Answered step by step

Verified Expert Solution

Question

1 Approved Answer

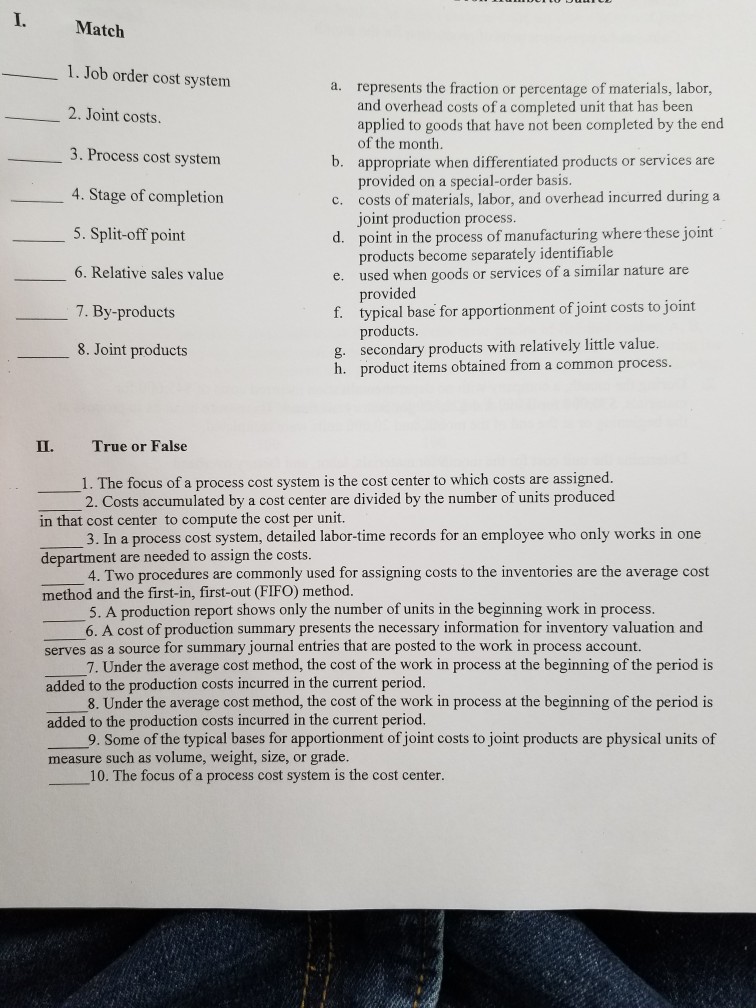

I. Match 1.Job order cost system 2. Joint costs. 3. Process cost system 4. Stage of completion 5. Split-off point 6. Relative sales value 7.

I. Match 1.Job order cost system 2. Joint costs. 3. Process cost system 4. Stage of completion 5. Split-off point 6. Relative sales value 7. By-products 8. Joint products a. represents the fraction or percentage of materials, labor, and overhead costs of a completed unit that has been applied to goods that have not been completed by the end of the month. b. appropriate when differentiated products or services are c. costs of materials, labor, and overhead incurred during a d. point in the process of manufacturing where these joint e. used when goods or services of a similar nature are f. typical base for apportionment of joint costs to joint g. secondary products with relatively little value. provided on a special-order basis. joint production process. products become separately identifiable provided products. product items obtained from a common process. h. II. True or False 1. The focus of a process cost system is the cost center to which costs are assigned. 2. Costs accumulated by a cost center are divided by the number of units produced 3. In a process cost system, detailed labor-time records for an employee who only works in one 4. Two procedures are commonly used for assigning costs to the inventories are the average cost 5. A production report shows only the number of units in the beginning work in process. in that cost center to compute the cost per unit. department are needed to assign the costs. method and the first-in, first-out (FIFO) method. serves as a source for summary journal entries that are posted to the work in process account. added to the production costs incurred in the current period added to the production costs incurred in the current period. 6. A cost of production summary presents the necessary information for inventory valuation and 7. Under the average cost method, the cost of the work in process at the beginning of the period is 8. Under the average cost method, the cost of the work in process at the beginning of the period is 9. Some of the typical bases for apportionment of joint costs to joint products are physical units of measure such as volume, weight, size, or grade. 10. The focus of a process cost system is the cost center

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started