Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i konw u guys one time just can answer one question. but please just this time help me, i have 20 questions need to upload

i konw u guys one time just can answer one question. but please just this time help me, i have 20 questions need to upload but i dont have enough time.

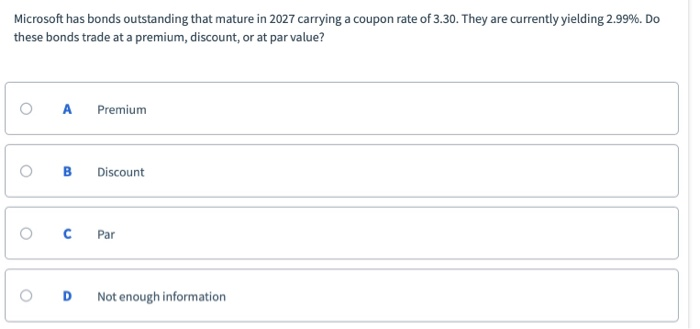

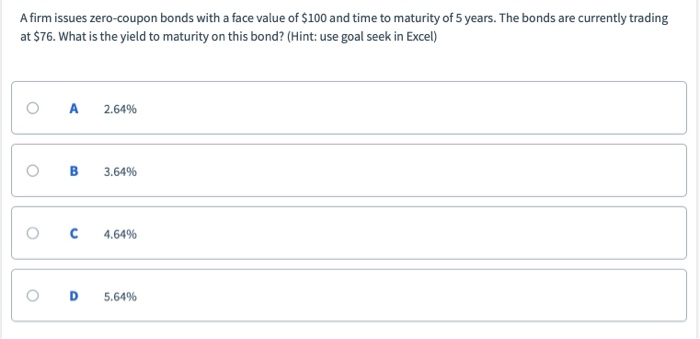

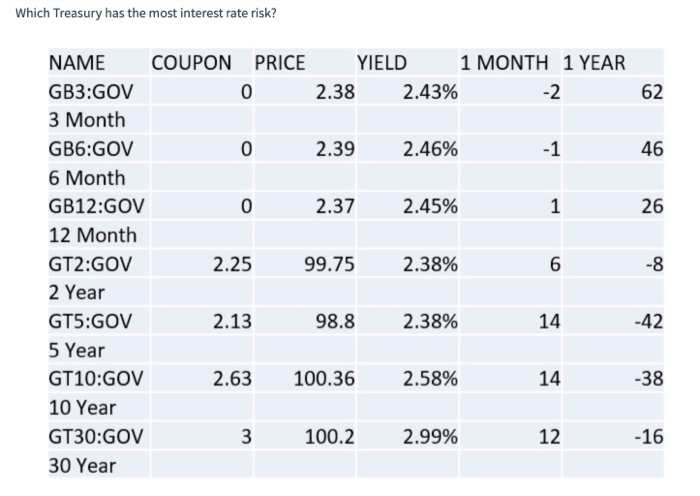

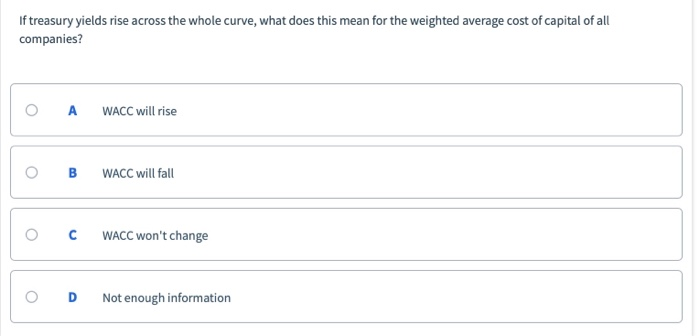

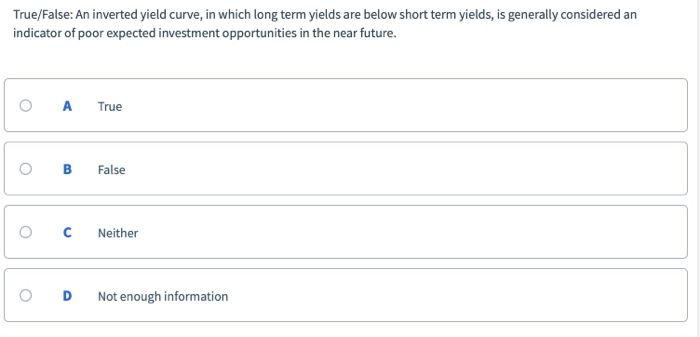

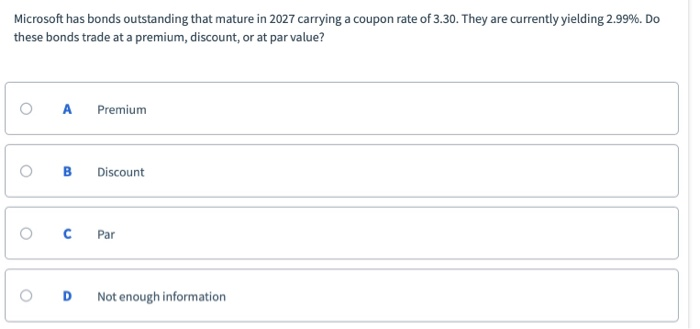

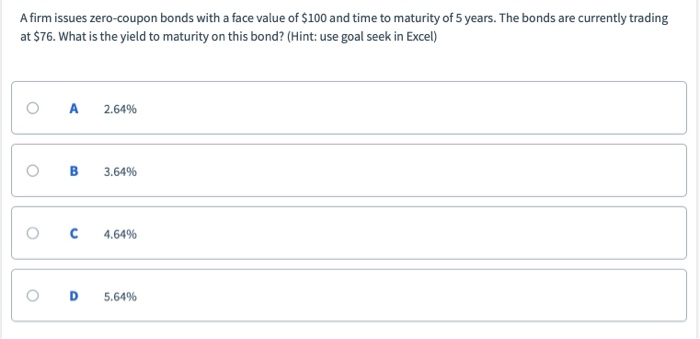

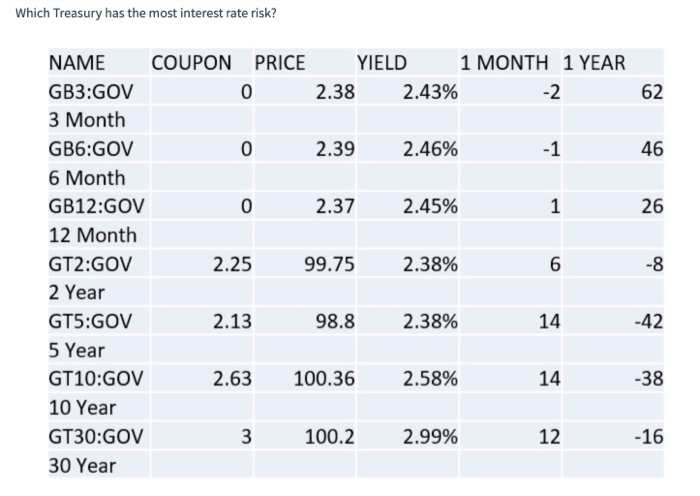

Microsoft has bonds outstanding that mature in 2027 carrying a coupon rate of 3.30. They are currently yielding 2.99%. Do these bonds trade at a premium, discount, or at par value? O A Premium O B Discount O Par O D Not enough information A firm issues zero-coupon bonds with a face value of $100 and time to maturity of 5 years. The bonds are currently trading at $76. What is the yield to maturity on this bond? (Hint: use goal seek in Excel) 0 A 2.6496 B 3.64% 4.64% D 5.6496 Which Treasury has the most interest rate risk? NAME COUPON GB3:GOV 3 Month GB6:GOV 6 Month GB12:GOV 12 Month GT2:GOV 2 Year GT5:GOV 5 Year GT10:GOV 10 Year GT30:GOV 30 Year PRICE 0 YIELD 1 MONTH 1 YEAR 2.38 2.43% -2 62 46 0 2.39 2.46% -1 0 2.37 2.45% 1 26 2.25 99.75 2.38% -8 2.13 14 98.8 2.38% -42 14 2.63 100.36 2.58% -38 100.2 2.99% 12 -16 O A12 month O B 5year C 10year O D 30 year If treasury yields rise across the whole curve, what does this mean for the weighted average cost of capital of all companies? 0 A WACC will rise O B WACC will fall C WACC won't change O D Not enough information True/False: An inverted yield curve, in which long term yields are below short term yields, is generally considered an indicator of poor expected investment opportunities in the near future. A True B False O CNeither O D Not enough information

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started