Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I have need answer of all questions. All parts 9-10 The earnings, dividends, and stock price of Motortech Inc. are expected to grow at Cost

I have need answer of all questions.

All parts

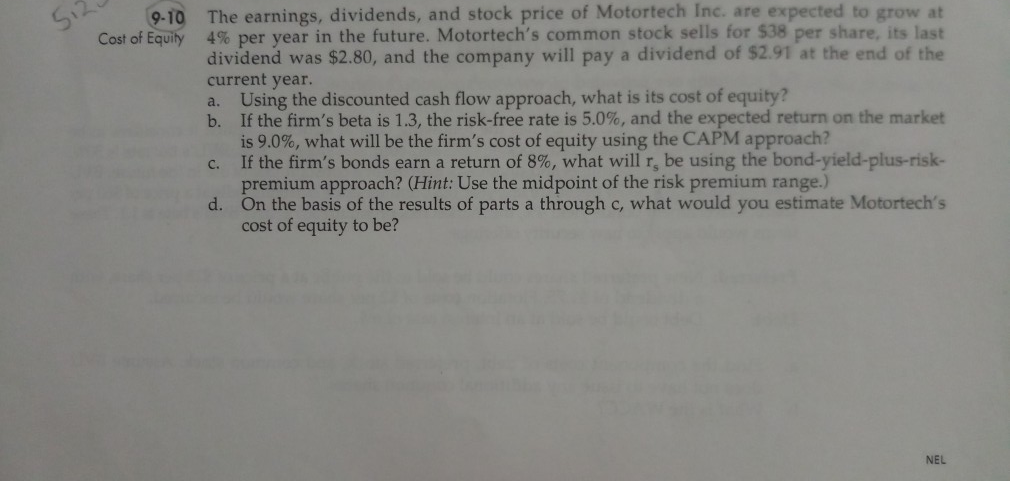

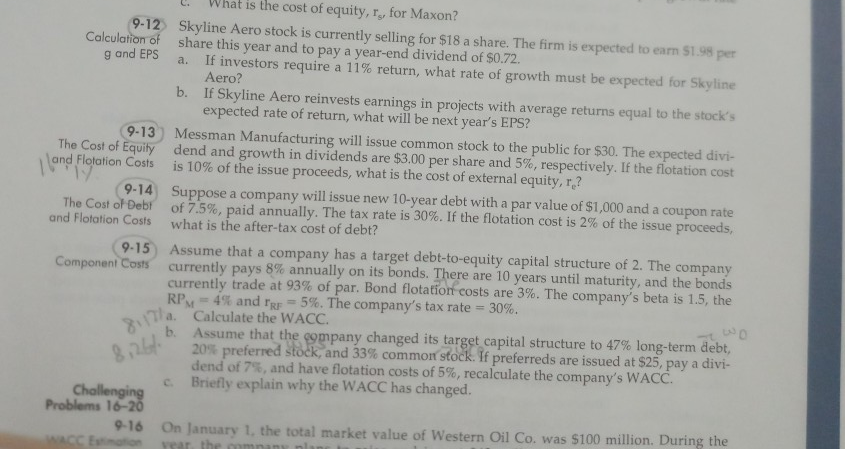

9-10 The earnings, dividends, and stock price of Motortech Inc. are expected to grow at Cost of Equity 4% per year in the future. Motortech's common stock sells for $38 per share, its last dividend was $2.80, and the company will pay a dividend of $2.91 at the end of the current year. a. Using the discounted cash flow approach, what is its cost of equity? b. If the firm's beta is 1.3, the risk-free rate is 5.0%, and the expected return on the market is 9.0%, what will be the firm's cost of equity using the CAPM approach? If the firm's bonds earn a return of 8%, what will r, be using the bond-yield-plus-risk- premium approach? (Hint: Use the midpoint of the risk premium range.) d. On the basis of the results of parts a through c, what would you estimate Motortech's cost of equity to be? C. NEL hat is the cost of equity, r for Maxon? 9-12 Calculation of g and EPS Skyline Aero stock is currently selling for $18 a share. The firm is expected to earn 51.98 per share this year and to pay a year-end dividend of $0.72. If investors require a 11% return, what rate of growth must be expected for Skyline Aero? b. If Skyline Aero reinvests earnings in projects with average returns equal to the stock's expected rate of return, what will be next year's EPS? a. Messman Manufacturing will issue common stock to the public for $30. The expected divi- 9-13 The Cost of Equity dend and growth in dividends are $3.00 per share and 5%, respectively. If the flotation cost land Flotation Costs is 10% of the issue proceeds, what is the cost of external equity, r? 9-14 The Cost of Deb and Flotation Costs Suppose a company will issue new 10-year debt with a par value of $1,000 and a coupon rate of 7.5%, paid annually. The tax rate is 30 %. If the flotation cost is 2% of the issue proceeds, what is the after-tax cost of debt? 9-15 Assume that a company has a target debt-to-equity capital structure of 2. The company Component Costs currently pays 8% annually currently trade at 93% of par. Bond flotation costs are 3 %. The company's beta is 1.5, the RP 4% and rgF 5 %. The company's tax rate la. Calculate the WACC. b. Assume that the company changed its target capital structure to 47% long-term debt, 20% preferred stock, and 33% common stock. If preferreds are issued at $25, pay a divi- dend of 7%, and have flotation costs of 5 %, recalculate the company's WACC. c Briefly explain why the WACC has changed. on its bonds. There are 10 years until maturity, and the bonds 30%. &264 Challenging Problems 16-20 9-16 On January 1, the total market value of Western Oil ap a pan n ar Apacaadap aar ass p RV aa aung pmem 9-11 Cor al Equty Mason Constraction's o E 3.34 s $279 4 30% of its earnings as dividends, and the stock sel for $2 Caleulate the past growth rate in earningg i Thi Caleulate the nest espected dividend pr share DA will continue What is the cost of equity, , for Mason Skyline Aeno stock is currently selling foe $18 a share. The firm is espected i ears1pe share this year and to pay a year-nd dividend of S0N72 a. t 9-12 Caleulaton o a and EPS If investors require a 11% return, what rate of gronwth must be enpected to yli Auro b. If Skyline Aero reinvests earnings in projects with average returns epaal to the soks expected rate of return, what will be nest year's EPS 9-13 The Cost of Equity land Flotoon Costs Messman Manufacturing will issue commn stock to the public foe $30. The expected div dend and growth in dividends are $3.00 per share and 5%, respectively 1t the flotation cs is 10% of the issue proceeds, what is the cost of exbertal equity, t 9-14 The Cost of Debr Supppose a company will issue new 10-year debt with a par valhue of $1,000 and a coupun rate of 7.5%, paid annually. The tax rate is 30%. If the fotatkm cont is 2% of the issue proceeds. what is the after-tax cost of debt? and Flolahon Costs Assume that a company has a target debt-to-equity capital structure of 2. The company currently pays 8% annually on its bonds. There are 10 years until maturity, and the bonds currently trade at 93% of par. Bond flotation costs are 3%. The companys beta is 1.5, the RP-4% and r-5%. The company's tax rate Calculate the WACC 9-15 Component Coss 30% Assume that the eompany changed its target capital structure to 47 % long-term debt, 20% preferred t and 33% common stock. If preferreds are issued at $25, pay a divi- dend of 7%, and have flotation costs of 5%, recaiculate the company's WACC Briefly explain why the WACC has changed On January 1, the total market value of Western Oil Co, was $100 million. During the year, the company plans to raise and invest $42 million in new projects. The firm's nesent market value debt-to-equity ratio is 1.81. Assume that there is no short-term debt New bonds will have a 7% coupon rate, and they will be sold at par. Common Problems 16-20 916 at 550 a share Shareholders required rate of return consists of rate of 6% The corporate taxStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started