I have to write a 1 page (approximately) report with these data. Could you help me please?

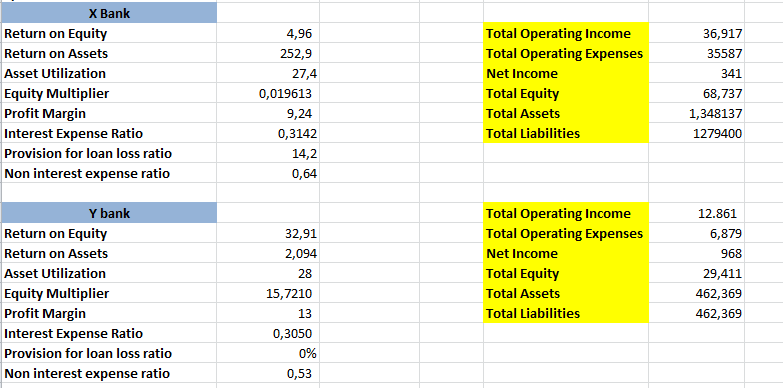

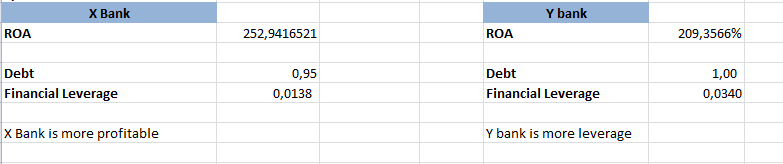

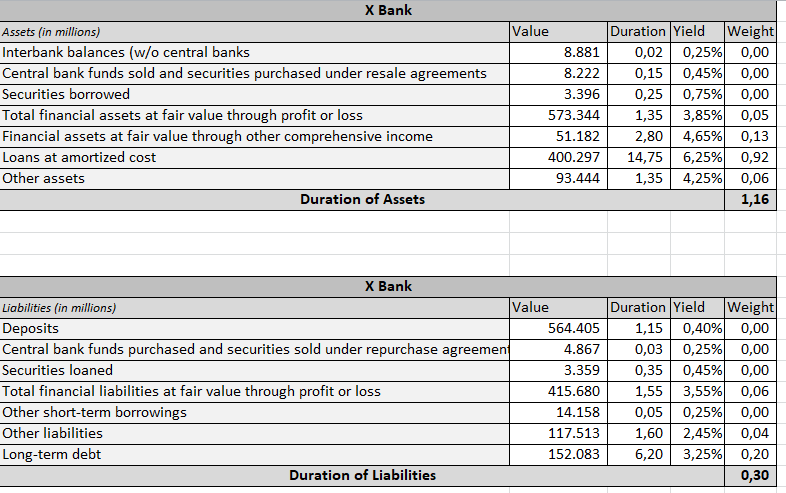

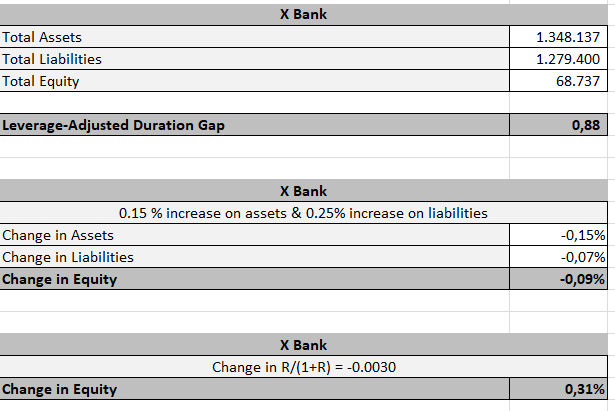

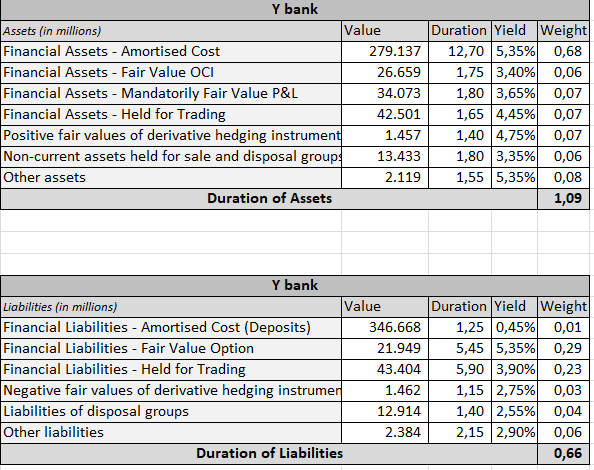

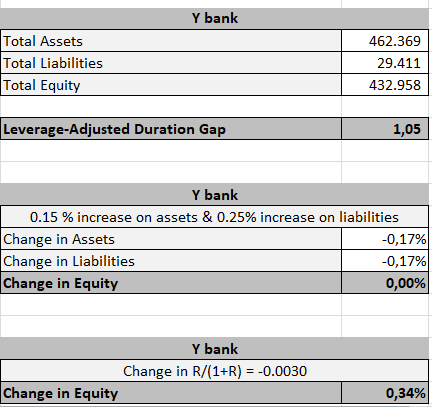

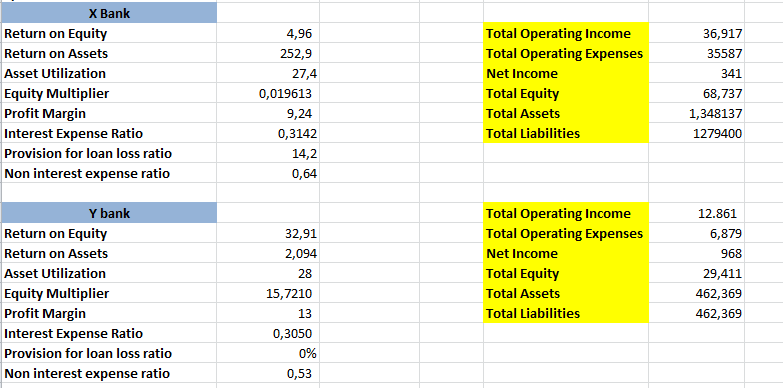

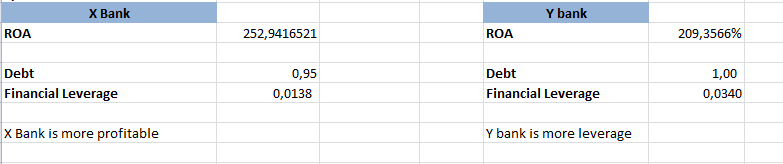

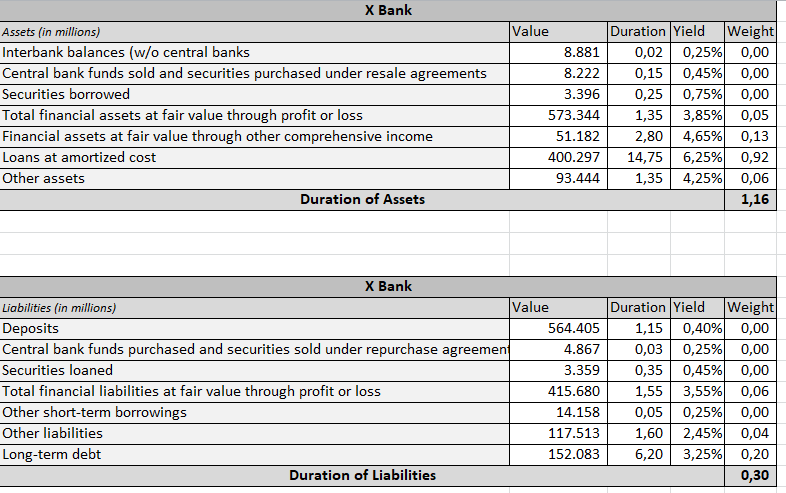

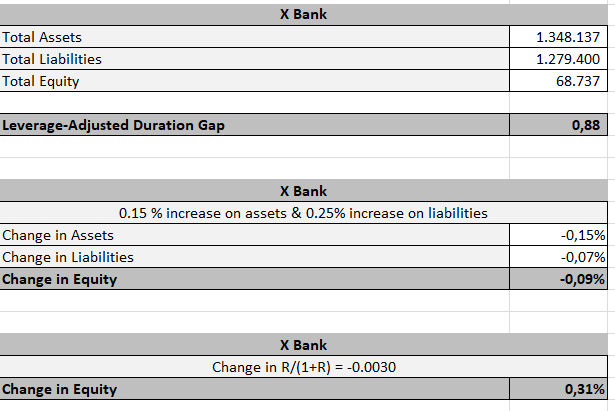

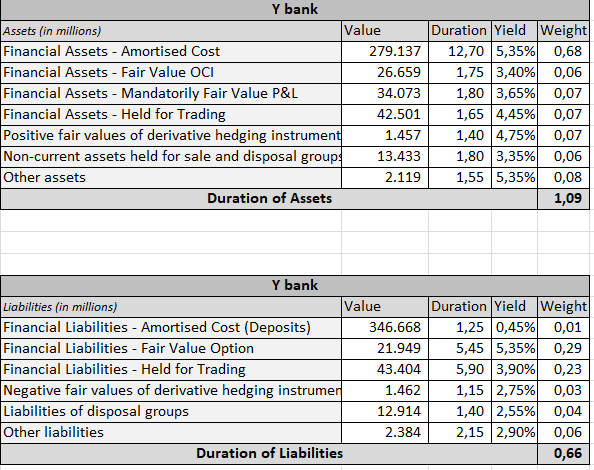

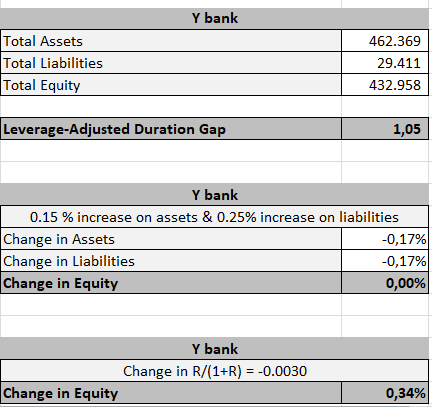

X Bank Return on Equity Return on Assets Asset Utilization Equity Multiplier Profit Margin Interest Expense Ratio Provision for loan loss ratio Non interest expense ratio 4,96 252,9 27,4 0,019613 9,24 0,3142 14,2 0,64 Total Operating Income Total Operating Expenses Net Income Total Equity Total Assets Total Liabilities 36,917 35587 341 68,737 1,348137 1279400 Y bank Return on Equity Return on Assets Asset Utilization Equity Multiplier Profit Margin Interest Expense Ratio Provision for loan loss ratio Non interest expense ratio 32,91 2,094 28 15,7210 13 0,3050 0% 0,53 Total Operating Income Total Operating Expenses Net Income Total Equity Total Assets Total Liabilities 12.861 6,879 968 29,411 462,369 462,369 X Bank Y bank ROA 252,9416521 ROA 209,3566% Debt Financial Leverage 0,95 0,0138 Debt Financial Leverage 1,00 0,0340 X Bank is more profitable Y bank is more leverage X Bank Assets (in millions) Interbank balances (w/o central banks Central bank funds sold and securities purchased under resale agreements Securities borrowed Total financial assets at fair value through profit or loss Financial assets at fair value through other comprehensive income Loans at amortized cost Other assets Duration of Assets Value Duration Yield Weight 8.881 0,02 0,25% 0,00 8.222 0,15 0,45% 0,00 3.396 0,25 0,75% 0,00 573.344 1,35 3,85% 0,05 51.182 2,80 4,65% 0,13 400.297 14,75 6,25% 0,92 93.444 1,35 4,25% 0,06 1,16 X Bank Liabilities (in millions) Value Duration Yield Weight Deposits 564.405 1,15 0,40% 0,00 Central bank funds purchased and securities sold under repurchase agreemen 4.867 0,03 0,25% 0,00 Securities loaned 3.359 0,35 0,45% 0,00 Total financial liabilities at fair value through profit or loss 415.680 1,55 3,55% 0,06 Other short-term borrowings 14.158 0,05 0,25% 0,00 Other liabilities 117.513 1,60 2,45% 0,04 Long-term debt 152.083 6,20 3,25% 0,20 Duration of Liabilities 0,30 Y bank Assets (in millions) Value Duration Yield Weight Financial Assets - Amortised Cost 279.137 12,70 5,35% 0,68 Financial Assets - Fair Value OCI 26.659 1,75 3,40% 0,06 Financial Assets - Mandatorily Fair Value P&L 34.073 1,80 3,65% 0,07 Financial Assets - Held for Trading 42.501 1,65 4,45% 0,07 Positive fair values of derivative hedging instrument 1.457 1,40 4,75% 0,07 Non-current assets held for sale and disposal group 13.433 1,80 3,35% 0,06 Other assets 2.119 1,55 5,35% 0,08 Duration of Assets 1,09 Y bank Liabilities (in millions) Value Duration Yield Weight| Financial Liabilities - Amortised Cost (Deposits) 346.668 1,25 0,45% 0,01 Financial Liabilities - Fair Value Option 21.949 5,45 5,35% 0,29 Financial Liabilities - Held for Trading 43.404 5,90 3,90% 0,23 Negative fair values of derivative hedging instrumer 1.462 1,15 2,75% 0,03 Liabilities of disposal groups 12.914 1,40 2,55% 0,04 Other liabilities 2.384 2,15 2,90% 0,06 Duration of Liabilities 0,66 Y bank Total Assets Total Liabilities Total Equity 462.369 29.411 432.958 Leverage-Adjusted Duration Gap 1,05 Y bank 0.15 % increase on assets & 0.25% increase on liabilities Change in Assets -0,17% Change in Liabilities -0,17% Change in Equity 0,00% Y bank Change in R/(1+R) = -0.0030 Change in Equity 0,34% X Bank Return on Equity Return on Assets Asset Utilization Equity Multiplier Profit Margin Interest Expense Ratio Provision for loan loss ratio Non interest expense ratio 4,96 252,9 27,4 0,019613 9,24 0,3142 14,2 0,64 Total Operating Income Total Operating Expenses Net Income Total Equity Total Assets Total Liabilities 36,917 35587 341 68,737 1,348137 1279400 Y bank Return on Equity Return on Assets Asset Utilization Equity Multiplier Profit Margin Interest Expense Ratio Provision for loan loss ratio Non interest expense ratio 32,91 2,094 28 15,7210 13 0,3050 0% 0,53 Total Operating Income Total Operating Expenses Net Income Total Equity Total Assets Total Liabilities 12.861 6,879 968 29,411 462,369 462,369 X Bank Y bank ROA 252,9416521 ROA 209,3566% Debt Financial Leverage 0,95 0,0138 Debt Financial Leverage 1,00 0,0340 X Bank is more profitable Y bank is more leverage X Bank Assets (in millions) Interbank balances (w/o central banks Central bank funds sold and securities purchased under resale agreements Securities borrowed Total financial assets at fair value through profit or loss Financial assets at fair value through other comprehensive income Loans at amortized cost Other assets Duration of Assets Value Duration Yield Weight 8.881 0,02 0,25% 0,00 8.222 0,15 0,45% 0,00 3.396 0,25 0,75% 0,00 573.344 1,35 3,85% 0,05 51.182 2,80 4,65% 0,13 400.297 14,75 6,25% 0,92 93.444 1,35 4,25% 0,06 1,16 X Bank Liabilities (in millions) Value Duration Yield Weight Deposits 564.405 1,15 0,40% 0,00 Central bank funds purchased and securities sold under repurchase agreemen 4.867 0,03 0,25% 0,00 Securities loaned 3.359 0,35 0,45% 0,00 Total financial liabilities at fair value through profit or loss 415.680 1,55 3,55% 0,06 Other short-term borrowings 14.158 0,05 0,25% 0,00 Other liabilities 117.513 1,60 2,45% 0,04 Long-term debt 152.083 6,20 3,25% 0,20 Duration of Liabilities 0,30 Y bank Assets (in millions) Value Duration Yield Weight Financial Assets - Amortised Cost 279.137 12,70 5,35% 0,68 Financial Assets - Fair Value OCI 26.659 1,75 3,40% 0,06 Financial Assets - Mandatorily Fair Value P&L 34.073 1,80 3,65% 0,07 Financial Assets - Held for Trading 42.501 1,65 4,45% 0,07 Positive fair values of derivative hedging instrument 1.457 1,40 4,75% 0,07 Non-current assets held for sale and disposal group 13.433 1,80 3,35% 0,06 Other assets 2.119 1,55 5,35% 0,08 Duration of Assets 1,09 Y bank Liabilities (in millions) Value Duration Yield Weight| Financial Liabilities - Amortised Cost (Deposits) 346.668 1,25 0,45% 0,01 Financial Liabilities - Fair Value Option 21.949 5,45 5,35% 0,29 Financial Liabilities - Held for Trading 43.404 5,90 3,90% 0,23 Negative fair values of derivative hedging instrumer 1.462 1,15 2,75% 0,03 Liabilities of disposal groups 12.914 1,40 2,55% 0,04 Other liabilities 2.384 2,15 2,90% 0,06 Duration of Liabilities 0,66 Y bank Total Assets Total Liabilities Total Equity 462.369 29.411 432.958 Leverage-Adjusted Duration Gap 1,05 Y bank 0.15 % increase on assets & 0.25% increase on liabilities Change in Assets -0,17% Change in Liabilities -0,17% Change in Equity 0,00% Y bank Change in R/(1+R) = -0.0030 Change in Equity 0,34%