Question

****I just need part A required A to be solved with solution INTEGRATIVE CASE 4.1/ Page 318 - Starbucks Part A - a. , b.

****I just need part A required A to be solved with solution

INTEGRATIVE CASE 4.1/ Page 318 - Starbucks

Part A - a. , b. , c (pg: 318)

Part B - a and b (Pg: 322)

Show transcribed image text

Expert Answer

aloksingh answered this

aloksingh answered this

Was this answer helpful?

1

0

5,633 answers

Answer A:-

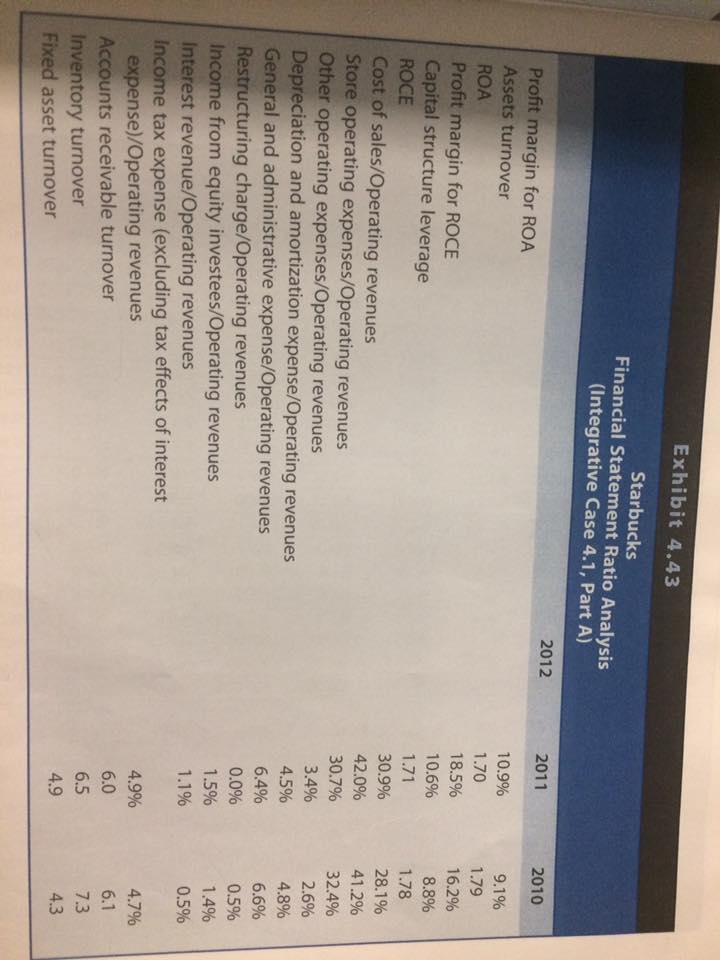

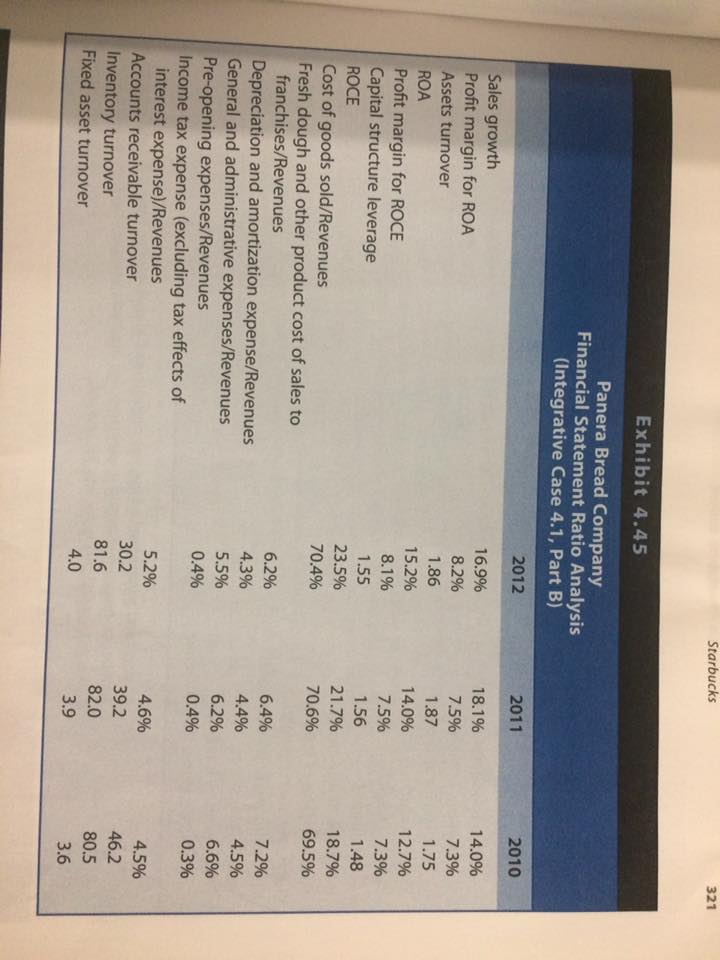

| 2012 | 2011 | 2010 | |

| Profit margin for ROA | 13.5% | 10.90% | 9.10% |

| Assets turnover | 1.35 | 1.7 | 1.79 |

| ROA | 18.2% | 18.50% | 16.20% |

| Profit margin for ROCE | 13.1% | 10.60% | 8.80% |

| Capital structure leverage | 1.64 | 1.71 | 1.78 |

| ROCE | 29.1% | 30.90% | 28.10% |

| Cost of sales/Operating revenues | 43.7% | 42% | 41.20% |

| Store operating expenses/Operating revenues | 29.5% | 30.70% | 32.40% |

| Other operating expenses/Operating revenues | 3.2% | 3.40% | 2.60% |

| Depreciation and amortization expense/Operating revenues | 4.1% | 4.50% | 4.80% |

| General and administrative expense/Operating revenues | 6.0% | 6.40% | 6.60% |

| Restructuring charge/Operating revenues | 0.0% | 0.00% | 0.50% |

| Income from equity investees/Operating revenues | 1.6% | 1.50% | 1.40% |

| Interest revenue/Operating revenues | 0.7% | 1.10% | 0.50% |

| Income tax expense (excluding tax effects of interest expense)/Operating revenues | 1.4% | 4.90% | 4.70% |

| Accounts receivable turnover | 4.72 | 6.00 | 6.10 |

| Inventory turnover | 5.27 | 6.50 | 7.30 |

| Fixed asset turnover | 5.31 | 4.90 | 4.30 |

Answer B:-

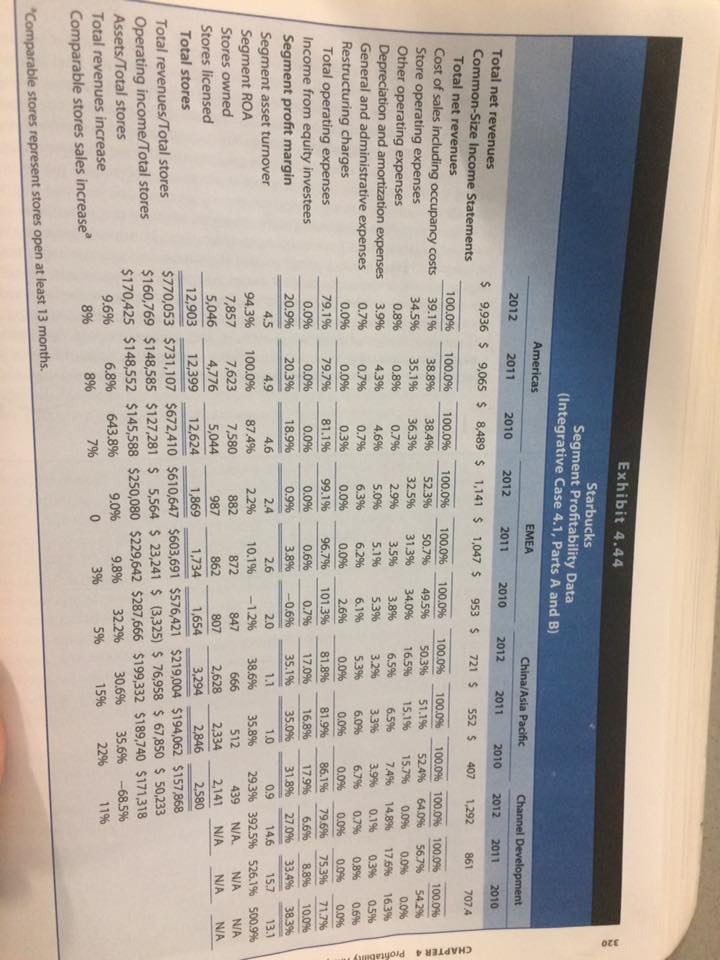

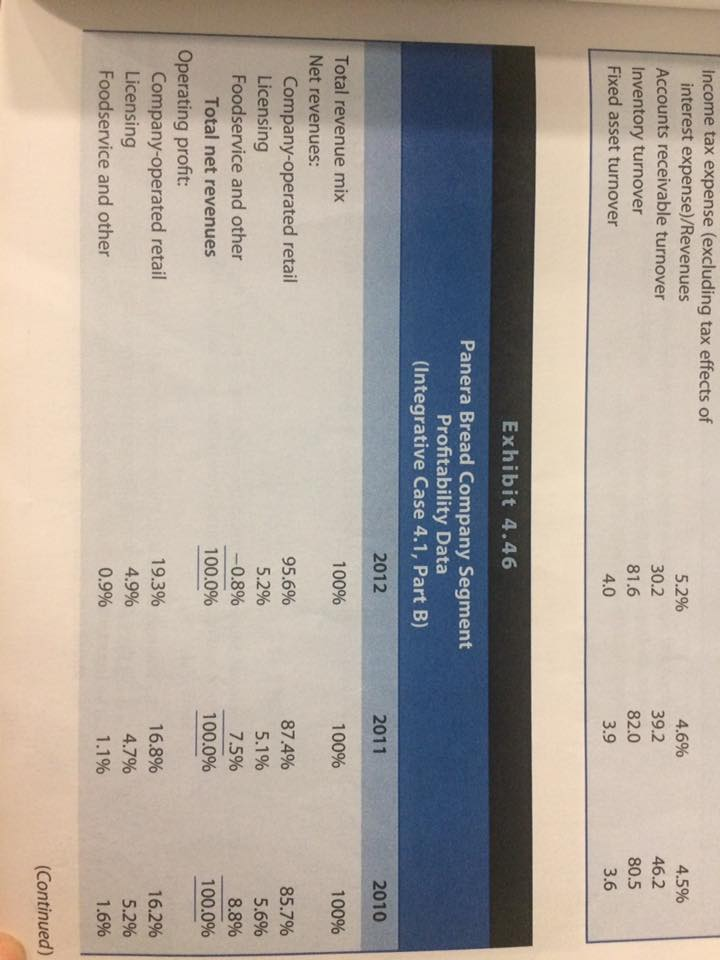

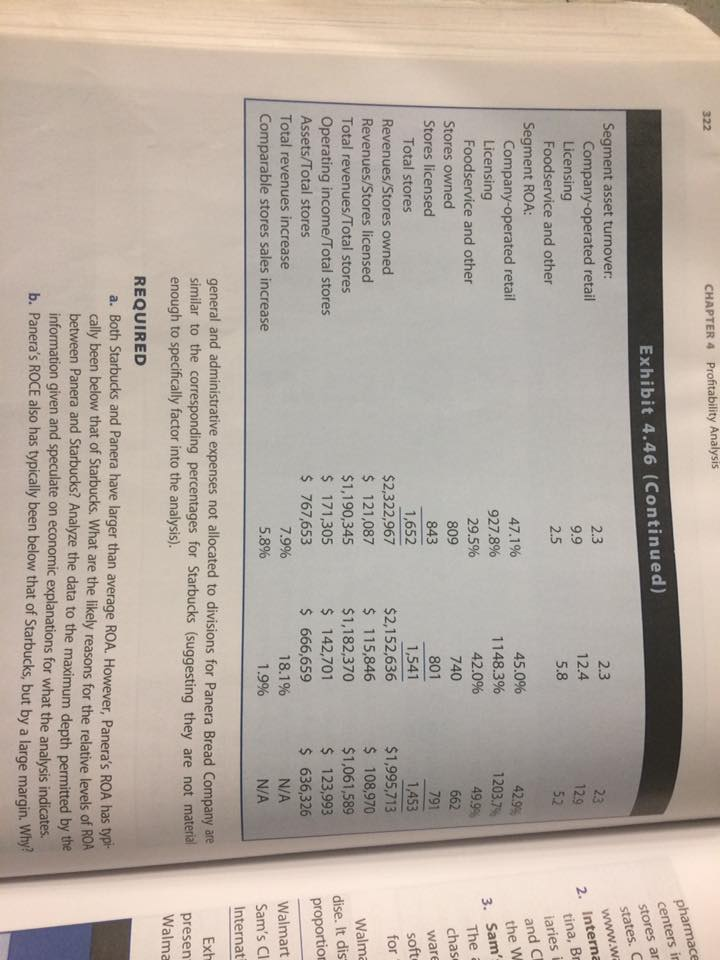

- There was an increase in ROA from 16.2% to 18.5% from the year 2010 to 2011 and there was no change in 2012 as it maintained on 18.2% - An increasing trend has been observed in the profit margins from 2010 to 2012 as it rose from 8.8 % to 13.1%. - There was a decline in the asset turnover year after year. - There was a slight decline in the Account receivable turnover and inventory turnover and an increase in the fixed asset turnover from 4.3 to 5.31 _Various expense to-Sale Percentages - In the USA, there was an increase in ROA from 2010 to 2011 but a slight decline was observed during 2012 but it also experienced the increment in EMEA and China/Asia Pacific. In fact, the channel development sector experienced a decline from 2011 to 2012. In both USA and EMEA region, the firm experienced an increase in profit margin but in China or Asia, it was constant from 2011 to 2012. All the three regions experienced Asset turnover and it declined for product and Geographic Segments. - During 2010 to 2011, ROCE increased slightly and from 2011 to 2012, it declined. - There was a decline in total operating expenditures in USA and Asia but it increased in 2012 for EMEA

Answer C:-

- The net income level, which impacts the profit margin can be seen as the most vital reason behind the Starbucks ROCE fluctuation during the 3 years - There was a direct impact on to asset turnover and capital leverage due to the openings of new stores

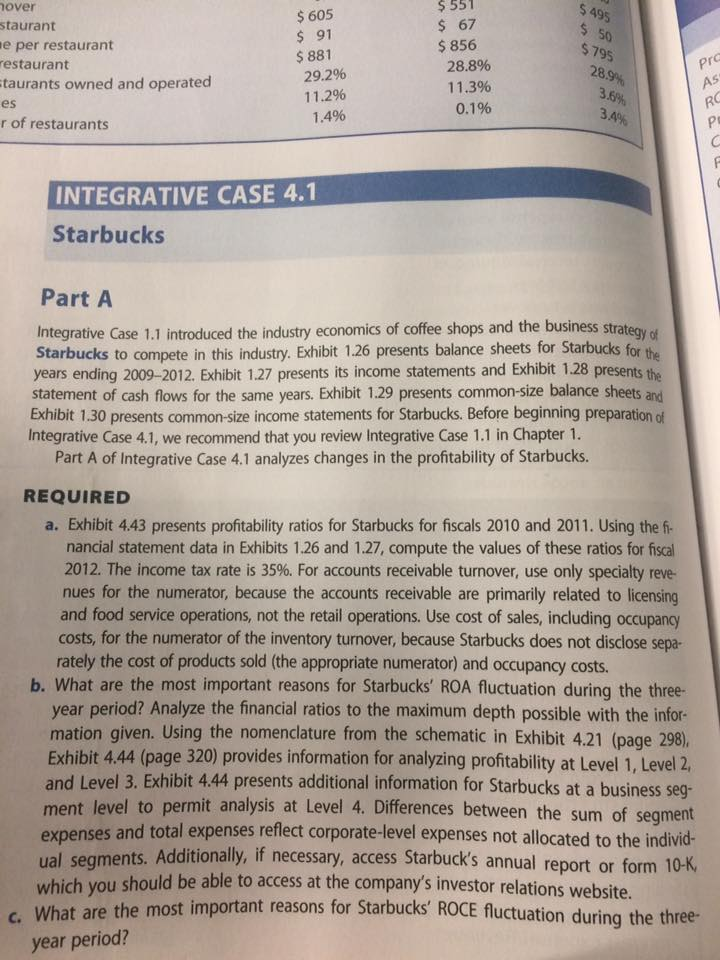

$ 605 $ 91 $ 881 $ 551 S 67 $ 856 $ 495 s 50 over staurant e per restaurant restaurant taurants owned and operated es r of restaurants 9s pr 28.8% 11.3% 0.1% 28.9% 29.26 11.2% 1.4% 36% 34% INTEGRATIVE CASE 4.1 Starbucks Part A Integrative Case 1.1 introduced the industry economics of coffee shops and the business stratecy Starbucks to compete in this industry. Exhibit 1.26 presents balance sheets for Starbucks f years ending 2009-2012. Exhibit 1.27 presents its income statements and Exhibit 1.28 presents statement of cash flows for the same years. Exhibit 1.29 presents common-size balance sheets Exhibit 1.30 presents common-size income statements for Starbucks. Before beginning preparation of Integrative Case 4.1, we recommend that you review Integrative Case 1.1 in Chapter 1. Part A of Integrative Case 4.1 analyzes changes in the profitability of Starbucks REQUIRED Exhibit 4.43 presents profitability ratios for Starbucks for fiscals 2010 and 2011. Using the f nancial statement data in Exhibits 1.26 and 1.27, compute the values of these ratios for fiscal 2012. The income tax rate is 35%. For accounts receivable turnover, use only specialty r nues for the numerator, because the accounts receivable are primarily related to licensing and food service operations, not the retail operations. Use cost of sales, including occupanc costs, for the numerator of the inventory turnover, because Starbucks does not disclose sepa- rately the cost of products sold (the appropriate numerator) and occupancy costs. b. What are the most important reasons for Starbucks' ROA fluctuation during the thr year period? Analyze the financial ratios to the maximum depth possible with the infor mation given. Using the nomenclature from the schematic in Exhibit 4.21 (page 298), Exhibit 4.44 (page 320) provides information for analyzing profitability at Level 1, Level 2 and Level 3. Exhibit 4.44 presents additional information for Starbucks at a business seg ment level to permit analysis at Level 4 . Differences between the sum of segmen expenses and total expenses reflect corporate-level expenses not allocated to the individ- Additionally, if necessary, access Starbuck's annual report or form 10-K, hich you sho uld be able to access at the company's investor relations website. most important reasons for Starbucks' ROCE fluctuation during the three- c. What are the year period? $ 605 $ 91 $ 881 $ 551 S 67 $ 856 $ 495 s 50 over staurant e per restaurant restaurant taurants owned and operated es r of restaurants 9s pr 28.8% 11.3% 0.1% 28.9% 29.26 11.2% 1.4% 36% 34% INTEGRATIVE CASE 4.1 Starbucks Part A Integrative Case 1.1 introduced the industry economics of coffee shops and the business stratecy Starbucks to compete in this industry. Exhibit 1.26 presents balance sheets for Starbucks f years ending 2009-2012. Exhibit 1.27 presents its income statements and Exhibit 1.28 presents statement of cash flows for the same years. Exhibit 1.29 presents common-size balance sheets Exhibit 1.30 presents common-size income statements for Starbucks. Before beginning preparation of Integrative Case 4.1, we recommend that you review Integrative Case 1.1 in Chapter 1. Part A of Integrative Case 4.1 analyzes changes in the profitability of Starbucks REQUIRED Exhibit 4.43 presents profitability ratios for Starbucks for fiscals 2010 and 2011. Using the f nancial statement data in Exhibits 1.26 and 1.27, compute the values of these ratios for fiscal 2012. The income tax rate is 35%. For accounts receivable turnover, use only specialty r nues for the numerator, because the accounts receivable are primarily related to licensing and food service operations, not the retail operations. Use cost of sales, including occupanc costs, for the numerator of the inventory turnover, because Starbucks does not disclose sepa- rately the cost of products sold (the appropriate numerator) and occupancy costs. b. What are the most important reasons for Starbucks' ROA fluctuation during the thr year period? Analyze the financial ratios to the maximum depth possible with the infor mation given. Using the nomenclature from the schematic in Exhibit 4.21 (page 298), Exhibit 4.44 (page 320) provides information for analyzing profitability at Level 1, Level 2 and Level 3. Exhibit 4.44 presents additional information for Starbucks at a business seg ment level to permit analysis at Level 4 . Differences between the sum of segmen expenses and total expenses reflect corporate-level expenses not allocated to the individ- Additionally, if necessary, access Starbuck's annual report or form 10-K, hich you sho uld be able to access at the company's investor relations website. most important reasons for Starbucks' ROCE fluctuation during the three- c. What are the year periodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started