Question

I have some news to share... I recently accepted a job offer with the City of Hollis. I decided to transition into governmental accounting because

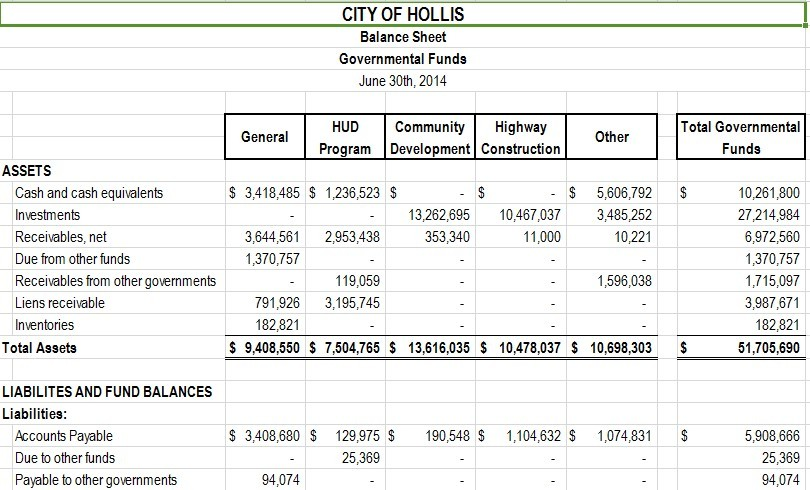

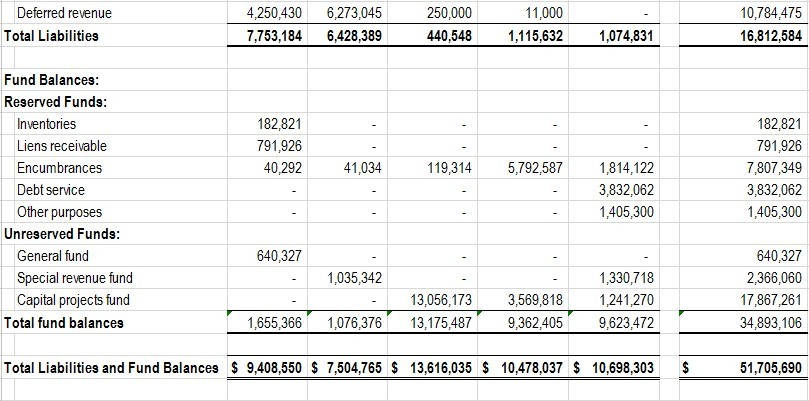

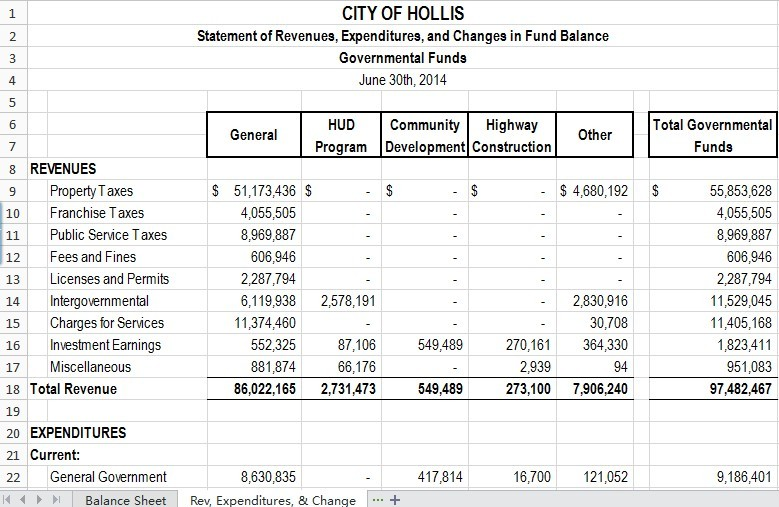

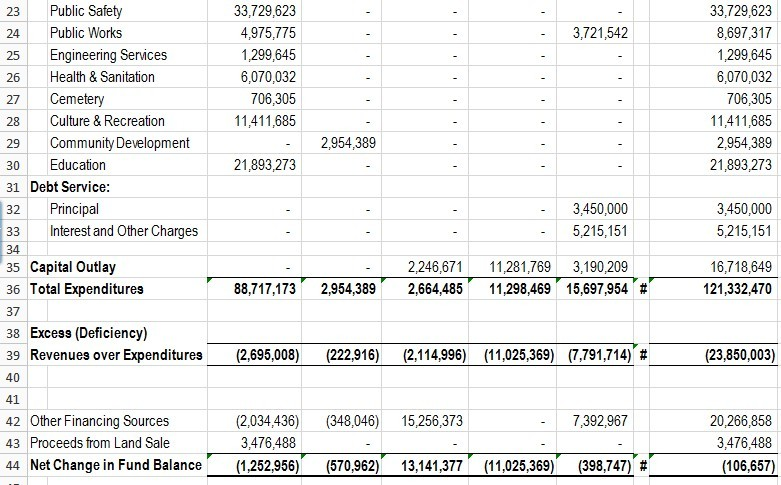

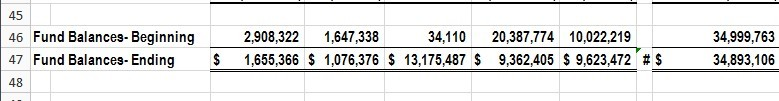

I have some news to share... I recently accepted a job offer with the City of Hollis. I decided to transition into governmental accounting because of the fantastic retirement benefits. I was wondering if you (my oldest, dearest friend) could help me prepare for my new job? I've been studying Governmental Accounting Standards to prepare for my new job, and I've written down a variety of questions. Could you answer the below questions and help clarify my understanding of governmental accounting? Please refer to the 6/30/14 City of Hollis' fund financial statements (attached).

QUESTIONS:

1. Which of these governmental funds are major funds? Please explain why each governmental fund is categorized as a major fund.

2. Which of these governmental funds are not major funds? Please explain why each governmental fund is categorized as a non-major fund.

3. Can I include smaller governmental funds in my listing of major funds (for voluntary, supplemental purposes)? Please explain why or why not.

4. The Government-Wide Statement of Activities includes various types of depreciable assets, so why are depreciable assets excluded from my (attached) governmental fund balance sheet?

5. Why is the Governmental Fund total balance different than the Governmental Activities total Net Assets? Please explain how to reconcile the differences between the Governmental Fund total balance and the Governmental Activities total Net Assets.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started