Question

I know how to perform consolidation for companies with a simple group structure, but Ive not learned how to perform consolidation for companies with a

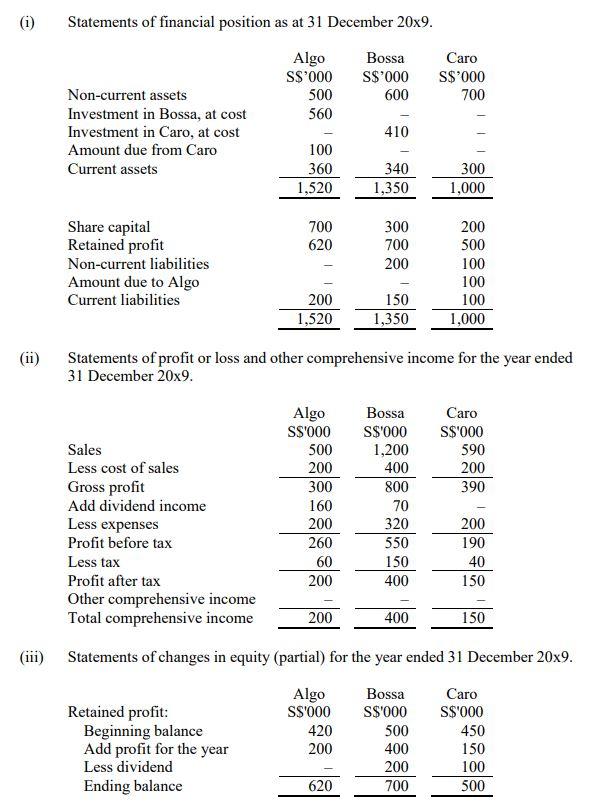

I know how to perform consolidation for companies with a simple group structure, but Ive not learned how to perform consolidation for companies with a complex group structure. I prepared these draft consolidated financial statements based on what Ive learned about consolidation for a simple group structure. Raynald commented, as he handed to you the financial statements he had prepared. Raynald is an intern who had just joined the accounting department of Algo Company. You are his supervisor at Algo Company. A few days ago, you had assigned him to prepare the draft consolidated financial statements for the Algo group for the year ended 31 December 20x9. Could you let me know whether there are any errors in this set of draft consolidated financial statements and advise me on how I could correct the errors? asked Raynald. You have the following information about the Algo group: On 1 January 20x8, Algo Company paid $560,000 to acquire 80% of the ordinary shares of Bossa Company. On that date, the book value and fair value of Bossa Companys identifiable net assets were represented by share capital of $300,000 and retained profit of $300,000. On 1 January 20x6, Bossa Company had paid $410,000 to acquire 70% of the ordinary shares of Caro Company. On that date, the book value and fair value of Caro Companys identifiable net assets were represented by share capital of $200,000 and retained profit of $200,000. On 1 January 20x8, Caro Company had a share capital of $200,000 and retained profit of $350,000. During 20x9, Bossa Company sold inventory to Caro Company at cost plus 50%. The total intercompany sales for 20x9 was S$180,000. As at 31 December 20x9, the inventory had not been resold to external parties. All dividends were declared out of 20x9 profits, and had been duly paid and received. Algo Company, Bossa Company, and Caro Company adopt the Singapore Financial Reporting Standards (International) (SFRS(I)). All the relevant SFRS(I) that were issued by the Accounting Standards Council as at 1 January 2021 are assumed to have been effective on 1 January 20x6. All the companies present annual financial statements with 31 December financial year-ends. The group policy was to measure inventory using the first-in, first-out method and measure non-controlling interests at the acquisition date based on their proportionate share of the acquisition-date fair value of the identifiable net assets of the subsidiaries acquired. Ignore the deferred tax effects, if any, arising from consolidation. Assume that a direct shareholding interest of more than 50% gives rise to control, and a direct shareholding interest of 20% or more but less than 50% gives rise to significant influence. The individual statements of financial position as at 31 December 20x9, individual statements of profit or loss and other comprehensive income for the year ended 31 December 20x9, and individual statements of changes in equity (partial) for the year ended 31 December 20x9 of Algo Company, Bossa Company, and Caro Company are provided here.

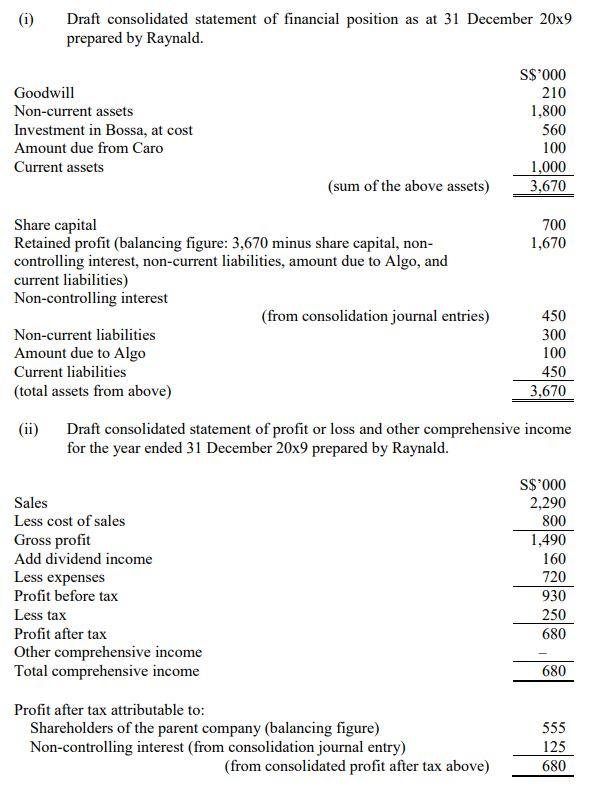

Shown below is the draft consolidated statement of financial position as at 31 December 20x9 and the draft consolidated statement of profit or loss and other comprehensive income for the year ended 31 December 20x9 prepared by Raynald.

The words in brackets in the draft consolidated financial statements are the notes that Raynald had included in the draft consolidated financial statements to explain how he computed some of the financial statement items and some of the subtotals.

Highlight the errors in the draft consolidated financial statements that Raynald had prepared.

For each error identified, discuss why it is an error and how it can be corrected.

Statements of financial position as at 31 December 20x9. Algo S$'000 500 560 Bossa S$'000 600 Caro S$'000 700 Non-current assets Investment in Bossa, at cost Investment in Caro, at cost Amount due from Caro Current assets 410 100 360 1,520 340 1,350 300 1,000 700 620 Share capital Retained profit Non-current liabilities Amount due to Algo Current liabilities 300 700 200 200 500 100 100 100 1,000 200 1,520 150 1,350 (11) Statements of profit or loss and other comprehensive income for the year ended 31 December 20x9. Caro S$'000 590 200 390 Sales Less cost of sales Gross profit Add dividend income Less expenses Profit before tax Less tax Profit after tax Other comprehensive income Total comprehensive income Algo S$'000 500 200 300 160 200 260 60 200 Bossa S$'000 1,200 400 800 70 320 550 150 400 200 190 40 150 200 400 150 Statements of changes in equity (partial) for the year ended 31 December 20x9. Retained profit: Beginning balance Add profit for the year Less dividend Ending balance Algo S$'000 420 200 Bossa S$'000 500 400 200 700 Caro S$'000 450 150 100 500 620 Draft consolidated statement of financial position as at 31 December 20x9 prepared by Raynald. Goodwill Non-current assets Investment in Bossa, at cost Amount due from Caro Current assets S$'000 210 1,800 560 100 1,000 3,670 (sum of the above assets) 700 1,670 Share capital Retained profit (balancing figure: 3,670 minus share capital, non- controlling interest, non-current liabilities, amount due to Algo, and current liabilities) Non-controlling interest (from consolidation journal entries) Non-current liabilities Amount due to Algo Current liabilities (total assets from above) 450 300 100 450 3,670 (ii) Draft consolidated statement of profit or loss and other comprehensive income for the year ended 31 December 20x9 prepared by Raynald. Sales Less cost of sales Gross profit Add dividend income Less expenses Profit before tax Less tax Profit after tax Other comprehensive income Total comprehensive income S$'000 2,290 800 1,490 160 720 930 250 680 680 Profit after tax attributable to: Shareholders of the parent company (balancing figure) Non-controlling interest (from consolidation journal entry) (from consolidated profit after tax above) 555 125 680 Statements of financial position as at 31 December 20x9. Algo S$'000 500 560 Bossa S$'000 600 Caro S$'000 700 Non-current assets Investment in Bossa, at cost Investment in Caro, at cost Amount due from Caro Current assets 410 100 360 1,520 340 1,350 300 1,000 700 620 Share capital Retained profit Non-current liabilities Amount due to Algo Current liabilities 300 700 200 200 500 100 100 100 1,000 200 1,520 150 1,350 (11) Statements of profit or loss and other comprehensive income for the year ended 31 December 20x9. Caro S$'000 590 200 390 Sales Less cost of sales Gross profit Add dividend income Less expenses Profit before tax Less tax Profit after tax Other comprehensive income Total comprehensive income Algo S$'000 500 200 300 160 200 260 60 200 Bossa S$'000 1,200 400 800 70 320 550 150 400 200 190 40 150 200 400 150 Statements of changes in equity (partial) for the year ended 31 December 20x9. Retained profit: Beginning balance Add profit for the year Less dividend Ending balance Algo S$'000 420 200 Bossa S$'000 500 400 200 700 Caro S$'000 450 150 100 500 620 Draft consolidated statement of financial position as at 31 December 20x9 prepared by Raynald. Goodwill Non-current assets Investment in Bossa, at cost Amount due from Caro Current assets S$'000 210 1,800 560 100 1,000 3,670 (sum of the above assets) 700 1,670 Share capital Retained profit (balancing figure: 3,670 minus share capital, non- controlling interest, non-current liabilities, amount due to Algo, and current liabilities) Non-controlling interest (from consolidation journal entries) Non-current liabilities Amount due to Algo Current liabilities (total assets from above) 450 300 100 450 3,670 (ii) Draft consolidated statement of profit or loss and other comprehensive income for the year ended 31 December 20x9 prepared by Raynald. Sales Less cost of sales Gross profit Add dividend income Less expenses Profit before tax Less tax Profit after tax Other comprehensive income Total comprehensive income S$'000 2,290 800 1,490 160 720 930 250 680 680 Profit after tax attributable to: Shareholders of the parent company (balancing figure) Non-controlling interest (from consolidation journal entry) (from consolidated profit after tax above) 555 125 680Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started