Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I hope the images are more clear, my apologies! Required information [The following information applies to the questions displayed below] The radiology department at St.

I hope the images are more clear, my apologies!

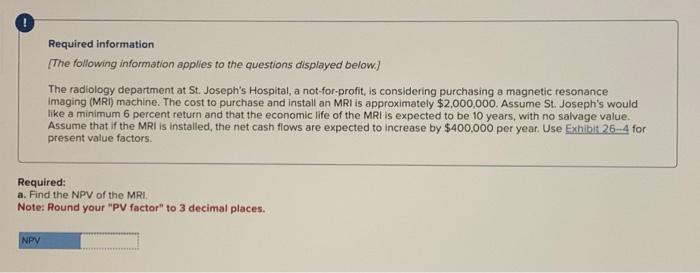

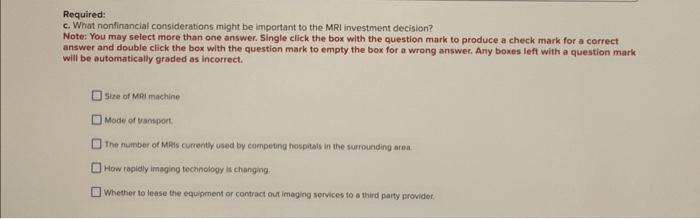

Required information [The following information applies to the questions displayed below] The radiology department at St. Joseph's Hospital, a not-for-profit, is considering purchasing a magnetic resonance imaging (MRi) machine. The cost to purchase and install an MRI is approximately $2,000,000. Assume St. Joseph's would like a minimum 6 percent return and that the economic life of the MRI is expected to be 10 years, with no salvage value. Assume that if the MRI is installed, the net cash flows are expected to increase by $400.000 per year. Use Exhibit 264 for present value factors. Required: a. Find the NPV of the MRI. Note: Round your "PV factor" to 3 decimal places. Required: b. Should the hospital acquire the MRI? Required: c. What nonfinancial considerations might be important to the MRI investment decision? Note: You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect. Size of MRi machine Mode of trinsport The number of MRIs eumenty used by compenng hosplals in the surrounding area How tapidly imaging technotogy is changing. Whether to lease the equigment or contract out imaging services to a third party provider Required information [The following information applies to the questions displayed below] The radiology department at St. Joseph's Hospital, a not-for-profit, is considering purchasing a magnetic resonance imaging (MRI) machine. The cost to purchase and install an MRI is approximately $2,000,000. Assume St. Joseph's would like a minimum 6 percent return and that the economic life of the MRI is expected to be 10 years, with no salvage value. Assume that if the MRI is installed, the net cash flows are expected to increase by $400,000 per year. Use Exhibit 264 for present value factors. Required: a. Find the NPV of the MRI. Note: Round your "PV factor" to 3 decimal places. Required: b. Should the hospital acquire the MRI? Required: c. What nonlinancial considerabions might be important to the. MR1 investment decision? Note: You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect. whte of MRi machine Mode of transort. The number of Mais curcenty used by compeung hospitais in the surrounding area How ragidly imaging technoibgy is changing Whether to lease the equipment or comtract out imaging services to a third party provider

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started