i & ii

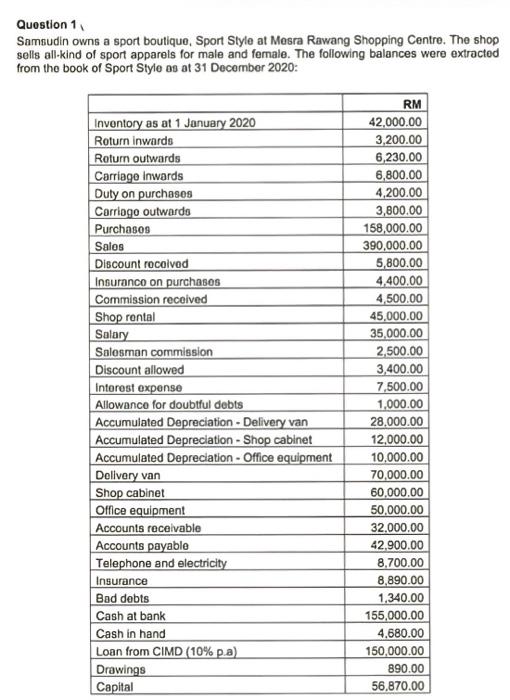

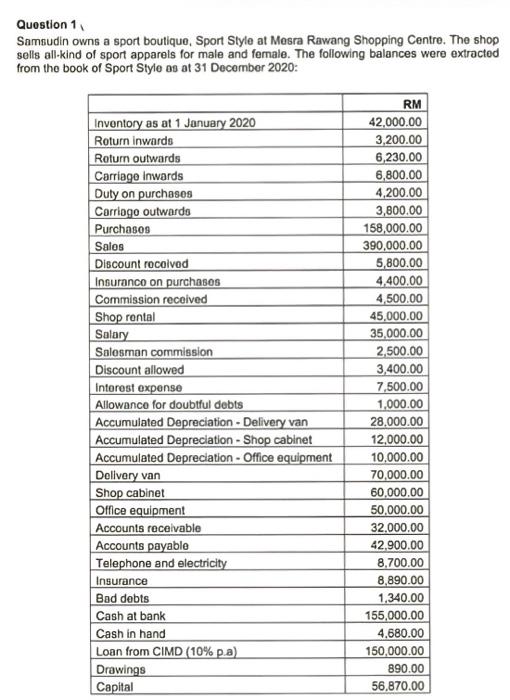

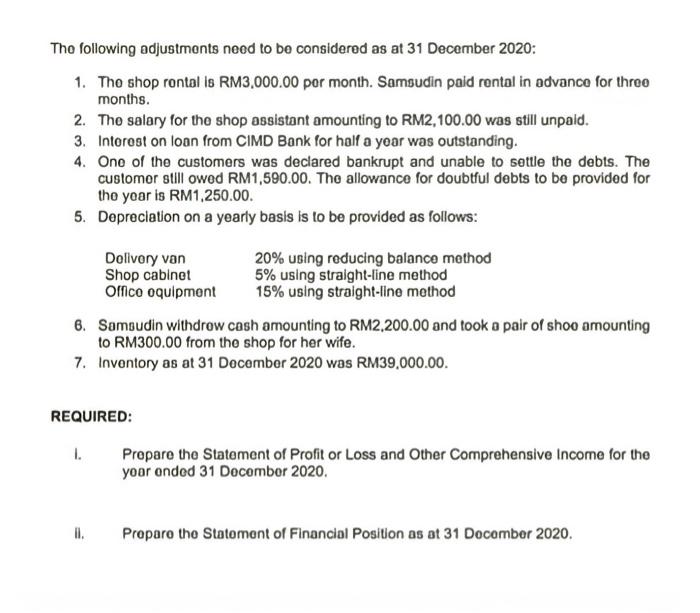

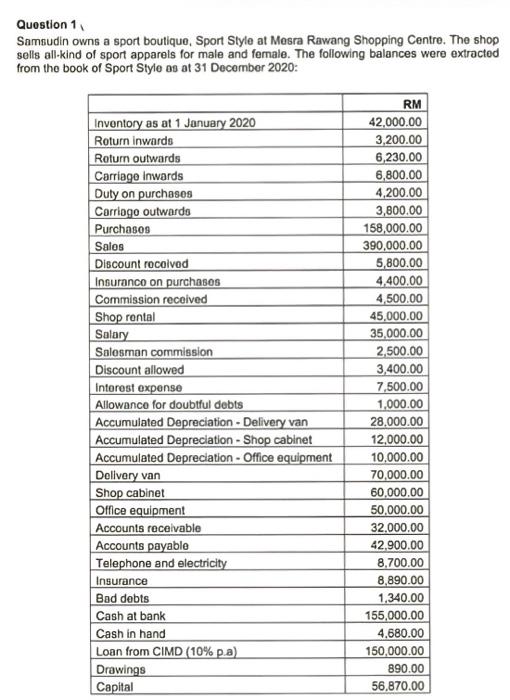

Question 1 Samsudin owns a sport boutique, Sport Style at Mesra Rawang Shopping Centre. The shop sells all kind of sport apparels for male and female. The following balances were extracted from the book of Sport Style os at 31 December 2020: Inventory as at 1 January 2020 Roturn inwards Roturn outwards Carriago Inwards Duty on purchases Carriogo outwardo Purchases Salos Discount rocaivod Insurance on purchases Commission received Shop rental Salary Salesman commission Discount allowed Interest oxponse Allowance for doubtful debts Accumulated Depreciation - Delivery van Accumulated Depreciation - Shop cabinet Accumulated Depreciation - Office equipment Delivery van Shop cabinet Office equipment Accounts receivable Accounts payable Telephone and electricity Insurance Bad debts Cash at bank Cash in hand Loan from CIMD (10% p.a) Drawings Capital RM 42,000.00 3,200.00 6,230.00 6,800.00 4,200.00 3,800.00 158,000.00 390,000.00 5,800.00 4,400.00 4,500.00 45,000.00 35,000.00 2,500.00 3,400.00 7,500.00 1.000.00 28,000.00 12,000.00 10.000.00 70,000.00 60,000.00 50,000.00 32.000.00 42,900.00 8.700.00 8,890.00 1,340.00 155,000.00 4.680.00 150,000.00 890.00 56.870.00 The following adjustments need to be considered as at 31 December 2020: 1. The shop rontal is RM3,000.00 por month. Samsudin paid rental in advance for three months. 2. The salary for the shop assistant amounting to RM2,100.00 was still unpaid. 3. Interest on loan from CIMD Bank for half a yoar was outstanding. 4. One of the customers was declared bankrupt and unable to settle the debts. The customer still owed RM1,590.00. The allowance for doubtful debts to be provided for the yoar is RM1.250.00. 5. Depreciation on a yearly basis is to be provided as follows: Delivery van 20% using reducing balance method Shop cabinet 5% using straight-line method Offico equipment 15% using straight-line method 6. Samsudin withdrow cosh amounting to RM2,200.00 and took a pair of shoo amounting to RM300.00 from the shop for her wife. 7. Inventory as at 31 December 2020 was RM39,000.00. REQUIRED: I. Prepare the Statement of Profit or Loss and Other Comprehensive Income for the yoor onded 31 December 2020. Prepare the Statoment of Financial Position as at 31 Docomber 2020