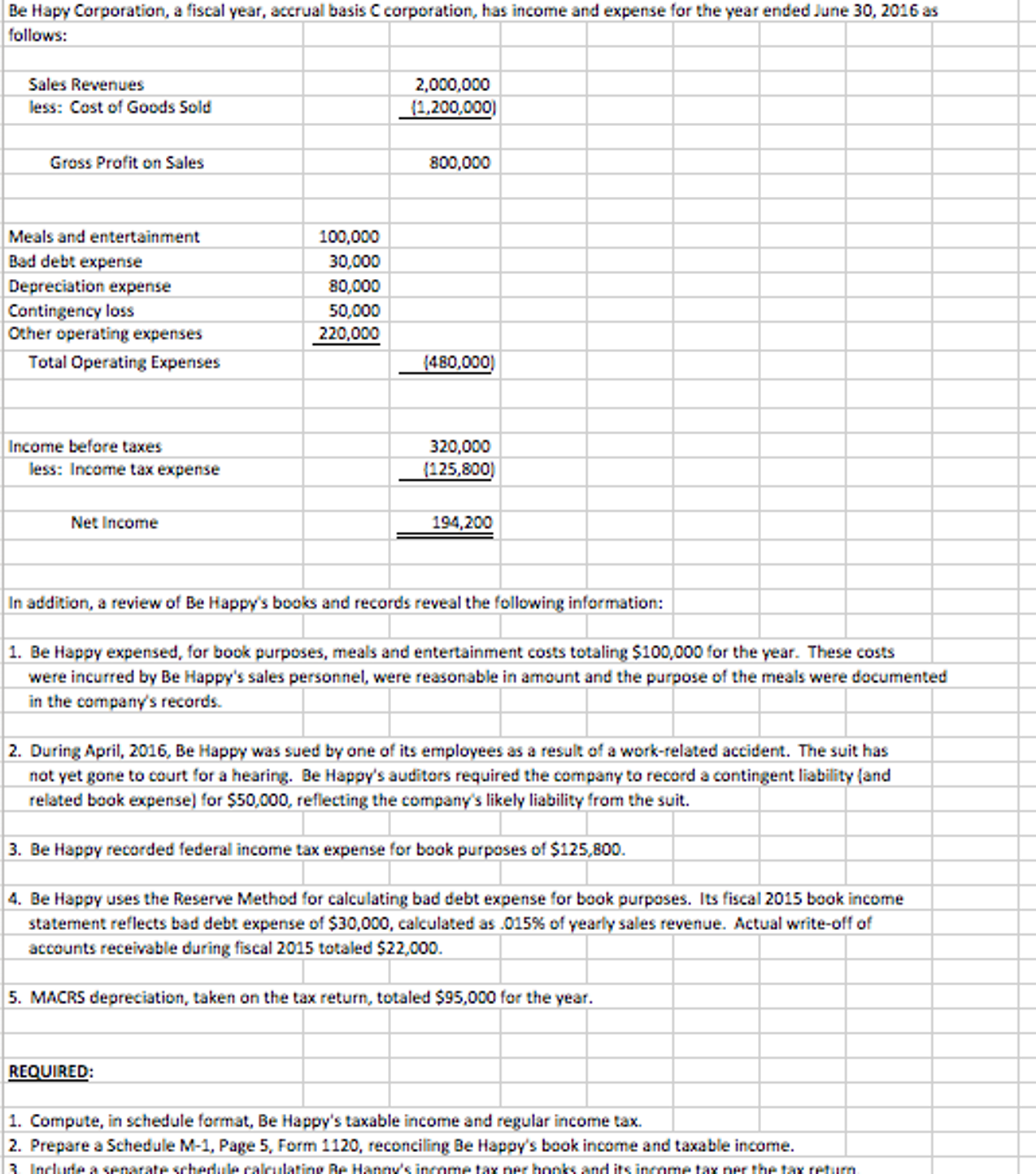

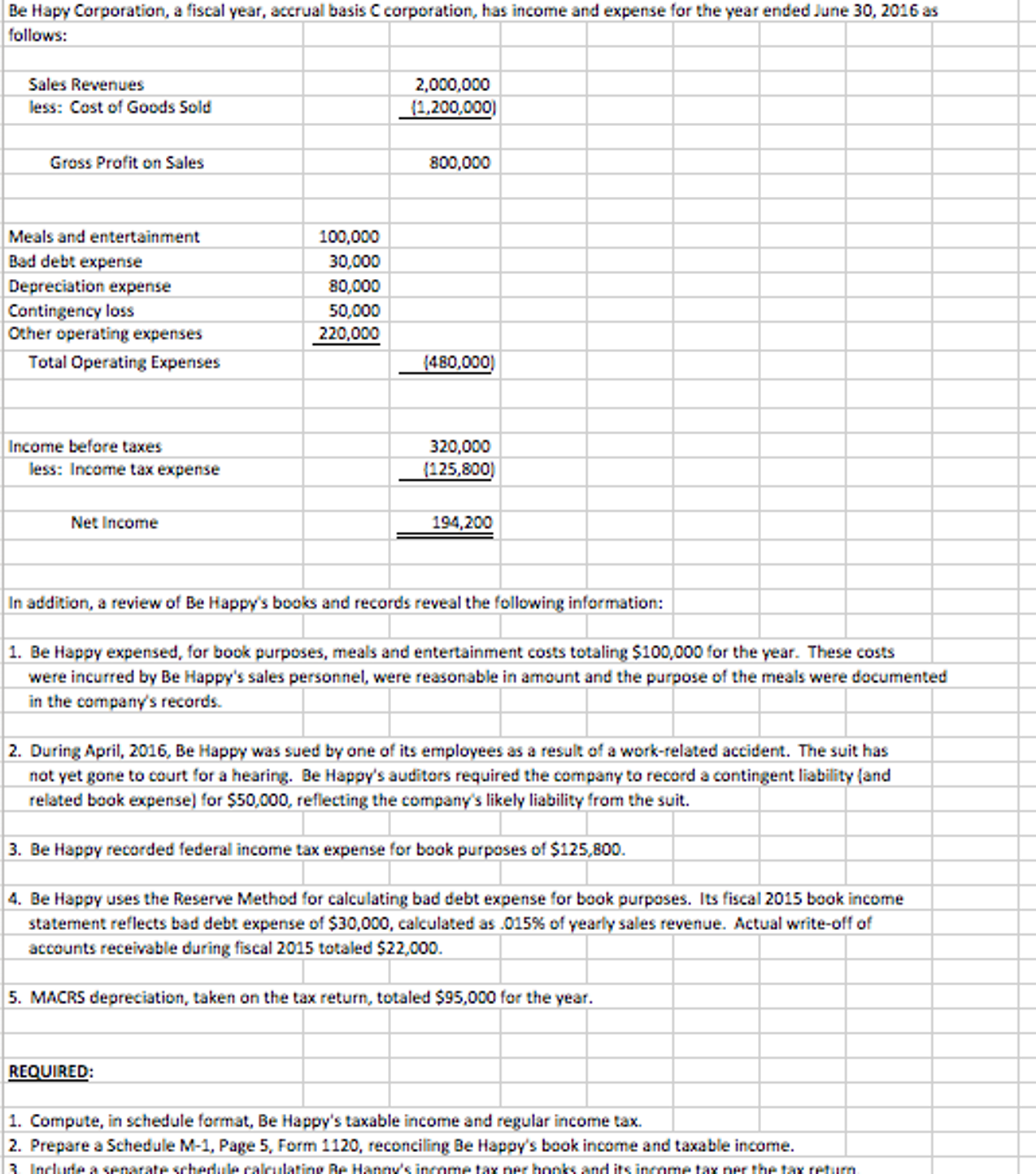

I have figured out #1 and #2, I just need help with #3: include a separate schedule calculating Be Happy's income tax per books and and its income tax per the tax return.

Be Hapy Corporation, a fiscal year, accrual basis C corporation, has income and expense for the year ended June 30, 2016 as follows: In addition, a review of Be Happy s books and records reveal the following information: Be Happy expensed, for book purposes, meals and entertainment costs totaling $100,000 for the year. These costs were incurred by Be Happy's sales personnel, were reasonable in amount and the purpose of the meals were documented in the company's records. During April, 2016, Be Happy was sued by one of its employees as a result of a work-related accident. The suit has not yet gone to court 'or a hearing. Be Happy's auditors required the company to record a contingent liability and related back expense) for $50,000, reflecting the company s likely liability from the suit. Be Happy recorded federal income tax expense for book purposes of $125, 800. Be Happy uses the Reserve Method 'or calculating bad debt expense 'or book purposes. Its fiscal 2015 book income statement reflects bad debt expense of $30,000, calculated as .015% of yearly sales revenue. Actual write-off of accounts receivable during fiscal 2015 totaled $22,000. MACR5 depreciation, taken on the tax return, totaled $95,000 for the year. REQUIRED: Compute, in schedule format. Be Happy's taxable income and regular income tax. Prepare a Schedule M-1, Page 5, Form 1120, reconciling Be Happy's book income and taxable income. Be Hapy Corporation, a fiscal year, accrual basis C corporation, has income and expense for the year ended June 30, 2016 as follows: In addition, a review of Be Happy s books and records reveal the following information: Be Happy expensed, for book purposes, meals and entertainment costs totaling $100,000 for the year. These costs were incurred by Be Happy's sales personnel, were reasonable in amount and the purpose of the meals were documented in the company's records. During April, 2016, Be Happy was sued by one of its employees as a result of a work-related accident. The suit has not yet gone to court 'or a hearing. Be Happy's auditors required the company to record a contingent liability and related back expense) for $50,000, reflecting the company s likely liability from the suit. Be Happy recorded federal income tax expense for book purposes of $125, 800. Be Happy uses the Reserve Method 'or calculating bad debt expense 'or book purposes. Its fiscal 2015 book income statement reflects bad debt expense of $30,000, calculated as .015% of yearly sales revenue. Actual write-off of accounts receivable during fiscal 2015 totaled $22,000. MACR5 depreciation, taken on the tax return, totaled $95,000 for the year. REQUIRED: Compute, in schedule format. Be Happy's taxable income and regular income tax. Prepare a Schedule M-1, Page 5, Form 1120, reconciling Be Happy's book income and taxable income