Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I just attached 1. the balance sheet. and 2. the Statement of cash flow. I need step by step explanation and answer thanks. The following

I just attached 1. the balance sheet. and 2. the Statement of cash flow. I need step by step explanation and answer thanks.

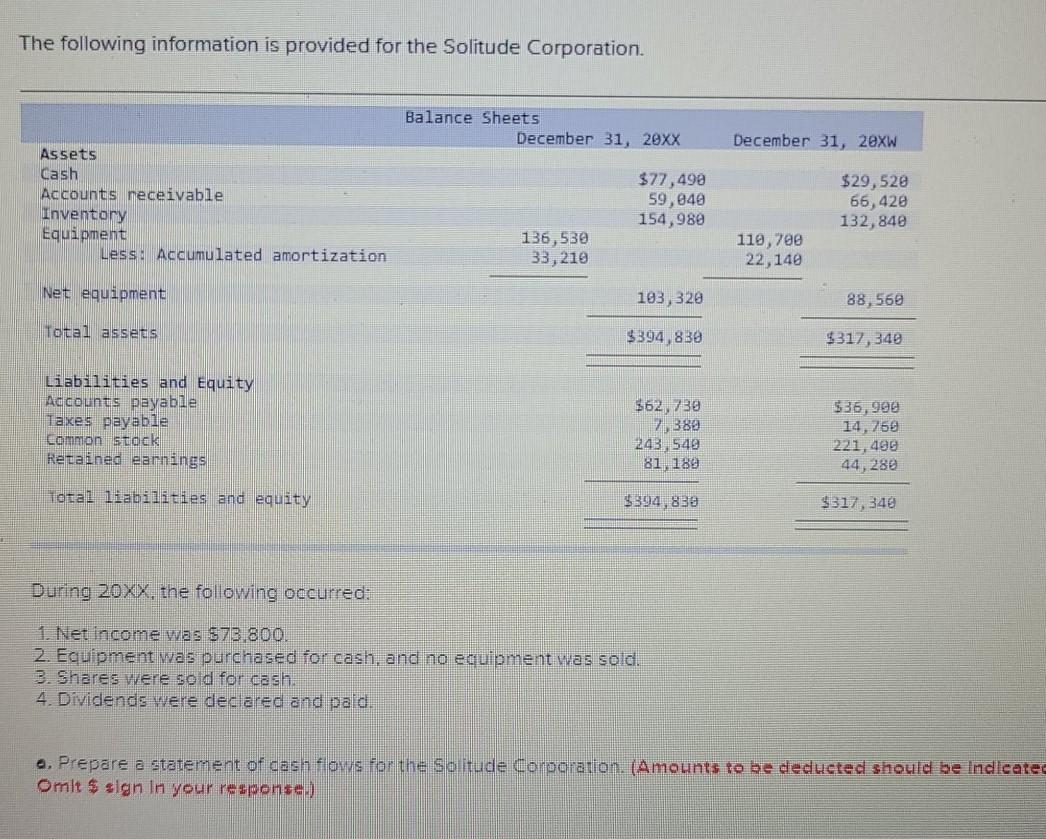

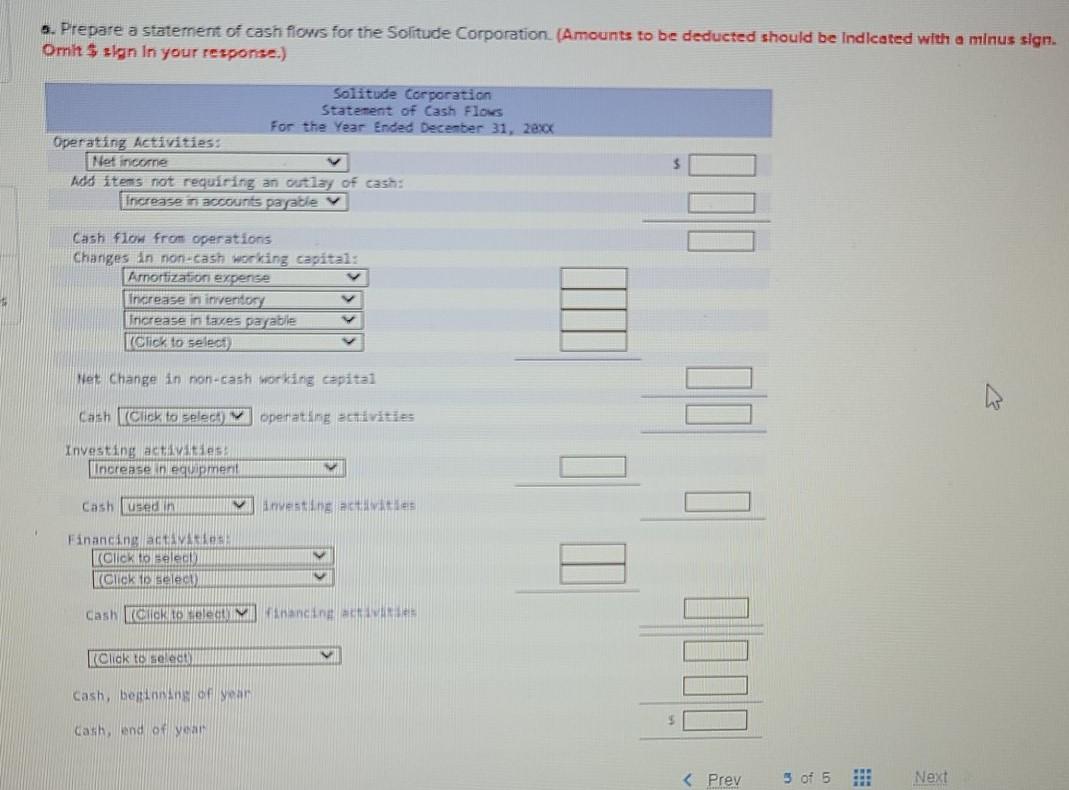

The following information is provided for the Solitude Corporation. Balance Sheets December 31, 20XX December 31, 20XW Assets Cash Accounts receivable Inventory Equipment Less. Accumulated amortization $77,490 59,040 154,980 $29,520 66,420 132,840 16,530 33,219 119,700 22,140 Net equipment 103,320 88,560 Total assets $394,830 $317, 340 Liabilities and Equity Accounts payabie Taxes payable Common stock Retained earnings $62,730 2,389 243, 540 81. 189 $36,990 14,750 221,490 44,280 Total liabilities and equity $394,839 $317, 346 During 20xx, the following occurred: 1. Net income was $73.800 2. Equipment was purchased for cash, and no equipment was sold. 3. Shares were sold for cash. 4. Dividends were declared and paid. e. Prepare a statement of cash flows for the Solitude Corporation. (Amounts to be deducted should be Indicated Omit $ sign in your response.) 3. Prepare a statement of cash flows for the Solitude Corporation (Amounts to be deducted should be Indicated with a minus sign. Omit $ sign In your response.) Solitude Corporation Statement of Cash Flows For the Year Ended December 31, 2xx Operating Activities: Net income Add items not requiring an outlay of cash: Increase in accounts payable Cash flow from operations Changes in non-cash working capital: Amortization expense Increase in inventos Increase in taxes payable Click to select 5 V Net Change in non-cash working capital Cash IClick to Elec operating activities Investing activities: increase nequipment Cash used in Vi investing activities Financing activiti Click Beled Click to see Cash KCCRONOMI Financing Click to select DJIE cash, beginning of an cash, end of yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started