I have done the sales, production, direct material, direct labor, and manufacturing overhead budget. (attaching the link of that question as a picture). please make the rest of the budgets such as the cash budget etc whatever is applicable, and please make the master budget( which I think contains budgeted income statement etc)

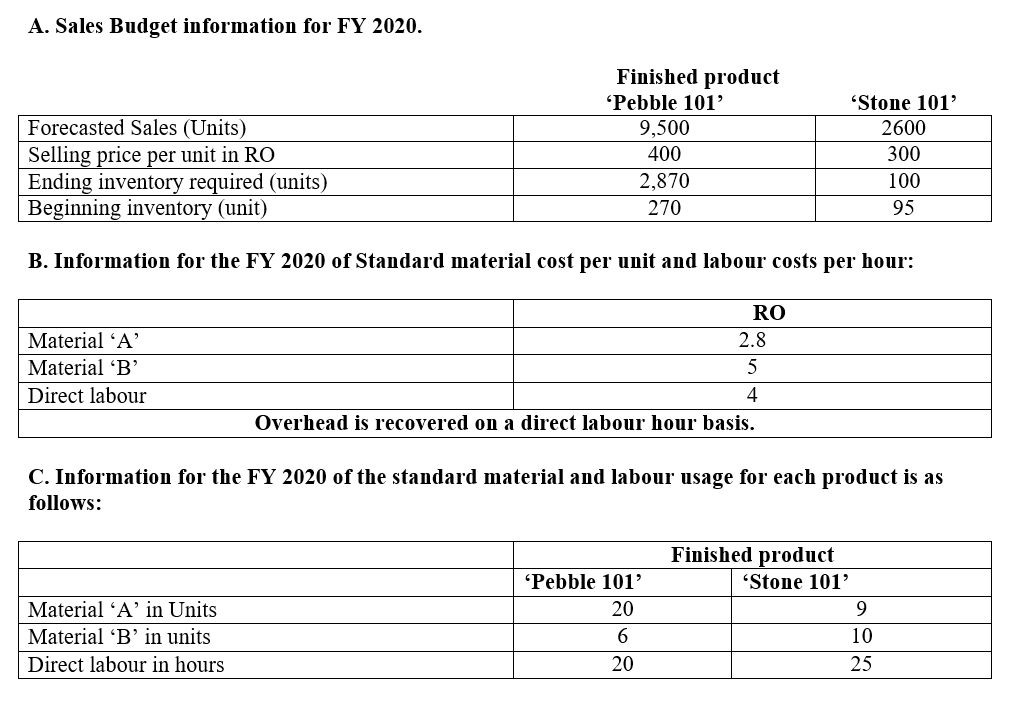

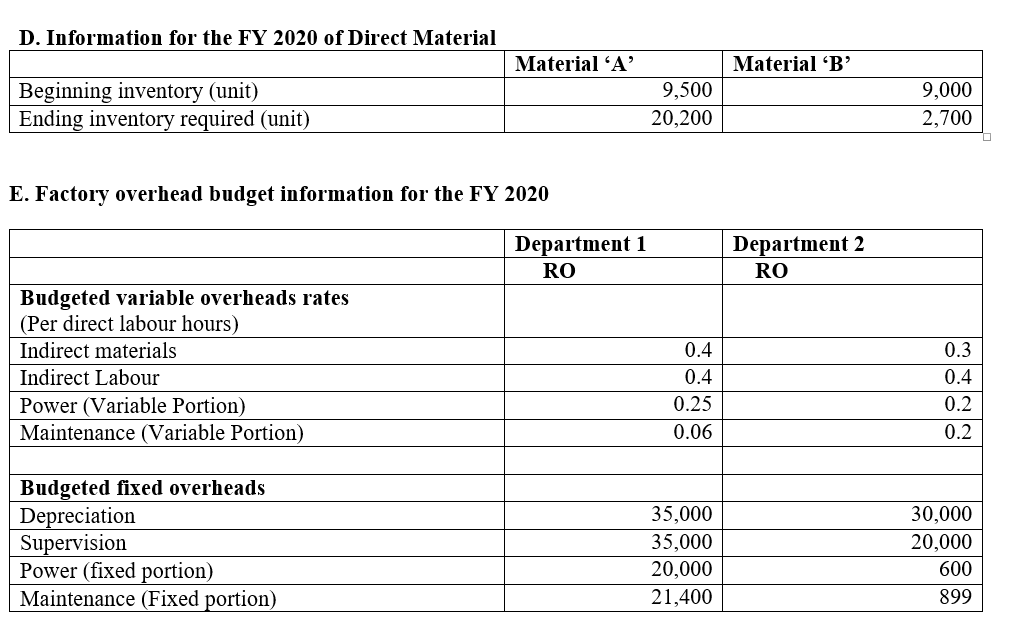

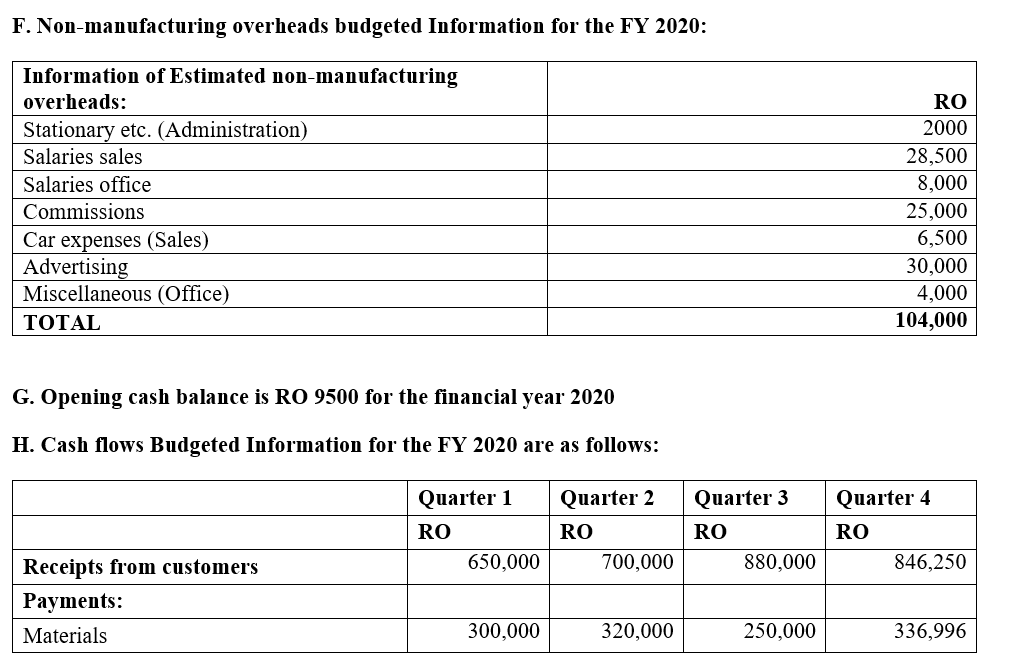

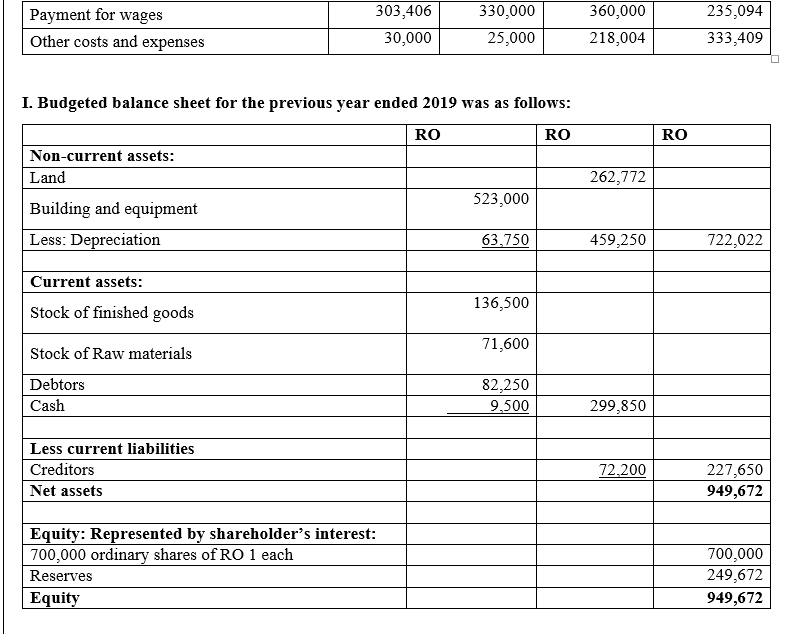

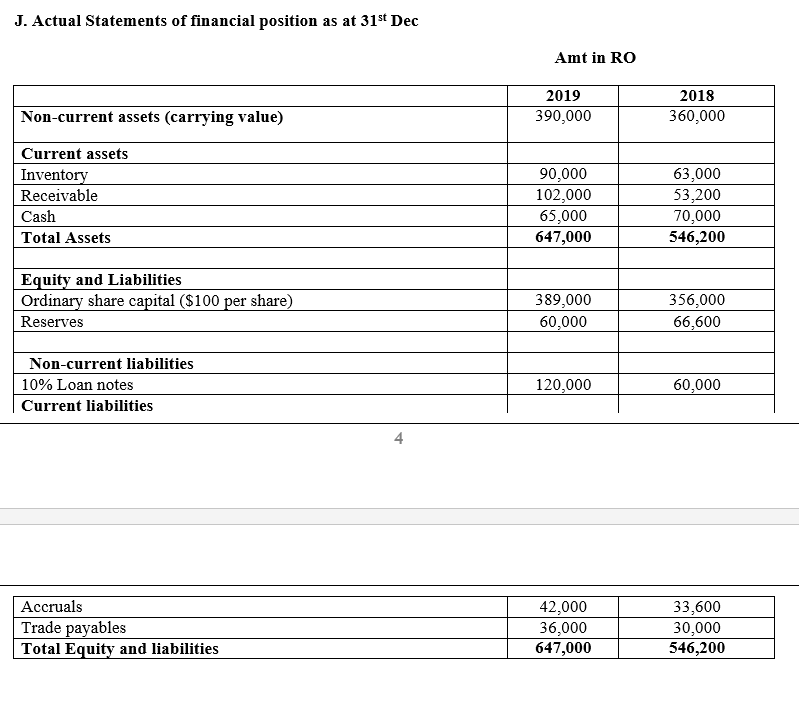

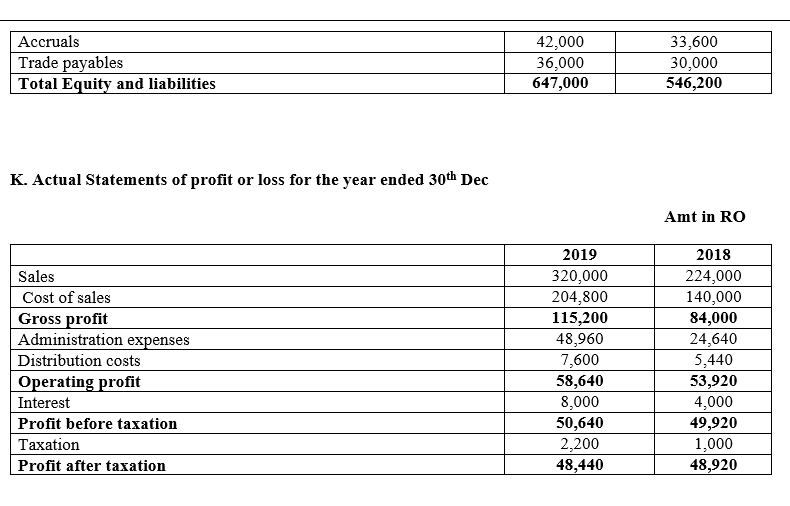

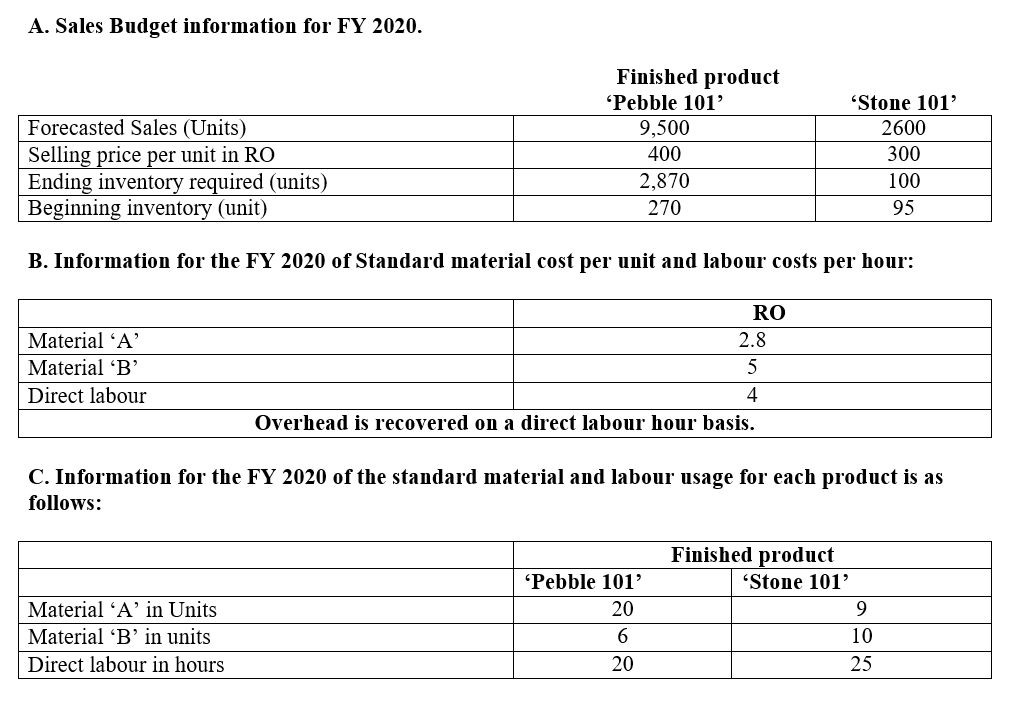

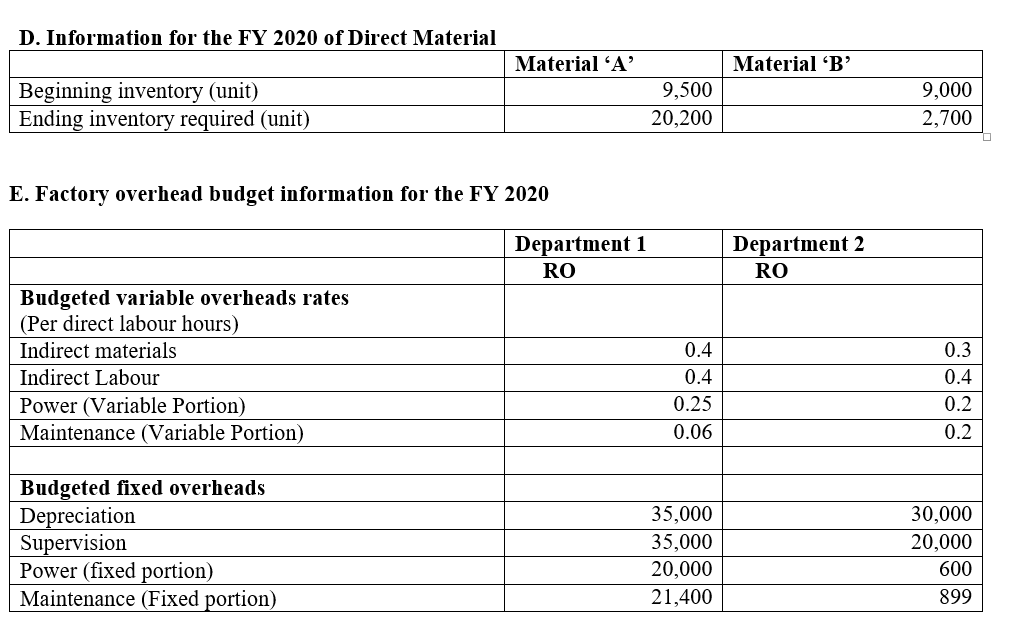

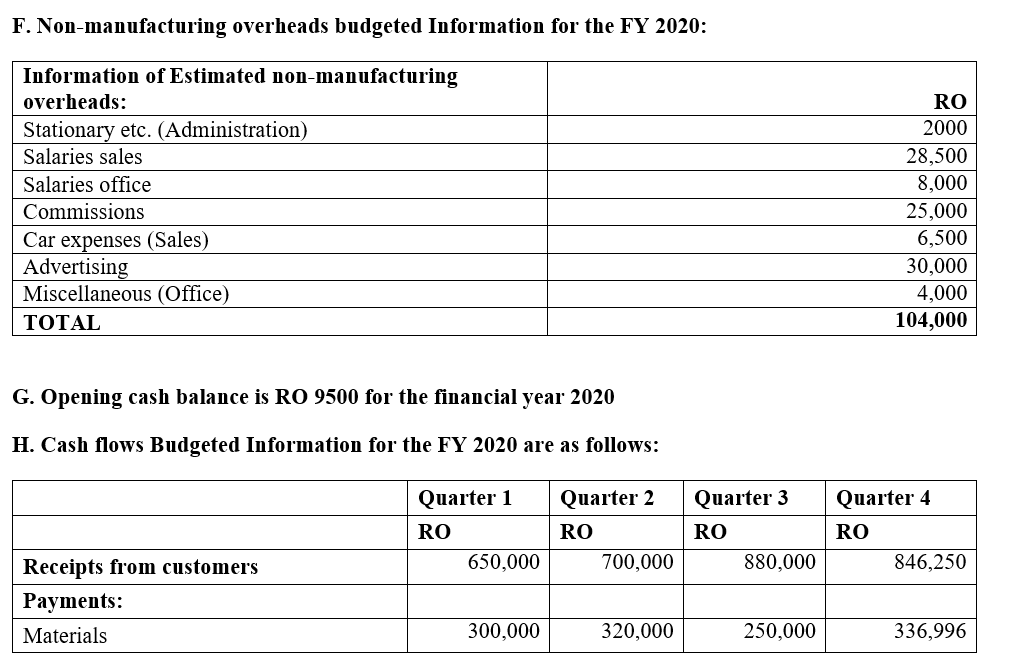

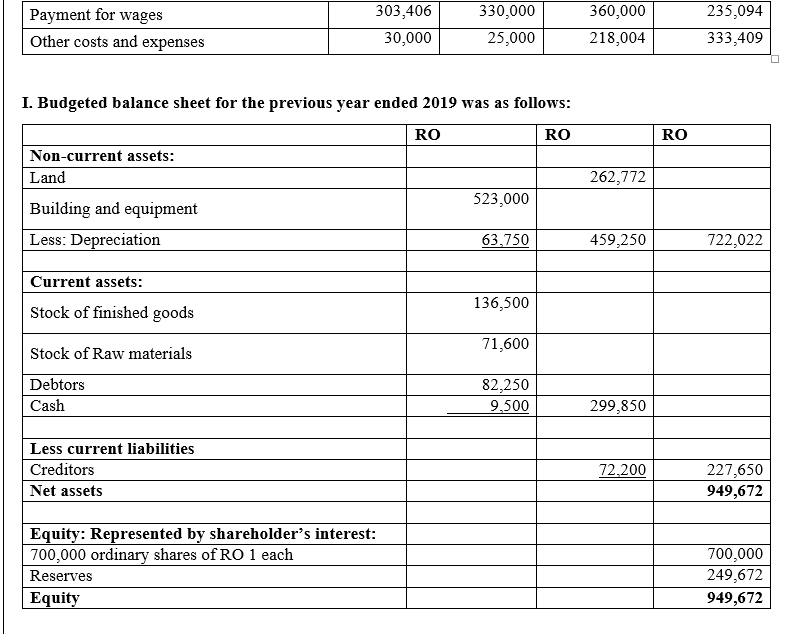

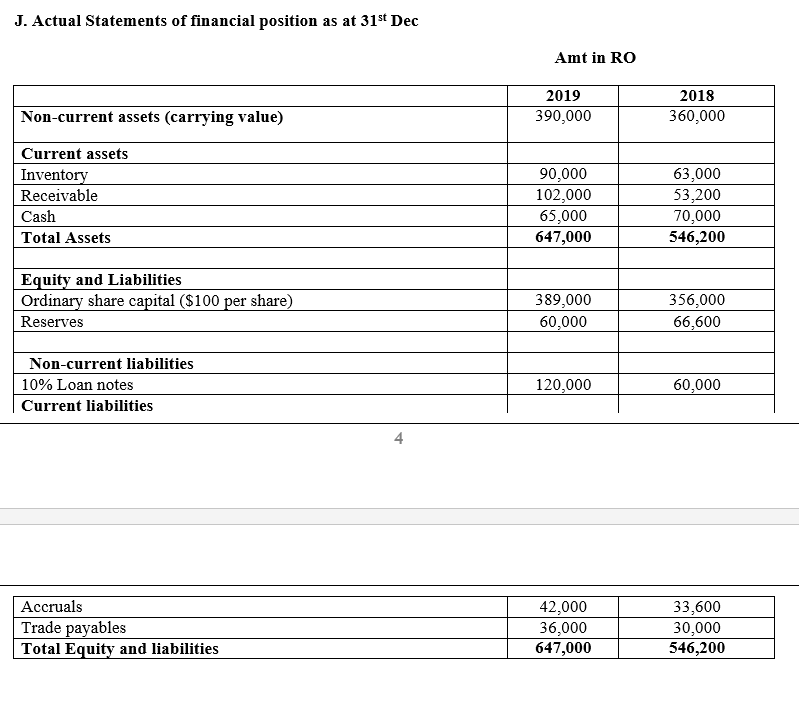

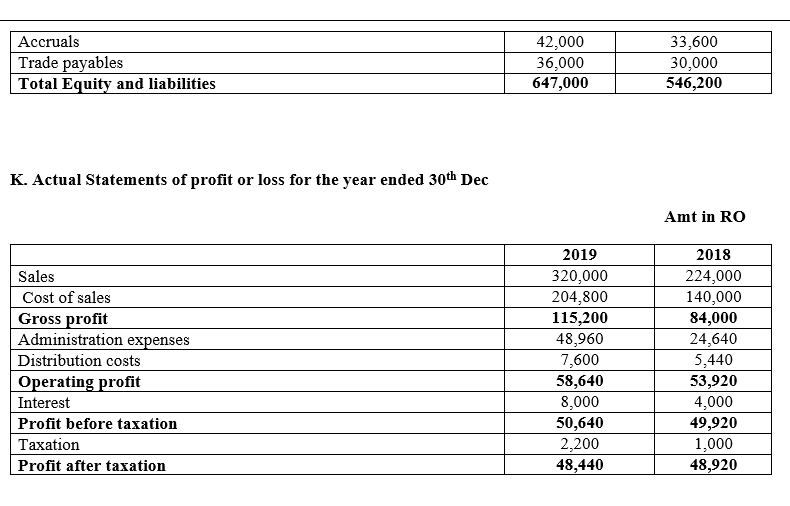

https://www.chegg.com/homework-help/questions-and-answers/please-prepare-functional-master-budgets-information provided- zoom-see-images-q46759969?trackid=_aLZQO15 A. Sales Budget information for FY 2020. Forecasted Sales (Units) Selling price per unit in RO Ending inventory required (units) Beginning inventory (unit) Finished product 'Pebble 101' 9,500 400 2,870 Stone 101 2600 300 100 270 95 B. Information for the FY 2020 of Standard material cost per unit and labour costs per hour: RO 2.8 Material 'A' Material 'B' Direct labour 4 Overhead is recovered on a direct labour hour basis. C. Information for the FY 2020 of the standard material and labour usage for each product is as follows: Pebble 101' 20 Material 'A' in Units Material 'B' in units Direct labour in hours Finished product 'Stone 101' 9 10 25 6 20 Material 'B' D. Information for the FY 2020 of Direct Material Material 'A' Beginning inventory (unit) Ending inventory required (unit) 9,500 20,200 9,000 2,700 E. Factory overhead budget information for the FY 2020 Department 2 Department 1 RO RO | Budgeted variable overheads rates (Per direct labour hours) Indirect materials Indirect Labour Power (Variable Portion) Maintenance (Variable Portion) 0.3 0.4 0.4 0.4 0.25 0.06 0.2 0.2 Budgeted fixed overheads Depreciation Supervision Power (fixed portion) Maintenance (Fixed portion) 35,000 35,000 20,000 21,400 30,000 20,000 600 899 F. Non-manufacturing overheads budgeted Information for the FY 2020: Information of Estimated non-manufacturing overheads: Stationary etc. (Administration) Salaries sales Salaries office Commissions Car expenses (Sales) Advertising Miscellaneous (Office) TOTAL RO 2000 28,500 8,000 25,000 6,500 30,000 4,000 104,000 G. Opening cash balance is RO 9500 for the financial year 2020 H. Cash flows Budgeted Information for the FY 2020 are as follows: Quarter 1 RO 650,000 Quarter 2 RO 700,000 Quarter 3 RO 880,000 Quarter 4 RO 846,250 Receipts from customers Payments: Materials 300,000 320,000 250,000 336,996 Payment for wages Other costs and expenses 303,406 30,000 330,000 25,000 360,000 218,004 235,094 333,409 I. Budgeted balance sheet for the previous year ended 2019 was as follows: RO RO RO Non-current assets: Land 262,772 523,000 Building and equipment Less: Depreciation 63,750 459,250 722,022 Current assets: Stock of finished goods 136,500 71,600 Stock of Raw materials Debtors Cash 82,250 9,500 299,850 Less current liabilities Creditors Net assets 72,200 227,650 949,672 Equity: Represented by shareholder's interest: 700,000 ordinary shares of RO 1 each Reserves Equity 700,000 249.672 949,672 J. Actual Statements of financial position as at 31st Dec Amt in RO 2018 2019 390,000 Non-current assets (carrying value) 360,000 Current assets Inventory Receivable Cash Total Assets 90,000 102.000 65,000 647,000 63,000 53,200 70,000 546,200 Equity and Liabilities Ordinary share capital ($100 per share) Reserves 389,000 60,000 356,000 66,600 Non-current liabilities 10% Loan notes Current liabilities 120,000 60,000 Accruals Trade payables Total Equity and liabilities 42,000 36,000 647,000 33,600 30,000 546,200 Accruals Trade payables Total Equity and liabilities 42,000 36,000 647,000 33,600 30,000 546,200 K. Actual Statements of profit or loss for the year ended 30th Dec Amt in RO Sales Cost of sales Gross profit Administration expenses Distribution costs Operating profit Interest Profit before taxation Taxation Profit after taxation 2019 320,000 204,800 115,200 48,960 7,600 58,640 8,000 50,640 2,200 48,440 2018 224,000 140,000 84,000 24,640 5,440 53,920 4,000 49.920 1,000 48,920 https://www.chegg.com/homework-help/questions-and-answers/please-prepare-functional-master-budgets-information provided- zoom-see-images-q46759969?trackid=_aLZQO15 A. Sales Budget information for FY 2020. Forecasted Sales (Units) Selling price per unit in RO Ending inventory required (units) Beginning inventory (unit) Finished product 'Pebble 101' 9,500 400 2,870 Stone 101 2600 300 100 270 95 B. Information for the FY 2020 of Standard material cost per unit and labour costs per hour: RO 2.8 Material 'A' Material 'B' Direct labour 4 Overhead is recovered on a direct labour hour basis. C. Information for the FY 2020 of the standard material and labour usage for each product is as follows: Pebble 101' 20 Material 'A' in Units Material 'B' in units Direct labour in hours Finished product 'Stone 101' 9 10 25 6 20 Material 'B' D. Information for the FY 2020 of Direct Material Material 'A' Beginning inventory (unit) Ending inventory required (unit) 9,500 20,200 9,000 2,700 E. Factory overhead budget information for the FY 2020 Department 2 Department 1 RO RO | Budgeted variable overheads rates (Per direct labour hours) Indirect materials Indirect Labour Power (Variable Portion) Maintenance (Variable Portion) 0.3 0.4 0.4 0.4 0.25 0.06 0.2 0.2 Budgeted fixed overheads Depreciation Supervision Power (fixed portion) Maintenance (Fixed portion) 35,000 35,000 20,000 21,400 30,000 20,000 600 899 F. Non-manufacturing overheads budgeted Information for the FY 2020: Information of Estimated non-manufacturing overheads: Stationary etc. (Administration) Salaries sales Salaries office Commissions Car expenses (Sales) Advertising Miscellaneous (Office) TOTAL RO 2000 28,500 8,000 25,000 6,500 30,000 4,000 104,000 G. Opening cash balance is RO 9500 for the financial year 2020 H. Cash flows Budgeted Information for the FY 2020 are as follows: Quarter 1 RO 650,000 Quarter 2 RO 700,000 Quarter 3 RO 880,000 Quarter 4 RO 846,250 Receipts from customers Payments: Materials 300,000 320,000 250,000 336,996 Payment for wages Other costs and expenses 303,406 30,000 330,000 25,000 360,000 218,004 235,094 333,409 I. Budgeted balance sheet for the previous year ended 2019 was as follows: RO RO RO Non-current assets: Land 262,772 523,000 Building and equipment Less: Depreciation 63,750 459,250 722,022 Current assets: Stock of finished goods 136,500 71,600 Stock of Raw materials Debtors Cash 82,250 9,500 299,850 Less current liabilities Creditors Net assets 72,200 227,650 949,672 Equity: Represented by shareholder's interest: 700,000 ordinary shares of RO 1 each Reserves Equity 700,000 249.672 949,672 J. Actual Statements of financial position as at 31st Dec Amt in RO 2018 2019 390,000 Non-current assets (carrying value) 360,000 Current assets Inventory Receivable Cash Total Assets 90,000 102.000 65,000 647,000 63,000 53,200 70,000 546,200 Equity and Liabilities Ordinary share capital ($100 per share) Reserves 389,000 60,000 356,000 66,600 Non-current liabilities 10% Loan notes Current liabilities 120,000 60,000 Accruals Trade payables Total Equity and liabilities 42,000 36,000 647,000 33,600 30,000 546,200 Accruals Trade payables Total Equity and liabilities 42,000 36,000 647,000 33,600 30,000 546,200 K. Actual Statements of profit or loss for the year ended 30th Dec Amt in RO Sales Cost of sales Gross profit Administration expenses Distribution costs Operating profit Interest Profit before taxation Taxation Profit after taxation 2019 320,000 204,800 115,200 48,960 7,600 58,640 8,000 50,640 2,200 48,440 2018 224,000 140,000 84,000 24,640 5,440 53,920 4,000 49.920 1,000 48,920