Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need Adjusted Journal Entries. Adjusted trail balance. Income Statement. Statement of Retained Earnings. Balance Sheet. Closing Entries. I have plenty of question remain so

I need Adjusted Journal Entries. Adjusted trail balance. Income Statement. Statement of Retained Earnings. Balance Sheet. Closing Entries. I have plenty of question remain so take what is needed.

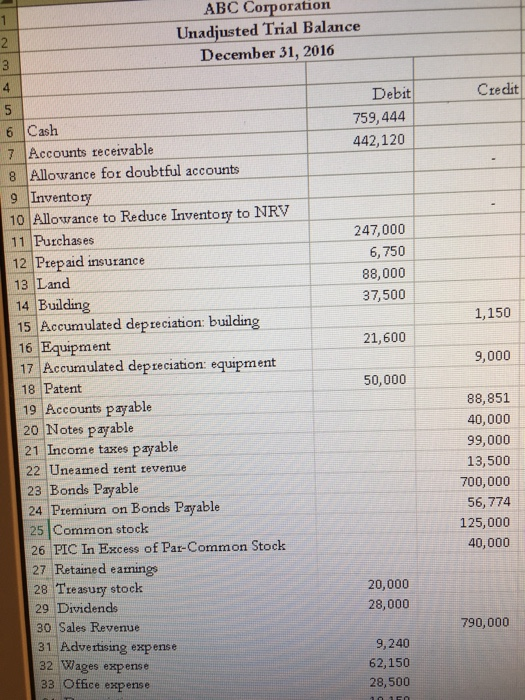

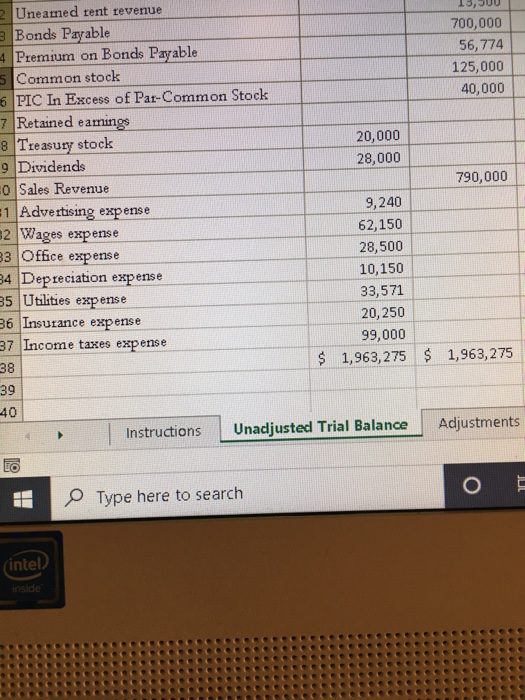

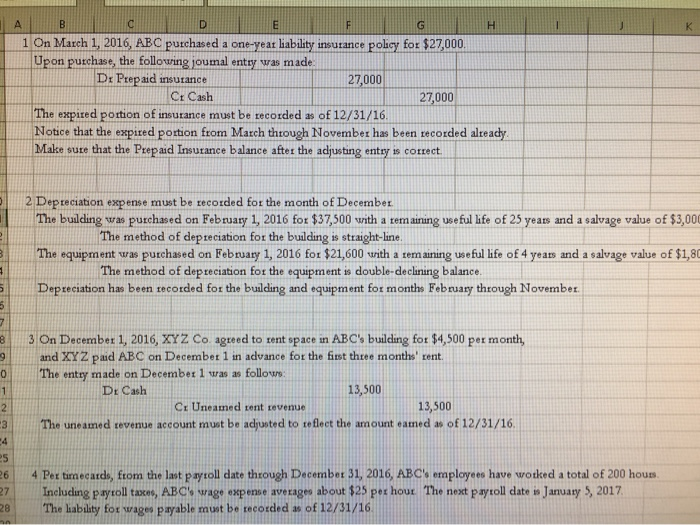

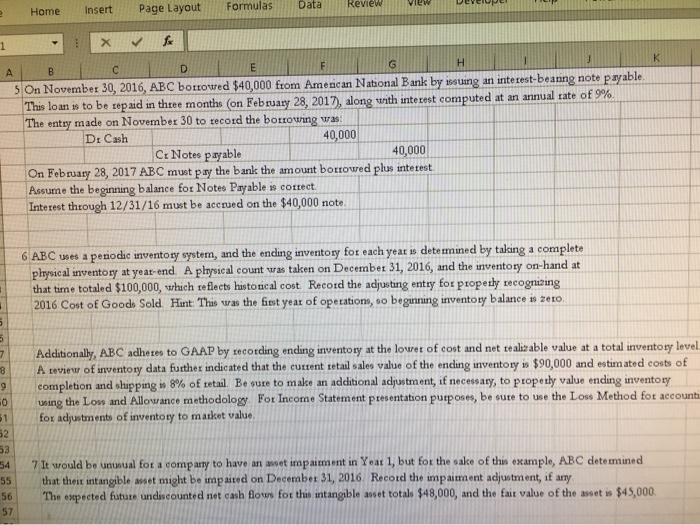

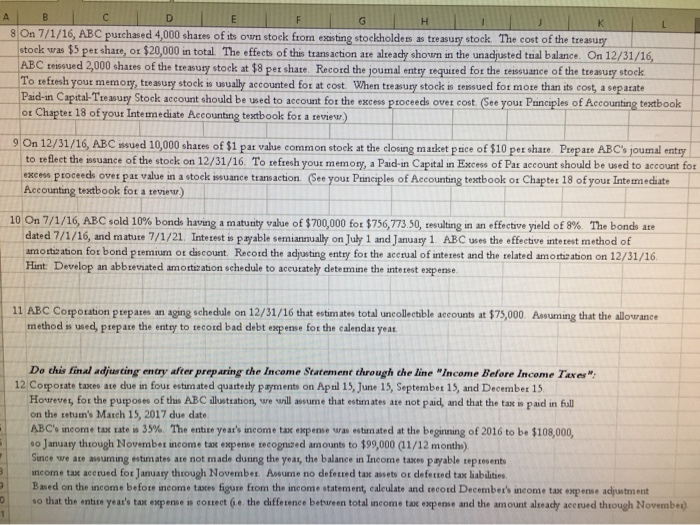

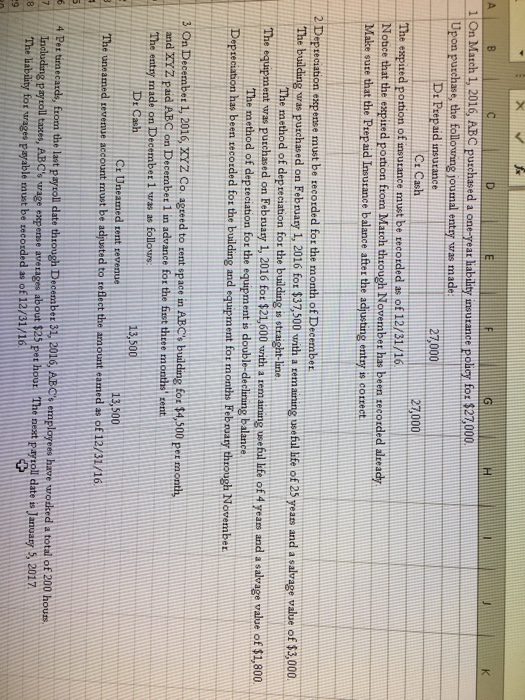

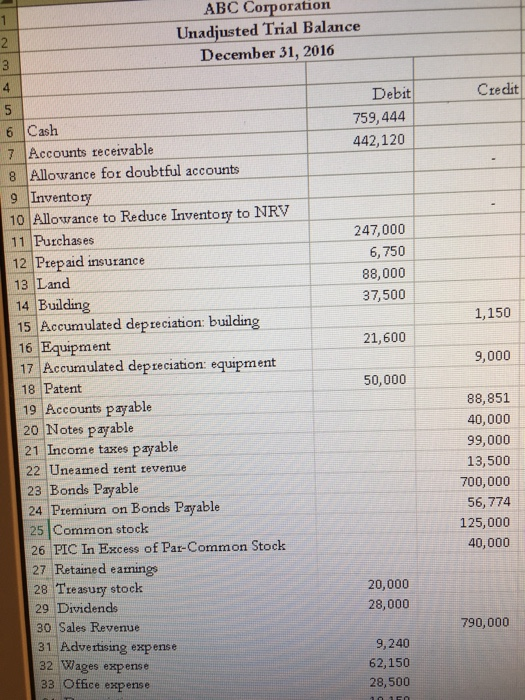

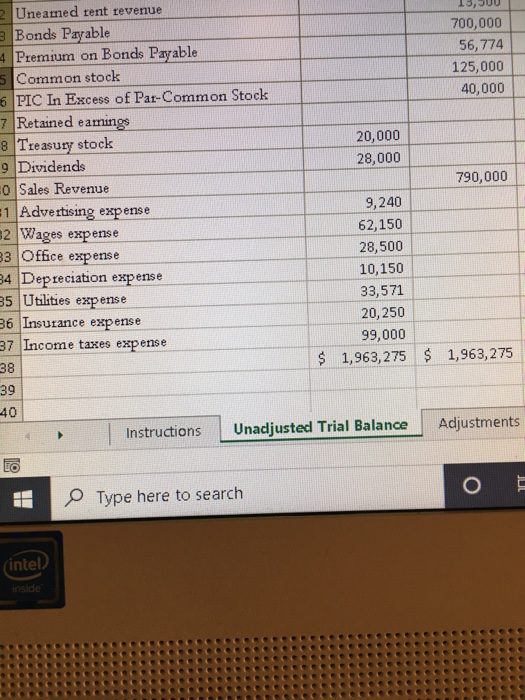

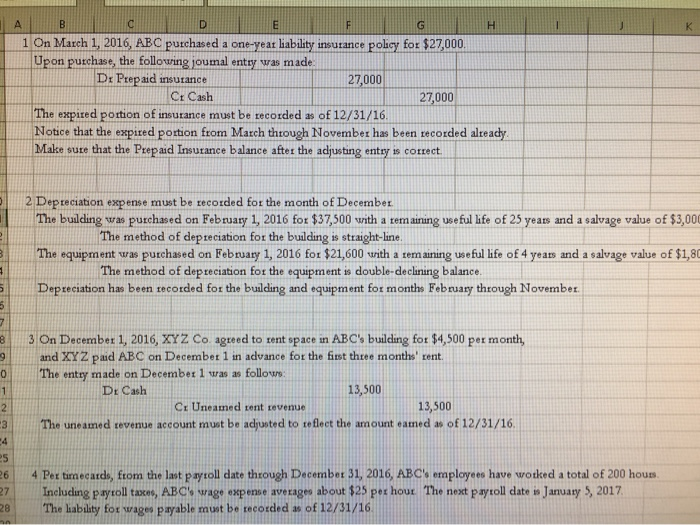

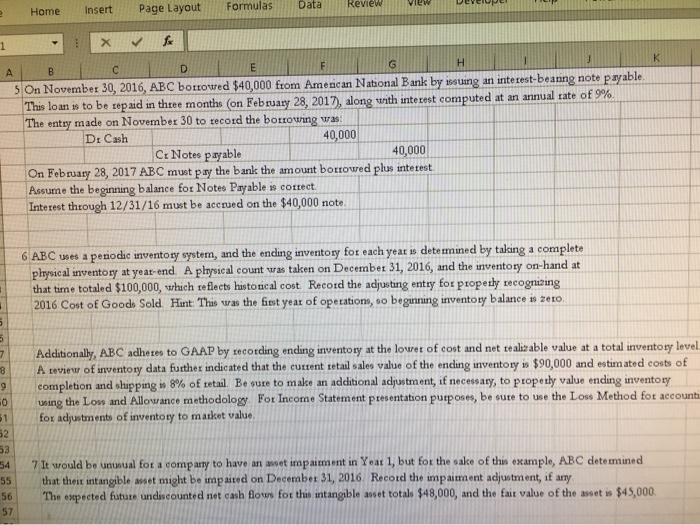

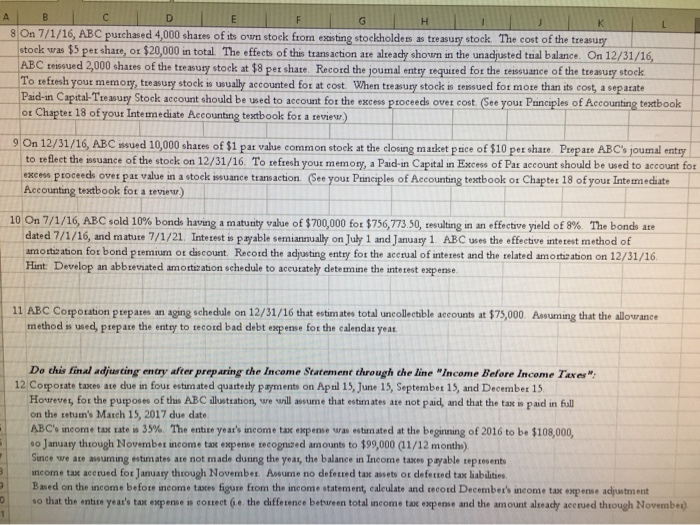

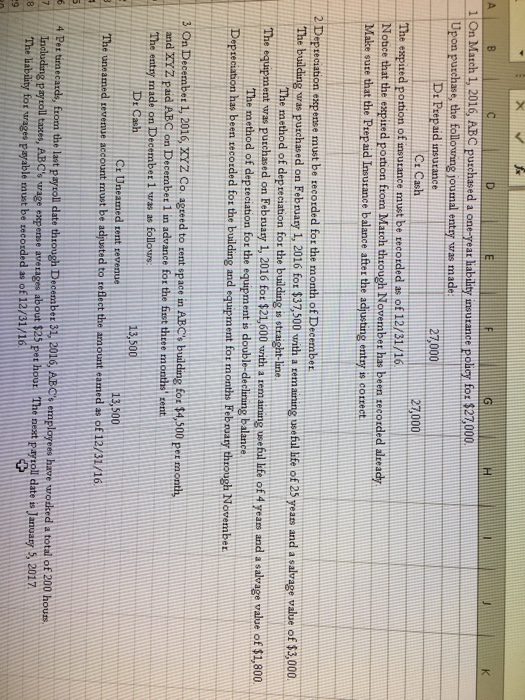

ABC Corporation Unadjusted Trial Balance December 31, 2016 Credit Debit 759,444 442,120 247,000 6,750 88,000 37,500 1,150 21,600 9,000 50,000 6 Cash 7 Accounts receivable 8 Allowance for doubtful accounts 9 Inventory 10 Allowance to Reduce Inventory to NRV 11 Purchases 12 Prepaid insurance 13 Land 14 Building 15 Accumulated depreciation: building 16 Equipment 17 Accumulated depreciation equipment 18 Patent 19 Accounts payable 20 Notes payable 21 Income taxes payable 22 Uneamed rent revenue 23 Bonds Payable 24 Premium on Bonds Payable 25 Common stock 26 PIC In Excess of Par-Common Stock 27 Retained eamings 28 Treasury stock 29 Dividends 30 Sales Revenue 31 Advertising expense 32 Wages expense 33 Office expense 88,851 40,000 99,000 13,500 700,000 56,774 125,000 40,000 20,000 28,000 790,000 9,240 62,150 28,500 1o, 700,000 56,774 125,000 40,000 20,000 28,000 Uneamed rent revenue Bonds Payable Premium on Bonds Payable Common stock 6 PIC In Excess of Par-Common Stock 7 Retained earnings 8 Treasury stock 9 Dividends Sales Revenue 1 Advertising expense 2 Wages expense 13 Office expense 34 Depreciation expense 35 Utilities expense 36 Insurance expense 37 Income taxes expense 790,000 9,240 62,150 28,500 10,150 33,571 20,250 99,000 $ 1,963,275 $ 1,963,275 40 Instructions Unadjusted Trial Balance Adjustments 1 O Type here to search o intel inside 1 On March 1, 2016, ABC purchased a one-yeat liability insurance policy for $27,000. Upon purchase, the following journal entry was made D: Prepaid insurance 27,000 Ct Cash 27,000 The expired portion of insurance must be recorded as of 12/31/16. Notice that the expired portion from March through November has been recorded alteady Make sure that the Prepaid Insurance balance after the adjusting entry is correct. 2 Depreciation expense must be recorded for the month of December The building was purchased on February 1, 2016 for $37,500 with a rem aining useful life of 25 years and a salvage value of $3,000 The method of depreciation for the building is straight-line. The equipment was purchased on February 1, 2016 for $21,600 with a remaining useful life of 4 years and a salvage value of $1,80 The method of depreciation for the equipment is double-declining balance Depreciation has been recorded for the building and equipment for months February through November O- 3 On December 1, 2016, XYZ Co agreed to rent space in ABC's building for $4,500 per month, and XYZ paid ABC on December 1 in advance for the first three months' cont The entry made on December 1 was as follow DECash 13,500 C: Uneamed rent revenue 13,500 The uneamed revenue account must be adjusted to teflect the amount eated as of 12/31/16, 4 Per timecards, from the last payroll date through December 31, 2016, ABC'employees have woked a total of 200 hours Including payroll taxes, ABC wage expense averages about $25 per hour. The next paytoll date is January 5, 2017 The lability for wage payable must be recorded as of 12/31/16 Home Insert Page Layout Formulas Data keview view - fa A B C D E F G H KI 5 On November 30, 2016, ABC borrowed $40,000 from American National Bank by issuing an interest-beanng note payable This loan is to be repaid in three months on February 28, 2017), along with interest computed at an annual rate of 9% The entry made on November 30 to record the borrowing was D: Cash 40,000 CrNotes payable 40,000 On February 28, 2017 ABC must pay the bank the amount bottowed plus interest. Assume the beginning balance for Notes Payable is correct. Interest through 12/31/16 must be accrued on the $40,000 note. 6 ABC uses a periodic inventory system, and the ending inventory for each year is determined by taking a complete physical inventory at year-end A plysical count was taken on December 31, 2016, and the inventory on-hand at that time totaled $100,000, which reflects historical cost Record the adjusting entry for properly recognizing 2016 Cost of Goods Sold. Hint. This was the first year of operations, so beginning inventory balance is zero Additionally, ABC adheres to GAAP by recording ending inventory at the lower of cost and net te alia able value at a total inventory level A review of inventory data further indicated that the current retail sales value of the ending inventory is $90,000 and estimated costs of completion and shipping is 8% of retail. Be sure to make an additional adjustment, if necessary, to properly value ending inventory using the Low and Allowance methodology For Income Statement presentation purposes, be sure to use the Loss Method for account for adjustments of inventory to market value w 7 It would be unul for a company to have an wet impaiment in Yeat 1, but for the sake of this example, ABC determined that the intangible awet might be impaired on December 31, 2016. Record the inpaiment adjustment, if any The expected future undiscounted net cash flows for this intangible asset totals $48,000, and the fair value of the asset is $45,000 A B coEFG 8 On 7/1/16, ABC purchased 4,000 shares of its own stock from existing stockholdes a treasury stock. The cost of the treasury stock was $5 per share, or $20,000 in total. The effects of this transaction are already shown in the unadjusted tual balance. On 12/31/16, ABC reissued 2,000 shares of the treasury stock at $8 per share. Record the journal entry required for the tissuance of the treasury stock To refresh your memory, treasury stock is usually accounted for at cost. When treasury stock is issued for more than its cost, a separate Pad-in Capital-Treasury Stock account should be used to account for the excess proceeds over cost. (See your Principles of Accounting textbook or Chapter 18 of your Intermediate Accounting textbook for a review) 91 On 12/31/16, ABC Wued 10,000 shares of $1 par value common stock at the closing market price of $10 per share. Prepare ABC's journal entry to reflect the issuance of the stock on 12/31/16. To refresh your memory, a Paid-in Capital in Excess of Pat account should be used to account for excess proceeds over par value in a stock issuance transaction. (See your Principles of Accounting textbook or Chapter 18 of your Intermediate Accounting textbook for a review) 10 On 7/1/16, ABC sold 10% bonds having a matunty value of $ 700,000 for $756,773.50, resulting in an effective yield of 8%. The bonds are dated 7/1/16, and mature 7/1/21 Interest is payable semiannually on July 1 and January 1. ABC uses the effective interest method of amortization for bond premium or discount. Record the adjusting entry for the accrual of interest and the related amortization on 12/31/16 Hint Develop an abbreviated amortization schedule to accurately detemine the interest expense. 11 ABC Corporation prepares an aging schedule on 12/31/16 that estimates total uncollectible accounts at $75,000. Assuming that the allowance method is used, prepare the entry to tecord bad debt expense for the calendar year Do this final adjusting entry after preparing the Income Statement through the line "Income Before Income Taxe 12 Corporate taxes are due in fout estimated quarterly payments on April 15, June 15, September 15, and December 15 Howeves for the purposes of this ABC station, we will assume that estimates are not paid, and that the tax is paid in full on the retuun's March 15, 2017 due date ABC's income tax rate is 35%. The entire year's income tax expense was estimated at the beginning of 2016 to be $108,000, 10 January through November income tax expense recognised amounts to 199,000 01/12 months) Since we are assuming estimates are not made during the year, the balance in Income taxes payable represents income tax accrued for January through November. Asume no deferred tax assets or defected tax liabilities Based on the income before income taxes figure from the income statement, calculate and record December's income tax expense adjustment so that the entire year's tax expense correct the difference between total income tax expense and the amount aleach and through Novembed A B C D E 1 On March 1, 2016, ABC purchased a one-year liability insurance policy for $27,000. Upon purchase the following journal entry was made Dt Prepaid insurance C: Cash ||27,000 The expired portion of insurance must be recorded as of 12/31/16, Notice that the expired portion from March through November has been recorded alteady Make sure that the Prepaid Insurance balance after the adjusting entry correct. 27,000 2 Depreciation expense must be recorded for the month of December The building was purchased on February 1, 2016 for $37,500 with a semaining useful life of 25 years and a salvage value of $3,000 The method of depreciation for the building is straight-line The equipment was purchased on February 1, 2016 for $21,600 with a remaining useful life of 4 yeam and a salvage value of $1,800 The method of depreciation for the equipment is double-declirung balance. Depreciation has been recorded for the building and equipment for months February through November On December 1, 2016, XYZ Co. agreed to rent space in ABC's building for $4,500 per month and XYZ paid ABC on December 1 in advance for the first three months rent The entry made on December 1 was as follows. Dr Cash 13,500 CE Uneamed rent revenue 13,500 The uneamed revenue account must be adjusted to reflect the amount eamed as of 12/31/16 4 Per timecards, from the last payroll date through December 31, 2016, ABC's employees have worked a total of 200 hours Including payroll aces, ABC wage expense avetages about $25 pet hoor. The next payroll date is January 5, 2017 The liability for wages payable must be recorded of 12/31/16

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started