Question

I have included the question and answer provided by my lecturer. The only part I don't understand is part (c). I am more or less

I have included the question and answer provided by my lecturer. The only part I don't understand is part (c). I am more or less able to follow the answer except for the very start of the answer to part (c). At the very start of the answer for part (c) it states: "Total asset value (before each dividend payment or stock repurchase) remains at $8,000,000. These assets earn $400,000 per year under either policy"

I don't understand why total asset value remains at $8,000,000. I understand that the $8,000,000 figure is calculated by the 100,000 shares outstanding by the $80 share price but why do we assume that the number of outstanding shares every year multiplied by the share price at that time will equal $8,000,000? Wouldn't the value of the company be constantly changing? Why do we assume that the total asset value of the company just remains at $8,000,000 every year?

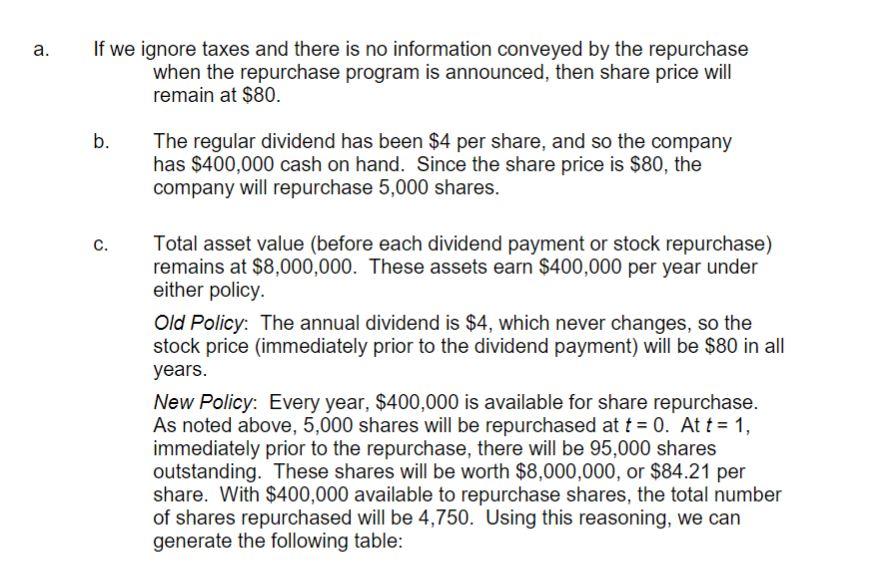

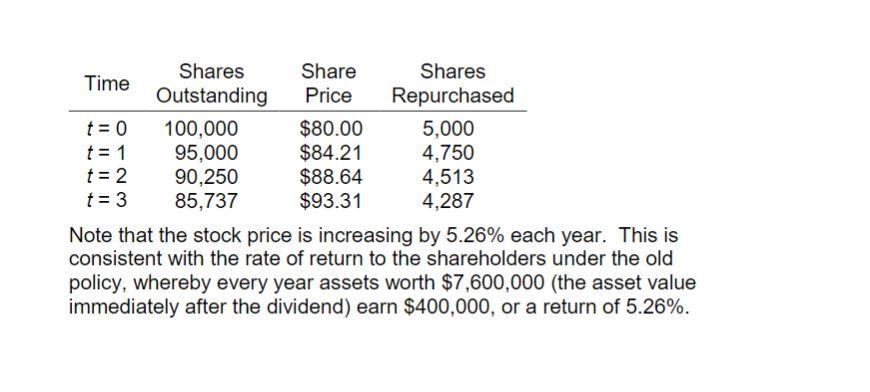

Hors d'Age Cheeseworks has been paying a regular cash dividend of $4 per share each year for over a decade. The company is paying out all its earnings as dividends and is not expected to grow. There are 100,000 shares outstanding, selling at $80 per share. The company has sufficient cash on hand to pay the next annual dividend. Suppose that Hors d'Age decides to cut its cash dividend to zero and announces that it will repurchase shares instead. a. What is the immediate stock price reaction? Ignore taxes, and assume that the repurchase program conveys no information about operating profitability or business risk. b. How many shares will Hors d'Age purchase? C. Project and compare future stock prices for the old and new policies. Do this for at least years 1, 2, and 3. a. If we ignore taxes and there is no information conveyed by the repurchase when the repurchase program is announced, then share price will remain at $80. b. The regular dividend has been $4 per share, and so the company has $400,000 cash on hand. Since the share price is $80, the company will repurchase 5,000 shares. C. Total asset value (before each dividend payment or stock repurchase) remains at $8,000,000. These assets earn $400,000 per year under either policy. Old Policy: The annual dividend is $4, which never changes, so the stock price (immediately prior to the dividend payment) will be $80 in all years. New Policy: Every year, $400,000 is available for share repurchase. As noted above, 5,000 shares will be repurchased at t = 0. At t= 1, immediately prior to the repurchase, there will be 95,000 shares outstanding. These shares will be worth $8,000,000, or $84.21 per share. With $400,000 available to repurchase shares, the total number of shares repurchased will be 4,750. Using this reasoning, we can generate the following table: Shares Share Shares Time Outstanding Price Repurchased t = 0 100,000 $80.00 5,000 t = 1 95,000 $84.21 4,750 t = 2 90,250 $88.64 4,513 t = 3 85,737 $93.31 4,287 Note that the stock price is increasing by 5.26% each year. This is consistent with the rate of return to the shareholders under the old policy, whereby every year assets worth $7,600,000 (the asset value immediately after the dividend) earn $400,000, or a return of 5.26%. Hors d'Age Cheeseworks has been paying a regular cash dividend of $4 per share each year for over a decade. The company is paying out all its earnings as dividends and is not expected to grow. There are 100,000 shares outstanding, selling at $80 per share. The company has sufficient cash on hand to pay the next annual dividend. Suppose that Hors d'Age decides to cut its cash dividend to zero and announces that it will repurchase shares instead. a. What is the immediate stock price reaction? Ignore taxes, and assume that the repurchase program conveys no information about operating profitability or business risk. b. How many shares will Hors d'Age purchase? C. Project and compare future stock prices for the old and new policies. Do this for at least years 1, 2, and 3. a. If we ignore taxes and there is no information conveyed by the repurchase when the repurchase program is announced, then share price will remain at $80. b. The regular dividend has been $4 per share, and so the company has $400,000 cash on hand. Since the share price is $80, the company will repurchase 5,000 shares. C. Total asset value (before each dividend payment or stock repurchase) remains at $8,000,000. These assets earn $400,000 per year under either policy. Old Policy: The annual dividend is $4, which never changes, so the stock price (immediately prior to the dividend payment) will be $80 in all years. New Policy: Every year, $400,000 is available for share repurchase. As noted above, 5,000 shares will be repurchased at t = 0. At t= 1, immediately prior to the repurchase, there will be 95,000 shares outstanding. These shares will be worth $8,000,000, or $84.21 per share. With $400,000 available to repurchase shares, the total number of shares repurchased will be 4,750. Using this reasoning, we can generate the following table: Shares Share Shares Time Outstanding Price Repurchased t = 0 100,000 $80.00 5,000 t = 1 95,000 $84.21 4,750 t = 2 90,250 $88.64 4,513 t = 3 85,737 $93.31 4,287 Note that the stock price is increasing by 5.26% each year. This is consistent with the rate of return to the shareholders under the old policy, whereby every year assets worth $7,600,000 (the asset value immediately after the dividend) earn $400,000, or a return of 5.26%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started