I have posted this question MUTIPLE times now, someone PLEASE HELP!!!!

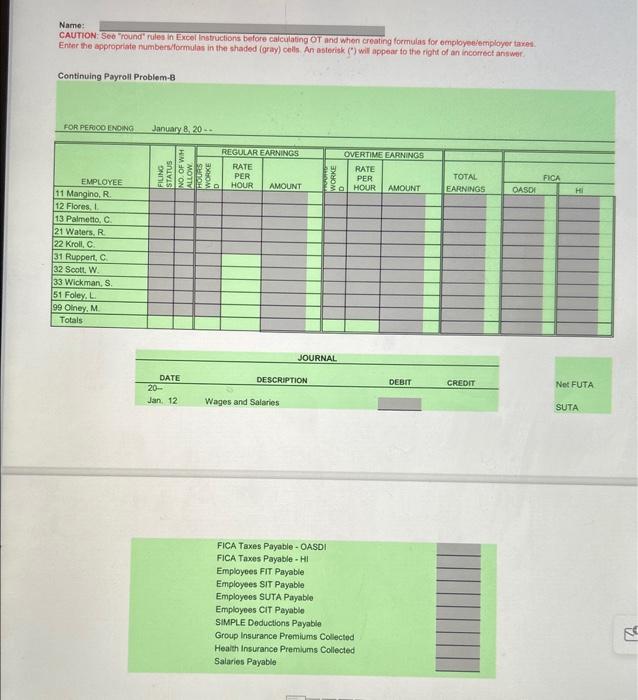

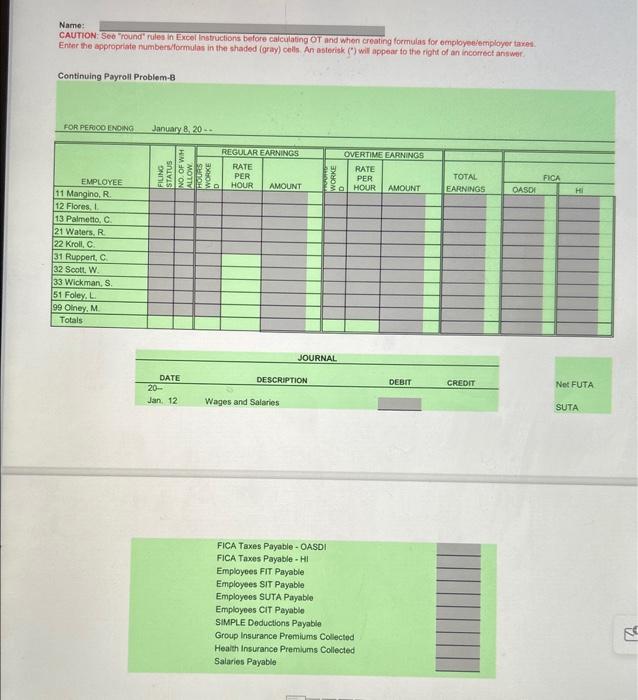

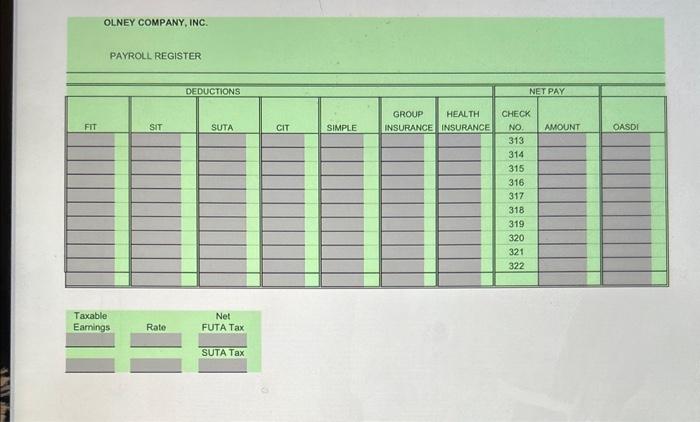

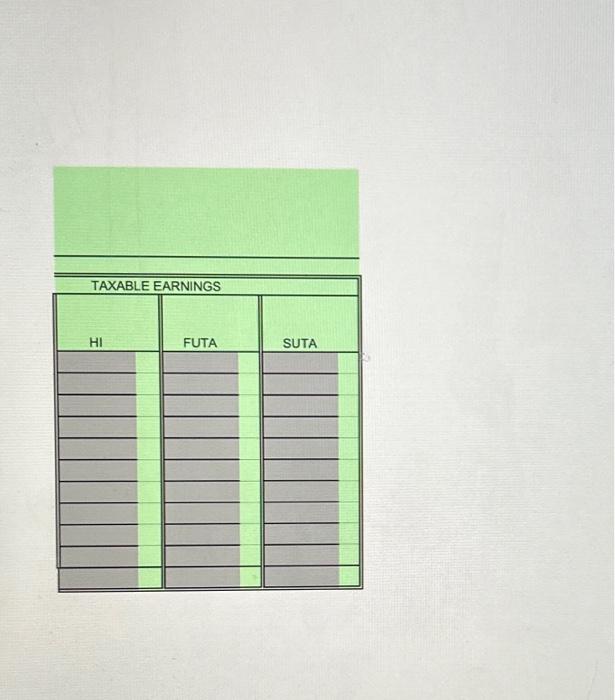

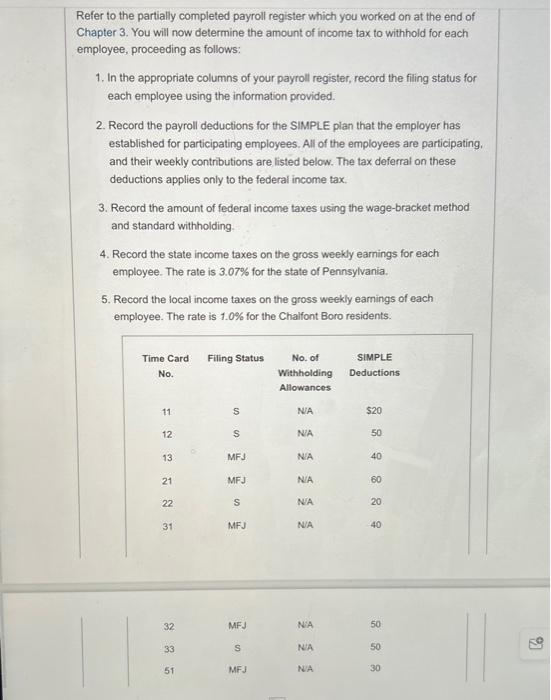

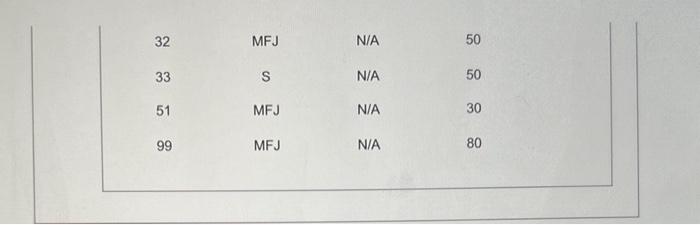

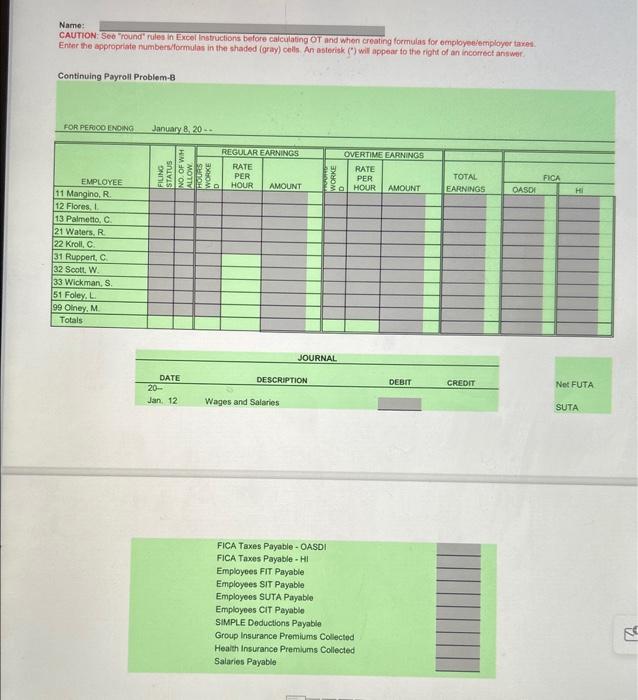

Name: CAuTION: Seo "round" rules in Excol instructions before calculating ot and when creating formulas for oenployeeiemployor taxes. Entar the appropriate Numbers/formulas in the shaded (gray) colls. Anr asterisk (") will appear to the right of an incorrect answer. Continuing Payroll Problem-B FOR REFUOQ EMBANC. laniaser an OLNEY COMPANY, INC. PAYROLL REGISTER \begin{tabular}{l||l||l||} \hline \hline \multicolumn{3}{|c||}{ TAXABLE EARNINGS } \\ \hline & & \\ \hline & FUTA & SUTA \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} Refer to the partially completed payroll register which you worked on at the end of Chapter 3. You will now determine the amount of income tax to withhold for each employee, proceeding as follows: 1. In the appropriate columns of your payroll register, record the filing status for each employee using the information provided. 2. Record the payroll deductions for the SIMPLE plan that the employer has established for participating employees. All of the employees are participating. and their weekly contributions are listed below. The tax deferral on these deductions applies only to the federal income tax. 3. Record the amount of federal income taxes using the wage-bracket method and standard withholding. 4. Record the state income taxes on the gross weekly eamings for each employee. The rate is 3.07% for the state of Pennsylvania. 5. Record the local income taxes on the gross weekly earnings of each employee. The rate is 1.0% for the Chalfont Boro residents. 32335199MFJSMFJMFJN/AN/AN/AN/A50503080 Name: CAuTION: Seo "round" rules in Excol instructions before calculating ot and when creating formulas for oenployeeiemployor taxes. Entar the appropriate Numbers/formulas in the shaded (gray) colls. Anr asterisk (") will appear to the right of an incorrect answer. Continuing Payroll Problem-B FOR REFUOQ EMBANC. laniaser an OLNEY COMPANY, INC. PAYROLL REGISTER \begin{tabular}{l||l||l||} \hline \hline \multicolumn{3}{|c||}{ TAXABLE EARNINGS } \\ \hline & & \\ \hline & FUTA & SUTA \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} Refer to the partially completed payroll register which you worked on at the end of Chapter 3. You will now determine the amount of income tax to withhold for each employee, proceeding as follows: 1. In the appropriate columns of your payroll register, record the filing status for each employee using the information provided. 2. Record the payroll deductions for the SIMPLE plan that the employer has established for participating employees. All of the employees are participating. and their weekly contributions are listed below. The tax deferral on these deductions applies only to the federal income tax. 3. Record the amount of federal income taxes using the wage-bracket method and standard withholding. 4. Record the state income taxes on the gross weekly eamings for each employee. The rate is 3.07% for the state of Pennsylvania. 5. Record the local income taxes on the gross weekly earnings of each employee. The rate is 1.0% for the Chalfont Boro residents. 32335199MFJSMFJMFJN/AN/AN/AN/A50503080