Answered step by step

Verified Expert Solution

Question

1 Approved Answer

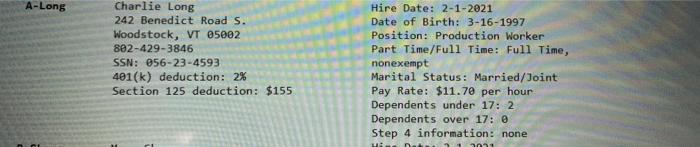

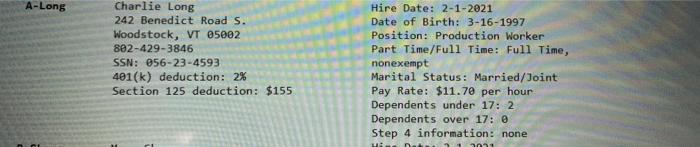

i just need help on charleie long on how to compute gross earnings with regular hours and overtime hours. A-Long Charlie Long 242 Benedict Road

i just need help on charleie long on how to compute gross earnings with regular hours and overtime hours.

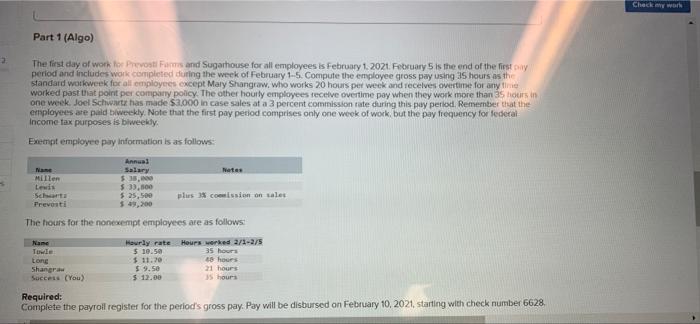

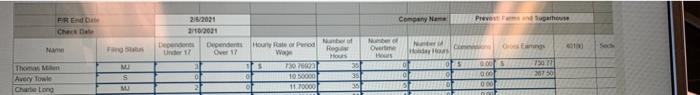

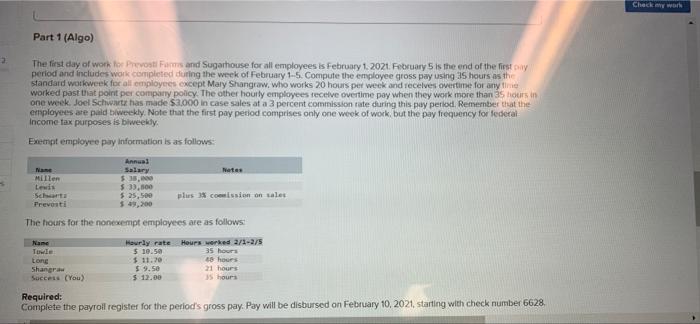

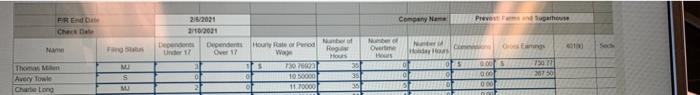

A-Long Charlie Long 242 Benedict Road S. Woodstock, VT 65002 802-429-3846 SSN: 056-23-4593 401(k) deduction: 2% Section 125 deduction: $155 Hire Date: 2-1-2021 Date of Birth: 3-16-1997 Position: Production Worker Part Time/Full Time: Full Time, nonexempt Marital Status: Married/Joint Pay Rate: $11.70 per hour Dependents under 17: 2 Dependents over 17: 0 Step 4 information: none Hi Check my work Part 1 (Algo) The first day of work to Prevosti Facts and Sugarhouse for all employees is February 1, 2021. February 5 is the end of the first day period and includes work completed during the week of February 1-5. Compute the employee gross pay using 35 hours as the standard workweek for all employees except Mary Shangraw, who works 20 hours per week and receives time for any worked past that point per company policy. The other hourly employees receive overtime pay when they werk more than 5 hours in one week. Joel Schwart has made $3.000 in case sales at a 3 percent commission rate during this pay period. Remember that the employees are paid biweekly. Note that the first pay period comprises only one week of work, but the pay frequency for federal Income tax purposes is biweekdy Exempt employee pay information is as follows: Annual Millen Lewis Schat Preventi $15. $ 3,500 $ 25,500 plus 3 Cossion on sales The hours for the nonexempt employees are as follows: Name Tule tong Shangra Success (You) Hourly rate Hours worked 2/1-2/ 5 10.50 35 hours $11.70 18 hours $ 9.50 21 hours $12.00 5 hours Required: Complete the payroll register for the period's gross pay. Pay will be disbursed on February 10, 2021, starting with check number 6628. Company Nam Prepare ER Edit Cher Man ng 2/8/2021 1102021 Na Dependent Opendents How to Prod Over 17 R W Hous os 730 76 39 10.50000 1170000 35 Nube Over Hus Way M Thomas Avery lowe Chartond S SE OG DET ERO MO TO A-Long Charlie Long 242 Benedict Road S. Woodstock, VT 65002 802-429-3846 SSN: 056-23-4593 401(k) deduction: 2% Section 125 deduction: $155 Hire Date: 2-1-2021 Date of Birth: 3-16-1997 Position: Production Worker Part Time/Full Time: Full Time, nonexempt Marital Status: Married/Joint Pay Rate: $11.70 per hour Dependents under 17: 2 Dependents over 17: 0 Step 4 information: none Hi Check my work Part 1 (Algo) The first day of work to Prevosti Facts and Sugarhouse for all employees is February 1, 2021. February 5 is the end of the first day period and includes work completed during the week of February 1-5. Compute the employee gross pay using 35 hours as the standard workweek for all employees except Mary Shangraw, who works 20 hours per week and receives time for any worked past that point per company policy. The other hourly employees receive overtime pay when they werk more than 5 hours in one week. Joel Schwart has made $3.000 in case sales at a 3 percent commission rate during this pay period. Remember that the employees are paid biweekly. Note that the first pay period comprises only one week of work, but the pay frequency for federal Income tax purposes is biweekdy Exempt employee pay information is as follows: Annual Millen Lewis Schat Preventi $15. $ 3,500 $ 25,500 plus 3 Cossion on sales The hours for the nonexempt employees are as follows: Name Tule tong Shangra Success (You) Hourly rate Hours worked 2/1-2/ 5 10.50 35 hours $11.70 18 hours $ 9.50 21 hours $12.00 5 hours Required: Complete the payroll register for the period's gross pay. Pay will be disbursed on February 10, 2021, starting with check number 6628. Company Nam Prepare ER Edit Cher Man ng 2/8/2021 1102021 Na Dependent Opendents How to Prod Over 17 R W Hous os 730 76 39 10.50000 1170000 35 Nube Over Hus Way M Thomas Avery lowe Chartond S SE OG DET ERO MO TO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started