Question

I need additional clarification on my specific questions below the question. The UFRO Company is considering the replacement of an existing spectrometer with a new

I need additional clarification on my specific questions below the question.

The UFRO Company is considering the replacement of an existing spectrometer with a new spectrometer; faster and with expanded capacity. If the new spectrometer is purchased, the existing (old) computer will be sold for $80,000 immediately. The existing spectrometer was purchased three (3) years ago for $500,000.

It is being depreciated under the 3-year MACRS schedule. The salvage value at the end of its six-year life will be $50,000.

The new spectrometer will be purchased for $800,000.

If the new spectrometer is purchased, accounts receivable increase immediately by $25,000; accruals will increase immediately by $40,000; and accounts payable will increase immediately by $30,000. The UFRO Company has a 30% corporate tax rate.

Shipping and installation will cost UFRO $80,000; and the modifications to the building will be $100,000.

If the new spectrometer is purchased, sales in year 1 will be $700,000, sales in year 2 will be $900,000, and sales in year 3 will be $950,000. Without the new spectrometer, sales will be $400,000 in year 1; $400,000 in year 2 and $400,000 in year 3. Operating expenses with the new spectrometer will be 40% of sales; with the old spectrometer those costs are 45% of sales.

The new computer will be depreciated using the 3-year MACRS schedule [yr.1: 33%; yr. 2: 45%; yr. 3: 15%; and yr. 4: 7%].

It is expected that the new spectrometer will be sold after three (3) years for $180,000. The UFRO Company has a cost of capital of 12%. Calculate the NPV, IRR, PAYBACK and MIRR

Questions...

Questions...

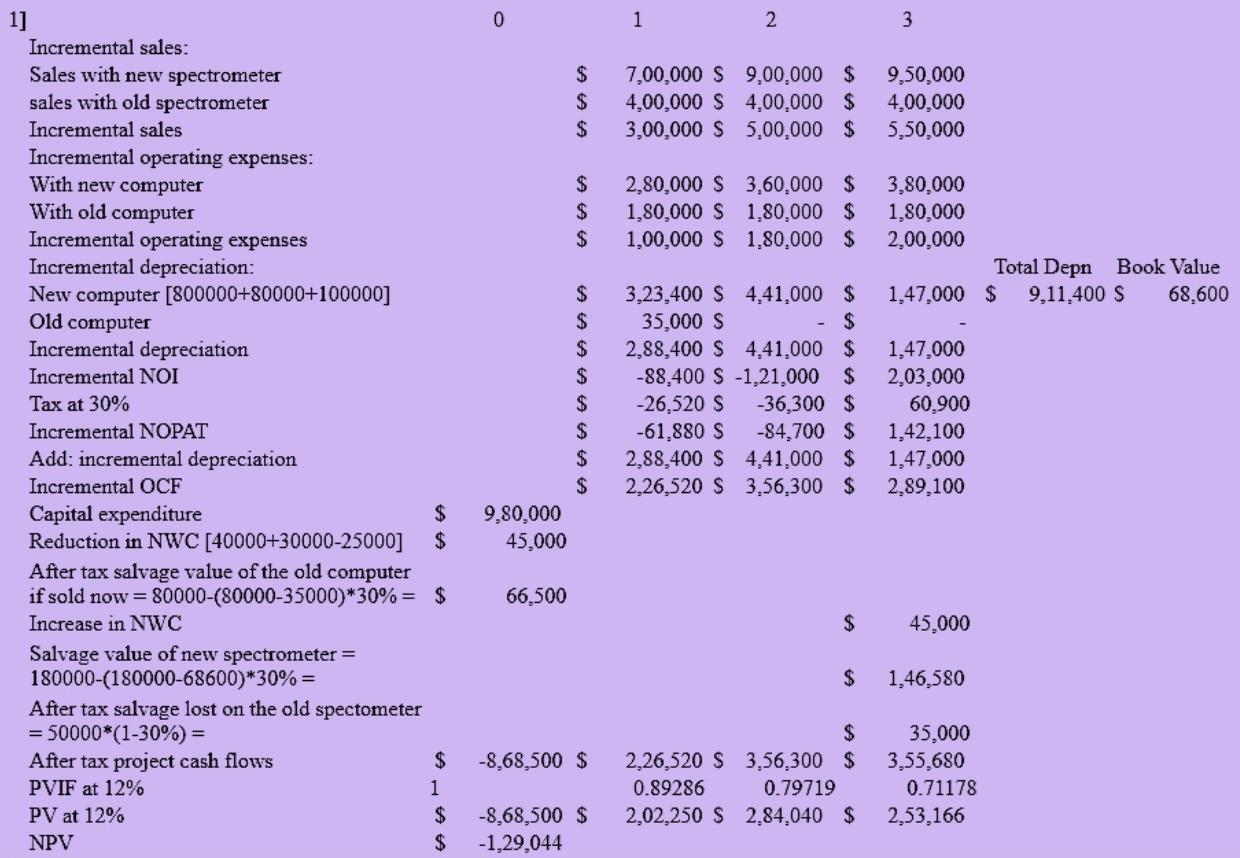

Capital expenditure= How was 980000 calculated?

For the after-tax project cash flows for year 3, how was 355,680 calculated?

PV at 12%, How is the first year -868500?

How was the 2nd year calculated to arrive at 202250?

NVP = How was this calculated to arrive at 129,044?

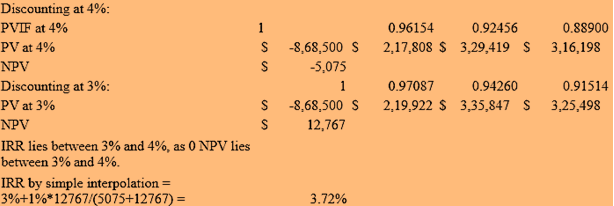

IRR PV at 4%= How was this calculated to arrive in the 1st year at 217808, year 2 329419?

How is the NVP a negative -5075? I have subtracted 868500-217808-329419-316198. PV at 3%

How was the 2nd year calculated to arrive at 219922? Thanks

Discounting at 4% : IRR lies between 3% and 4%, as 0 NPV lies between 3% and 4%. IRR by simple interpolation = 3%+1%12767/(5075+12767)= 3.72% Discounting at 4% : IRR lies between 3% and 4%, as 0 NPV lies between 3% and 4%. IRR by simple interpolation = 3%+1%12767/(5075+12767)= 3.72%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started