i need a solve , step by step

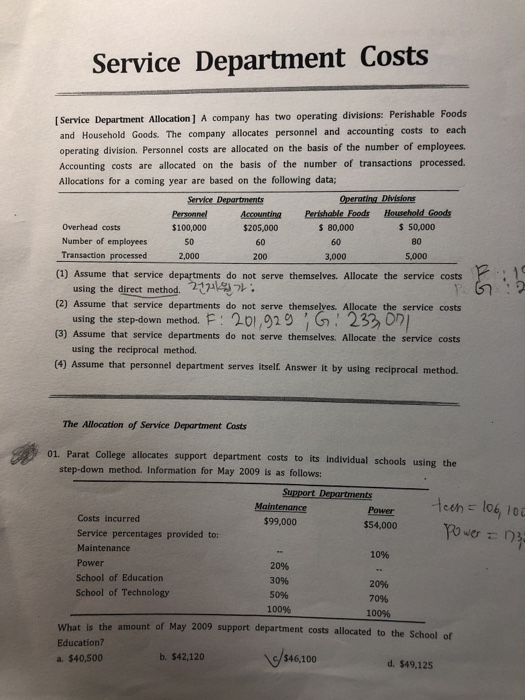

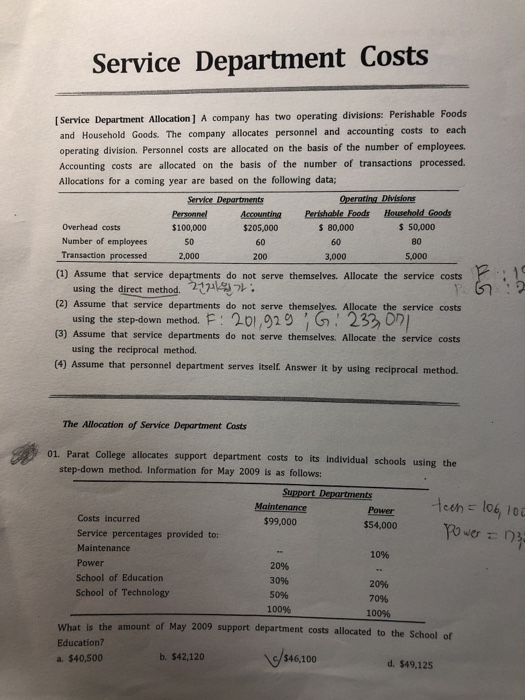

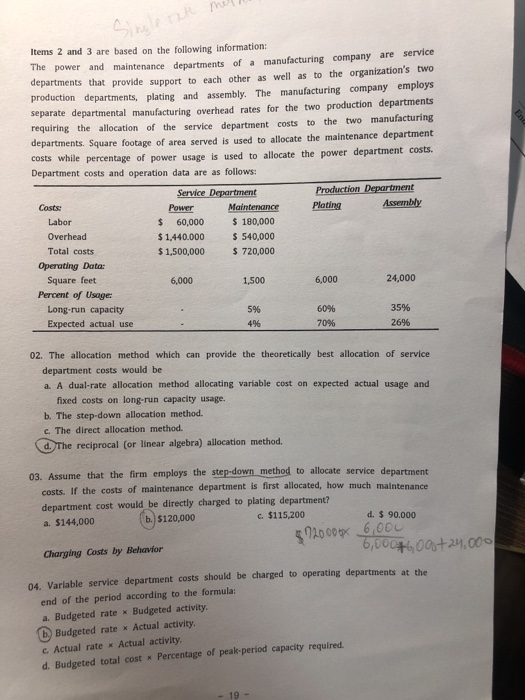

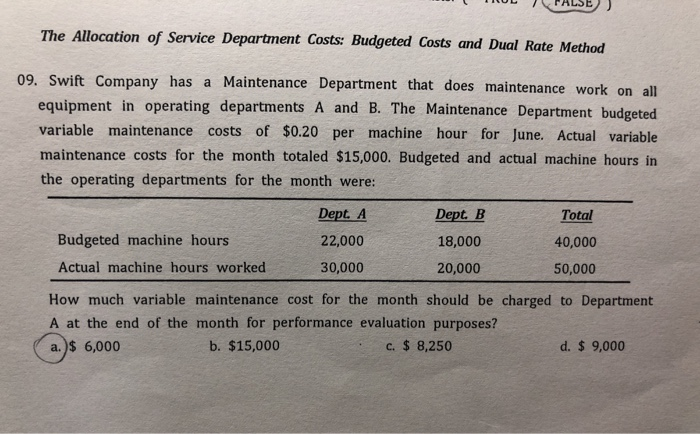

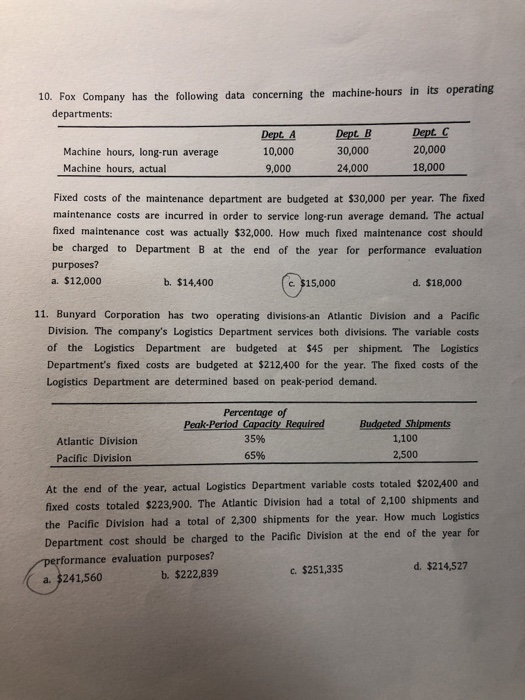

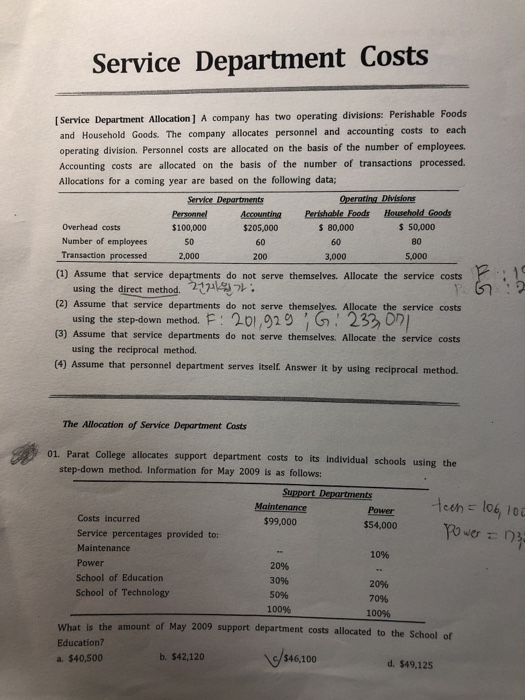

Department Costs Service [Service Department Allocation] A company has two operating divisions: Perishable Foods and Household Goods. The company allocates personnel and accounting costs to each operating division. Personnel costs are allocated on the basis of the number of employees. Accounting costs are alllocated on the basis of the number of transactions processed. Allocations for a coming year are based on the following data; Operating Divisions Service Departments Household Goods Personnel Accounting Perishable Foods $ 50,000 Overhead costs $ 80,000 $100,000 $205,000 Number of employees Transaction processed 50 80 60 60 2.000 200 3,000 5,000 (1) Assume that service departments do not serve themselves. Allocate the service costs : using the direct method. (2) Assume that service departments do not serve themselves. Allocate the service costs using the step-down method. F201,929 G233 OD (3) Assume that service departments do not serve themselves. Allocate the service costs using the reciprocal method. (4) Assume that personnel department serves itself. Answer it by using reciprocal method. The Allocation of Service Department Costs 01. Parat College allocates support department costs to its individual schools using the step-down method. Information for May 2009 is as follows: Support Departments Maintenance Heen l06 10 Power Costs incurred $99,000 $54,000 Service percentages provided to: Maintenance 10% Power 20% School of Education 30% 20% School of Technology 50% 70% 100% 100% What is the amount of May 2009 support department costs allocated to the School of Education? u6100 b. $42,120 a. $40,500 d. $49.125 Items 2 and 3 are based on the following information: The power and maintenance departments of a manufacturing company are service departments that provide support to each other as well as to the organization's two production departments, plating and assembly. The manufacturing company employs separate departmental manufacturing overhead rates for the two production departments requiring the allocation of the service department costs to the two manufacturing departments. Square footage of area served is used to allocate the maintenance department costs while percentage of power usage is used to allocate the power department costs. Department costs and operation data are as follows: Production Department Service Department Costs: Assembly Maintenance Plating Power Labor $ 60,000 $180,000 Overhead $ 540,000 $1,440.000 Total costs $ 720,000 $1,500,000 Operating Data Square feet 6,000 1,500 6.000 24,000 Percent of Usage Long-run capacity 5% 60% 35% Expected actual use 4% 70% 26% 02. The allocation method which can provide the theoretically best allocation of service department costs would be a. A dual-rate allocation method allocating variable cost on expected actual usage and fixed costs on long-run capacity usage. b. The step-down allocation method. c. The direct allocation method. d. The reciprocal (or linear algebra) allocation method. 03. Assume that the firm employs the step-down method to allocate service department costs. If the costs of maintenance department is first allocated, how much maintenance department cost would be directly charged to plating department? b. $120,000 c. $115,200 d. $ 90.000 a. $144,000 5920 00x 600 6,0004400424,00 Charging Costs by Behavior 04. Variable service department costs should be charged to operating departments at the end of the period according to the formula: a. Budgeted rate x Budgeted activity b) Budgeted rate x Actual activity. . Actual rate x Actual activity d. Budgeted total cost x Percentage of peak-period capacity required 19- The Allocation of Service Department Costs: Budgeted Costs and Dual Rate Method 09. Swift Company has a Maintenance Department that does maintenance work on all equipment in operating departments A and B. The Maintenance Department budgeted variable maintenance costs of $0.20 per machine hour for June. Actual variable maintenance costs for the month totaled $15,000. Budgeted and actual machine hours in the operating departments for the month were: Dept. A Dept. B Total Budgeted machine hours 22,000 18,000 40,000 Actual machine hours worked 30,000 20,000 50,000 How much variable maintenance cost for the month should be charged to Department A at the end of the month for performance evaluation purposes? a.)$ 6,000 b. $15,000 c. $ 8,250 d. $9,000 10. Fox Company has the following data concerning the machine-hours in its operating departments: Dept. C Dept. A Dept B 20,000 Machine hours, long-run average 10,000 30,000 18,000 Machine hours, actual 9,000 24,000 Fixed costs of the maintenance department are budgeted at $30,000 per year. The fixed maintenance costs are incurred in order to service long-run average demand. The actual maintenance cost was actually $32,000. How much fixed maintenance cost should be charged to Department B at the end of the year for performance evaluation fixed purposes? a. $12,000 c. $15,000 b. $14.400 d. $18,000 11. Bunyard Corporation has two operating divisions-an Atlantic Division and a Pacific Division. The company's Logistics Department services both divisions. The variable costs of the Logistics Department are budgeted at $45 per shipment The Logistics Department's fixed costs are budgeted at $212,400 for the year. The fixed costs of the Logistics Department are determined based on peak-period demand. Percentage of Peak-Period Capacity Required Budgeted Shipments 35% 1,100 Atlantic Division 65% 2,500 Pacific Division At the end of the year, actual Logistics Department variable costs totaled $202,400 and fixed costs totaled $223,900, The Atlantic Division had a total of 2,100 shipments and the Pacific Division had a total of 2,300 shipments for the year. How much Logistics Department cost should be charged to the Pacific Division at the end of the year for performance evaluation purposes? b. $222.839 d. $214,527 c. $251,335 a. $241.560