Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I have post the questions more than 3 time. please someone who can solve this question. please give the correct and clear answer. Post Parts

I have post the questions more than 3 time. please someone who can solve this question. please give the correct and clear answer.

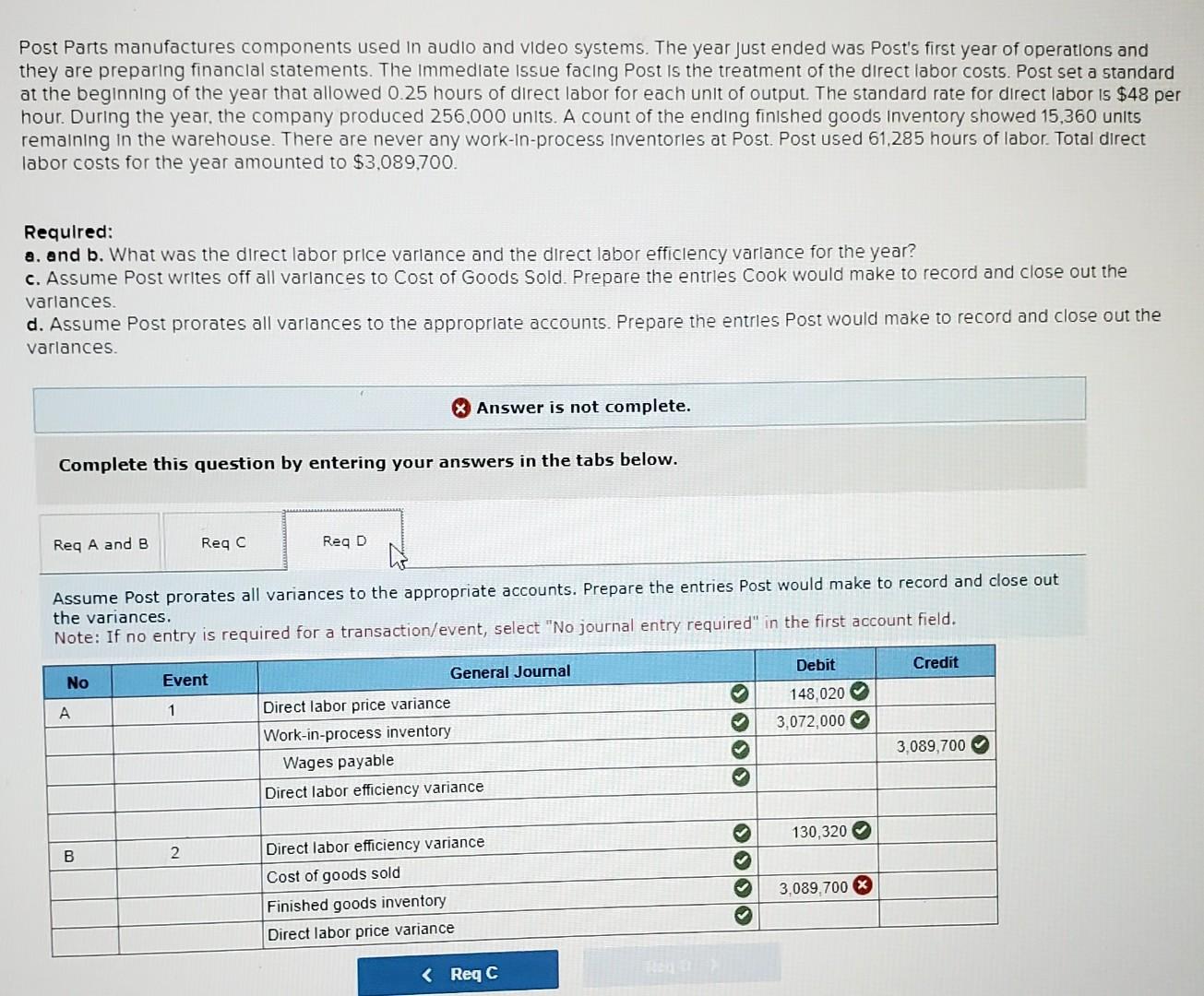

Post Parts manufactures components used in audio and video systems. The year Just ended was Post's first year of operations and they are preparing financlal statements. The Immedlate Issue facing Post is the treatment of the direct labor costs. Post set a standard at the beginning of the year that allowed 0.25 hours of direct labor for each unit of output. The standard rate for direct labor is $48 per hour. During the year, the company produced 256,000 units. A count of the ending finished goods Inventory showed 15,360 units remaining in the warehouse. There are never any work-In-process Inventorles at Post. Post used 61,285 hours of labor. Total direct labor costs for the year amounted to $3,089,700. Requlred: a. and b. What was the direct labor price varlance and the direct labor efficlency varlance for the year? c. Assume Post writes off all varlances to Cost of Goods Sold. Prepare the entrles Cook would make to record and close out the varlances. d. Assume Post prorates all varlances to the approprlate accounts. Prepare the entrles Post would make to record and close out the varlances. Answer is not complete. Complete this question by entering your answers in the tabs below. Assume Post prorates all variances to the appropriate accounts. Prepare the entries Post would make to record and close out Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. the variancesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started