Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i have no idea what im doing wrong. i felt confident doing this until i checked my answers. please help on both A and B

i have no idea what im doing wrong. i felt confident doing this until i checked my answers. please help on both A and B

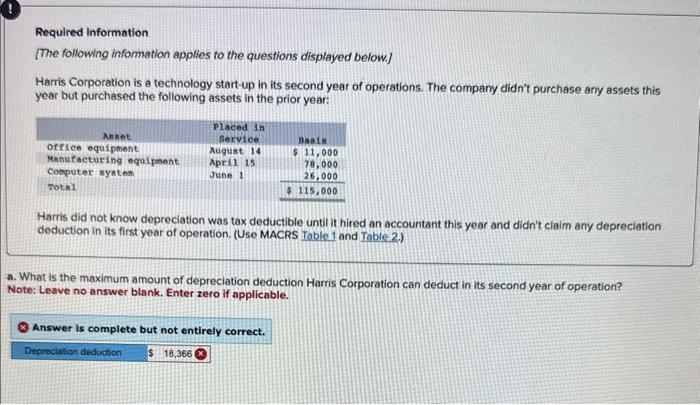

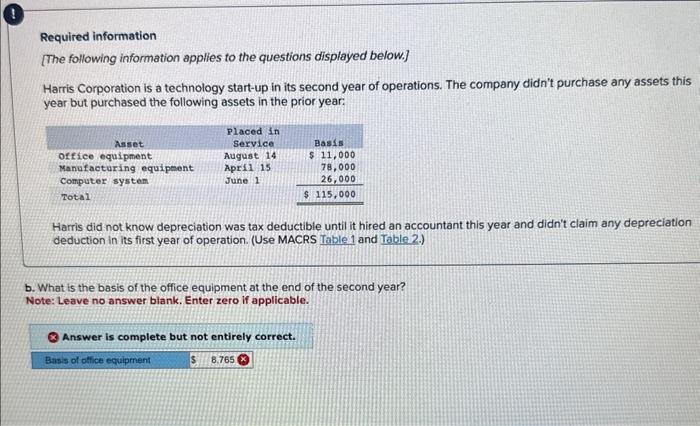

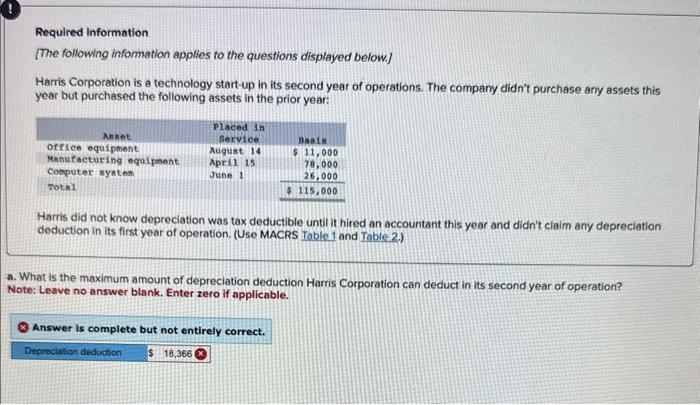

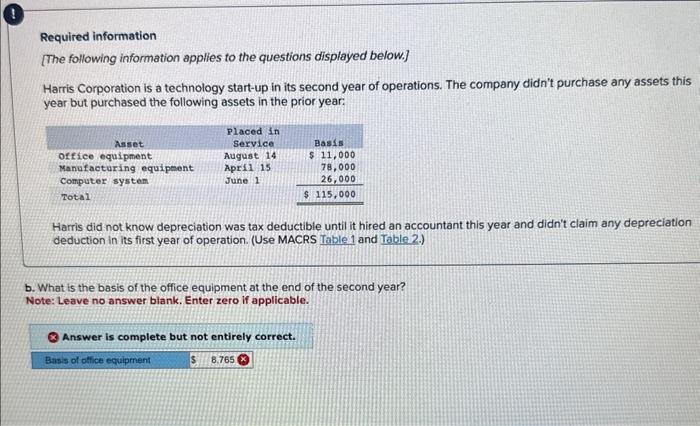

Required information [The following information applies to the questions displayed below.] Harris Corporation is a technology start-up in its second year of operations. The company didn't purchase any assets this year but purchased the following assets in the prior year: Harris did not know depreciation was tax deductible until it hired an accountant this year and didn't claim any depreciation deduction in its first year of operation. (Use MACRS Table 1 and Table 2.) What is the maximum amount of depreciation deduction Harris Corporation can deduct in its second year of operation? Dote: Leave no answer blank. Enter zero if applicable. Answer is complete but not entirely correct. Required information [The following information applies to the questions displayed below.] Harris Corporation is a technology start-up in its second year of operations. The company didn't purchase any assets this year but purchased the following assets in the prior year: Harris did not know depreciation was tax deductible until it hired an accountant this year and didn't claim any depreciation deduction in its first year of operation. (Use MACRS Table 1 and Table 2.) b. What is the basis of the office equipment at the end of the second year? Note: Leave no answer blank. Enter zero if applicable. Answer is complete but not entirely correct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started