Question

I HAVE THE ANSWERS JUST NEED A STEP BY STEP EXPLANATION OF HOW THE NUMBERS WERE CALCULATED ONLY TYPED ANSWERS PLEASE 1. If Johnson determines

I HAVE THE ANSWERS JUST NEED A STEP BY STEP EXPLANATION OF HOW THE NUMBERS WERE CALCULATED

ONLY TYPED ANSWERS PLEASE

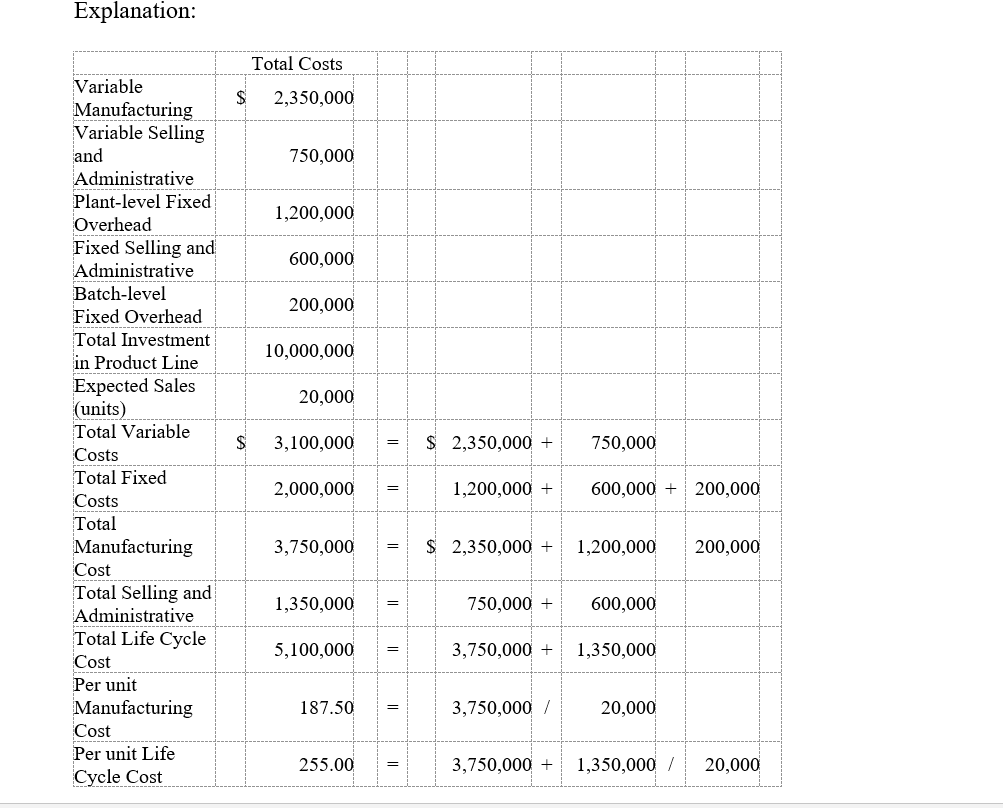

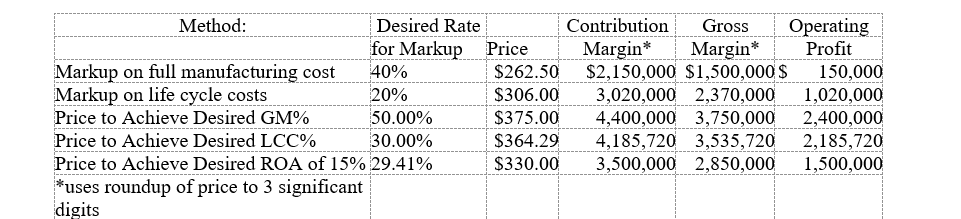

1. If Johnson determines price using a 40% markup of full manufacturing cost, the price is:

2. If Johnson determines price so as to receive a desired return on assets of 15%, the price is: (ESPECIALLY HOW DID THEY GET 29.41% - DESIRED RATE ??????)

3. If Johnson determines price using a desired gross margin percentage of 50%, the price is:

4. If Johnson determines price using a desired return on life cycle costs of 30%, the price is:

5. If Johnson determines price using a 20% markup of life cycle cost, the price is:

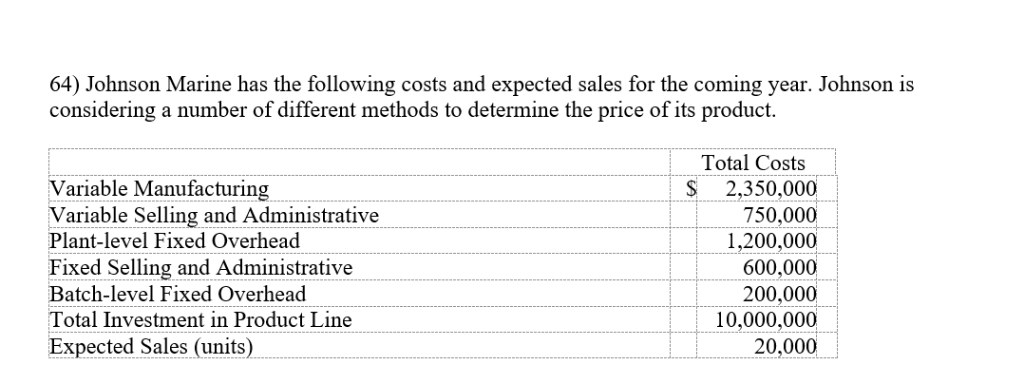

64) Johnson Marine has the following costs and expected sales for the coming year. Johnson is considering a number of different methods to determine the price of its product Total Costs Variable Manufacturing Variable Selling and Administrative Plant-level Fixed Overhead Fixed Selling and Administrative Batch-level Fixed Overhead S 2,350.000 750,000 1,200,000 600,000 200,000 10,000,000 20,000 otal Investment in Product Line Expected Sales (units) Explanation: Total Costs Variable Manufacturing Variable Selling and Administrative Plant-level Fixed Overhead Fixed Selling and Administrative Batch-level Fixed Overhead Total Investment in Product Line Expected Sales (units) Total Variable Costs Total Fixed Costs Total Manufacturing Cost Total Selling and Administrative Total Life Cycle Cost Per unit Manufacturing Cost Per unit Life Cycle Cost S 2,350,000 750,000 ,200.000 600,000 200,000 10,000,000 20,000 $ 3,100,000S2,350,000750,000 2,000,000 = 1,200,000600,000 +200,000 3,750,000-S 2,350,000 1,200,000200,000 1,350,000- 5,100,000- 750,000 +600,000 3,750,000 +1,350,000 187.50 !- 3,750,000 20,000 255.00- 3,750,000 +: ,350,000 / 20,000 Method Desired Rate for Markup Price ContributionGross Operating MarginMargin* Profit Markup on full manufacturing cost 40% Markup on life cycle costs Price to Achieve Desired GM% Price to Achieve Desired LCC% Price to Achieve Desired ROA of 15% 29.41% uses roundup of price to 3 significant digits $262.50 $2,150,000 $1,500,000S 150,000 $306.003,020,000 2,370,000 1,020,000 $375.00 4,400,000 3,750,0002,400,000 S364.294,185,720 3,535,7202,185,720 $330.003,500,000 2,850,000 1,500,000 20% 50.00% 30.00% 64) Johnson Marine has the following costs and expected sales for the coming year. Johnson is considering a number of different methods to determine the price of its product Total Costs Variable Manufacturing Variable Selling and Administrative Plant-level Fixed Overhead Fixed Selling and Administrative Batch-level Fixed Overhead S 2,350.000 750,000 1,200,000 600,000 200,000 10,000,000 20,000 otal Investment in Product Line Expected Sales (units) Explanation: Total Costs Variable Manufacturing Variable Selling and Administrative Plant-level Fixed Overhead Fixed Selling and Administrative Batch-level Fixed Overhead Total Investment in Product Line Expected Sales (units) Total Variable Costs Total Fixed Costs Total Manufacturing Cost Total Selling and Administrative Total Life Cycle Cost Per unit Manufacturing Cost Per unit Life Cycle Cost S 2,350,000 750,000 ,200.000 600,000 200,000 10,000,000 20,000 $ 3,100,000S2,350,000750,000 2,000,000 = 1,200,000600,000 +200,000 3,750,000-S 2,350,000 1,200,000200,000 1,350,000- 5,100,000- 750,000 +600,000 3,750,000 +1,350,000 187.50 !- 3,750,000 20,000 255.00- 3,750,000 +: ,350,000 / 20,000 Method Desired Rate for Markup Price ContributionGross Operating MarginMargin* Profit Markup on full manufacturing cost 40% Markup on life cycle costs Price to Achieve Desired GM% Price to Achieve Desired LCC% Price to Achieve Desired ROA of 15% 29.41% uses roundup of price to 3 significant digits $262.50 $2,150,000 $1,500,000S 150,000 $306.003,020,000 2,370,000 1,020,000 $375.00 4,400,000 3,750,0002,400,000 S364.294,185,720 3,535,7202,185,720 $330.003,500,000 2,850,000 1,500,000 20% 50.00% 30.00%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started