Answered step by step

Verified Expert Solution

Question

1 Approved Answer

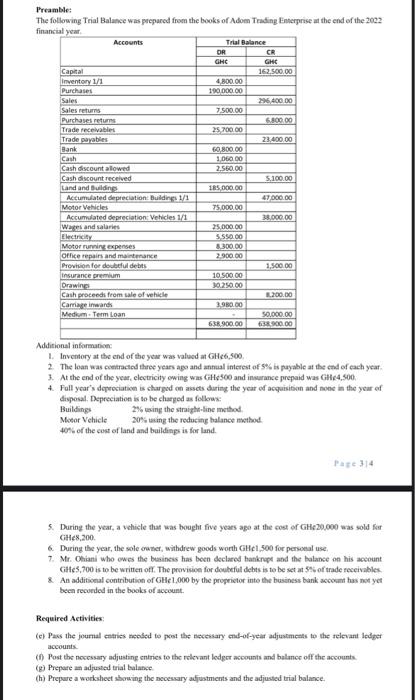

Preamble: The following Trial Balance was prepared from the books of Adom Trading Enterprise at the end of the 2022 financial year. Capital Inventory 1/1

Preamble: The following Trial Balance was prepared from the books of Adom Trading Enterprise at the end of the 2022 financial year. Capital Inventory 1/1 Purchases Sales Sales returns Accounts Purchases returns Trade receivables Trade payables Bank Cash Cash discount allowed Cash discount received Land and Buildings Accumulated depreciation: Buildings 1/1 Motor Vehicles Accumulated depreciation: Vehicles 1/1 Wages and salaries. Electricity Motor running expenses Office repairs and maintenance Provision for doubtful debts Insurance premium Drawings Cash proceeds from sale of vehicle Carriage inwards Medium - Term Loan Trial Balance DR GH 4,800.00 190,000.00 7,500.00 25,700.00 60,800.00 1,060.00 2,560.00 185,000.00 75,000.00 25,000.00 5,550.00 8,300.00 2,900.00 10,500.00 30,250.00 3,980.00 638,900.00 CR GH 162,500.00 296,400.00 6,800.00 23,400.00 5,100.00 47,000.00 38,000.00 1,500.00 8,200.00 50,000.00 638,900.00 Additional information: 1. Inventory at the end of the year was valued at GH6,500. 2. The loan was contracted three years ago and annual interest of 5% is payable at the end of each year. 3. At the end of the year, electricity owing was GH500 and insurance prepaid was GH4,500. 4. Full year's depreciation is charged on assets during the year of acquisition and none in the year of disposal. Depreciation is to be charged as follows: Buildings 2% using the straight-line method. Motor Vehicle 20% using the reducing balance method. 40% of the cost of land and buildings is for land. Page 34 5. During the year, a vehicle that was bought five years ago at the cost of GH20,000 was sold for GH8,200. 6. During the year, the sole owner, withdrew goods worth GH1,500 for personal use. 7. Mr. Ohiani who owes the business has been declared bankrupt and the balance on his account GH5,700 is to be written off. The provision for doubtful debts is to be set at 5% of trade receivables. 8. An additional contribution of GH1,000 by the proprietor into the business bank account has not yet been recorded in the books of account. Required Activities: (e) Pass the journal entries needed to post the necessary end-of-year adjustments to the relevant ledger accounts. (f) Post the necessary adjusting entries to the relevant ledger accounts and balance off the accounts. (g) Prepare an adjusted trial balance. (h) Prepare a worksheet showing the necessary adjustments and the adjusted trial balance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started