i just need answer

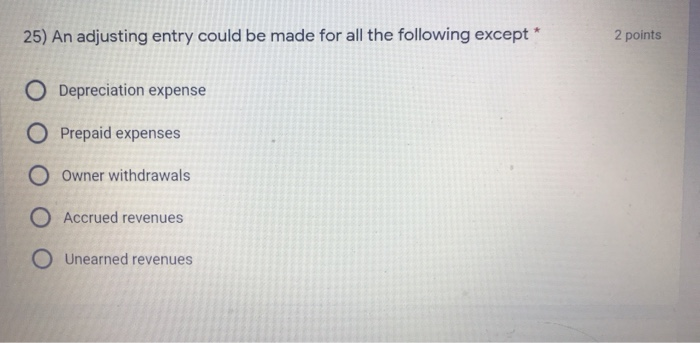

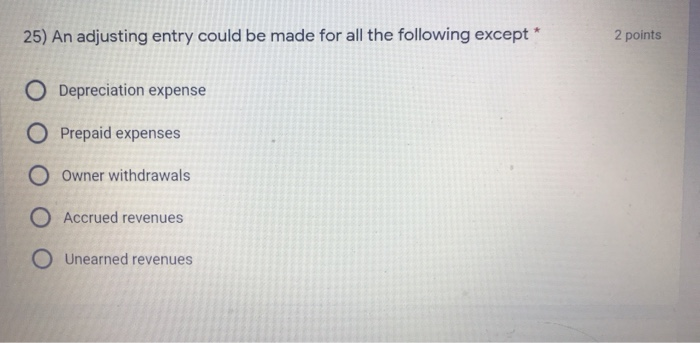

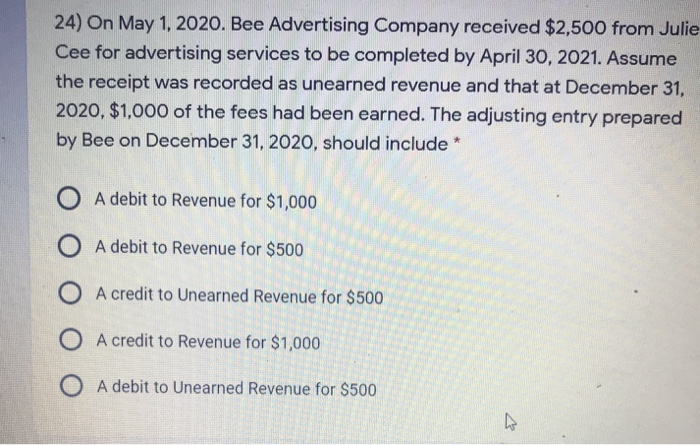

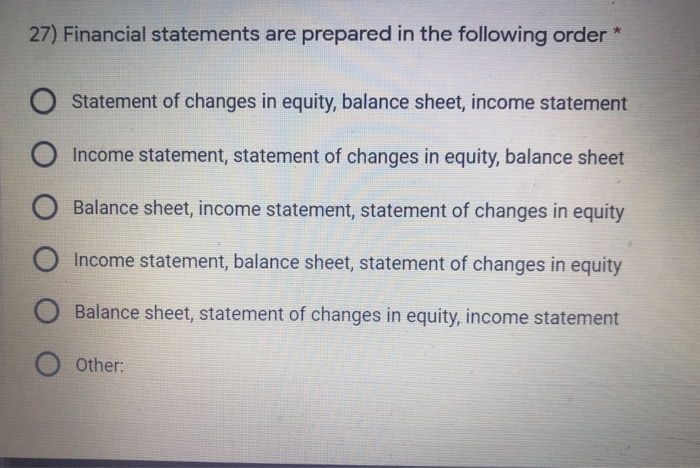

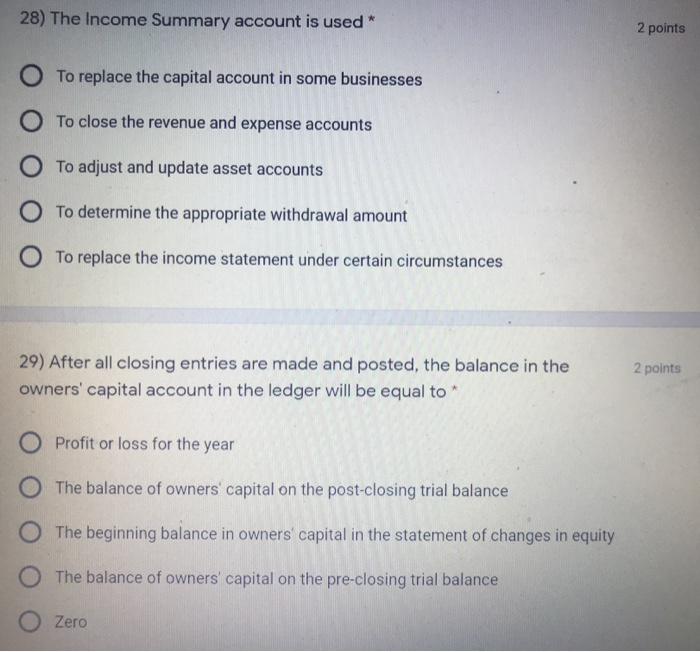

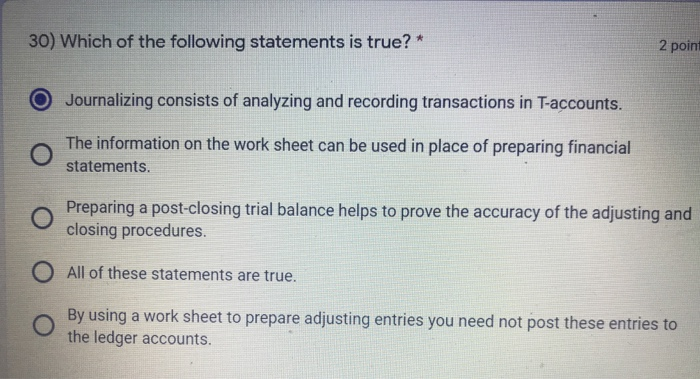

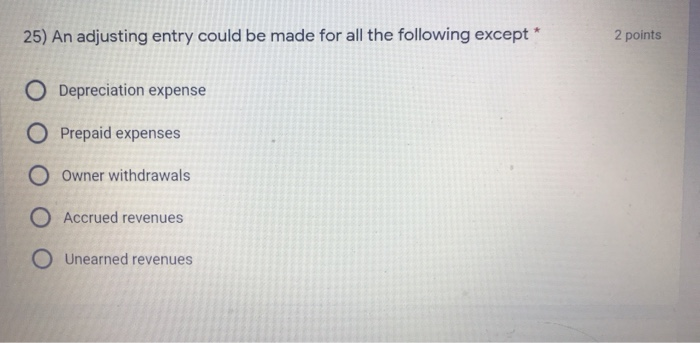

25) An adjusting entry could be made for all the following except * 2 points O Depreciation expense O Prepaid expenses O Owner withdrawals O Accrued revenues O Unearned revenues 24) On May 1, 2020. Bee Advertising Company received $2,500 from Julie Cee for advertising services to be completed by April 30, 2021. Assume the receipt was recorded as unearned revenue and that at December 31, 2020, $1,000 of the fees had been earned. The adjusting entry prepared by Bee on December 31, 2020, should include * O A debit to Revenue for $1,000 O A debit to Revenue for $500 O A credit to Unearned Revenue for $500 O A credit to Revenue for $1,000 O A debit to Unearned Revenue for $500 26) Which of the following accounts is most likely to be associated with an 2 points accrued expense? * O Unearned revenue O Salaries Payable O Accounts receivable O Depreciation expense O Service revenue * 27) Financial statements are prepared in the following order Statement of changes in equity, balance sheet, income statement Income statement, statement of changes in equity, balance sheet Balance sheet, income statement, statement of changes in equity Income statement, balance sheet, statement of changes in equity Balance sheet, statement of changes in equity, income statement Other: 28) The Income Summary account is used * 2 points O To replace the capital account in some businesses O To close the revenue and expense accounts O To adjust and update asset accounts O To determine the appropriate withdrawal amount O To replace the income statement under certain circumstances 2 points 29) After all closing entries are made and posted, the balance in the owners' capital account in the ledger will be equal to * O Profit or loss for the year O The balance of owners' capital on the post-closing trial balance O The beginning balance in owners' capital in the statement of changes in equity O The balance of owners' capital on the pre-closing trial balance O Zero 30) Which of the following statements is true? * 2 point O Journalizing consists of analyzing and recording transactions in T-accounts. The information on the work sheet can be used in place of preparing financial statements. Preparing a post-closing trial balance helps to prove the accuracy of the adjusting and closing procedures. O All of these statements are true. O By using a work sheet to prepare adjusting entries you need not post these entries to the ledger accounts