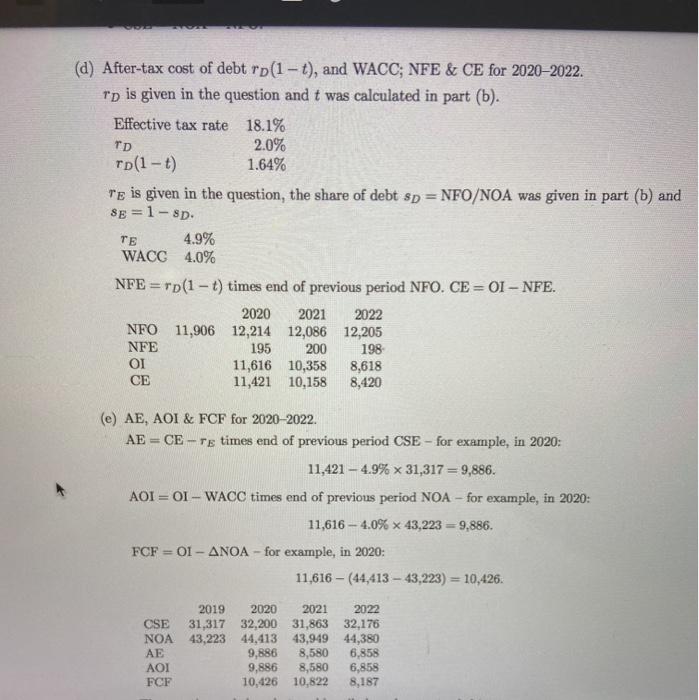

Question 3 You have reformulated the Imber Aedax Company's most recent financial statements and extracted the following information: Year ended 31 December 2019 3 million Sales 35,200 Interest expense minus interest income Earnings before tax 13,168 Tax expense 2,384 Comprehensive income (CE) 11,809 291 936 As at 31 December 2019 $ million Net operating working capital (OWC) Net non-current operating assets (NNCOA) 42.287 Net financial obligations (NFO) 11,906 (a) Calculate NOA (net operating assets) and CSE (common shareholders' equity) at theend of 2019. (2 marks) (b) Using the 2010 effective tax rate, calculate NFE (net financial expense) and on (operating income or NOPAT) for the year 2019. (5 marks) You now have the following forecast assumptions: 2020 thereafter Sales growth 10% 7% 4% 3% 01/ sales 30% 25% 20% 18% Previous year OWC / this year's sales 2.2% 2.0% 2.0% Previous year NNCOA / thin your's sales 106% 100% 98% NFO / NOA 27.6% 27.8% 27.5% 27.5% 2021 2022 (e) Predict sales and or for the years 2020 to 2022. Predict NOA, NFO and CSE for the years 2020 to 2022. 12 / 30 100% + You now have the following forecast assumptions: Sales growth OI / sales Previous year OWC / this year's sales Previous year NNCOA / this year's sales NFO / NOA 2020 2021 2022 10% 7% 4% 30% 25% 20% 2.2% 2.0% 105% 100% 27.5% 27.5% 27.5% thereafter 3% 18% 2.0% 98% 27.5% (c) Predict sales and Ol for the years 2020 to 2022. Predict NOA, NFO and CSE for the years 2020 to 2022. (6 marks) (a) Assuming that the 2019 tax rate continues to apply in future and that the cost of debt before tax shield benefit is 2%, find the after-tax cost of debt. Assuming that the cost of equity is 4.9% and using information given in the forecast table above, calculate the WACC (weighted average cost of capital). Round it to the nearest one tenth of a percent. Assuming that NFE equals previous year NFO times the after-tax cost of debt, calculate NFE and CE for the years 2020 to (6 marks) 2022 12 Examiners commentaries 2020 (e) Calculate predicted AE (abnormal earnings), AOI (abnormal operating income or abnormal NOPAT) and FCF (free cash flow) for the years 2020 to 2022. (6 marks) xw 11 V ways reformulated the mer Aday my the trantie IM Yaar anderember 114 Pales laket brence Minus intim Bathing before Tax 111 B.M Lembut (GE) lito A6 Atbember 2011 Net Operating ang Capital COWG) Net Mon-current aperte Assets (NINCOAS Ne hinancial obligarion ) 134 2,1 A) calu NA (net operating Asset) and ose (ammon chareholders 404) me end mark OWO Noting Awet NHLON 42.3 13.203 + em Common Shareholders equity (OLE) NOA - NPO 45,1mm b) using the 2014 effective tax rate, CAIUWA NFE Net Financial experce) and of creding Income or NOPAT) For the year 2014 (5) Effectwe ty Pate ct) Tax Experte warning scorethy 4384 13. Um = 17 0:11 Net tina A Exe (NFC) Interest Expence - Wherect votome) (-) = Falim (1-001) STM POP bazic DATE mit ce You now have the following concertatumphoni 2011 1023 Theater 1910 101 T 30 ax 354 IC eroth 0 / Previous Year W/ mic sar's sales previour year HNCOA / This Yeard als NFO / NOA 701 307 421 105 100 2154 2751 31-9% 2751 Predict malet and or for the WATT 500 to 2012 Predict NOA NO and 286 for Max 2010 to 2013 mark Trond/Gwent The (in Milli 2011 2030 2024 wies 35.100 10440 Gring income (1) 12,0 . 10,336 Net Operating Weng Car (2) 436 411 288 Non-unen op. Assets AS 15,18413.5025 OD0.449 wet Twia obliganon CNF) 1.12.214 12,015 0 Net On Act (NO) 43.223,134.381 commm shareholders (050) 1,312,00 B12.12 2018 2020 cales 20.30 139.200* LOY $68,110m opening income 201) 2030 Operating inom 10 ses can 30% 1 3333 - 438.730 3333 2 blom -2011 -22 Net operating Hoang capital, 300 = percentage of notwarsmes (301) CONC) $41436 X 22. m 2011 2021 Net non-cuirent operation Asett2020 ? Poceniage of next year sales (20) INNCOR) 41,430m x 105% $ 43,502 my NO DATE des ONO-COM financial no1010 NO 151 Um men har holdte 1010 st - $13,214 101 perating come2013 001) operating in come to satiet sati 35% 1 1 10,30 m kit:peting wong tap 2021 = Percentage Feat WALES (20233 con) current proting Adget 2021 percentage of exteritates (102) (NNCOA) or in 1907 18. m Net Operating Asset.2021 OD NNCOR (NO $ent tuotem 43.950 2014 Net Pinantial Olbia, 2011 (NO) 3 5% of NA $43.960 mA 11:57 $12.0f om a common shareholder i Equity, 2021 HOA - NEO $43, 950m - $12,08km DATE On CAPITAL 1021 LOW Cales et "her Pures of Wort ya 30 ward) + (x2 MARIA wat Non-cottoptan Aceh 36). CNN) Miten hat are ene (3033 grade) 44. Rim 48 A Bet3032 RAS ow WNCOR tim 49,95 Mat Ali 2014 INFO) = 25 m FO common shareholders Equity, 2005 NOA- (CSE) 144, 381m $12,205m 132,13 de assuming that the 2014 tax rate continues to apply future and that the cost of debt before tax shield benefit is ax, and the after-tax cost of debt. Assuming that the cost of earty is 49, and using information gwen in the forecast table above, calculate the wac (weighted Average cost of capital). Round it to the nearest one tenth of a percent. Assuming that NFE equals previous year No times me alter-tax cost of debt calculare NFE and CE for the years 2010 to 30). bemarks) Calculated by 18.1% or 0.181 rective Tax RATC (t) Glen! cost of Debt 27 OT 0-02 NA (d) After-tax cost of debt rp(1-t), and WACC; NFE & CE for 2020-2022. To is given in the question and t was calculated in part (b). Effective tax rate 18.1% TD 2.0% rp(1-t) 1.64% Te is given in the question, the share of debt sp = NFO/NOA was given in part (b) and SE=1-8p. 4.9% WACC 4.0% NFE = Tp(1 t) times end of previous period NFO. CE = 0I NFE. 2020 2021 2022 NFO 11,906 12,214 12,086 12,205 NFE 195 200 198 OI 11,616 10,358 8,618 CE 11,421 10.158 8,420 TE (e) AE, AOI & FCF for 2020-2022. AE = CE-TE times end of previous period CSE - for example, in 2020: 11,421 - 4.9% x 31,317 =9,886. AOI = OI - WACC times end of previous period NOA - for example, in 2020: 11,616 - 4.0% x 43,223 =9,886. FCF -- 01 - ANOA - for example, in 2020: 11,616 - (44,413 - 43,223) = 10,426. 2019 2020 2021 2022 CSE 31,317 32,200 31,863 32,176 NOA 43,223 44,413 43,949 44,380 AE 9,886 8,580 6,858 9,886 8,580 6,858 FCF 10,426 10,822 8.187 Question 3 You have reformulated the Imber Aedax Company's most recent financial statements and extracted the following information: Year ended 31 December 2019 3 million Sales 35,200 Interest expense minus interest income Earnings before tax 13,168 Tax expense 2,384 Comprehensive income (CE) 11,809 291 936 As at 31 December 2019 $ million Net operating working capital (OWC) Net non-current operating assets (NNCOA) 42.287 Net financial obligations (NFO) 11,906 (a) Calculate NOA (net operating assets) and CSE (common shareholders' equity) at theend of 2019. (2 marks) (b) Using the 2010 effective tax rate, calculate NFE (net financial expense) and on (operating income or NOPAT) for the year 2019. (5 marks) You now have the following forecast assumptions: 2020 thereafter Sales growth 10% 7% 4% 3% 01/ sales 30% 25% 20% 18% Previous year OWC / this year's sales 2.2% 2.0% 2.0% Previous year NNCOA / thin your's sales 106% 100% 98% NFO / NOA 27.6% 27.8% 27.5% 27.5% 2021 2022 (e) Predict sales and or for the years 2020 to 2022. Predict NOA, NFO and CSE for the years 2020 to 2022. 12 / 30 100% + You now have the following forecast assumptions: Sales growth OI / sales Previous year OWC / this year's sales Previous year NNCOA / this year's sales NFO / NOA 2020 2021 2022 10% 7% 4% 30% 25% 20% 2.2% 2.0% 105% 100% 27.5% 27.5% 27.5% thereafter 3% 18% 2.0% 98% 27.5% (c) Predict sales and Ol for the years 2020 to 2022. Predict NOA, NFO and CSE for the years 2020 to 2022. (6 marks) (a) Assuming that the 2019 tax rate continues to apply in future and that the cost of debt before tax shield benefit is 2%, find the after-tax cost of debt. Assuming that the cost of equity is 4.9% and using information given in the forecast table above, calculate the WACC (weighted average cost of capital). Round it to the nearest one tenth of a percent. Assuming that NFE equals previous year NFO times the after-tax cost of debt, calculate NFE and CE for the years 2020 to (6 marks) 2022 12 Examiners commentaries 2020 (e) Calculate predicted AE (abnormal earnings), AOI (abnormal operating income or abnormal NOPAT) and FCF (free cash flow) for the years 2020 to 2022. (6 marks) xw 11 V ways reformulated the mer Aday my the trantie IM Yaar anderember 114 Pales laket brence Minus intim Bathing before Tax 111 B.M Lembut (GE) lito A6 Atbember 2011 Net Operating ang Capital COWG) Net Mon-current aperte Assets (NINCOAS Ne hinancial obligarion ) 134 2,1 A) calu NA (net operating Asset) and ose (ammon chareholders 404) me end mark OWO Noting Awet NHLON 42.3 13.203 + em Common Shareholders equity (OLE) NOA - NPO 45,1mm b) using the 2014 effective tax rate, CAIUWA NFE Net Financial experce) and of creding Income or NOPAT) For the year 2014 (5) Effectwe ty Pate ct) Tax Experte warning scorethy 4384 13. Um = 17 0:11 Net tina A Exe (NFC) Interest Expence - Wherect votome) (-) = Falim (1-001) STM POP bazic DATE mit ce You now have the following concertatumphoni 2011 1023 Theater 1910 101 T 30 ax 354 IC eroth 0 / Previous Year W/ mic sar's sales previour year HNCOA / This Yeard als NFO / NOA 701 307 421 105 100 2154 2751 31-9% 2751 Predict malet and or for the WATT 500 to 2012 Predict NOA NO and 286 for Max 2010 to 2013 mark Trond/Gwent The (in Milli 2011 2030 2024 wies 35.100 10440 Gring income (1) 12,0 . 10,336 Net Operating Weng Car (2) 436 411 288 Non-unen op. Assets AS 15,18413.5025 OD0.449 wet Twia obliganon CNF) 1.12.214 12,015 0 Net On Act (NO) 43.223,134.381 commm shareholders (050) 1,312,00 B12.12 2018 2020 cales 20.30 139.200* LOY $68,110m opening income 201) 2030 Operating inom 10 ses can 30% 1 3333 - 438.730 3333 2 blom -2011 -22 Net operating Hoang capital, 300 = percentage of notwarsmes (301) CONC) $41436 X 22. m 2011 2021 Net non-cuirent operation Asett2020 ? Poceniage of next year sales (20) INNCOR) 41,430m x 105% $ 43,502 my NO DATE des ONO-COM financial no1010 NO 151 Um men har holdte 1010 st - $13,214 101 perating come2013 001) operating in come to satiet sati 35% 1 1 10,30 m kit:peting wong tap 2021 = Percentage Feat WALES (20233 con) current proting Adget 2021 percentage of exteritates (102) (NNCOA) or in 1907 18. m Net Operating Asset.2021 OD NNCOR (NO $ent tuotem 43.950 2014 Net Pinantial Olbia, 2011 (NO) 3 5% of NA $43.960 mA 11:57 $12.0f om a common shareholder i Equity, 2021 HOA - NEO $43, 950m - $12,08km DATE On CAPITAL 1021 LOW Cales et "her Pures of Wort ya 30 ward) + (x2 MARIA wat Non-cottoptan Aceh 36). CNN) Miten hat are ene (3033 grade) 44. Rim 48 A Bet3032 RAS ow WNCOR tim 49,95 Mat Ali 2014 INFO) = 25 m FO common shareholders Equity, 2005 NOA- (CSE) 144, 381m $12,205m 132,13 de assuming that the 2014 tax rate continues to apply future and that the cost of debt before tax shield benefit is ax, and the after-tax cost of debt. Assuming that the cost of earty is 49, and using information gwen in the forecast table above, calculate the wac (weighted Average cost of capital). Round it to the nearest one tenth of a percent. Assuming that NFE equals previous year No times me alter-tax cost of debt calculare NFE and CE for the years 2010 to 30). bemarks) Calculated by 18.1% or 0.181 rective Tax RATC (t) Glen! cost of Debt 27 OT 0-02 NA (d) After-tax cost of debt rp(1-t), and WACC; NFE & CE for 2020-2022. To is given in the question and t was calculated in part (b). Effective tax rate 18.1% TD 2.0% rp(1-t) 1.64% Te is given in the question, the share of debt sp = NFO/NOA was given in part (b) and SE=1-8p. 4.9% WACC 4.0% NFE = Tp(1 t) times end of previous period NFO. CE = 0I NFE. 2020 2021 2022 NFO 11,906 12,214 12,086 12,205 NFE 195 200 198 OI 11,616 10,358 8,618 CE 11,421 10.158 8,420 TE (e) AE, AOI & FCF for 2020-2022. AE = CE-TE times end of previous period CSE - for example, in 2020: 11,421 - 4.9% x 31,317 =9,886. AOI = OI - WACC times end of previous period NOA - for example, in 2020: 11,616 - 4.0% x 43,223 =9,886. FCF -- 01 - ANOA - for example, in 2020: 11,616 - (44,413 - 43,223) = 10,426. 2019 2020 2021 2022 CSE 31,317 32,200 31,863 32,176 NOA 43,223 44,413 43,949 44,380 AE 9,886 8,580 6,858 9,886 8,580 6,858 FCF 10,426 10,822 8.187