I know AGI is $141,209, but im struggling with QBI and deprciation.

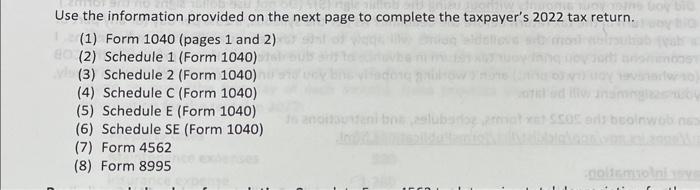

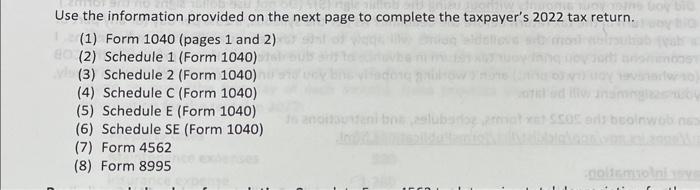

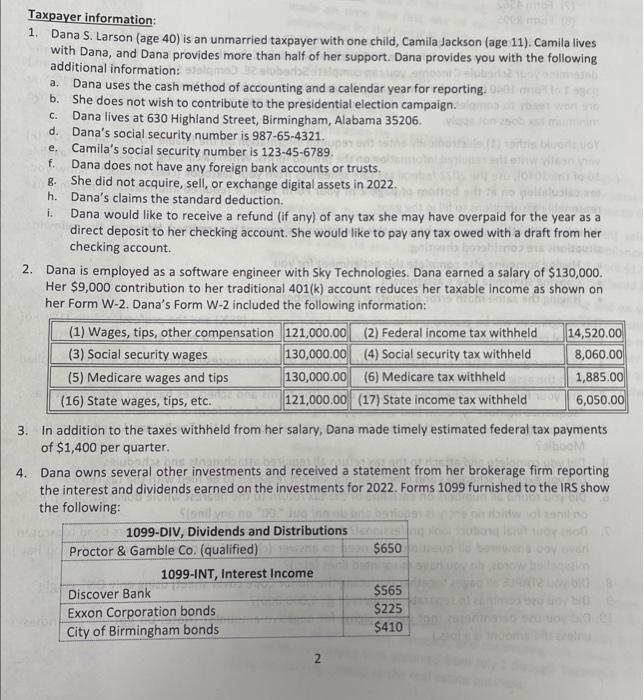

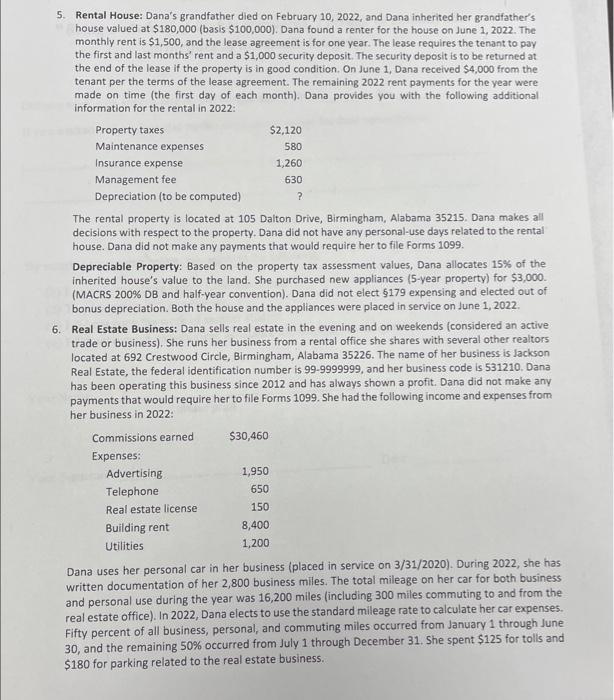

Use the information provided on the next page to complete the taxpayer's 2022 tax return. (1) Form 1040 (pages 1 and 2) (2) Schedule 1 (Form 1040) (3) Schedule 2 (Form 1040) (4) Schedule C (Form 1040) (5) Schedule E (Form 1040) (6) Schedule SE (Form 1040) (7) Form 4562 (8) Form 8995 Taxpayer information: 1. Dana S. Larson (age 40) is an unmarried taxpayer with one child, Camila Jackson (age 11). Camila lives with Dana, and Dana provides more than half of her support. Dana provides you with the following additional information: a. Dana uses the cash method of accounting and a calendar year for reporting. b. She does not wish to contribute to the presidential election campaign. c. Dana lives at 630 Highland Street, Birmingham, Alabama 35206. d. Dana's social security number is 987-65-4321. e. Camila's social security number is 123-45-6789. f. Dana does not have any foreign bank accounts or trusts. g. She did not acquire, sell, or exchange digital assets in 2022 . h. Dana's claims the standard deduction. i. Dana would like to receive a refund (if any) of any tax she may have overpaid for the year as a direct deposit to her checking account. She would like to pay any tax owed with a draft from her checking account. 2. Dana is employed as a software engineer with Sky Technologies. Dana earned a salary of $130,000. Her $9,000 contribution to her traditional 401(k) account reduces her taxable income as shown on her Form W-2. Dana's Form W-2 included the following information: 3. In addition to the taxes withheld from her salary, Dana made timely estimated federal tax payments of $1,400 per quarter. 4. Dana owns several other investments and received a statement from her brokerage firm reporting the interest and dividends earned on the investments for 2022. Forms 1099 furnished to the IRS show the following: 5. Rental House: Dana's grandfather died on February 10, 2022, and Dana inherited her grandfather's house valued at $180,000 (basis $100,000 ). Dana found a renter for the house on June 1,2022 . The monthly rent is $1,500, and the lease agreement is for one year. The lease requires the tenant to pay the first and last months' rent and a $1,000 security deposit. The security deposit is to be returned at the end of the lease if the property is in good condition. On June 1, Dana received $4,000 from the tenant per the terms of the lease agreement. The remaining 2022 rent payments for the year were made on time (the first day of each month). Dana provides you with the following additional information for the rental in 2022: The rental property is located at 105 Dalton Drive, Birmingham, Alabama 35215. Dana makes all decisions with respect to the property. Dana did not have any personal-use days related to the rental house. Dana did not make any payments that would require her to file forms 1099. Depreciable Property: Based on the property tax assessment values, Dana allocates 15% of the inherited house's value to the land. She purchased new appliances (5-year property) for $3,000. (MACRS 200\% DB and half-year convention). Dana did not elect $179 expensing and elected out of bonus depreciation. Both the house and the appliances were placed in service on June 1, 2022. 6. Real Estate Business: Dana sells real estate in the evening and on weekends (considered an active trade or business). She runs her business from a rental office she shares with several other realtors located at 692 Crestwood Circle, Birmingham, Alabama 35226. The name of her business is lackson Real Estate, the federal identification number is 99-9999999, and her business code is 531210. Dana has been operating this business since 2012 and has always shown a profit. Dana did not make any payments that would require her to file forms 1099 . She had the following income and expenses from her business in 2022: Dana uses her personal car in her business (placed in service on 3/31/2020). During 2022, she has written documentation of her 2,800 business miles. The total mileage on her car for both business and personal use during the year was 16,200 miles (including 300 miles commuting to and from the real estate office). In 2022, Dana elects to use the standard mileage rate to calculate her car expenses. Fifty percent of all business, personal, and commuting miles occurred from January 1 through June 30 , and the remaining 50% occurred from July 1 through December 31 . She spent $125 for tolls and $180 for parking related to the real estate business