Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I I don't understand why we don't include the operating cost for our calculations? Project Evaluation. Blooper Industries must replace its magnoosium purification system. Quick

I

I

I don't understand why we don't include the operating cost for our calculations?

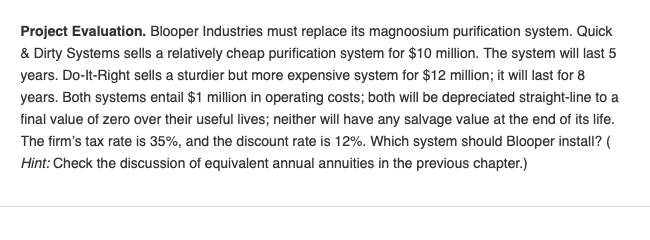

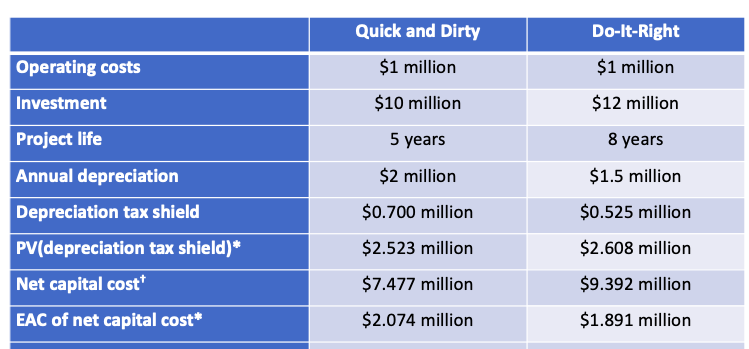

Project Evaluation. Blooper Industries must replace its magnoosium purification system. Quick & Dirty Systems sells a relatively cheap purification system for $10 million. The system will last 5 years. Do-It-Right sells a sturdier but more expensive system for $12 million; it will last for 8 years. Both systems entail $1 million in operating costs; both will be depreciated straight-line to a final value of zero over their useful lives; neither will have any salvage value at the end of its life. The firm's tax rate is 35%, and the discount rate is 12%. Which system should Blooper install? ( Hint: Check the discussion of equivalent annual annuities in the previous chapter.) Operating costs Investment Project life Annual depreciation Depreciation tax shield PV(depreciation tax shield)* Net capital cost EAC of net capital cost* Quick and Dirty $1 million $10 milliorn 5 years $2 million $0.700 million $2.523 million $7.477 million $2.074 million Do-lt-Right $1 million 12 million 8 years $1.5 milliorn $0.525 million $2.608 million $9.392 million $1.891 millionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started