Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I January 2016, Impress Supplies Sdn Bhd (ISSB) enters into two contracts (Contract A and Contract B) with customers that are similar except for

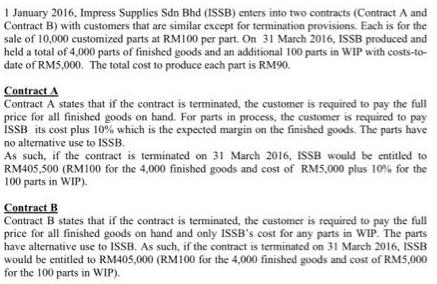

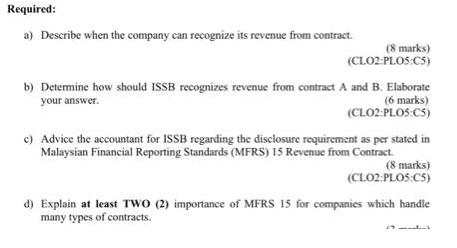

I January 2016, Impress Supplies Sdn Bhd (ISSB) enters into two contracts (Contract A and Contract B) with customers that are similar except for termination provisions. Each is for the sale of 10,000 customized parts at RMI00 per part. On 31 March 2016, ISSB produced and held a total of 4,000 parts of finished goods and an additional 100 parts in WIP with costs-to- date of RM5,000. The total cost to produce each part is RM90. Contract A Contract A states that if the contract is terminated, the customer is required to pay the full price for all finished goods on hand. For parts in process, the customer is required to pay ISSB its cost plus 10% which is the expected margin on the finished goods. The parts have no alternative use to ISSB. As such, if the contract is terminated on 31 March 2016, ISSB would be entitled to RM405,500 (RM100 for the 4,000 finished goods and cost of RM5,000 plus 10% for the 100 parts in WIP). Contract B Contract B states that if the contract is terminated, the customer is required to pay the full price for all finished goods on hand and only ISSB's cost for any parts in WIP. The parts have alternative use to ISSB. As such, if the contract is terminated on 31 March 2016, ISSB would be entitled to RM405,000 (RM100 for the 4,000 finished goods and cost of RM5,000 for the 100 parts in WIP). Required: a) Describe when the company can recognize its revenue from contract. (8 marks) (CLO2-PLOS:C5) b) Determine how should ISSB recognizes revenue from contract A and B. Elaborate (6 marks) (CLO2:PLOS:C5) your answer. e) Advice the accountant for ISSB regarding the disclosure requirement as per stated in Malaysian Financial Reporting Standards (MFRS) 15 Revenue from Contract. (8 marks) (CLO2:PLOS:CS) d) Explain at least TwO (2) importance of MFRS 15 for companies which handie many types of contracts.

Step by Step Solution

★★★★★

3.56 Rating (180 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Recognizing Revenue in Accordance with Performance Recall the conditions for revenue recognition Conditions 1 and 2 state that revenue would be recognized when the seller has done what is exp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started