Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i. Katarina has just won a $20 million lottery, which will pay her $1 million at the end of each year for 20 years.

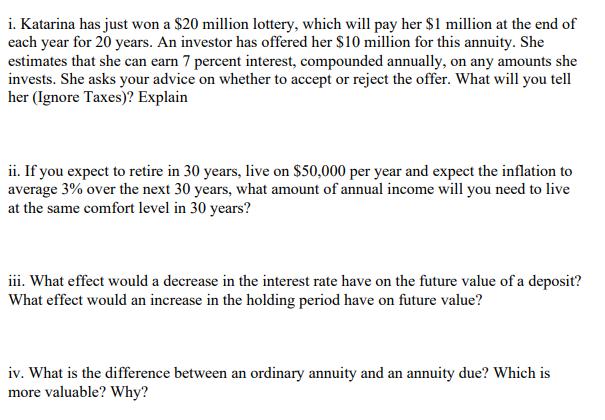

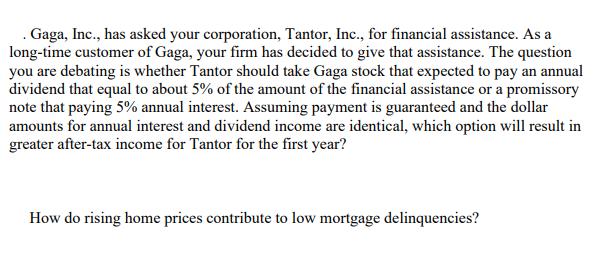

i. Katarina has just won a $20 million lottery, which will pay her $1 million at the end of each year for 20 years. An investor has offered her $10 million for this annuity. She estimates that she can earn 7 percent interest, compounded annually, on any amounts she invests. She asks your advice on whether to accept or reject the offer. What will you tell her (Ignore Taxes)? Explain ii. If you expect to retire in 30 years, live on $50,000 per year and expect the inflation to average 3% over the next 30 years, what amount of annual income will you need to live at the same comfort level in 30 years? iii. What effect would a decrease in the interest rate have on the future value of a deposit? What effect would an increase in the holding period have on future value? iv. What is the difference between an ordinary annuity and an annuity due? Which is more valuable? Why? . Gaga, Inc., has asked your corporation, Tantor, Inc., for financial assistance. As a long-time customer of Gaga, your firm has decided to give that assistance. The question you are debating is whether Tantor should take Gaga stock that expected to pay an annual dividend that equal to about 5% of the amount of the financial assistance or a promissory note that paying 5% annual interest. Assuming payment is guaranteed and the dollar amounts for annual interest and dividend income are identical, which option will result in greater after-tax income for Tantor for the first year? How do rising home prices contribute to low mortgage delinquencies?

Step by Step Solution

★★★★★

3.42 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION i To determine whether Katarina should accept or reject the offer we need to compare the present value of receiving 1 million annually for 20 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started