Question

i. ii. As a foreign exchange trader, you observe the following quotes for Tunisian Dinar (TND), South African Rand (ZAR) and U.S. Dollar (USD)

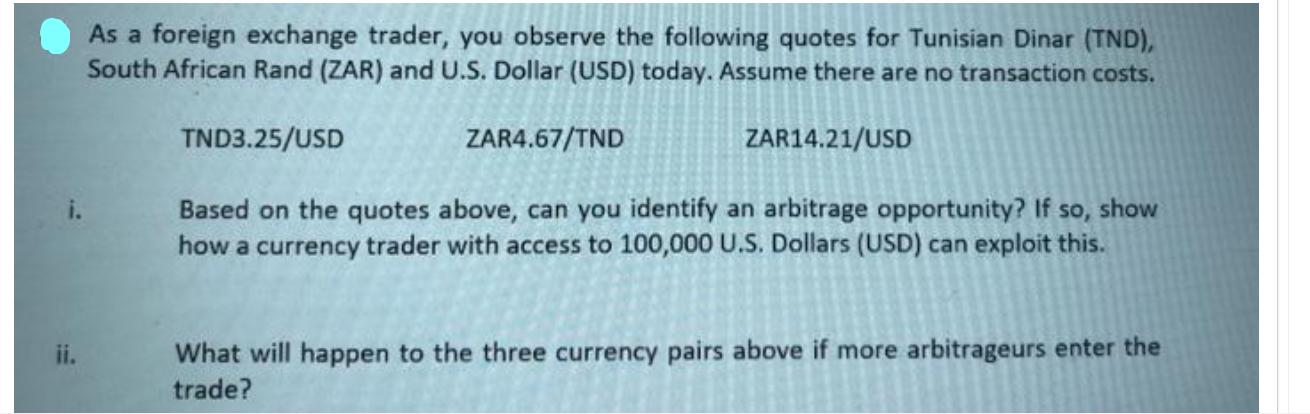

i. ii. As a foreign exchange trader, you observe the following quotes for Tunisian Dinar (TND), South African Rand (ZAR) and U.S. Dollar (USD) today. Assume there are no transaction costs. TND3.25/USD ZAR4.67/TND ZAR14.21/USD Based on the quotes above, can you identify an arbitrage opportunity? If so, show how a currency trader with access to 100,000 U.S. Dollars (USD) can exploit this. What will happen to the three currency pairs above if more arbitrageurs enter the trade?

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Nobased on the given quotesthere is no arbitrage opportunity Heres why An arbitrage opportunity exis...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Accounting

Authors: Joe Hoyle, Thomas Schaefer, Timothy Doupnik

10th edition

0-07-794127-6, 978-0-07-79412, 978-0077431808

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App