Answered step by step

Verified Expert Solution

Question

1 Approved Answer

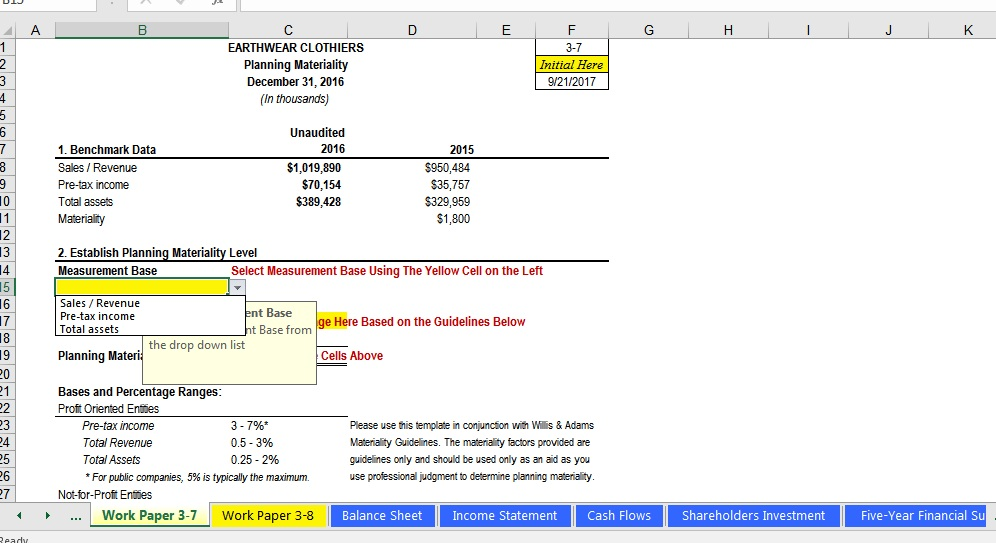

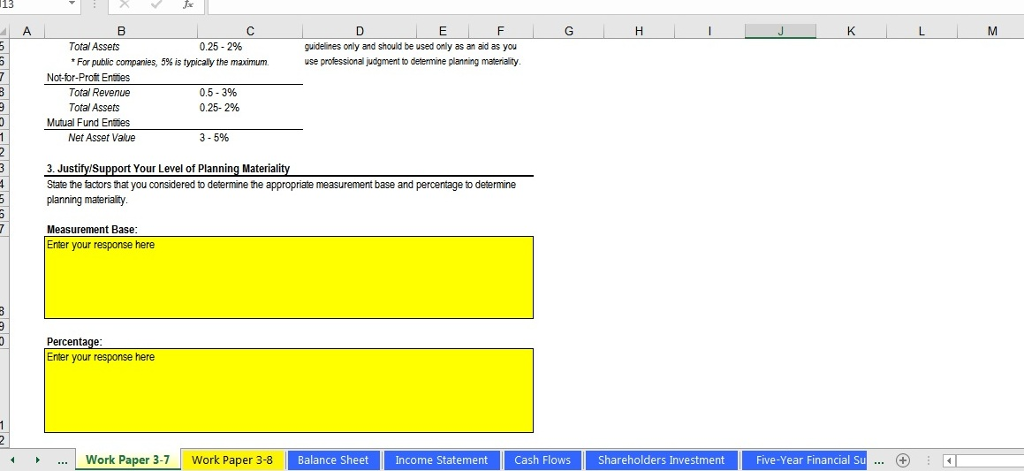

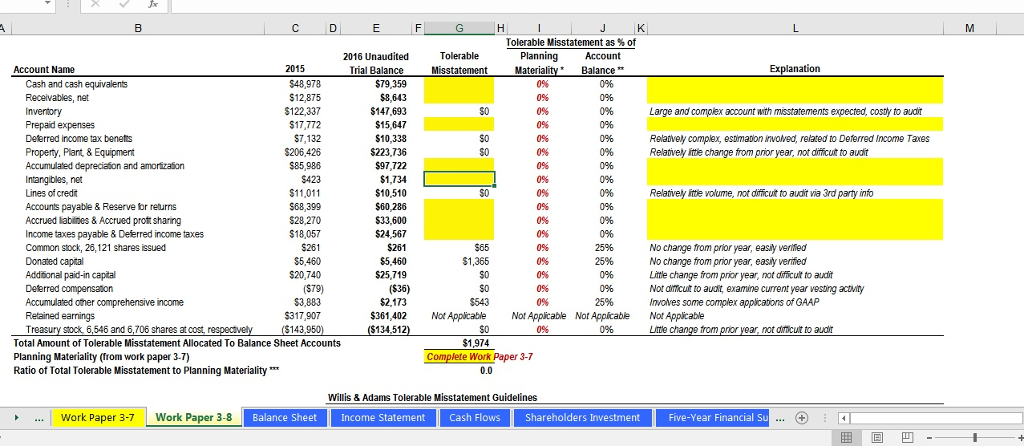

I have to answer in the yellow colored boxes.. can anyone help to get answers about materiality and tolerable misstatement? The percentages of planning materiality

I have to answer in the yellow colored boxes.. can anyone help to get answers about materiality and tolerable misstatement?

I have to answer in the yellow colored boxes.. can anyone help to get answers about materiality and tolerable misstatement?

The percentages of planning materiality and account balance is being automatically changed once I typed in the numbers of tolerable misstatement

EARTHWEAR CLOTHIERS Planning Materiality December 31, 2016 (In thousands) 3-7 Initial Here 9/21/2017 1. Benchmark Data Sales/Revenue Pre-tax income Total assets Materiality Unaudited 2016 $1,019,890 $70,154 $389,428 2015 $950,484 $35,757 $329,959 $1,800 2. Establish Planning Materiality Level Measurement Base Select Measurement Base Using The Yellow Cell on the Left 5 I6 17 Sales Revenue Pre-tax income Total assets t Base t Base from e Here Based on the Guidelines Below the drop down list Planning Mater Cells Above Bases and Percentage Ranges Proft Oriented Enties Pre-tax income Total Revenue Total Assets * For public companies, 5% is typically the maximum. 3.7% 0.5-3% 0.25-2% Please use istemplate in conjuncion ih W is& Adams Materiality Guidelines. The materiality factors provided ane guidelines only and should be used only as an aid as you use professional judgment to determine planning materiality 4 Not-for-Proft Enties .Work Paper 3-7 Work Paper 3-8 Balance Sheet Income Statement Cash Flows Shareholders Investment Five-Year Financial SuStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started