Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need all parts to 3 questions . please answer it right or let an expert answer. question 1: part 1 needed question 2 :

i need all parts to 3 questions . please answer it right or let an expert answer.

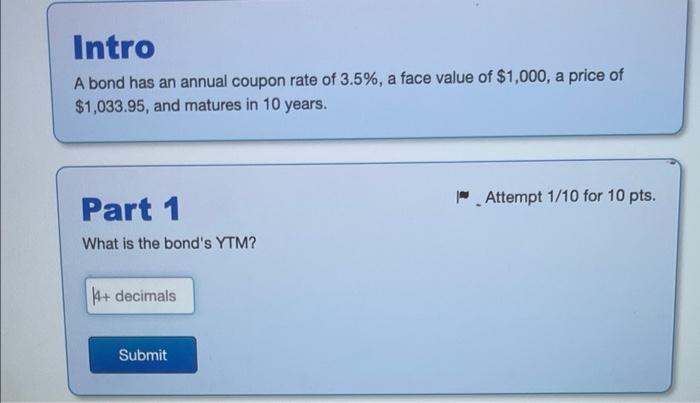

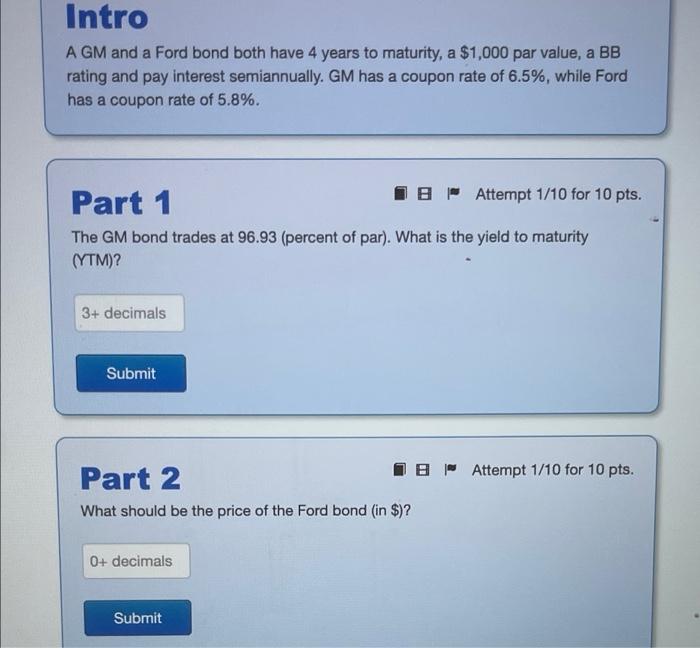

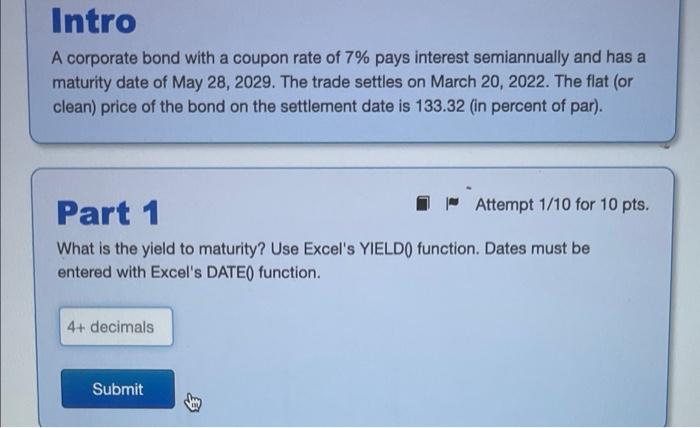

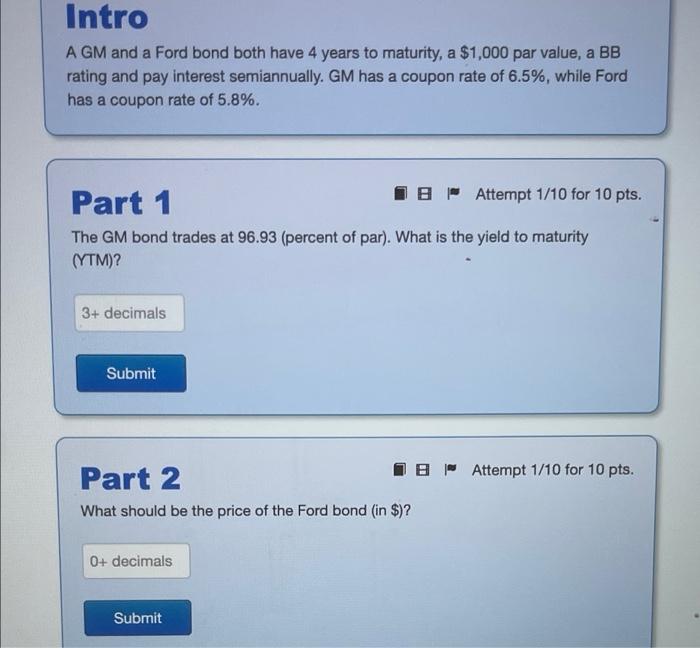

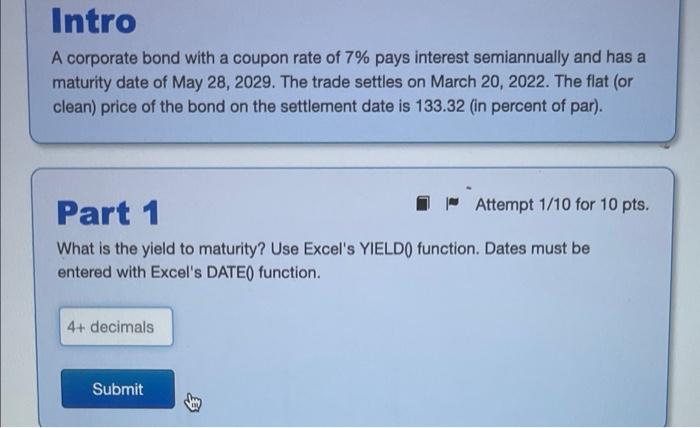

Intro A bond has an annual coupon rate of 3.5%, a face value of $1,000, a price of $1,033.95, and matures in 10 years. Attempt 1/10 for 10 pts. Part 1 What is the bond's YTM? \+ decimals Submit Intro A GM and a Ford bond both have 4 years to maturity, a $1,000 par value, a BB rating and pay interest semiannually. GM has a coupon rate of 6.5%, while Ford has a coupon rate of 5.8%. IB Attempt 1/10 for 10 pts. Part 1 The GM bond trades at 96.93 (percent of par). What is the yield to maturity (YTM)? 3+ decimals Submit Part 2 IB Attempt 1/10 for 10 pts. What should be the price of the Ford bond (in $)? 0+ decimals Submit Intro A corporate bond with a coupon rate of 7% pays interest semiannually and has a maturity date of May 28, 2029. The trade settles on March 20, 2022. The flat (or clean) price of the bond on the settlement date is 133.32 (in percent of par). Part 1 | Attempt 1/10 for 10 pts. What is the yield to maturity? Use Excel's YIELD() function. Dates must be entered with Excel's DATE() function. 4+ decimals Submit question 1: part 1 needed

question 2 : part 1 & 2 needed

question 3: part 1 needed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started