Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I have tried to figure this question out, but I have no idea what to do. d. Compute the cost of goods available for sale,

I have tried to figure this question out, but I have no idea what to do.

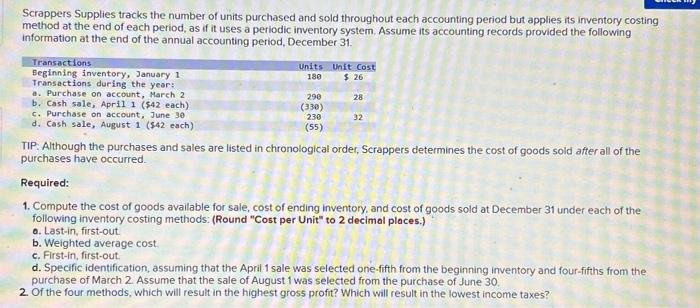

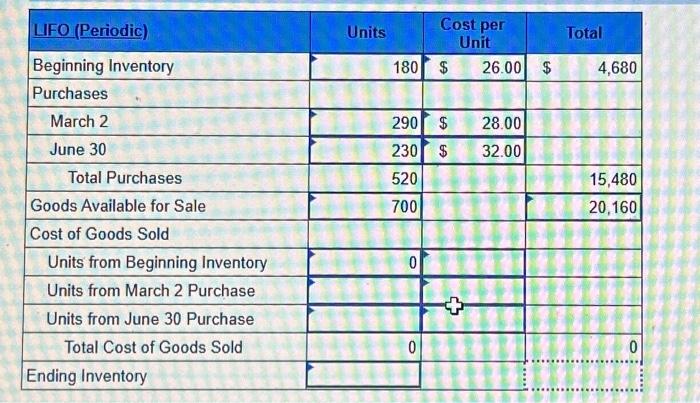

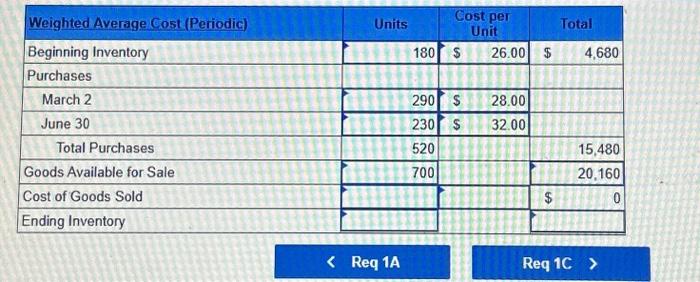

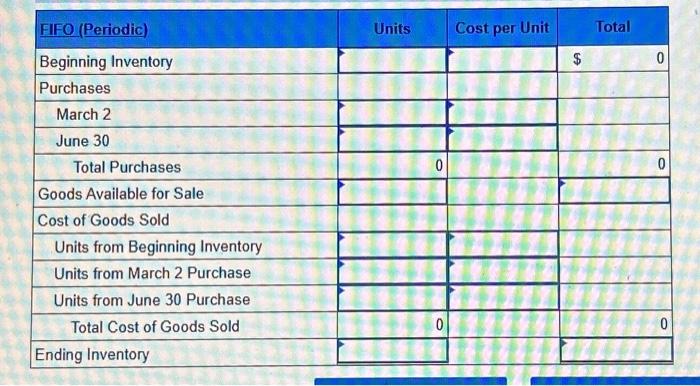

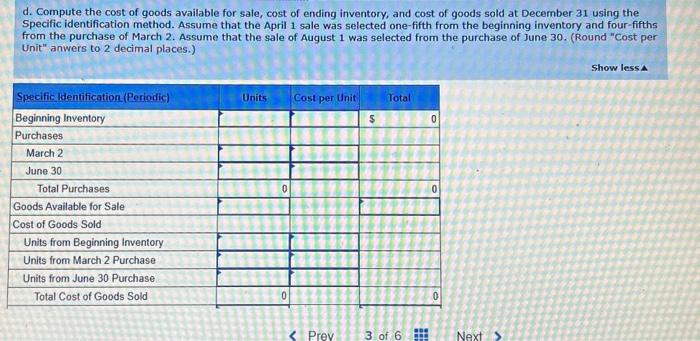

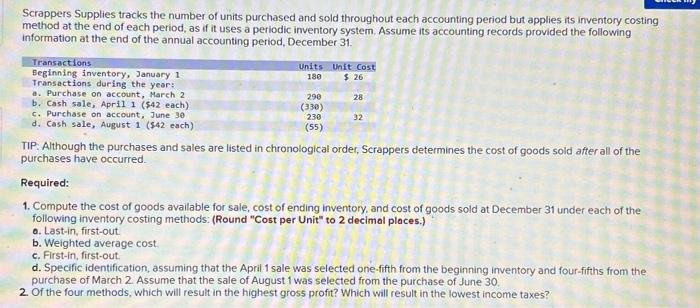

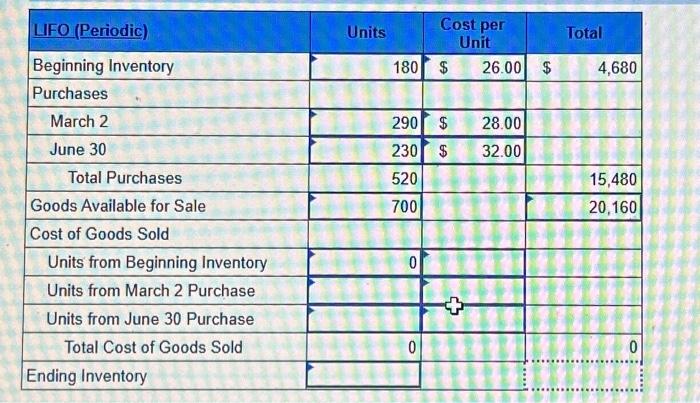

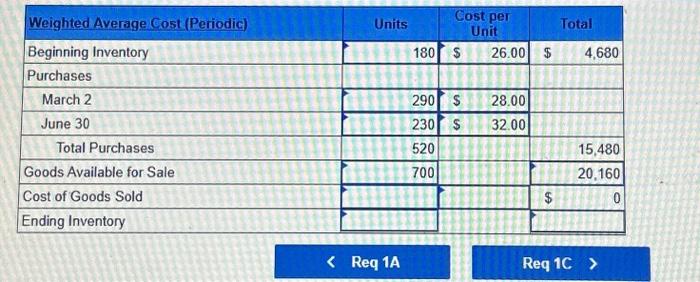

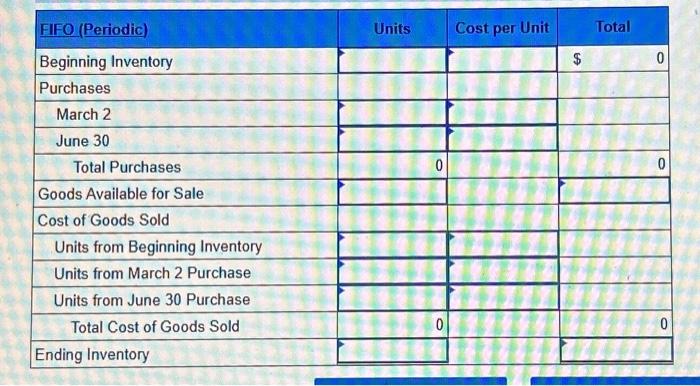

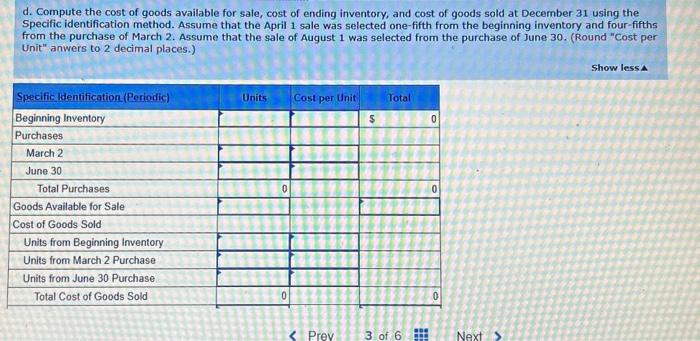

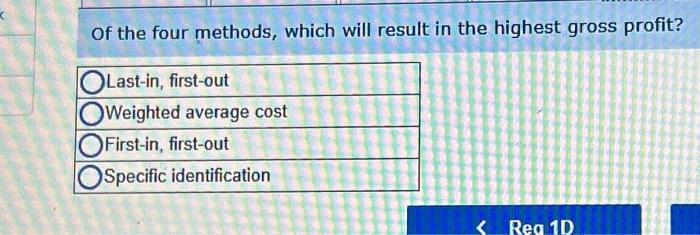

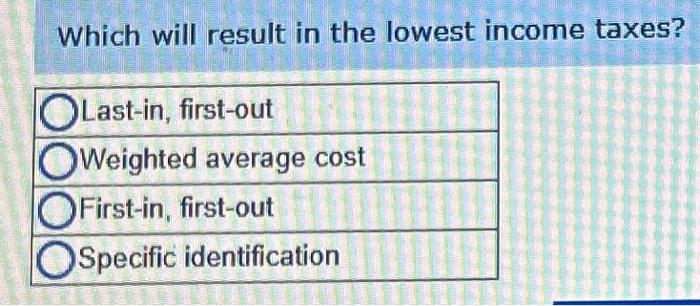

d. Compute the cost of goods available for sale, cost of ending inventory, and cost of goods sold at December 31 using the Specific identification method. Assume that the April 1 sale was selected one-fifth from the beginning inventory and four-fifths from the purchase of March 2. Assume that the sale of August 1 was selected from the purchase of June 30 . (Round "Cost per Unit" anwers to 2 decimal places.) \begin{tabular}{|l|l|l|l|} \hline FIFO (Periodic) & Units & Cost per Unit & Total \\ \hline Beginning Inventory & & & $ \\ \hline Purchases & & & \\ \hline March 2 & & & \\ \hline June 30 & & & \\ \hline Total Purchases & & & \\ \hline Goods Available for Sale & & & \\ \hline Cost of Goods Sold & & & \\ \hline Units from Beginning Inventory & & & \\ \hline Units from March 2 Purchase & & & \\ \hline Units from June 30 Purchase & & & \\ \hline Total Cost of Goods Sold & & & \\ \hline Ending Inventory & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline Weighted Average Cost (Periodic) & Units & \multicolumn{2}{|c|}{CostperUnit} & \multicolumn{2}{|c|}{ Total } \\ \hline Beginning Inventory & 180 & s & 26.00 & $ & 4,680 \\ \hline Purchases & 8 & 18 & 7 & 14 & \\ \hline March 2 & 290 & s & 28.00 & & \\ \hline June 30 & 8170230 & s & 32.00 & & \\ \hline Total Purchases & 520 & & & & 15,480 \\ \hline Goods Available for Sale & 700 & & & & 20,160 \\ \hline Cost of Goods Sold & & & & $ & 0 \\ \hline Ending Inventory & & & & 0 & \\ \hline \end{tabular} Of the four methods, which will result in the highest gross profit? Which will result in the lowest income taxes? \begin{tabular}{|c|c|c|c|} \hline UFO (Periodic) & Units & CostperUnit & Total \\ \hline Beginning Inventory & 180 & 26.00 & 4,680 \\ \hline \begin{tabular}{|l|} Purchases \\ \end{tabular} & & & \\ \hline March 2 & 290 & $28.00 & \\ \hline June 30 & 230 & 32.00 & \\ \hline Total Purchases & 520 & & 15,480 \\ \hline Goods Available for Sale & 700 & & 20,160 \\ \hline Cost of Goods Sold & +2 & & \\ \hline Units from Beginning Inventory & 0 & & \\ \hline Units from March 2 Purchase & & & \\ \hline Units from June 30 Purchase & & & \\ \hline Total Cost of Goods Sold & 0 & & \\ \hline nding Inventory & & & \\ \hline \end{tabular} Scrappers Supplies tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each period, as if it uses a periodic inventory system. Assume its accounting records provided the following information at the end of the annual accounting period, December 31 . TIP. Although the purchases and sales are listed in chronological order, Scrappers determines the cost of goods sold after all of the purchases have occurred. Required: 1. Compute the cost of goods available for sale, cost of ending inventory, and cost of goods sold at December 31 under each of the following inventory costing methods: (Round "Cost per Unit" to 2 decimal places.) o. Last-in, first-out. b. Weighted average cost. c. First-in, first-out. d. Specific identification, assuming that the April 1 sale was selected one-fifth from the beginning inventory and four-fifths from the purchase of March 2 . Assume that the sale of August 1 was selected from the purchase of June 30 . 2. Of the four methods, which will result in the highest gross profit? Which will result in the lowest income taxes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started