Answered step by step

Verified Expert Solution

Question

1 Approved Answer

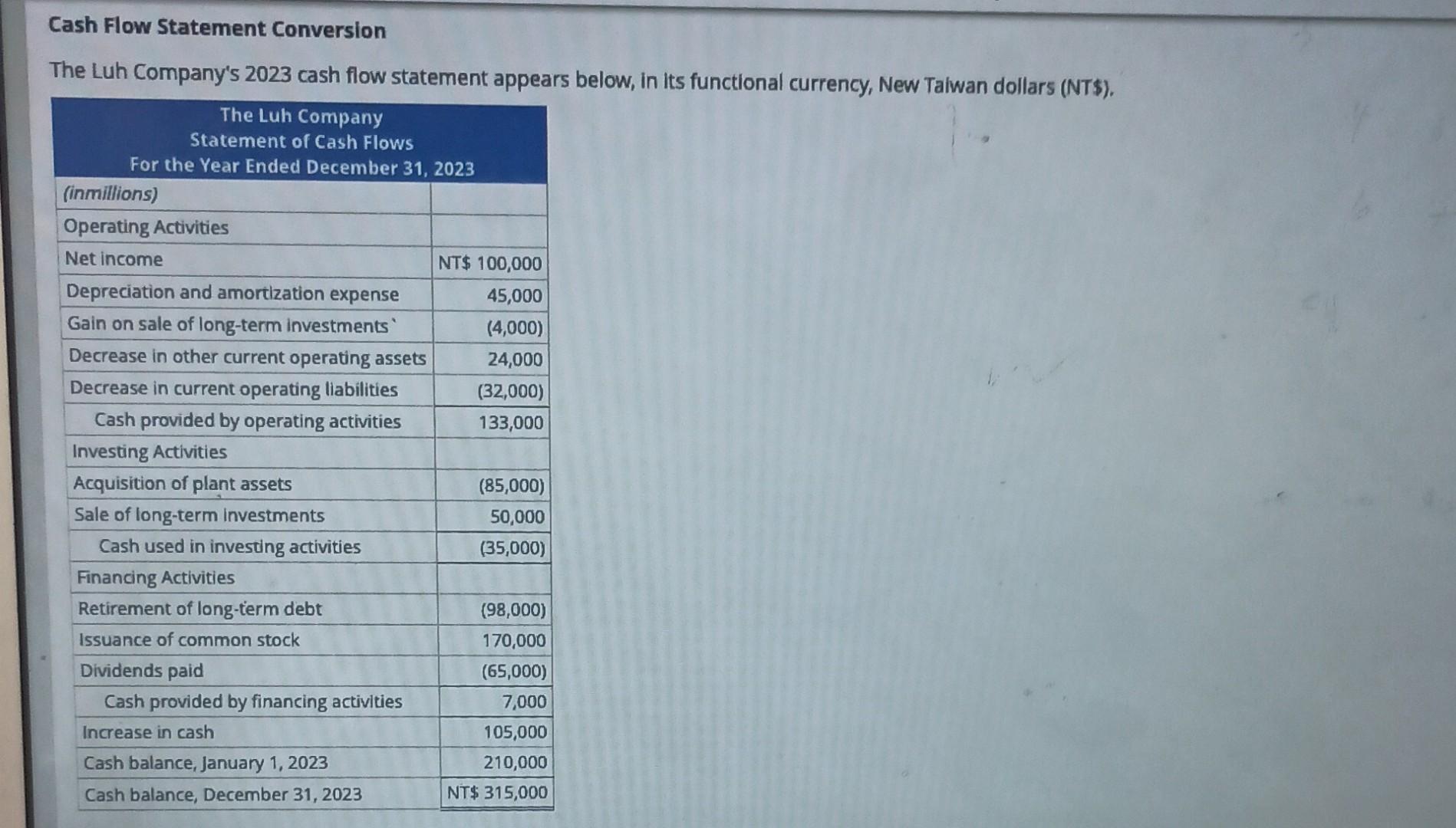

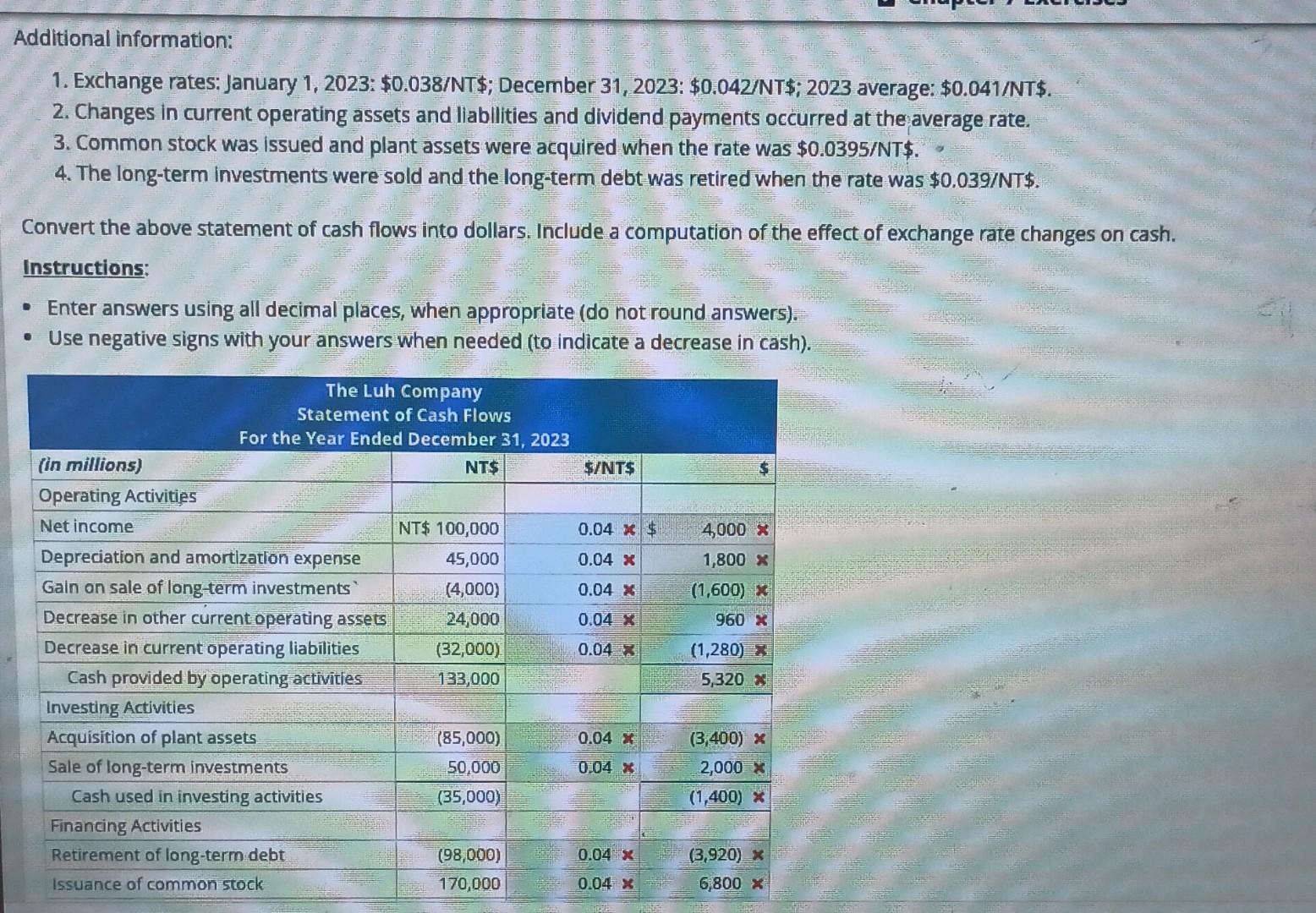

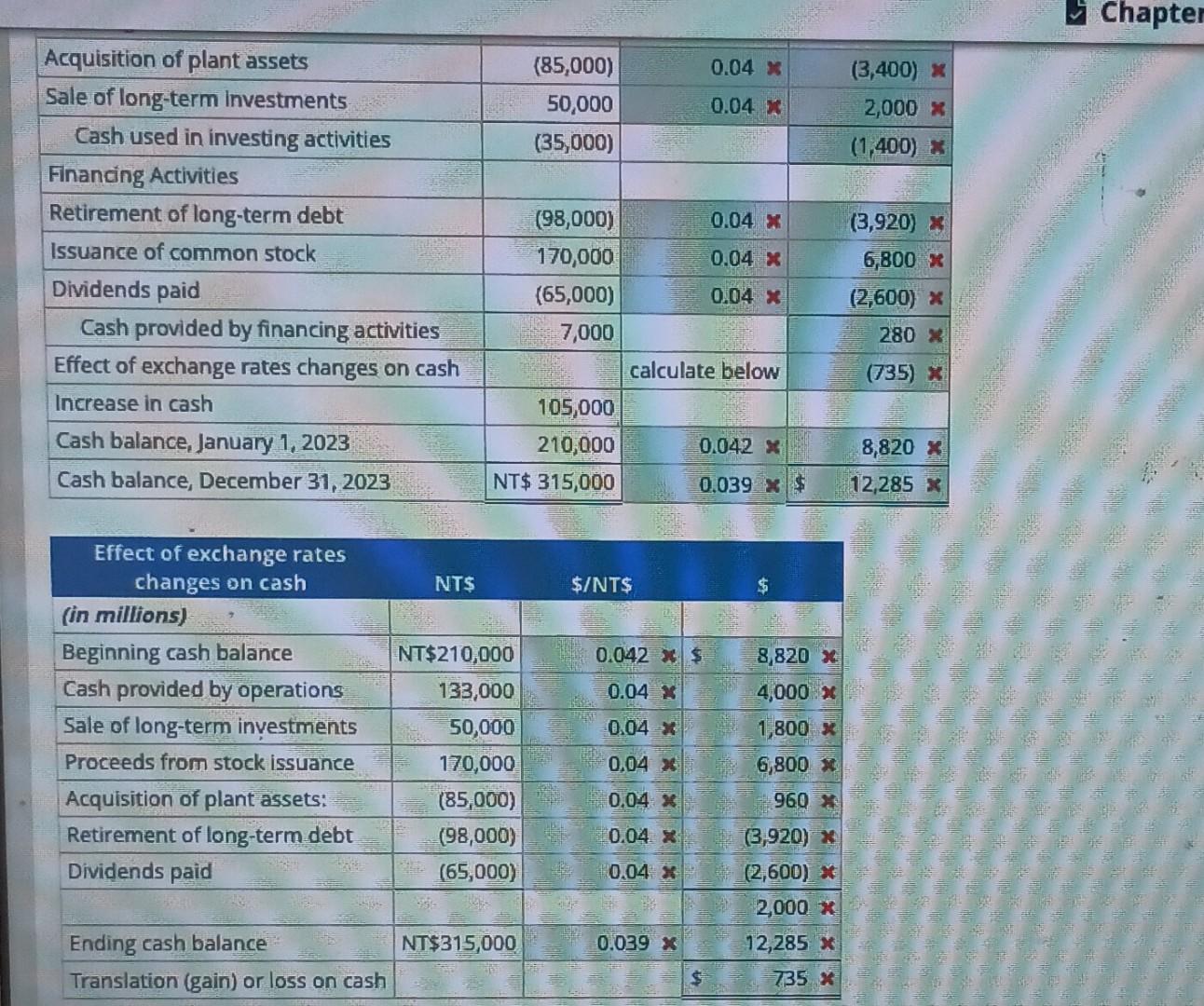

Additional information: 1. Exchange rates: January 1, 2023: $0.038/NT$; December 31,2023:$0.042/NT$;2023 average: $0.041/NT$. 2. Changes in current operating assets and liabllities and dividend payments occurred

Additional information: 1. Exchange rates: January 1, 2023: $0.038/NT$; December 31,2023:$0.042/NT$;2023 average: $0.041/NT$. 2. Changes in current operating assets and liabllities and dividend payments occurred at the average rate. 3. Common stock was issued and plant assets were acquired when the rate was $0.0395/NT$. 4. The long-term investments were sold and the long-term debt was retired when the rate was $0.039/NT$. Convert the above statement of cash flows into dollars. Include a computation of the effect of exchange rate changes on cash. Instructions: \begin{tabular}{|l|r|r|r|} \hline Acquisition of plant assets & (85,000) & 0.04 & (3,400) \\ \hline Sale of long-term Investments & 50,000 & 0.04 & 2,000 \\ \hline \multicolumn{1}{|c|}{ Cash used in investing activities } & (35,000) & & (1,400) \\ \hline Financing Activities & & & \\ \hline Retirement of long-term debt & (98,000) & 0.04 & (3,920) \\ \hline Issuance of common stock & 170,000 & 0.04 & 6,800 \\ \hline Dividends paid & (65,000) & 0.04 & (2,600) \\ \hline \multicolumn{1}{|c|}{ Cash provided by financing activities } & 7,000 & & 280 \\ \hline Effect of exchange rates changes on cash & 105,000 & calculate below & (735) \\ \hline Increase in cash & 210,000 & 0.042 & 8,820 \\ \hline Cash balance, January 1, 2023 & NT\$ 315,000 & 0.039 & 12,285 \\ \hline Cash balance, December 31,2023 & & \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline \begin{tabular}{c} Effect of exchange rates \\ changes on cash \end{tabular} & NT\$ & $/NT$ & & & $ \\ \hline \multicolumn{6}{|l|}{ (in millions) } \\ \hline Beginning cash balance & NT $210,000 & 0.042 & x & $ & 8,820x \\ \hline Cash provided by operations & 133,000 & 0.04 & x & & 4,000x \\ \hline Sale of long-term investments & 50,000 & 0.04 & x & & 1,800x \\ \hline Proceeds from stock issuance. & 170,000 & 0,04 & x & & 6,800 \\ \hline Acquisition of plant assets: & (85,000) & 0.04 & x & & 960 \\ \hline Retirement of long-term debt & (98,000) & 0.04 & x & & (3,920) \\ \hline \multirow[t]{2}{*}{ Dividends paid } & (65,000) & 0.04 & x & & (2,600)x \\ \hline & & & =1 & & 2,000 \\ \hline Ending cash balance & NT $315,000 & 0.039 & x & & 12,285x \\ \hline Translation (gain) or loss on cash & & & = & $ & 735 \\ \hline \end{tabular} Cash Flow Statement Conversion The Luh Company's 2023 cash flow statement appears below, in its functional currency, New Talwan dollars (NT\$). Additional information: 1. Exchange rates: January 1, 2023: $0.038/NT$; December 31,2023:$0.042/NT$;2023 average: $0.041/NT$. 2. Changes in current operating assets and liabllities and dividend payments occurred at the average rate. 3. Common stock was issued and plant assets were acquired when the rate was $0.0395/NT$. 4. The long-term investments were sold and the long-term debt was retired when the rate was $0.039/NT$. Convert the above statement of cash flows into dollars. Include a computation of the effect of exchange rate changes on cash. Instructions: \begin{tabular}{|l|r|r|r|} \hline Acquisition of plant assets & (85,000) & 0.04 & (3,400) \\ \hline Sale of long-term Investments & 50,000 & 0.04 & 2,000 \\ \hline \multicolumn{1}{|c|}{ Cash used in investing activities } & (35,000) & & (1,400) \\ \hline Financing Activities & & & \\ \hline Retirement of long-term debt & (98,000) & 0.04 & (3,920) \\ \hline Issuance of common stock & 170,000 & 0.04 & 6,800 \\ \hline Dividends paid & (65,000) & 0.04 & (2,600) \\ \hline \multicolumn{1}{|c|}{ Cash provided by financing activities } & 7,000 & & 280 \\ \hline Effect of exchange rates changes on cash & 105,000 & calculate below & (735) \\ \hline Increase in cash & 210,000 & 0.042 & 8,820 \\ \hline Cash balance, January 1, 2023 & NT\$ 315,000 & 0.039 & 12,285 \\ \hline Cash balance, December 31,2023 & & \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline \begin{tabular}{c} Effect of exchange rates \\ changes on cash \end{tabular} & NT\$ & $/NT$ & & & $ \\ \hline \multicolumn{6}{|l|}{ (in millions) } \\ \hline Beginning cash balance & NT $210,000 & 0.042 & x & $ & 8,820x \\ \hline Cash provided by operations & 133,000 & 0.04 & x & & 4,000x \\ \hline Sale of long-term investments & 50,000 & 0.04 & x & & 1,800x \\ \hline Proceeds from stock issuance. & 170,000 & 0,04 & x & & 6,800 \\ \hline Acquisition of plant assets: & (85,000) & 0.04 & x & & 960 \\ \hline Retirement of long-term debt & (98,000) & 0.04 & x & & (3,920) \\ \hline \multirow[t]{2}{*}{ Dividends paid } & (65,000) & 0.04 & x & & (2,600)x \\ \hline & & & =1 & & 2,000 \\ \hline Ending cash balance & NT $315,000 & 0.039 & x & & 12,285x \\ \hline Translation (gain) or loss on cash & & & = & $ & 735 \\ \hline \end{tabular} Cash Flow Statement Conversion The Luh Company's 2023 cash flow statement appears below, in its functional currency, New Talwan dollars (NT\$)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started