Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i) Jennifer Incorporated is a start-up company which has just issued its Initial public offering (IPO). The company has subsequently been listed on the Ghana

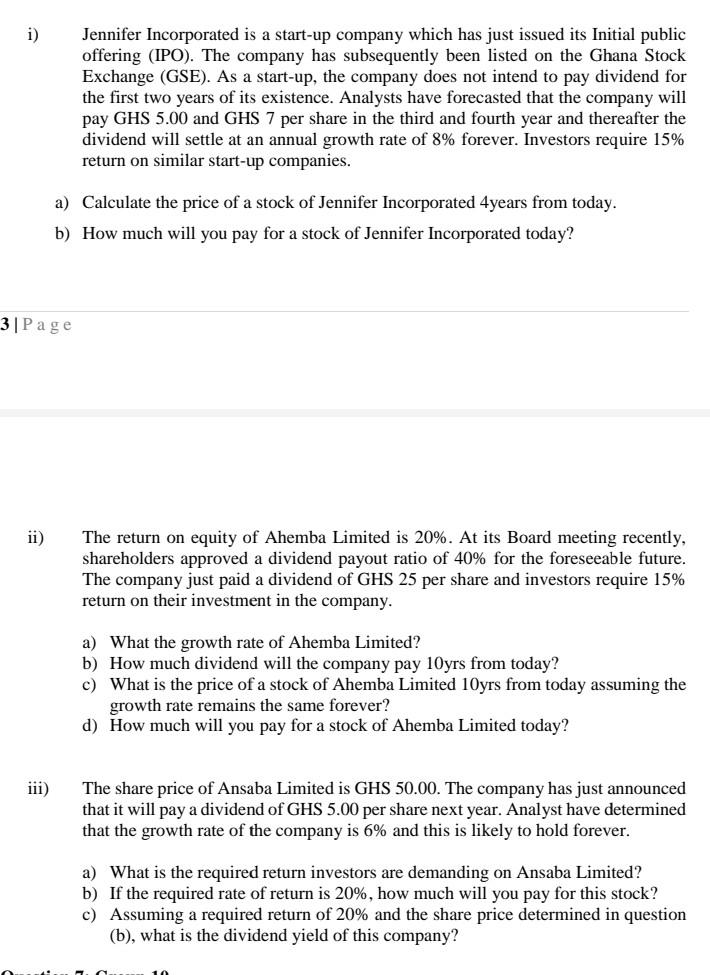

i) Jennifer Incorporated is a start-up company which has just issued its Initial public offering (IPO). The company has subsequently been listed on the Ghana Stock Exchange (GSE). As a start-up, the company does not intend to pay dividend for the first two years of its existence. Analysts have forecasted that the company will pay GHS 5.00 and GHS 7 per share in the third and fourth year and thereafter the dividend will settle at an annual growth rate of 8% forever. Investors require 15% return on similar start-up companies. a) Calculate the price of a stock of Jennifer Incorporated 4 years from today. b) How much will you pay for a stock of Jennifer Incorporated today? 3 Page ii) The return on equity of Ahemba Limited is 20%. At its Board meeting recently, shareholders approved a dividend payout ratio of 40% for the foreseeable future. The company just paid a dividend of GHS 25 per share and investors require 15% return on their investment in the company. a) What the growth rate of Ahemba Limited? b) How much dividend will the company pay 10yrs from today? c) What is the price of a stock of Ahemba Limited 10yrs from today assuming the growth rate remains the same forever? d) How much will you pay for a stock of Ahemba Limited today? iii) The share price of Ansaba Limited is GHS 50.00. The company has just announced that it will pay a dividend of GHS 5.00 per share next year. Analyst have determined that the growth rate of the company is 6% and this is likely to hold forever. a) What is the required return investors are demanding on Ansaba Limited? b) If the required rate of return is 20%, how much will you pay for this stock? c) Assuming a required return of 20% and the share price determined in question (b), what is the dividend yield of this company

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started