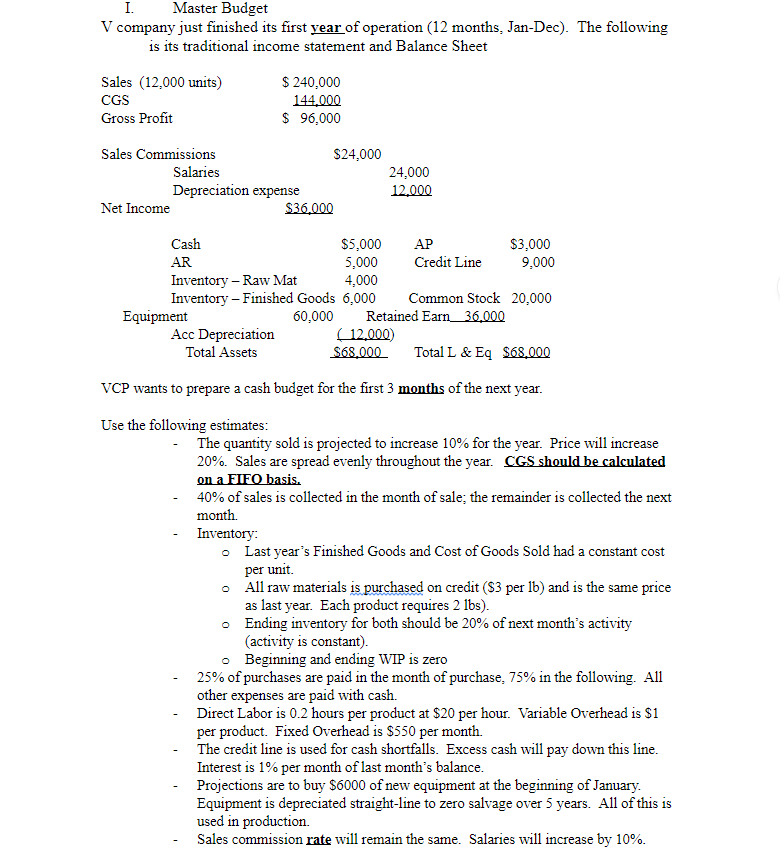

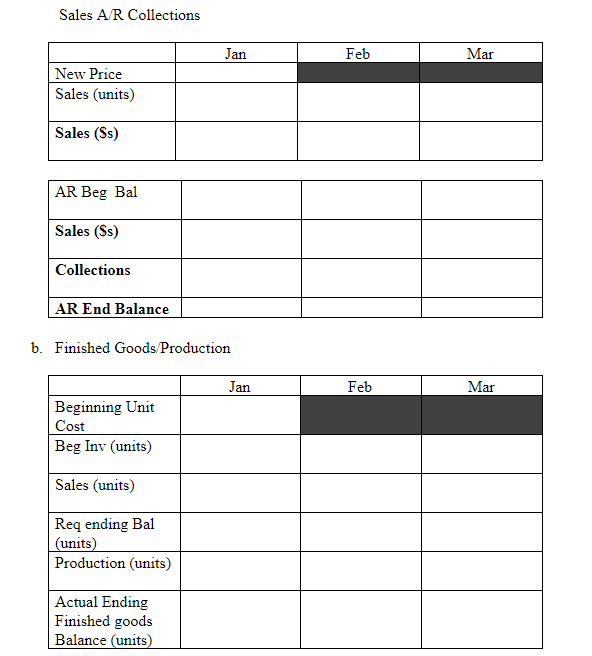

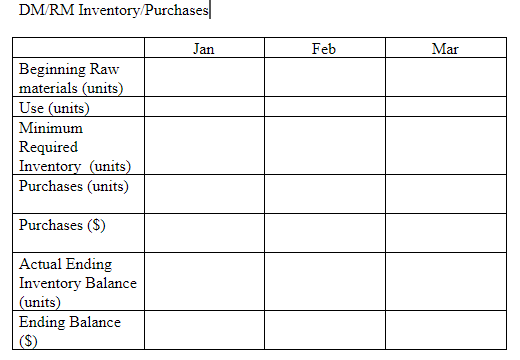

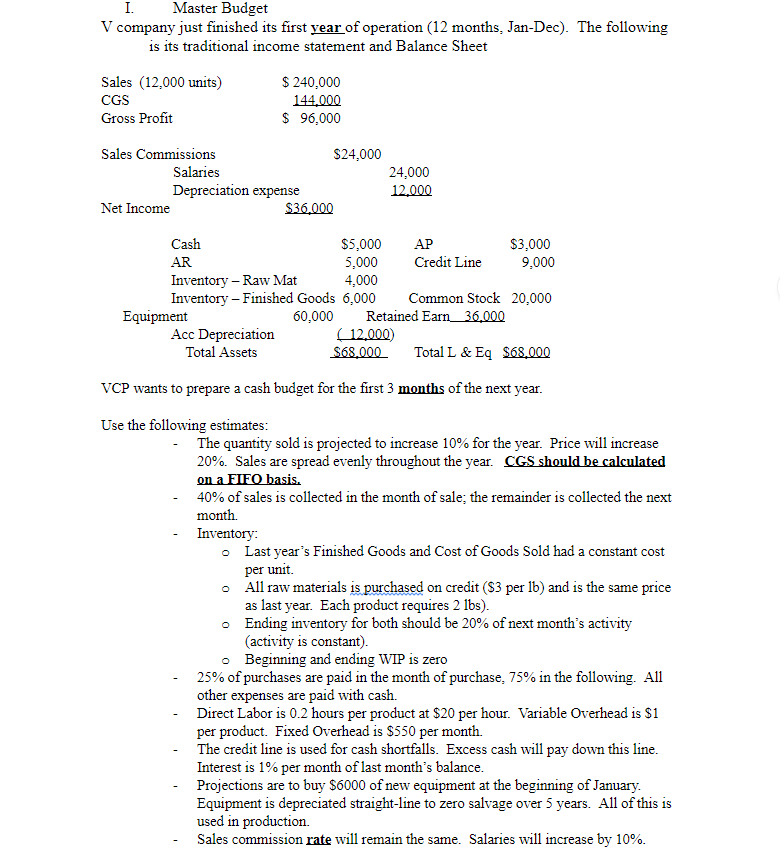

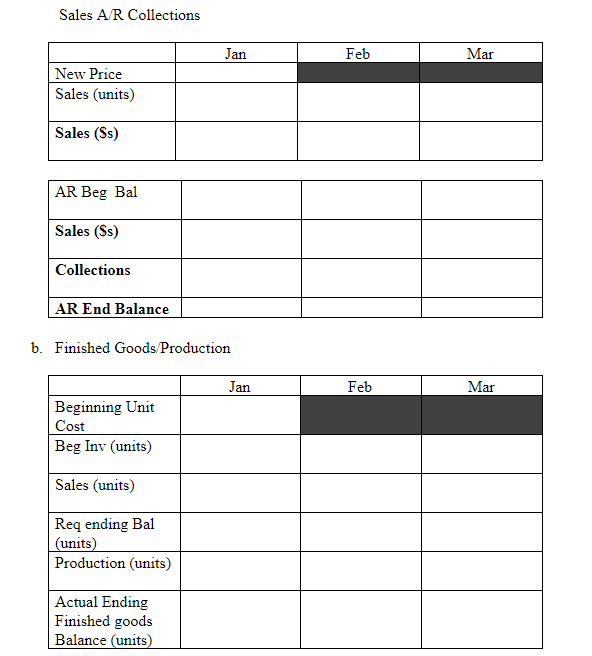

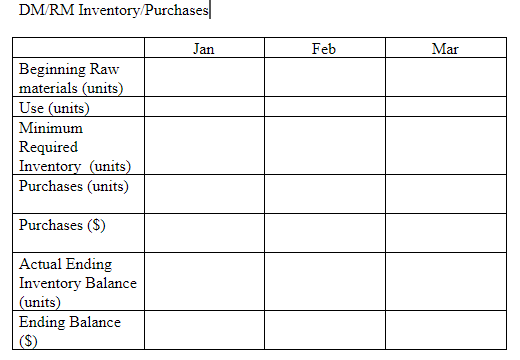

I. Master Budget V company just finished its first year of operation (12 months, Jan-Dec). The following is its traditional income statement and Balance Sheet Sales (12,000 units) CGS Gross Profit $ 240,000 144.000 $ 96,000 Sales Commissions $24,000 Salaries 24,000 Depreciation expense 12.000 Net Income $36.000 Cash $5,000 AP $3,000 AR 5,000 Credit Line 9,000 Inventory - Raw Mat 4.000 Inventory - Finished Goods 6,000 Common Stock 20,000 Equipment 60,000 Retained Earn_36.000 Acc Depreciation 12,000) Total Assets $68.000 Total L & Eq $68.000 VCP wants to prepare a cash budget for the first 3 months of the next year. Use the following estimates: The quantity sold is projected to increase 10% for the year. Price will increase 20%. Sales are spread evenly throughout the year. CGS should be calculated on a FIFO basis. 40% of sales is collected in the month of sale: the remainder is collected the next month Inventory: o Last year's Finished Goods and Cost of Goods Sold had a constant cost per unit. All raw materials is purchased on credit ($3 per lb) and is the same price as last year. Each product requires 2 lbs). Ending inventory for both should be 20% of next month's activity (activity is constant). o Beginning and ending WIP is zero 25% of purchases are paid in the month of purchase. 75% in the following. All other expenses are paid with cash. Direct Labor is 0.2 hours per product at $20 per hour. Variable Overhead is $1 per product. Fixed Overhead is $550 per month. The credit line is used for cash shortfalls. Excess cash will pay down this line. Interest is 1% per month of last month's balance. Projections are to buy $6000 of new equipment at the beginning of January Equipment is depreciated straight-line to zero salvage over 5 years. All of this is used in production. Sales commission rate will remain the same. Salaries will increase by 10%. Sales AR Collections Feb Mar New Price Sales (units) Sales (Ss) AR Beg Bal Sales (SS) Collections AR End Balance b. Finished Goods Production Jan Feb Mar Beginning Unit Cost Beg Inv (units) Sales (units) Req ending Bal (units) Production (units) Actual Ending Finished goods Balance (units) DM/RM Inventory/Purchases Jan Feb Mar Beginning Raw materials (units) Use (units) Minimum Required Inventory (units) Purchases (units) Purchases ($) Actual Ending Inventory Balance (units) Ending Balance ($) I. Master Budget V company just finished its first year of operation (12 months, Jan-Dec). The following is its traditional income statement and Balance Sheet Sales (12,000 units) CGS Gross Profit $ 240,000 144.000 $ 96,000 Sales Commissions $24,000 Salaries 24,000 Depreciation expense 12.000 Net Income $36.000 Cash $5,000 AP $3,000 AR 5,000 Credit Line 9,000 Inventory - Raw Mat 4.000 Inventory - Finished Goods 6,000 Common Stock 20,000 Equipment 60,000 Retained Earn_36.000 Acc Depreciation 12,000) Total Assets $68.000 Total L & Eq $68.000 VCP wants to prepare a cash budget for the first 3 months of the next year. Use the following estimates: The quantity sold is projected to increase 10% for the year. Price will increase 20%. Sales are spread evenly throughout the year. CGS should be calculated on a FIFO basis. 40% of sales is collected in the month of sale: the remainder is collected the next month Inventory: o Last year's Finished Goods and Cost of Goods Sold had a constant cost per unit. All raw materials is purchased on credit ($3 per lb) and is the same price as last year. Each product requires 2 lbs). Ending inventory for both should be 20% of next month's activity (activity is constant). o Beginning and ending WIP is zero 25% of purchases are paid in the month of purchase. 75% in the following. All other expenses are paid with cash. Direct Labor is 0.2 hours per product at $20 per hour. Variable Overhead is $1 per product. Fixed Overhead is $550 per month. The credit line is used for cash shortfalls. Excess cash will pay down this line. Interest is 1% per month of last month's balance. Projections are to buy $6000 of new equipment at the beginning of January Equipment is depreciated straight-line to zero salvage over 5 years. All of this is used in production. Sales commission rate will remain the same. Salaries will increase by 10%. Sales AR Collections Feb Mar New Price Sales (units) Sales (Ss) AR Beg Bal Sales (SS) Collections AR End Balance b. Finished Goods Production Jan Feb Mar Beginning Unit Cost Beg Inv (units) Sales (units) Req ending Bal (units) Production (units) Actual Ending Finished goods Balance (units) DM/RM Inventory/Purchases Jan Feb Mar Beginning Raw materials (units) Use (units) Minimum Required Inventory (units) Purchases (units) Purchases ($) Actual Ending Inventory Balance (units) Ending Balance ($)