Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need a complete solution of this problem, DO NOT COPY AND PASTE SOLUTION FROM COURSEHERO PLEASE Teekay LNG Partners L.P. is considering whether to

I need a complete solution of this problem, DO NOT COPY AND PASTE SOLUTION FROM COURSEHERO PLEASE

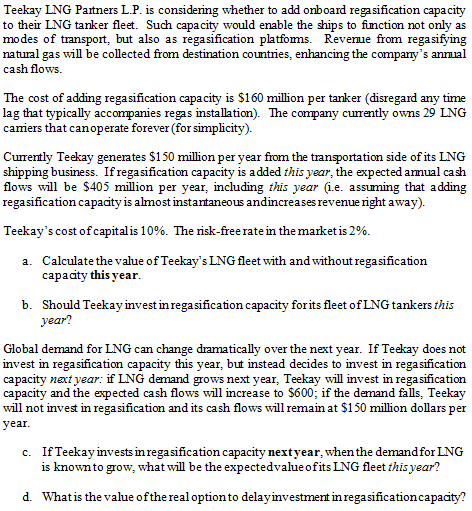

Teekay LNG Partners L.P. is considering whether to add onboard regasification capacity to their LNG tanker fleet. Such capacity would enable the ships to function not only as modes of transport, but also as regasification platforms. Revenue from regasifying natural gas will be collected from destination countries, enhancing the company's annual cashflows. The cost of adding regasification capacity is $160 million per tanker (disregard any time lag that typically accompanies regas installation). The company currently owns 29 LNG carriers that canoperate forever (for simplicity). Currently Teekay generates $150 million per year from the transportation side of its LNG shipping business. If regasification capacity is added this year, the expected annual cash flows will be S405 million per year, including this year (i.e. assuming that adding regasification capacity is almost instantaneous andincreases revenue right away). Teekay's cost of capital is 10%. The risk-free rate in the market is 2%. Calculate the value of Teekay's LNG fleet with and without regasification capacity this year. Should Teekay invest inregasification capacity for its fleet of LNG tankers this year? Global demand for LNG can change dramatically over the next year. If Teekay does not invest in regasification capacity this year, but instead decides to invest in regasification capacity next year: if LNG demand grows next year. Teekay will invest in regasification capacity and the expected cash flows will increase to $600; if the demand falls. Teekay will not invest in regasification and its cash flows will remain at $150 million dollars per yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started