I have provided the required journal entries for both February and March. I have already done the February jounral entry, t chart, closing entry, income statement and balance sheet. Now I need to do the same but for the month of March.

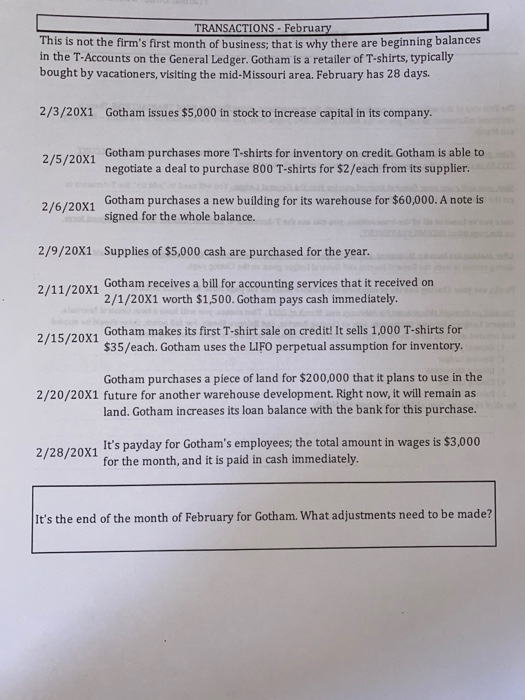

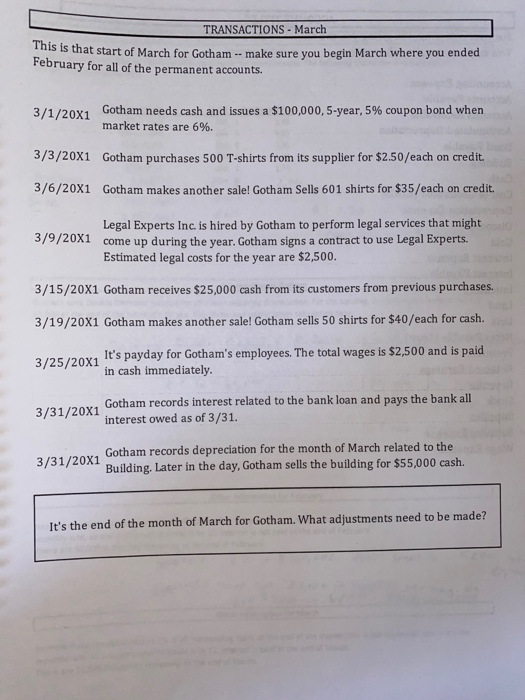

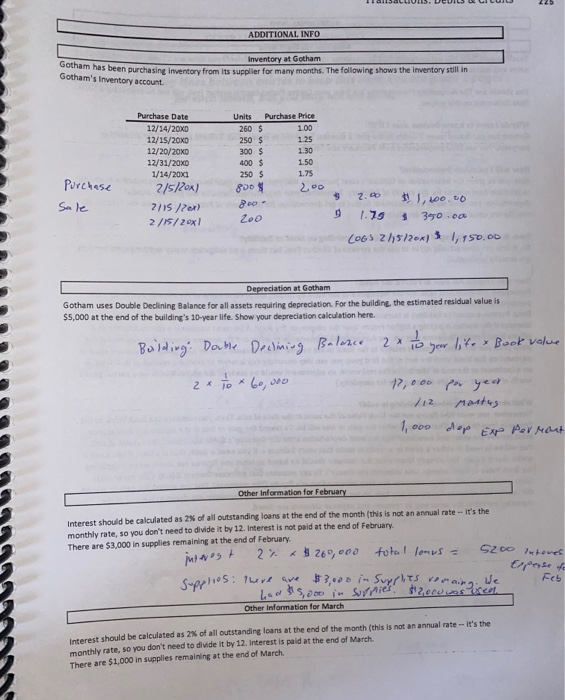

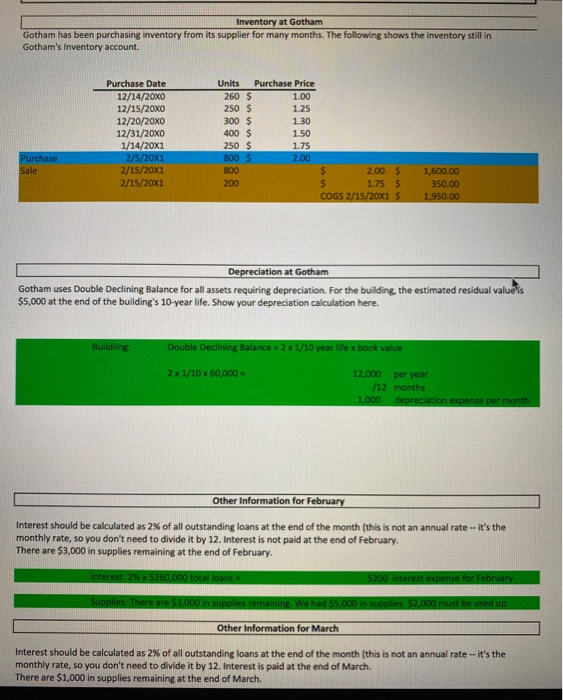

TRANSACTIONS - February This is not the firm's first month of business; that is why there are beginning balances in the T-Accounts on the General Ledger. Gotham is a retailer of T-shirts, typically bought by vacationers, visiting the mid-Missouri area. February has 28 days. 2/3/20X1 Gotham issues $5,000 in stock to increase capital in its company. 2/5/20X1 Gotham purchases more T-shirts for inventory on credit. Gotham is able to negotiate a deal to purchase 800 T-shirts for $2/each from its supplier. 2/6/20X1 Gotham purchases a new building for its warehouse for $60,000. A note is signed for the whole balance. 2/9/20X1 Supplies of $5,000 cash are purchased for the year. 2/11/2011 Gotham receives a bill for accounting services that it received on 2/1/20X1 worth $1,500. Gotham pays cash immediately. 2/15/20X1 Gotham makes its first T-shirt sale on credit! It sells 1,000 T-shirts for $35/each. Gotham uses the LIFO perpetual assumption for inventory. Gotham purchases a piece of land for $200,000 that it plans to use in the 2/20/20X1 future for another warehouse development. Right now, it will remain as land. Gotham increases its loan balance with the bank for this purchase. JOV, It's payday for Gotham's employees; the total amount in wages is $3,000 for the month, and it is paid in cash immediately. It's the end of the month of February for Gotham. What adjustments need to be made? TRANSACTIONS - March is is that start of March for Gotham -- make sure you begin March where you ended February for all of the permanent accounts. 3/1/20X1 Gotham needs cash and issues a $100,000,5-year, 5% coupon bond when market rates are 6%. 3/3/20X1 Gotham purchases 500 T-shirts from its supplier for $2.50/each on credit. 3/6/20X1 Gotham makes another sale! Gotham Sells 601 shirts for $35/each on credit. 3/9/20X1 Legal Experts Inc. is hired by Gotham to perform legal services that might come up during the year. Gotham signs a contract to use Legal Experts. Estimated legal costs for the year are $2,500. 3/15/20X1 Gotham receives $25,000 cash from its customers from previous purchases. 3/19/20X1 Gotham makes another sale! Gotham sells 50 shirts for $40/each for cash. 3125/20X1 It's payday for Gotham's employees. The total wages is $2,500 and is paid in cash immediately. 3/31/20X1 Gotham records interest related to the bank loan and pays the bank all interest owed as of 3/31. Gotham records depreciation for the month of March related to the 3/31/20X1 Building. Later in the day, Gotham sells the building for $55,000 cash. It's the end of the month of March for Gotham. What adjustments need to be made? Transactions: Debits & Credits Date GENERAL JOURNAL - March PG1 Accounts Debit Credit rou may want to skip lines between entries to keep this neat You are given 2 pages for each month, but you may not use them. Transactions: Debits & Credits Transactions: Debits & Credits Income Statement - March Closing Entries - March Balance Sheet - March Inventory at Gotham Gotham has been purchasing inventory from its supplier for many months. The following shows the inventory still in Gotham's Inventory account. Purchase Date 12/14/20x0 12/15/20/0 12/20/20x0 12/31/20X0 1/14/20X1 2/5/20X1 2/15/20x1 2/15/20X1 Units Purchase Price 260 $ 1.00 250 $ 1.25 300 $ 1.30 400 $ 1.50 250 $ 800 $ 2.00 800 200 1.75 Purchase Sale 2.00 $ 1.75 S COGS 2/15/20x1 $ 1,600.00 350.00 1,950.00 Depreciation at Gotham Gotham uses Double Declining Balance for all assets requiring depreciation. For the building, the estimated residual values $5,000 at the end of the building's 10-year life. Show your depreciation calculation here. Building Double Declining Balance = 2 x 1/10 year life x book value 2x 1/10 x 60,000 = 12,000 per year /12 months 1.000 depreciation expense per month Other Information for February it's the Interest should be calculated as 2% of all outstanding loans at the end of the month (this is not an annual rate monthly rate, so you don't need to divide it by 12. Interest is not paid at the end of February. There are $3,000 in supplies remaining at the end of February Interest: 2% x 5260.000 total loans 5200 interest expense for February Supplies: There are $3,000 in supplies remaining. We had $5,000 in supplies. $2,000 must be used up. Other Information for March it's the Interest should be calculated as 2% of all outstanding loans at the end of the month (this is not an annual rate monthly rate, so you don't need to divide it by 12. Interest is paid at the end of March. There are $1,000 in supplies remaining at the end of March. TRANSACTIONS - February This is not the firm's first month of business; that is why there are beginning balances in the T-Accounts on the General Ledger. Gotham is a retailer of T-shirts, typically bought by vacationers, visiting the mid-Missouri area. February has 28 days. 2/3/20X1 Gotham issues $5,000 in stock to increase capital in its company. 2/5/20X1 Gotham purchases more T-shirts for inventory on credit. Gotham is able to negotiate a deal to purchase 800 T-shirts for $2/each from its supplier. 2/6/20X1 Gotham purchases a new building for its warehouse for $60,000. A note is signed for the whole balance. 2/9/20X1 Supplies of $5,000 cash are purchased for the year. 2/11/2011 Gotham receives a bill for accounting services that it received on 2/1/20X1 worth $1,500. Gotham pays cash immediately. 2/15/20X1 Gotham makes its first T-shirt sale on credit! It sells 1,000 T-shirts for $35/each. Gotham uses the LIFO perpetual assumption for inventory. Gotham purchases a piece of land for $200,000 that it plans to use in the 2/20/20X1 future for another warehouse development. Right now, it will remain as land. Gotham increases its loan balance with the bank for this purchase. JOV, It's payday for Gotham's employees; the total amount in wages is $3,000 for the month, and it is paid in cash immediately. It's the end of the month of February for Gotham. What adjustments need to be made? TRANSACTIONS - March is is that start of March for Gotham -- make sure you begin March where you ended February for all of the permanent accounts. 3/1/20X1 Gotham needs cash and issues a $100,000,5-year, 5% coupon bond when market rates are 6%. 3/3/20X1 Gotham purchases 500 T-shirts from its supplier for $2.50/each on credit. 3/6/20X1 Gotham makes another sale! Gotham Sells 601 shirts for $35/each on credit. 3/9/20X1 Legal Experts Inc. is hired by Gotham to perform legal services that might come up during the year. Gotham signs a contract to use Legal Experts. Estimated legal costs for the year are $2,500. 3/15/20X1 Gotham receives $25,000 cash from its customers from previous purchases. 3/19/20X1 Gotham makes another sale! Gotham sells 50 shirts for $40/each for cash. 3125/20X1 It's payday for Gotham's employees. The total wages is $2,500 and is paid in cash immediately. 3/31/20X1 Gotham records interest related to the bank loan and pays the bank all interest owed as of 3/31. Gotham records depreciation for the month of March related to the 3/31/20X1 Building. Later in the day, Gotham sells the building for $55,000 cash. It's the end of the month of March for Gotham. What adjustments need to be made? Transactions: Debits & Credits Date GENERAL JOURNAL - March PG1 Accounts Debit Credit rou may want to skip lines between entries to keep this neat You are given 2 pages for each month, but you may not use them. Transactions: Debits & Credits Transactions: Debits & Credits Income Statement - March Closing Entries - March Balance Sheet - March Inventory at Gotham Gotham has been purchasing inventory from its supplier for many months. The following shows the inventory still in Gotham's Inventory account. Purchase Date 12/14/20x0 12/15/20/0 12/20/20x0 12/31/20X0 1/14/20X1 2/5/20X1 2/15/20x1 2/15/20X1 Units Purchase Price 260 $ 1.00 250 $ 1.25 300 $ 1.30 400 $ 1.50 250 $ 800 $ 2.00 800 200 1.75 Purchase Sale 2.00 $ 1.75 S COGS 2/15/20x1 $ 1,600.00 350.00 1,950.00 Depreciation at Gotham Gotham uses Double Declining Balance for all assets requiring depreciation. For the building, the estimated residual values $5,000 at the end of the building's 10-year life. Show your depreciation calculation here. Building Double Declining Balance = 2 x 1/10 year life x book value 2x 1/10 x 60,000 = 12,000 per year /12 months 1.000 depreciation expense per month Other Information for February it's the Interest should be calculated as 2% of all outstanding loans at the end of the month (this is not an annual rate monthly rate, so you don't need to divide it by 12. Interest is not paid at the end of February. There are $3,000 in supplies remaining at the end of February Interest: 2% x 5260.000 total loans 5200 interest expense for February Supplies: There are $3,000 in supplies remaining. We had $5,000 in supplies. $2,000 must be used up. Other Information for March it's the Interest should be calculated as 2% of all outstanding loans at the end of the month (this is not an annual rate monthly rate, so you don't need to divide it by 12. Interest is paid at the end of March. There are $1,000 in supplies remaining at the end of March