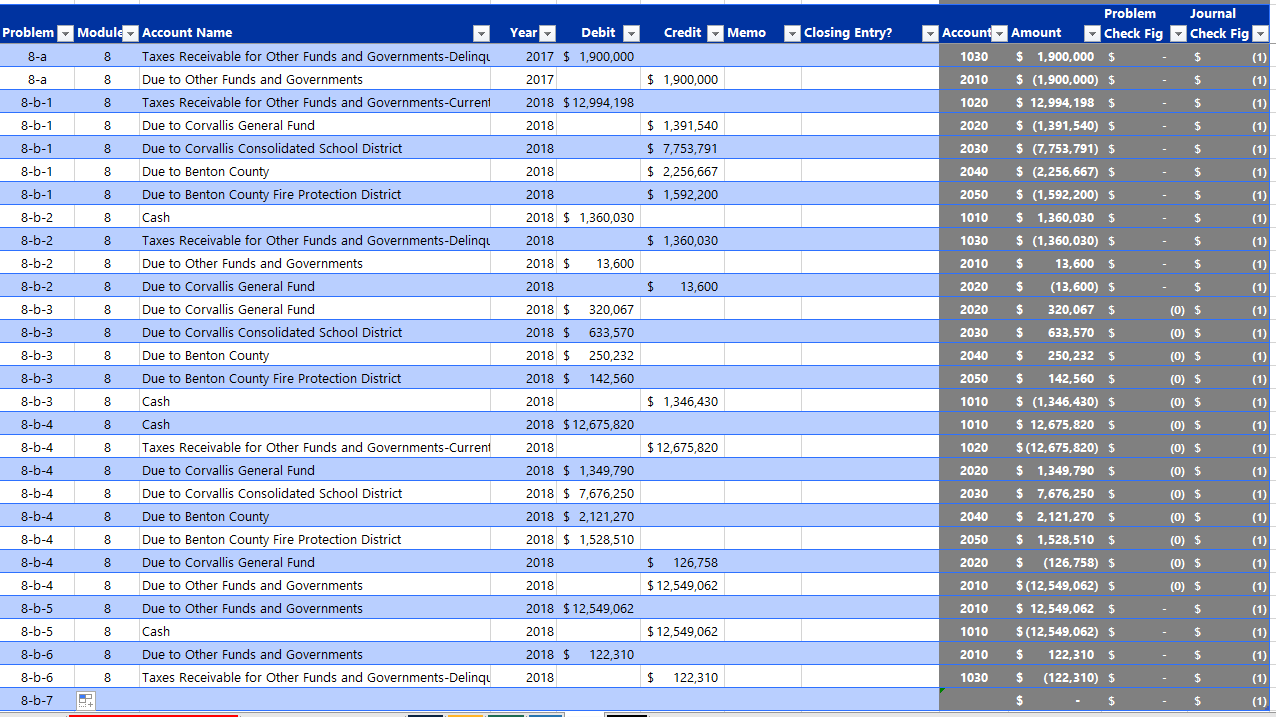

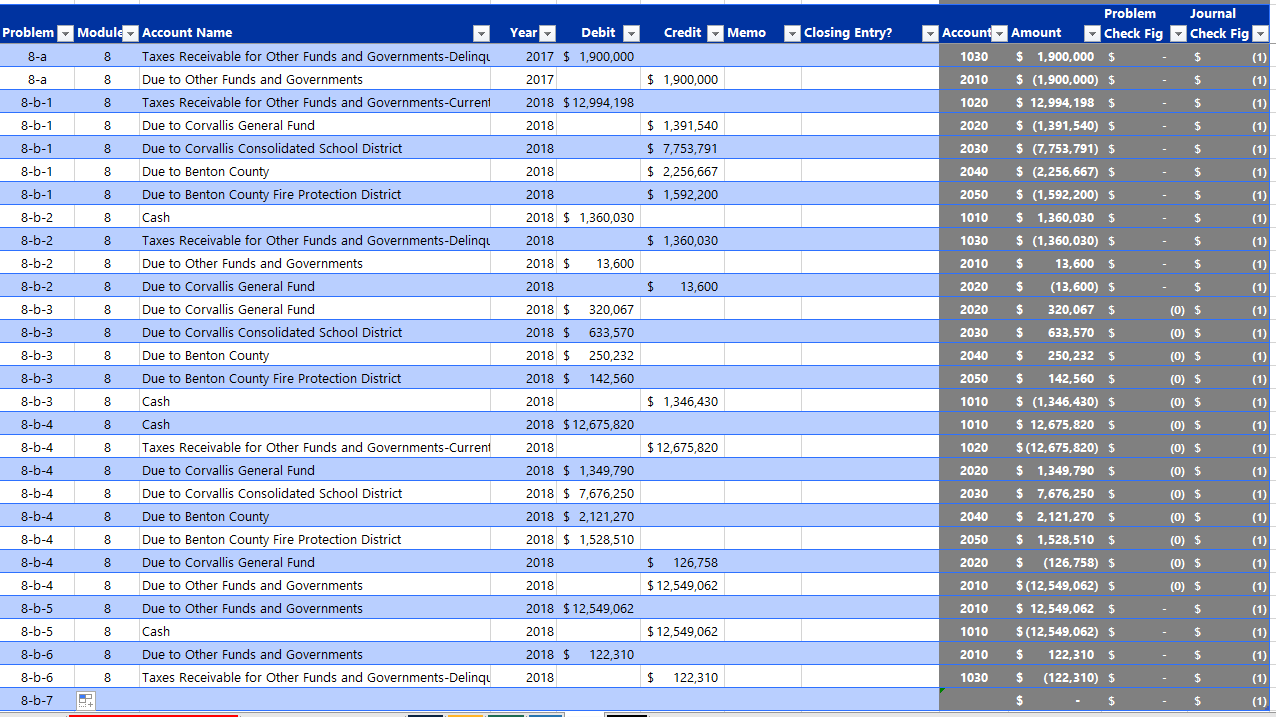

I just need help with how to record 8-b-7:

| [8-b-7] |

| as delinquent and to record a receivable for interest and penalties of 8 percent on the |

| reclassified amount (round amount to nearest whole dollar). The interest and penalties |

| portion of the total amount should be debited to Taxes Receivable for Other Funds and |

| GovernmentsDelinquent and credited to Due to Other Funds and Governments. You |

| need only record the aggregate amounts reclassified in the general journal; the tax |

| administrator will update the detailed tax ledger records for these reclassifications. |

Here is what I have already for my Tax Agency Fund:

Journal Check Fig Credit Memo Closing Entry? Year Debit 2017 $ 1,900,000 2017 $ (1) Problem 8-a 8-a 8a 8-b-1 8-b-1 $ 1,900,000 $ (1) $ (1) Module Account Name 8 Taxes Receivable for Other Funds and Governments-Delinq 8 Due to Other Funds and Governments 8 Taxes Receivable for Other Funds and Governments-Current 8 Due to Corvallis General Fund 8 Due to Corvallis Consolidated School District 8 Due to Benton County 8 Due to Benton County Fire Protection District 2018 $ 12,994, 198 2018 - $ (1) $ (1) 8-6-1 8-6-1 2018 2018 $ 1,391,540 $ 7,753,791 $ 2,256,667 $ 1,592,200 - $ (1) 8-6-1 2018 $ $ 1 (1) 8 Cash - $ (1) 8-6-2 8-b-2 8 2018 $ 1,360,030 2018 2018 $ 13,600 $ 1,360,030 $ (1) 8 $ (1) 8-b-2 8-b-2 8 2018 $ 13,600 $ (1) 8 320,067 (1) 8-6-3 8-b-3 2018 $ 2018 $ (0) $ (0) $ 8 (1) 633,570 250,232 8-b-3 8 2018 $ Problem Account Amount Check Fig 1030 $ 1,900,000 $ 2010 $ (1,900,000) $ 1020 $ 12,994, 198 $ 2020 $ (1,391,540) $ 2030 $ (7,753,791) $ 2040 $ (2,256,667) $ 2050 $ (1,592,200) $ 1010 $ 1,360,030 $ 1030 $ (1,360,030) $ 2010 $ 13,600 $ $ 2020 $ (13,600) $ 2020 $ $ 320,067 $ 2030 $ 633,570 $ 2040 $ 250,232 $ 2050 $ $ 142,560 $ 1010 $ (1,346,430) $ 1010 $ 12,675,820 $ 1020 $(12,675,820) $ 2020 $ 1,349,790 $ $ 2030 $ 7,676,250 $ 2040 $ 2,121,270 $ 2050 $ 1,528,510 $ 2020 $ (126,758) $ 2010 $(12,549,062) $ 2010 $ 12,549,062 $ 1010 $ (12,549,062) $ 2010 $ 122,310 $ 1030 $ (122,310) $ $ $ (1) (0) $ (0) $ 8-b-3 8 (1) 8-6-3 8 $ 1,346,430 (0) $ (1) 2018 $ 142,560 2018 2018 $ 12,675,820 2018 8 (0) $ (1) 8-b-4 8-b-4 8 $ 12,675,820 (0) $ Taxes Receivable for Other Funds and Governments-Delinqu Due to Other Funds and Governments Due to Corvallis General Fund Due to Corvallis General Fund Due to Corvallis Consolidated School District Due to Benton County Due to Benton County Fire Protection District Cash Cash Taxes Receivable for Other Funds and Governments-Current Due to Corvallis General Fund Due to Corvallis Consolidated School District Due to Benton County Due to Benton County Fire Protection District Due to Corvallis General Fund Due to Other Funds and Governments Due to Other Funds and Governments Cash Due to Other Funds and Governments Taxes Receivable for Other Funds and Governments-Delinqu (1) 8-b-4 8 (0) $ (1) 8-b-4 8 (0) $ (1) 8 2018 $ 1,349,790 2018 $ 7,676,250 2018 $ 2,121,270 2018 $ 1,528,510 2018 (0) $ 8-b-4 8-b-4 (1) 8 (0) $ (1) 8-b-4 8 (1) $ 126,758 $ 12,549,062 (0) $ () $ (0) $ 8-b-4 8 2018 (1) 8 $ (1) 8-b-5 8-b-5 2018 $ 12,549,062 2018 8 $ 12,549,062 - $ (1) 8-b-6 8 2018 $ 122,310 $ (1) 8-b-6 8 2018 $ $ 122,310 - $ (1) 8-b-7 $ (1) Journal Check Fig Credit Memo Closing Entry? Year Debit 2017 $ 1,900,000 2017 $ (1) Problem 8-a 8-a 8a 8-b-1 8-b-1 $ 1,900,000 $ (1) $ (1) Module Account Name 8 Taxes Receivable for Other Funds and Governments-Delinq 8 Due to Other Funds and Governments 8 Taxes Receivable for Other Funds and Governments-Current 8 Due to Corvallis General Fund 8 Due to Corvallis Consolidated School District 8 Due to Benton County 8 Due to Benton County Fire Protection District 2018 $ 12,994, 198 2018 - $ (1) $ (1) 8-6-1 8-6-1 2018 2018 $ 1,391,540 $ 7,753,791 $ 2,256,667 $ 1,592,200 - $ (1) 8-6-1 2018 $ $ 1 (1) 8 Cash - $ (1) 8-6-2 8-b-2 8 2018 $ 1,360,030 2018 2018 $ 13,600 $ 1,360,030 $ (1) 8 $ (1) 8-b-2 8-b-2 8 2018 $ 13,600 $ (1) 8 320,067 (1) 8-6-3 8-b-3 2018 $ 2018 $ (0) $ (0) $ 8 (1) 633,570 250,232 8-b-3 8 2018 $ Problem Account Amount Check Fig 1030 $ 1,900,000 $ 2010 $ (1,900,000) $ 1020 $ 12,994, 198 $ 2020 $ (1,391,540) $ 2030 $ (7,753,791) $ 2040 $ (2,256,667) $ 2050 $ (1,592,200) $ 1010 $ 1,360,030 $ 1030 $ (1,360,030) $ 2010 $ 13,600 $ $ 2020 $ (13,600) $ 2020 $ $ 320,067 $ 2030 $ 633,570 $ 2040 $ 250,232 $ 2050 $ $ 142,560 $ 1010 $ (1,346,430) $ 1010 $ 12,675,820 $ 1020 $(12,675,820) $ 2020 $ 1,349,790 $ $ 2030 $ 7,676,250 $ 2040 $ 2,121,270 $ 2050 $ 1,528,510 $ 2020 $ (126,758) $ 2010 $(12,549,062) $ 2010 $ 12,549,062 $ 1010 $ (12,549,062) $ 2010 $ 122,310 $ 1030 $ (122,310) $ $ $ (1) (0) $ (0) $ 8-b-3 8 (1) 8-6-3 8 $ 1,346,430 (0) $ (1) 2018 $ 142,560 2018 2018 $ 12,675,820 2018 8 (0) $ (1) 8-b-4 8-b-4 8 $ 12,675,820 (0) $ Taxes Receivable for Other Funds and Governments-Delinqu Due to Other Funds and Governments Due to Corvallis General Fund Due to Corvallis General Fund Due to Corvallis Consolidated School District Due to Benton County Due to Benton County Fire Protection District Cash Cash Taxes Receivable for Other Funds and Governments-Current Due to Corvallis General Fund Due to Corvallis Consolidated School District Due to Benton County Due to Benton County Fire Protection District Due to Corvallis General Fund Due to Other Funds and Governments Due to Other Funds and Governments Cash Due to Other Funds and Governments Taxes Receivable for Other Funds and Governments-Delinqu (1) 8-b-4 8 (0) $ (1) 8-b-4 8 (0) $ (1) 8 2018 $ 1,349,790 2018 $ 7,676,250 2018 $ 2,121,270 2018 $ 1,528,510 2018 (0) $ 8-b-4 8-b-4 (1) 8 (0) $ (1) 8-b-4 8 (1) $ 126,758 $ 12,549,062 (0) $ () $ (0) $ 8-b-4 8 2018 (1) 8 $ (1) 8-b-5 8-b-5 2018 $ 12,549,062 2018 8 $ 12,549,062 - $ (1) 8-b-6 8 2018 $ 122,310 $ (1) 8-b-6 8 2018 $ $ 122,310 - $ (1) 8-b-7 $ (1)