Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I mainly need answers for b) and c) a m Section B - This question is COMPULSORY and MUST be attempted. Section A questions are

I mainly need answers for b) and c)

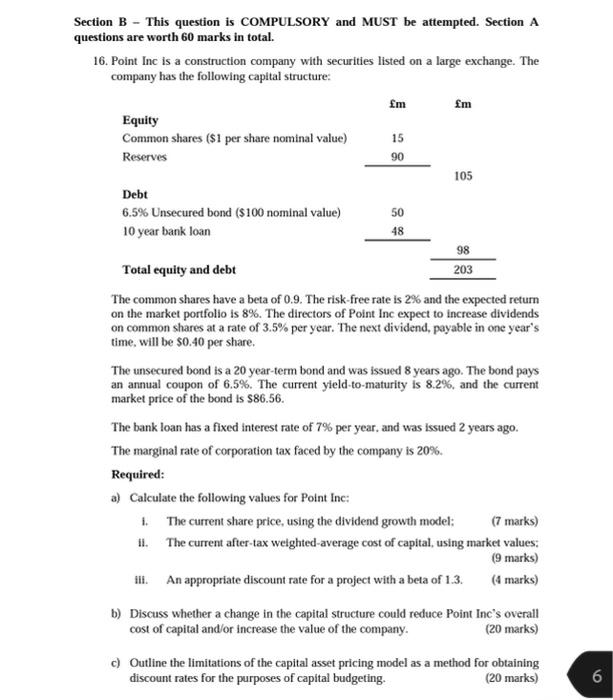

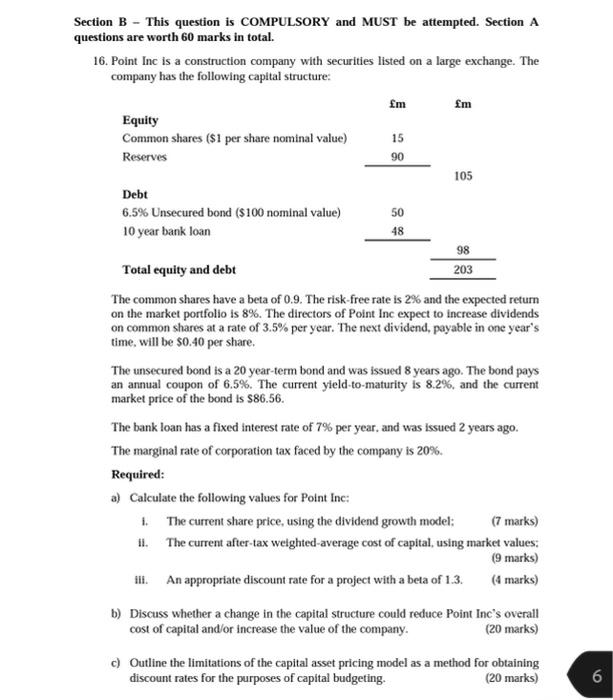

a m Section B - This question is COMPULSORY and MUST be attempted. Section A questions are worth 60 marks in total. 16. Point Inc is a construction company with securities listed on a large exchange. The company has the following capital structure: m Equity Common shares ($1 per share nominal value) 15 Reserves 90 105 Debt 6.5% Unsecured bond ($100 nominal value) 50 10 year bank loan 48 98 Total equity and debt 203 The common shares have a beta of 0.9. The risk-free rate is 2% and the expected return on the market portfolio is 8%. The directors of Point Inc expect to increase dividends on common shares at a rate of 3.5% per year. The next dividend, payable in one year's time will be $0.40 per share. The unsecured bond is a 20 year-term bond and was issued 8 years ago. The bond pays an annual coupon of 6.5%. The current yield-to-maturity is 8.2%, and the current market price of the bond is $86.56. The bank loan has a fixed interest rate of 7% per year, and was issued 2 years ago. The marginal rate of corporation tax faced by the company is 20%. Required: a) Calculate the following values for Point Inc: The current share price, using the dividend growth model: (7 marks) 1. The current after-tax weighted-average cost of capital, using market values. (9 marks) Ill. An appropriate discount rate for a project with a beta of 1.3. (4 marks) b) Discuss whether a change in the capital structure could reduce Point Inc's overall cost of capital and/or increase the value of the company. (20 marks) c) Outline the limitations of the capital asset pricing model as a method for obtaining discount rates for the purposes of capital budgeting. (20 marks) 6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started